Author: 63

Translator: Daniel Han CHEN

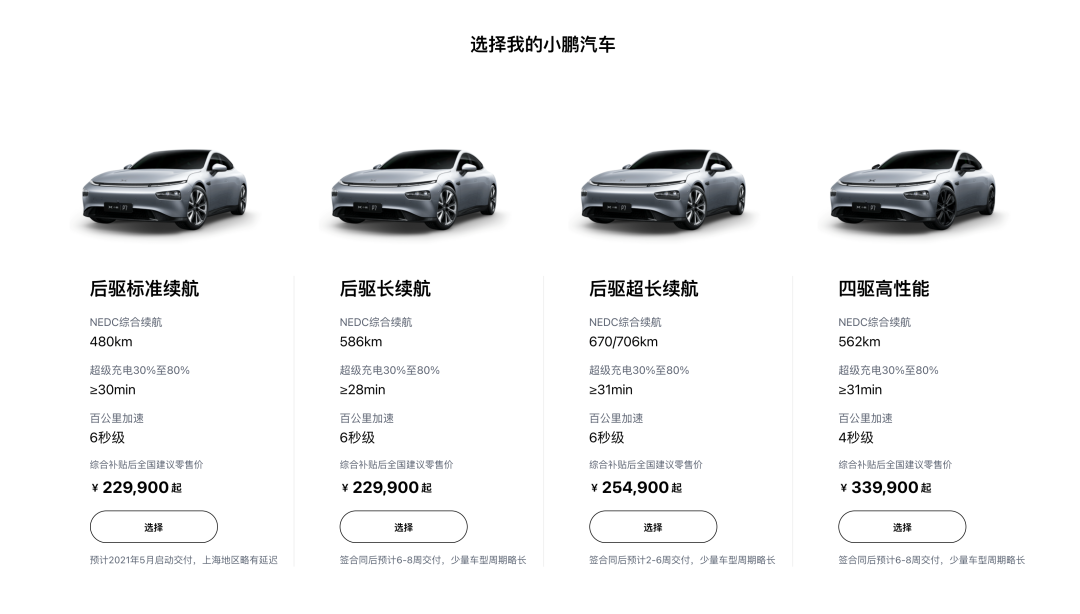

On March 3rd, Xpeng launched the P7 model equipped with LFP batteries produced by Contemporary Amperex Technology Co., Limited (CATL). The vehicle has a battery capacity of 60.2 kWh and NEDC range of 480 km, with post-subsidy prices starting at RMB 229,900.

The prices for the RWD Standard Range P7 and RWD Long Range P7 are the same. However, the former is equipped with XPILOT 2.5 driving assistance system and the price will go up slightly to just RMB 239,900 with XPILOT 3.0 on board.

According to the financial report published by Xpeng, 98% of the P7s ordered by customers can support XPILOT 2.5 and 3.0.

In this way, for customers who appreciate the driving assistance capacity offered by Xpeng, XPILOT 2.5 or 3.0 is now available at a much lower price point, making it more affordable. This will undoubtedly drive up P7 sales.The credit should be given to LFP battery.

The Return of LFP Battery

In 2020, LFP battery continues to shine as it did before.

During the development of NEVs in China, LFP battery became the mainstay of the NEV market back in 2015, surpassing ternary lithium battery with only a small fraction of the market share.

However, government subsidies for NEVs require constant improvement in energy density. Due to electrochemical characteristics, the energy density of LFP battery remains about 120 Wh/kg. With the same weight, the battery capacity of LFP battery is 33.3% less than that of nickel-rich ternary lithium battery.

Given the subsidies policy requirements as well as users’ strong demand to boost energy density and cruise range, ternary lithium battery seems to be ahead of the game.

Thanks to favorable government policies, ternary lithium battery has enjoyed sound development in recent years.Before 2020, the market share taken by LFP battery dropped all the way from 68.6% in 2015 to 32.0% in 2019. On the contrary, ternary lithium battery boasted its increasing market share from 28.4% to 61.7%.

