Author: Lingfang Wang

As an old car manufacturer, the limelight of Jianghuai New Energy has been completely taken away by the new energy car companies.

Not only has its national sales ranking been poor in the past two years, but also its business card of Anhui Automobile and Hefei Automobile are facing the threat of being taken away by NIO and Volkswagen.

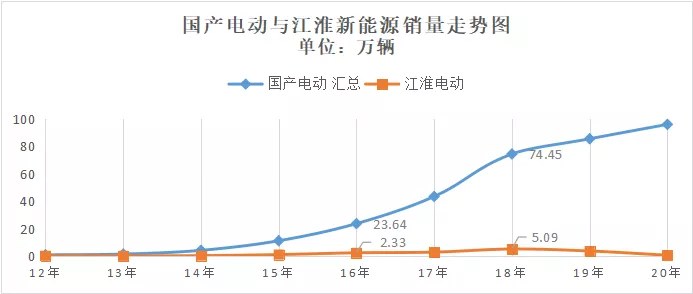

If we turn back time, we can find that Jianghuai was an indispensable force in China’s new energy vehicle industry. Before 2015, during the promotion stage of new energy vehicles, Jianghuai was one of the top-ranking car companies. Before 2019, the personal user base of Jianghuai New Energy was still leading in scale.

However, starting from 2019, the sales volume of Jianghuai New Energy vehicles began to show a significant year-on-year decline, losing its halo.

Nowadays, the trend of new energy vehicles has become a consensus. Can Jianghuai New Energy rise again?

In early May, “Electric Vehicle Observer” came to Hefei, Anhui, and interviewed Xia Shunli, the Party Secretary and General Manager of Jianghuai New Energy Passenger Vehicle Company.

Jianghuai New Energy, which is now a joint venture with Volkswagen, has learned from NIO and benchmarked Volkswagen internally, promoted system reform with customers as the center and supported itself with external forces accumulated over more than ten years of technology. All these efforts are made to make a comeback.

The Rise and Fall

Jianghuai New Energy vehicles can be said to have reached its peak “as soon as they debuted”.

According to the data of China Passenger Car Association, in 2012, the sales volume of domestically produced electric vehicles was 8,500 units, and Jianghuai alone sold 1,422 units, with a market share of nearly 17%.

Since then, Jianghuai New Energy vehicles have developed together with China’s new energy vehicles and played an important role in the early market. During the promotion stages of ten cities and thousands of vehicles from 2009 to 2012 and 88 cities nationwide from 2013 to 2015, Jianghuai was one of the leading new energy vehicle companies.

Riding on this momentum, in 2016, Jianghuai released the “first pure electric SUV in China” – iEV6S at the auto show. As the first pure electric SUV in China, it combined the characteristics of pure electric vehicles and SUVs. It could enjoy exclusive license plates for new energy vehicles in cities with limited license plates such as Beijing and Shanghai. With its high cost-effectiveness, it was well received by the market.

Just when Jianghuai planned to use the momentum of this model to increase sales, the Chinese government tightened its control over the application of overseas ternary batteries. Foreign battery companies represented by Samsung and LG have been unable to enter the “Automotive Power Battery Industry Standard Conditions” (commonly known as the “Battery White List”).

Without entering the “Battery White List”, Jianghuai iEV6S could not receive national subsidies.

In July 2016, Jianghuai Automobile Co., Ltd. had to stop producing this electric SUV with Samsung SDI batteries.

At that time, buyers would not accept a new energy vehicle without subsidies, as its price was much higher than that of conventional fuel vehicles.

Due to the highly anticipated iEV6S failing to sell smoothly, Jianghuai’s sales were significantly lower than expected, and the gap with the industry’s growth rate began to widen.Although the IEV6S had its battery replaced later, its sales were greatly discounted due to much lower performance than Samsung’s batteries.

One step at a time. 2017 is a landmark year for the global pure electric technology-driven transformation. Not only did global electric vehicle sales exceed one million units, but many international automakers also set new strategic targets in the field of electric vehicles.

In 2017, China’s new energy vehicle sales experienced a significant growth. Due to reasons such as the change of power battery suppliers, Jianghuai’s new products failed to keep up with the pace, leading to a sharp decline in sales growth that year. The trend of Jianghuai’s slow development of new energy became increasingly apparent.

