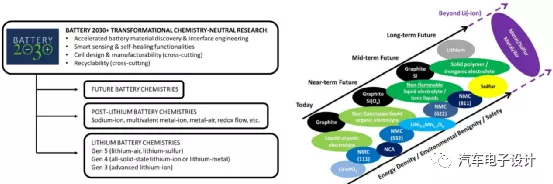

On weekends, the hottest topic of discussion is about the sodium-ion battery. After Ningde announced the maturity of their sodium-ion battery and plans to launch their product in July, they have essentially led the investment in this direction themselves. As shown in the following figure, according to our original understanding of power and electrochemical energy storage batteries, the EU’s “Battery 2030” future key development battery systems include lithium-ion batteries (Gen3, Gen4, and Gen5), non-lithium-ion batteries (sodium-ion batteries are a rather early order), and future new batteries. It’s unexpected that we are pulling sodium-ion batteries out as mature in this field.

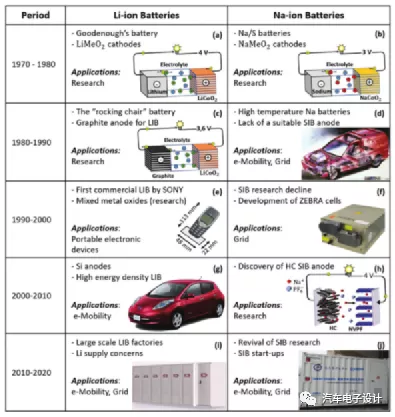

Sodium-ion batteries were also studied almost simultaneously with lithium-ion batteries in the late 1970s. However, lithium-ion batteries occupy a good position in terms of application scope and maturity. From the present point of view, the main potential application field of sodium-ion batteries is in energy storage.

Before Chinese companies entered this research field, there were mainly several startup companies in Europe, America, and Japan trying and exploring. We can roughly summarize the operating conditions of European companies, mainly including Faradion Limited in the UK and TIAMAT SAS in France.

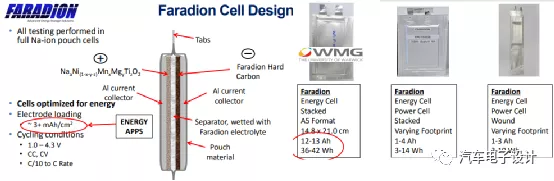

1) Faradion

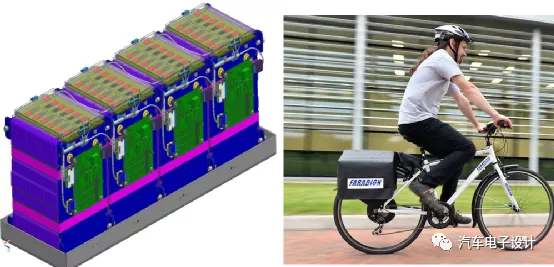

This startup was established in 2011 and released their product design mainly in 2017, and then negotiated cooperation with lithium-ion battery companies. Below are some of their product designs (positive electrode materials are Ni, Mn, Ti-based O3/P2-type layered oxides, and negative electrode materials are hard carbon), mainly for some energy storage and electric bicycle installation attempts (this battery capacity is relatively small). From subsequent reports, Faradion’s business model mainly explores the application of sodium-ion batteries in vehicles together with IPLTech in India, Phillips66 in the United States, and Renault in the field of electrification. Overall, the story of this company is still in its early stages and has not particularly aroused the interest of European R&D and investors.

2) Timat from France

Timat was incubated by the French National Center for Scientific Research (CNRS) in 2017, aiming to use the 18650 battery with general dimensions to make a sodium-ion battery. From the current information available, Timat is slightly slower than Faradion, mainly undertaking some advanced projects in Europe. The partner is Plastic Omnium, and Timat’s standardized sodium-ion battery technology is integrated into a 48V battery pack, which is used in high-power light hybrid powertrain architectures. From Timat’s long-term goals, the focus is primarily on developing low-voltage systems for hybrid vehicles.

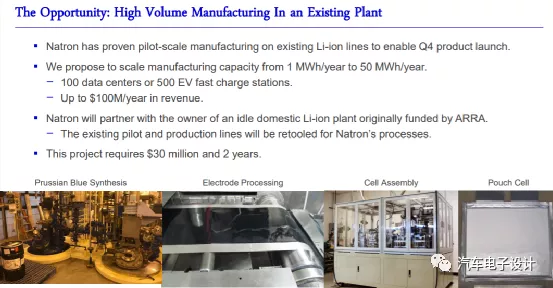

3) Natron Energy

This company was founded in 2012, and on the one hand, received $20 million from the US Department of Energy to expand production of electric cores (by restructuring the existing lithium battery production line), and later received an investment of $35 million led by ABB.

Summary

We currently have no way of knowing the truth of the story in China. However, since China is currently the core of the entire battery industry, many research and corporate resources are dedicated to it, which is bound to be more powerful than Europe and the United States. However, it is certain that cheap and easily available raw materials and simple and convenient processes are the main focus of this round of sodium-ion batteries as a branch product of lithium-ion batteries, mainly aimed at offsetting the skyrocketing prices of lithium, cobalt, nickel and other materials after full-scale application. Whether we can see the landing of sodium-ion batteries in July is completely unknown at this time.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.