But such a trend was reversed in 2020.

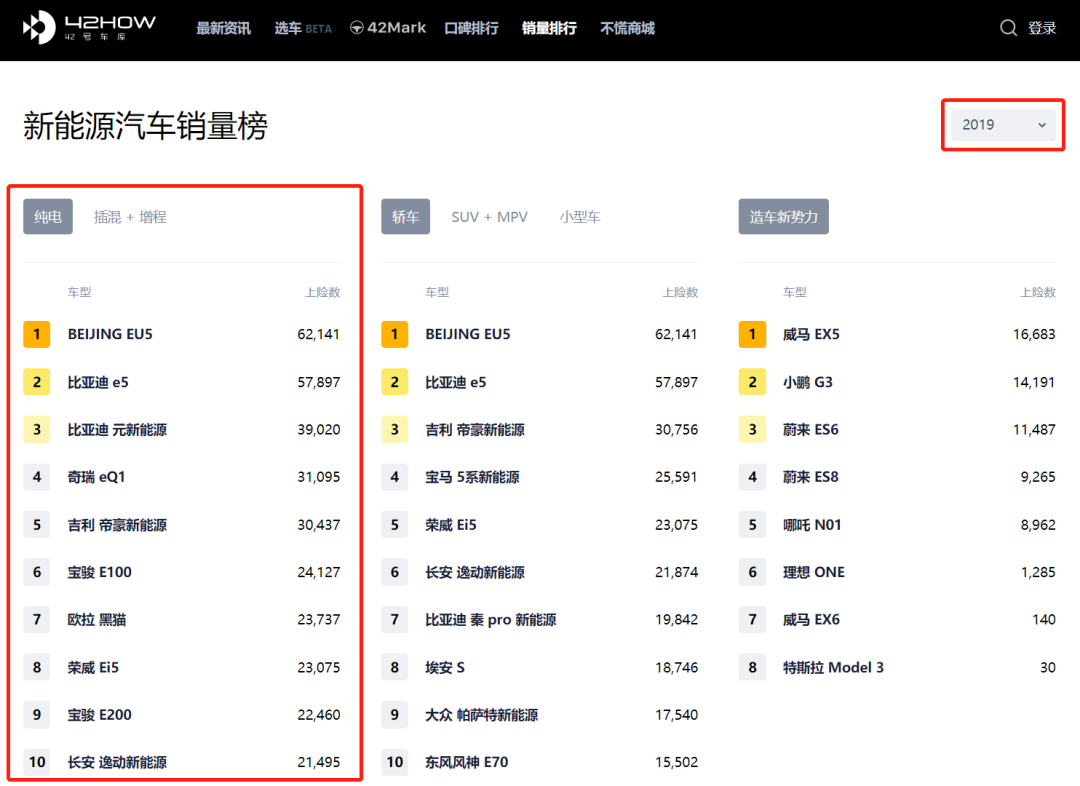

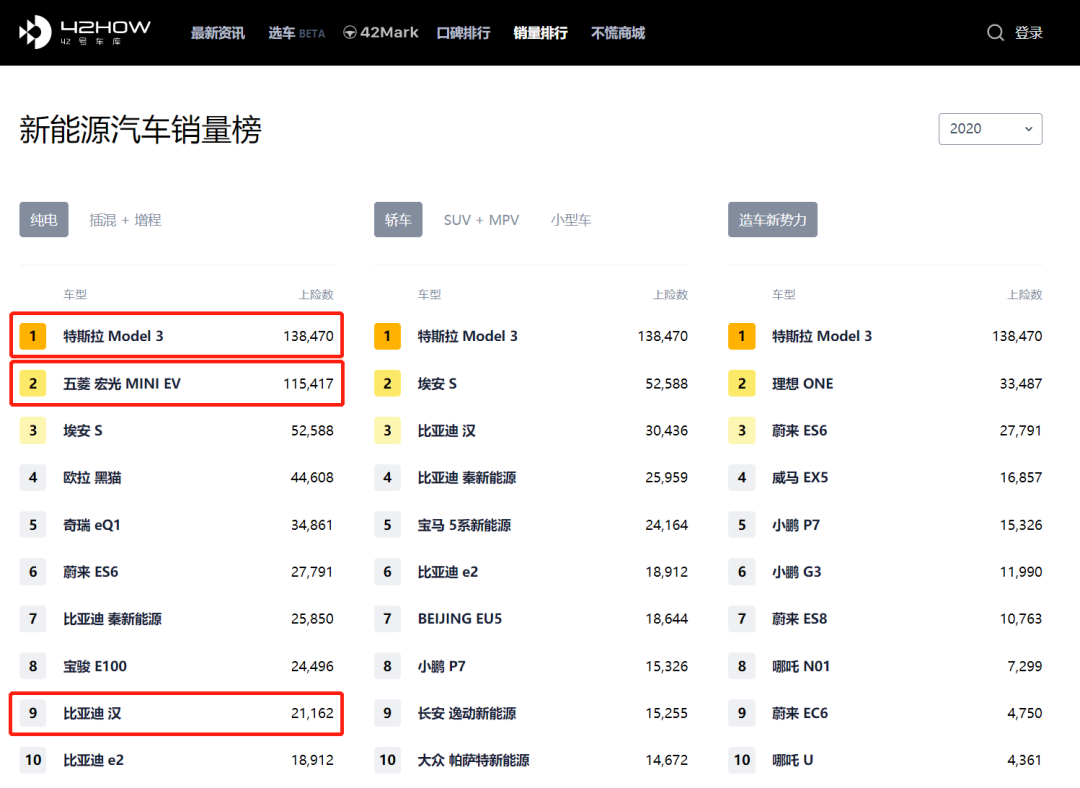

According to the ranking in car insurance rate on the official website of 42HOW, for the top 10 best-selling Chinese BEV in 2019, all of them adopted ternary lithium battery.

But among the top 10 popular models in 2020, 3 of them chose LFP battery instead.

Based on the data published by the Ministry of Industry and Information Technology of the P.R.C., among altogether 115 models in the first batch of recommended vehicle models for the promotion and application of NEV in 2021, 85 of them were equipped with LFP battery, accounting for 73.9%.Obviously, LFP battery has once again become an alternative solution to ternary lithium batteries, owing to technological improvements in LFP batteries and their significant cost advantages.

Resolving Persistent Issues with LFP Batteries

In 2020, ternary lithium batteries saw a decline in development momentum, while LFP batteries continued to progress rapidly.

One perennial issue with LFP batteries has been their low energy density and poor performance at low temperatures. Although it is difficult to change the electrochemical characteristics of the battery, certain auxiliary technologies can be helpful in addressing these problems.

In late 2019, CATL officially introduced Cell To Pack (CTP) technology, which transforms the internal structure of the battery pack by eliminating modules and directly integrating cells into packs.The module-free structure has a series of advantages including helping improve volume utilization efficiency of the battery pack by 15 to 20%, increase energy density by 10 to 15%, reduce the number of parts for battery packs by 40% and enhance the production efficiency by 50%.

As a result, the system energy density of LFP battery manages to exceed 160 Wh/kg, thus fulfilling the requirements posed by the subsidies policy. This is a critical precondition for its use – if LFP battery is not eligible for the subsidies, the cost of it will not be reduced, meaning it might be better to continue the use of ternary lithium battery.BYD also decided to adopt a similar technology after conducting extensive research on LFP battery. In early 2020, BYD launched its Blade Battery, which follows almost the same principle as CTP by CATL. The idea is to increase the overall energy density of the battery pack by inserting more cells into the limited space within the pack through the removal of modules.

However, BYD’s Blade Battery, which is its version of the LFP battery pack, only boasts an energy density of 140 Wh/kg. This is overshadowed by its counterpart – CTP by CATL – which has an impressive energy density of 160 Wh/kg.