However, prior to 2019, Jianghuai’s new energy vehicles still ranked among the top 10 in terms of sales due to consumers’ accumulation from the early stage.

CEO with a technical background

In 2018, Xia Shunli, a CEO with a technical background, took over as CEO of Jianghuai’s new energy division.

In that year, a major event for Jianghuai was the recall: In 2018, JAC Motors recalled 4,248 units of its iEV5 electric vehicle.

The recall was triggered by several spontaneous combustion incidents since 2016. In June 2016, a Jianghuai iEV5 electric vehicle caught fire and burned in Sanlitun, Beijing. Subsequent incidents of spontaneous combustion aggravated consumers’ concerns about the safety of Jianghuai’s electric vehicles, and a recall was a must.

Perhaps it was the spontaneous combustion and recall incidents that made Jianghuai realize that there were still many shortcomings in the maturity of new energy vehicle products. The improvement of product reliability and stability must be considered as the top priority for the company’s development.

Xia Shunli, an engineer and former director of the New Energy Vehicle Research Institute, is obviously suitable for the position.

He participated in the entire process of technological development for Jianghuai’s new energy vehicles and helped the company create nine generations of electric vehicle technology and four generations of products.

Xia Shunli, who graduated from Hefei University of Technology with a master’s degree in 1999, began his research and development of RuiFeng engines after joining JAC Motors.

In 2007, Xia Shunli, who had achieved remarkable results in engine development, was assigned by his superiors to set up a new department – the New Power Department. This department later evolved into the New Energy Vehicle Department, where he served as director of the New Energy Vehicle Research Institute.

Xia Shunli first came into contact with electric vehicles in 2002, but at the time they used lead-acid batteries.

Xia Shunli recalled that he made a 6-7 meter minibus at the time that could run for 80-100 kilometers. However, he found that the vehicle’s climbing performance was too poor, mainly due to the weak discharge capacity of the battery, so the project was terminated.After having experience with pure electric vehicles, Xia Shunli was assigned to lead the new power department, and began to focus on hybrid power technologies, spending two years evaluating various routes such as micro-hybrid, full hybrid, and extended range, while discovering various issues.

In 2009, Left Yanan, who was then the Chairman of Jianghuai Automobile, made a decision to invest in pure electric vehicles, which meant Jianghuai was committing to the development of pure electric technology. Subsequently, Xia Shunli oversaw extensive technical cooperation with companies such as Guoxuan High-tech and Hua Ting Power to develop electric vehicle technologies.

The Lithium Iron Phosphate and Small Battery Cell Route Persisted for Many Years

In Xia Shunli’s eyes, safety is the top priority for the development of new energy vehicles.

When recalling this period of history, Xia Shunli used “painful” and “agonizing” to describe the decision-making process regarding the choice between Lithium Iron Phosphate and Ternary cells, as well as the decision on whether or not to pursue a large-scale development.

Xia Shunli told “Electric Vehicle Observer” that they began researching battery technology as early as 2010. After communicating with Xu Xingwu, who just returned from abroad and became the Executive Vice President of the Guoxuan High-tech Research Institute, both parties were aware of the dangers of batteries. “Batteries can explode and may even cause fatalities if the amount is significant”.

Xia Shunli’s first reaction was that batteries cannot be used as vehicle power as fatalities caused by an explosion is a serious issue. However, developing new energy vehicles is a national policy, and technology is continuously improving, and pure electric technology is already confirmed, so their strategy cannot be too radical.

Therefore, Jianghuai and Guoxuan initially locked their technical route into Lithium Iron Phosphate with small battery cells, “ideally the battery capacity should be below 20ah.”

For safety, Xia Shunli told “Electric Vehicle Observer” that they used 10Ah batteries at the beginning.

(1) Resolving Safety Issues in Ten Years

Despite this, Jianghuai’s early electric vehicles faced challenges in battery safety. Xia Shunli recalled that as vehicle mileage requirements became higher, they also had to use Ternary cells, but the early battery explosion test results were not ideal.

The fires in 2016 and the recall events in 2018 made Xia Shunli realize that the loading standards for Ternary cells needed to be reevaluated.

Firstly, Jianghuai tightened the test requirements. “All development must pass 100 thermal runaway tests where none of the 100 battery packs catch fire.”

