Evolution of the Car Travel Industry Chain: AutocarMax’s Focus

This is a sweeping structural transformation that affects all aspects of the industry, from Tier-1 to Tier-3. As OEMs enter more markets, the products being supplied are more white-label than ever before. In addition, some chip companies are gradually moving towards system-level products. Our industry is undergoing fundamental changes.

“When Tier-1 to Tier-3 are all affected, it’s becoming clear that our industry is undergoing fundamental changes, as OEMs must also ensure that sensors, sensor fusion, data, data processing, and artificial intelligence technologies are all in place. This directly results in changes in the collaboration between traditional Tier-1 and OEMs. OEMs may obtain the products or services they are interested in from Tier-1’s solutions, not a one-size-fits-all solution,” explained Frank Petznick, the global head of ADAS at Continental, a supplier giant, when asked by AutocarMax.

“We must rethink our position. We are no longer Tier-1, but need to strengthen our core competency through horizontal collaboration.” We need to quickly integrate technology to enhance our value proposition to clients. This is also the direction of the market. Only if you are fast enough can you survive.”

All changes revolve around the same theme, namely, the trend towards software-defined cars across the industry. In traditional cars, the various functional modules are often not interconnected, and any change in one module requires the entire module to be refreshed, often requiring cooperation from multiple suppliers. Nowadays, the industry’s focus is on software-driven thinking, anchored in autonomous driving, and redefining intelligent cars.

A Strategic Adjustment

The pain is felt throughout the industry. Not just pressure, but the sense of crisis keeps mounting. “But what can we do during a crisis?” asks ADAS’s China Director Luo Yun. This led to Continental Group’s new strategy to establish the Autonomous Driving and Travel Business Group, which is set to be officially established on January 1, 2022, with its core comprised of the current ADAS business unit.Regarding the motivation for establishing a new business group, Frank Petznick further explained that “it is mainly because we have invested heavily in new technology fields. The Continental Group hopes to rapidly expand in this area in the next few years. At the same time, we also hope to cooperate with partners in a more open-minded manner and collaborate with global technology companies, including those in China, through technical exchanges.”

Through independent operations, Continental can have a higher visibility, both internally and externally. This approach can also make Continental faster and more flexible, especially in terms of cooperation, so that it is not limited by the hierarchical restrictions of the Continental Group. “This is also the secret to achieving rapid development in the future,” said Frank Petznick.

Luo Yun added, “On the other hand, this reflects the greater determination and commitment of the Continental Group in this field, especially from the perspective of partners and customers, who can better see this point.”

Regarding the “Advanced Driver Assistance Systems and Autonomous Driving” field, this is a strategy that Continental has been laying out for many years.

As early as 2015, the Continental Group acquired Elektrobit Automotive, a globally renowned software solutions and services provider, for $680 million USD to expand its capabilities in the development of automotive systems and software solutions. This company has a deep expertise in software, providing engineering services, software, algorithms, and development tools for various ADAS functions; providing interaction design for human-machine interface; developing ECU based on AUTOSAR standards; and providing automotive network security protection.

In March of this year, the Continental Group acquired a portion of the shares of Recogni, a startup company dedicated to AI and real-time object recognition chip architecture research and development. In the future, this new processor will be used for Continental’s high-performance vehicle computers and other applications to enable faster processing of sensor data in the automation and autonomous driving process.

In 2021, the 150th anniversary of this giant, they are still transforming from a supplier of automotive and transportation industry giants to a global technology company providing interconnectivity solutions.

At the Shanghai Auto Show, the Continental Group showcased a range of core technologies and product combinations in the fields of advanced driver assistance and autonomous driving, including the sixth generation long-distance millimeter wave radar, surround radar, HFL110 solid-state short-range laser radar, ultra-high-resolution 8 million pixel perception camera, and high-performance computing unit for the vehicle body.## Values to Watch Out For

It is worth noting that this generation of millimeter-wave radar further improves detection range and accuracy over the previous generation. Not only can it support the latest NCAP-related functions, but it can also output target point clouds containing height information to the controller for 360-degree radar environment construction.