With the same weight, the CTP technology enables the battery to be larger and provides longer cruise range when being applied in different scenarios.## Another Shortcoming of LFP Battery: Poor Low-Temperature Performance

One of the great drawbacks of LFP battery is its poor low-temperature performance. However, in 2019, CATL released its self-heating technology for the cell. With the algorithm integrated in BMS (Battery Management System) and vehicle powertrain architecture, the cell can be well-controlled, enabling quick charging and discharging in a short amount of time. The technology works by heating the cell from within, thus achieving the self-heating purpose.

Under test conditions, the battery is able to warm up by 2℃ per minute. And during the entire heating process, the temperature difference between the cells will not exceed 4℃.

Besides improving the battery itself, having better infrastructure is also conducive to the increasing popularity of LFP battery.According to data released by the China Electric Vehicle Charging Infrastructure Promotion Alliance, the number of charging piles nationwide reached 1,681,000 by the end of December 2020, of which 807,000 were public charging piles with a year-on-year growth of 56.4% and 874,000 were private, growing by 24.3% compared to last year.

This increasing convenience in charging is reducing users’ anxiety about driving range, and is paving the way for the development of LFP batteries.

Nowadays, the fatal flaws of LFP batteries are no longer fatal. The biggest reason and driving factor for battery manufacturers and car companies to use LFP batteries is their low price.

Absolute advantage in price

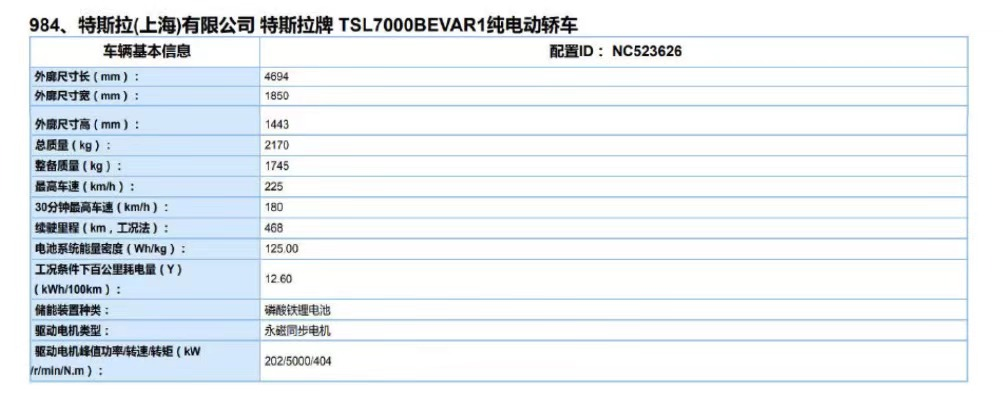

Tesla first used LFP batteries in their cars.In October 2020, Tesla推出了使用CATL生产的LFP电池的Model 3。借助新型电池,标准续航版的NEDC续航里程从445公里提高到468公里,而价格则从271,500元人民币降至249,900元人民币,使其更加实惠。

这是Tesla第二次与中国供应商合作,第一次停止坚持三元锂电池并开始使用其他类型的电池。

考虑到Tesla的销量正在逐步攀升,由Tesla Giga上海工厂生产的Model 3已经出口到日本和欧洲市场,显然Tesla已充分认可中国制造的LFP电池,并希望利用廉价的LFP电池拓展更多外国市场。

曾毓群在采访中表示:“我们有可能向位于柏林的Tesla工厂提供产品”。Based on the Battery Price Survey published by BNEF in December 2020, the cost of battery pack in 2020 was around 137 US dollars per kWh – a decrease of 13% compared with 2019. And the cell price stood at 102 US dollars per kWh.

BNEF predicts that the lowest possible cost of LFP battery in 2021 will be 80 US dollars per kWh and it is expected to be further decreased to 50 US dollars per kWh in 2023.