In order to achieve this requirement, they conducted many experiments simulating the impact of cell explosions on batteries and surrounding areas.

After numerous tests, Xia Shunli and his team found that it was difficult to avoid individual cell fires. After consulting almost all experts in the industry, Xia Shunli accepted the fact that Ternary cells always have the possibility of catching fire.

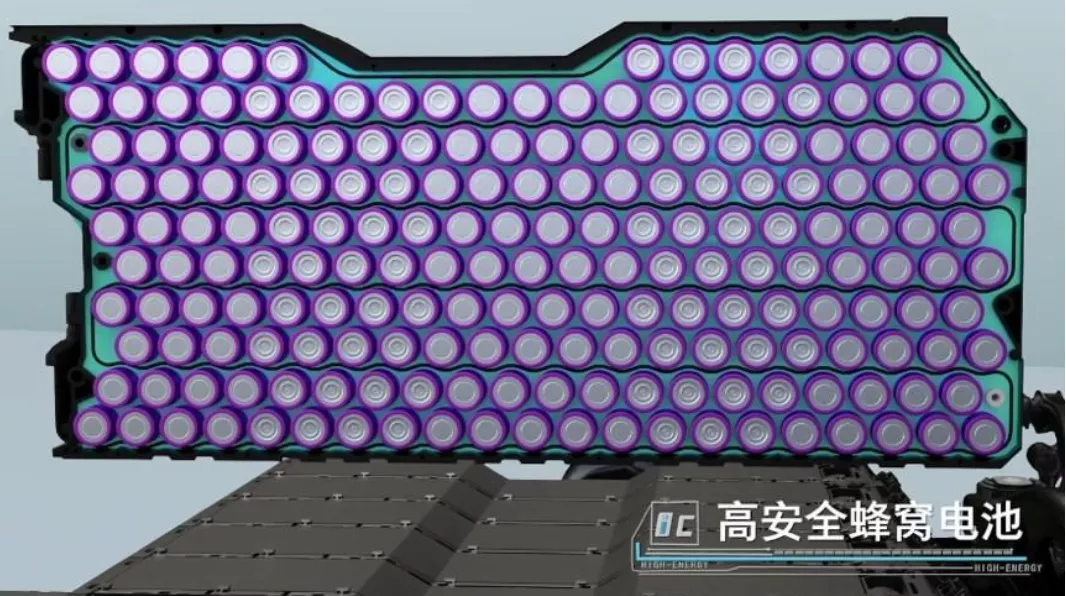

Finally, in 2018, Jianghuai and Huating Power developed honeycomb batteries, which fully resolved the issue of battery packs catching fire.Summer Shunli pointed out that the cylindrical battery has indeed played a role. Practice has proven that 6 battery explosions have been found, but there are no safety problems with battery packs and vehicles.

“Approximately 1 billion yuan has been invested in materials, research and development, etc., and more than 10,000 experiments have been conducted.“

For this reason, JAC Motors has been exploring this for a full 10 years.

(2) Solving Low Temperature Performance Issues

Although the safety of lithium iron phosphate batteries is better than that of ternary batteries, and their energy density is also constantly improving, low temperature performance has become another urgent problem.

In response to this issue, Xia Shunli and Xu Xingwu began to discuss the feasibility of the full-tab ear. The advantages of the full tab ear are low internal resistance and good heat transfer.

Xia Shunli said that compared with other square battery technologies, the circular lithium iron phosphate battery of the full-tab ear has a faster and more uniform overall temperature increase, while most competitors are square liquid-cooled technologies and do not have this advantage.

For example, the temperature difference between the center zone and the peripheral cell of the battery using this technology is only 3-5 degrees, and the temperature balance can be achieved in 5-10 minutes of charging, while other large square batteries may take about 30 minutes for the temperature to be consistent.

In terms of specific driving range, Xia Shunli said that their data shows that in Jinan, in winter, the actual driving range of JAC’s models is 50-80 kilometers more than that of competitive models with the same driving range rating.

In addition, Xia Shunli also revealed that the 4680 cylindrical battery is also an important choice for them in the future, with a diameter of 46 mm and a height that can be considered up to 100 mm.

(3) Fast Charging Strategy is Cautious

Compared with products of other companies, JAC’s previous models were the most complained about by consumers in terms of charging speed.