In fact, the first two generations of Continental’s millimeter-wave radar also occupy an absolute leading position in the market. In April, Continental achieved an important milestone of producing its 1 billionth millimeter-wave radar. Since Continental Group began domestic production of its products at its Shanghai plant in 2017, more than 20 new car models with Continental Group’s ADAS products have been launched on the market in Shanghai alone in 2020.

“The (solid-state lidar) is now ready for mass production, which is not a matter of a few years, but a matter of the present,” said Frank Petznick.

“Regarding sensors, we have first-class solutions to provide functional software implementations, and we have some very intelligent solutions for processing data. This not only involves sensor data, but also sensor fusion. Data fusion must be correct, processable, and, most importantly, support functional implementation,” he said.

In addition, Continental Group has also received orders for high-performance computing units with a total value of more than 4 billion euros from several major host manufacturers, including ID.3 and ID.4. It is also the first automotive supplier to provide central processing units for Volkswagen’s ID. series.

During the auto show, Continental Group also signed a memorandum of cooperation with Horizon Robotics, announcing the establishment of an intelligent driving joint venture. It will fully leverage the advantages of the two parent companies in terms of product quality, supply chain, as well as artificial intelligence chips and algorithms, and provide industry-leading advanced driver assistance and autonomous driving software and hardware system solutions for local and global OEM customers.

In 2020, Continental Group and Horizon Robotics had reached a cooperation intention. The Journey series of AI chips and algorithms will be integrated into a variety of Continental Group’s ADAS products, and the two parties will work together to create high-performance, high-quality, and suitable intelligent driving solutions for China’s driving scenarios.

All strategic layouts indicate the strategic significance of this field, pointing to a promising market.# A Field of Hope

Nikolai Setzer, CEO of Continental AG, firmly stated that, “The adjusted strategy has shown us the way to success. In the next three years, the autonomous driving market will at least double. In the field of advanced driver assistance systems and autonomous driving, Continental aims to continue to be the global technological leader.”

Under this trend, more and more traditional car manufacturers, new energy vehicle startups, and technology companies are joining this race.

“This repeatedly validates that we are on the right track, and at the right time, doing something great.”

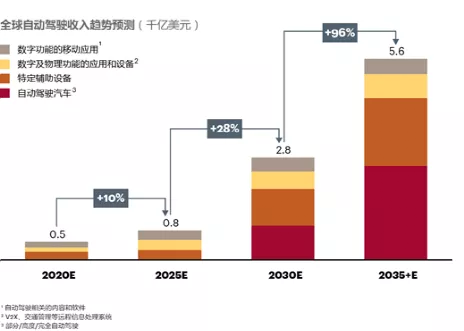

Indeed, behind the adjustment of the corporate structure is the huge potential of the entire autonomous driving and mobility market. According to IHS’s forecast, the autonomous driving car market will start an explosive growth in around 2025. By 2035, half of the road vehicles will achieve autonomous driving, and the total revenue of autonomous driving vehicles and related equipment and applications will exceed 500 billion US dollars.

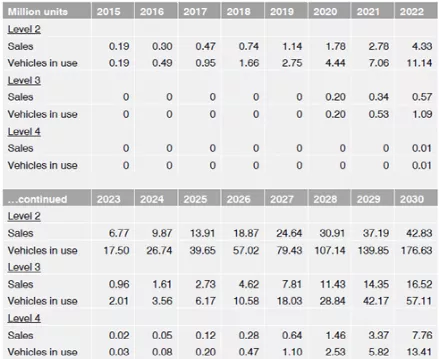

Berg Insight, a Swedish market research company, has conducted more detailed research. The data shows that vehicles with Level 3 autonomy began sales in 2020, with sales of 200,000 units that year, and will increase rapidly in the next decade at an annual compound growth rate of 55%. Vehicles with Level 4 autonomy will start appearing in 2022, with expected sales of 10,000 units that year, and will have an explosive growth at a compound growth rate of 130%.

At the same time, Continental’s ADAS related business has also shown a considerable growth rate, seemingly confirming the strong trend. The data shows that from 2013 to 2019, Continental’s ADAS sales revenue increased fivefold, reaching 2 billion euros (approximately 15.5 billion yuan) in 2019.

