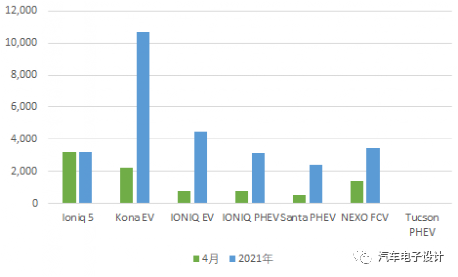

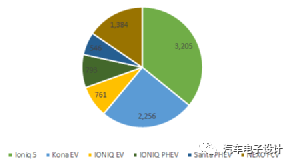

Now tracking vehicle models, 800V can be classified separately. Here we mainly track the supply of SiC modules under the 800V system platform. Hyundai Kia’s current sales target for Ioniq 5 is 70,000 units in 2021 (half of the overall BEV16 plan). Since the start of deliveries in Europe in April, the sales volume of this vehicle has indeed increased. In April, 3,205 vehicles were delivered. There are two important areas of focus:

1) Is the substitution of Hyundai’s other BEVs significant with the 800V Ioniq 5?

2) Can the supply of SiC-related devices be ensured during mass production?

Quantities of Hyundai’s New Energy Vehicles and Ioniq 5

Hyundai’s new energy vehicles can be mainly divided into three types:

-

Pure electric vehicles: 6,222 in April (up 4% YoY), with a total of 18,370 in 2021.

-

Plug-in hybrid electric vehicles: 1,339 in April (up 98%), with a total of 5,570 in 2021. Hyundai’s cost in this field seems unable to compete, so the proportion is relatively low.

-

Fuel cell vehicles (FCV): 1,384 in April (up 51%), with a total of 3,435 in 2021. Hyundai can currently compare with Toyota in this niche market, and the two main companies are sticking to it with the support of energy strategies in South Korea and Japan.

So the interesting thing is that in April, with the suspension of KONA sales in South Korea, the sales of Ioniq 5 reached 3,205, surpassing the damaged reputation of KONA with 2,256 as the sales leader of Hyundai’s electric vehicles.

From the current vehicle model competitiveness, there is no significant difference in the battery capacity and range between KONA and Ioniq. In terms of various characteristics, Ioniq 5 is much more competitive than KONA and Ioniq EV. According to current demand in Europe and South Korea, the scaling of this vehicle will not be restricted by the demand end (Q1 orders reached 41,779).

## Supply of SiC Modules

## Supply of SiC Modules

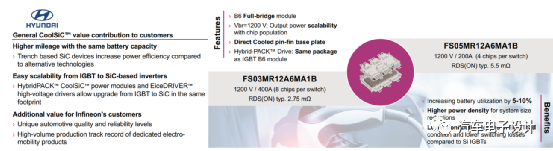

In a May material from Infineon, it was stated that the Ioniq 5 uses Infineon’s Hybrid Pack Cool SiC module. In Infineon’s press release, it was mentioned that supply to the public will begin in June 2021, where Hyundai may have a certain priority.

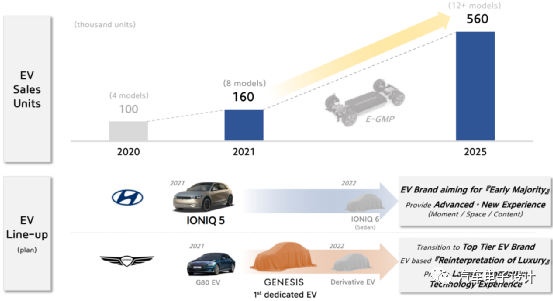

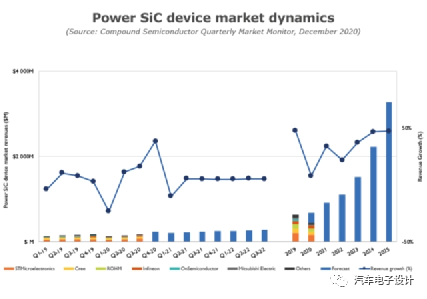

Based on current iterations, Yole forecasts an annual growth rate of 30%-40% for SiC, which may be conservative. In 2021, there will be an addition of 100,000 800V products, and with the continuous increase of E-GMP and PPE platforms in 2022, there will be higher demand for Silicon Carbide modules.

Conclusion:

Currently, charging power in China seems to be a bottleneck. Mainly, on one hand, we are concerned about the impact of fast charging on battery safety, and on the other hand, the previously laid fast charging network needs to be upgraded. However, this trend is still quite evident. Car manufacturers are planning their own fast charging networks, which directly demand for improving fast charging power.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.