Among all the models currently available in the market, Xpeng’s P7, powered by LFP battery, manages to lower down the cost of owning XPILOT by 20,000 RMB for customers. The same also goes to low-end vehicles. For example, MINIEV of Wuling Hongguang uses LFP battery which helps reduce its selling price to somewhere around 30,000 RMB.

The overall BOM cost of electric vehicles can be significantly cut down with the rise of LFP battery. As a result, electric vehicles will be increasingly cost-effective to attract more consumers who want to give it a go.Following the trend, the shipments of LFP battery have risen sharply.

In 2020, the installed capacity of ternary lithium battery was 38.9 GWh, which represents a 4.1% decrease compared to the previous year, while LFP battery’s installed capacity enjoyed a year-on-year increase of 20.6%, reaching 24.4 GWh.

The three companies with the largest installed capacity of LFP battery in 2020 were: CATL, BYD, and GOTION HIGH-TECH.

CATL’s installed capacity, after a year-on-year growth of 21.21%, totaled 13,680.12 MWh, gaining 58.9% of market share. By comparison, BYD’s market share was 17.38% last year with an installed capacity of 4,036.3 MWh, which was 45.21% higher than the previous year.

Diversified Demand in the Market

LFP battery has various undeniable advantages and is on the rise, as evidenced by its growing shipments. However, this does not necessarily mean ternary lithium battery will be phased out.The introduction of new policies is making the NEV industry more market-oriented.

It is apparent that Tesla’s Model 3 Standard Range Plus, Xpeng’s RWD Standard Range P7, and Wuling Hongguang’s MINIEV share an emphasis on controlling BOM costs rather than improving cruise range.

Consumers are becoming increasingly receptive to electric vehicles and LFP batteries can make them more affordable.

LFP batteries will always face low-current scenarios due to their relatively low energy density, and charging and discharging performance at low temperatures may be even more disappointing.

On November 2nd, 2020, the General Office of the State Council of the P.R.C. issued “The New Energy Vehicle Industry Development Plan (2021-2035),” which states that NEVs will comprise 25% of all vehicles sold in 2025, totaling eight million vehicle sales.The production and sales of NEVs in China achieved a historic high of 1,366,000 and 1,367,000 respectively in 2020, representing a year-on-year growth rate of 7.5% and 10.9%.

This also indicates that NEV sales are expected to increase by 5.8 times in the next four years. To meet the needs of more customers, it is crucial for NEVs to cover as many scenarios as possible.

While LFP batteries have become the preferred choice for some customers who are price-conscious, ternary lithium batteries still remain the best option for those who prioritize range. In 2019, CATL pioneered the launch of NCM 811 battery cells, enabling many models to achieve a range of over 600 km, and even up to 700 km. Last year, CATL released NCM 523 battery cells, which feature larger modules and a square shell, and have achieved an energy density of 180 Wh/kg in a safer way, thanks to a higher working efficiency of the modules.Electric vehicles are becoming increasingly popular among consumers due to the higher energy density of ternary lithium batteries. In the past few years, NIO has experienced significant growth and serves as a prime example of this trend.

The ES8, launched in mid-2018, utilized a 70 kWh battery from CATL and had a cruise range of only 355 km. In 2019, the battery was upgraded to NCM 811 battery cells with a higher energy density, thereby increasing the battery pack capacity to 84 kWh without altering its size. In 2020, CATL optimized the battery structure, raising the capacity of the same battery to 100 kWh and thus enabling the same model to achieve a cruise range of up to 500 km.

Currently, LFP and ternary lithium batteries are in a deadlock. In a diversified market such as this, they seem to complement each other more effectively.# Think about the analogy.

In the era dominated by fossil fuel-powered cars, models sold to the Middle East require larger radiators while vehicles in the Far East need bigger PTC heaters.

Battery comes in different types and its value can only be maximized with the right type for a specific purpose.

Turning back to CATL, it might be the champion of our time with the largest shipments of both LFP battery and ternary lithium battery in China.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.