At the 2020 financial report meeting, Continental also pointed out that the field of assisted driving and autonomous driving is its profitable growth area. From 2018 to 2020, the Group received ADAS and autonomous driving orders worth as much as 9 billion euros from automakers. The potential supply volume will also multiply in the next few years. To this end, the Group will focus on this field and plans to invest an additional 200-250 million euros in related fields in 2021.

Apart from the trend opportunities, Continental Group has encountered the problem of performance decline under the current reality such as the pandemic and semiconductor supply shortage. From this perspective, it also needs to redefine its new business support structures.

Apart from the trend opportunities, Continental Group has encountered the problem of performance decline under the current reality such as the pandemic and semiconductor supply shortage. From this perspective, it also needs to redefine its new business support structures.

In the challenging market environment, Continental Group’s sales in fiscal year 2020 were 37.7 billion euros, a year-on-year decrease of 12.7%. The adjusted operating profit was 1.3 billion euros, and the adjusted pre-tax profit margin was 3.5%, while the corresponding figures in the previous fiscal year were 3.2 billion euros and 7.3% respectively. Under the influence of the decline in sales, the adjusted operating profit and net profit were -718 million euros and -962 million euros respectively. The company estimates that global automobile production will not recover to the level of 2017 before 2025.

It can be said that many industry giants like Continental Group have been working hard to maintain a stable financial situation and ensure sufficient cash flow in 2020. The start of 2021, the “semiconductor supply shortage”, means yet another huge challenge.

Under the comprehensive performance of multiple factors, at a capital market event at the end of last year, Continental Group directly identified “turning changes towards interconnectivity and sustainable mobility into opportunities” as its strategic support pillar.

Frank Petznick also specifically pointed out, “We will increase our focus on China in areas such as ADAS and R&D, and strengthen their foundation in China, so that we can better keep up with China’s development speed and the development speed of Chinese partners and customers when it comes to implementation.”

To achieve these goals, Continental Group must have sufficient authorization to accelerate the flow of technology and talents in China, ultimately forming the solutions required by China.

Continental Group is very clear about this.

“China’s autonomous driving ecosystem is the most complete and active. China’s new systems are already among the world’s leading in terms of technology and business models.”

Multiple agencies also predict that China may become the world’s largest autonomous driving car market.

According to IHS’s forecast, China’s autonomous driving cars are expected to reach 5.7 million in 2035, surpassing the United States’ 4.5 million to become the world’s largest market for autonomous driving technology applications. At the same time, Boston Consulting Group also stated that China will become the world’s largest autonomous driving market within 15 years.

According to the monitoring data of the GAIC Intelligent Automotive Research Institute, the number of new cars equipped with ADAS intelligent driving system in China in January this year was 671,600, a year-on-year increase of 22.38%, maintaining a high growth rate. Taking the 77GHz millimeter-wave radar as an example, in 2020, the number of new cars in China equipped with Continental Group’s forward radar reached 2.632 million, a year-on-year increase of more than 50%.

At the same time, another set of data indicates room for growth. In 2020, the ADAS installation rate for new cars priced under RMB150,000 in the Chinese market was only 16.49%, far below the full-year installation rate of 34.49%.

In China, the number of employees in the Continental Group’s ADAS business unit has doubled in the past three years, with about 80% of them engaged in development work. This undoubtedly confirms the strategic importance of the Chinese market to the Continental Group. The company recently announced plans to establish a software and system development center in China.

In fact, in the face of multiple unfavorable factors, the Chinese market has already provided strong business support to the Continental Group. Last year, the Continental Group achieved year-on-year sales growth of about 2% in the China region. The group revealed that 24% of its sales in 2020 came from Asia, with the China region making a significant contribution.

If the Continental Group’s bet on the “ADAS and autonomous driving market” with its future performance growth pillar is a high-stakes gamble, then the new sprouts emerging in the Chinese market give people hope.

In 137 days, the Continental Group will celebrate its 150th anniversary, a history longer than the evolution of the automobile civilization, during which about one billion drivers entrusted their lives to the Continental Group while traveling.

Today, three out of every four cars in the world use Continental Group technology. In the future, all achievements will be sealed, and new medals will require new military exploits.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.