Xia Shunli said that with the high specific energy ternary battery of the full-tab ear, it is possible to charge up to 80% within half an hour, which is basically the industry standard.

Previously, the product achieved a balance between battery safety and life. “Lithium will be separated after fast charging, and the result that caters to consumer demand will bring hidden dangers to safety.”

In terms of consumer experience and safety, Xia Shunli chose to prioritize safety-due to this strategy that seems slightly conservative.

Focusing on Brand Upgrade for 5 Years

Since JAC Volkswagen started its cooperation in 2017, it has been 5 years now.

In Xia Shunli’s view, in these 5 years, JAC Motors has been striving to do one thing, which is to elevate product quality to Volkswagen’s level.Summer Shunli told “Electric Vehicle Observer” that the first car produced by the collaboration of Volkswagen and JAC Motors – the SEAT Mii electric, has run nearly 300,000 kilometers on Volkswagen’s testing ground. “After the run, it was just in time for Volkswagen CEO Diess to take office. After Diess took office, he confirmed it again and spent another year confirming it.”

The quality of the product has been confirmed, but the disadvantage is that it missed the best sales opportunity.

Originally scheduled to be launched in 2018, it was postponed until 2019. In 2019, government subsidies fell by 75%, which had a huge impact. At the same time, their long-delayed marketing model also resulted in the car having almost no sales.

However, Summer Shunli insists that quality must come first.

In October of last year, after Volkswagen acquired shares in JAC Motors and the JAC products met Volkswagen’s standards, the two sides reached a consensus and authorized the SEAT brand to JAC Motors. JAC’s new energy vehicle also began to use the SEAT brand.

Speaking of the positioning of the SEAT brand, Summer Shunli said that it is positioned as a high-quality, cost-effective, and intelligent product.

In addition to the debut of the SEAT Mii electric, JAC Motors’ other products include the SEAT E10X and E40X, which are positioned in the A00 and A class, respectively. JAC Motors already had advantages in the microcar segment, so they have placed significant expectations on the E10X.

Perhaps it is the quality-first strategy that makes Summer Shunli very confident in the SEAT E10X. He told “Electric Vehicle Observer”: “I think that at present, the SEAT E10X has obvious advantages in quality, handling, and intelligence compared to competing cars.”

Looking forward to the future, Summer Shunli said that JAC Motors wants to build two intelligent platforms in the field of new energy: one is a small vehicle platform with a price range of 50,000 to 100,000 yuan, and the other is a medium-sized platform with a price range of around 200,000 yuan.

In terms of small cars, they want to spend about two years to create a small car with a range of 500 kilometers, weighing about 1 ton, and interchangeable battery packs ranging from 200 to 500 kilometers.

In terms of large and medium-sized vehicles, Summer Shunli wants to create a compact or family-first product that can be made into an intelligent electric vehicle costing around 200,000 yuan. He believes that such products are mainly aimed at the market in 3-5 years.

In the “14th Five-Year Plan” period, SEAT New Energy will also launch more than 10 new high-end intelligent products using a new dedicated platform, covering the A00 to B segments of the market.The small target set by JAC New Energy for this year is to sell at least 50,000 vehicles, including 40,000 micro-cars and 10,000 A-class passenger cars.

How to win 50,000 customers?

Unlike when JAC New Energy first started making electric vehicles, the electric vehicle consumer market has undergone fundamental changes.

For JAC New Energy, the improvement of technology and quality is necessary, but not enough.

As the general manager, Xia Shunli is not just focusing on technology. “My main job is actually to adjust our entire system with a user-centered, user-based perspective.” Xia Shunli said.

“Our R&D and marketing must be centered on the user’s perspective,” said Xia Shunli. In terms of R&D, “we no longer do whatever technology we have or what our clients need.”

He believes that capturing demand requires foresight. As a general manager, his main consideration is, “what products should we make for the future? What services should we provide?”

Regarding marketing, Xia Shunli said that it needs to be “systematic.” The so-called “systematic” means that products must find customers through the use of technologies such as the internet of things and digital technologies.

“The whole system needs to change,” Xia Shunli emphasized. This judgment is consistent with the opinions of external observers. However, it is difficult to implement, and whether JAC can seize the second chance of new energy vehicles will depend on whether it dares to initiate a self-revolution.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.