Introduction: How to create a high-end new energy brand? It’s simple, establish a comprehensive system for new energy vehicles, rather than just producing a product. The developing new energy market determines that a product is not the only key to open the market.

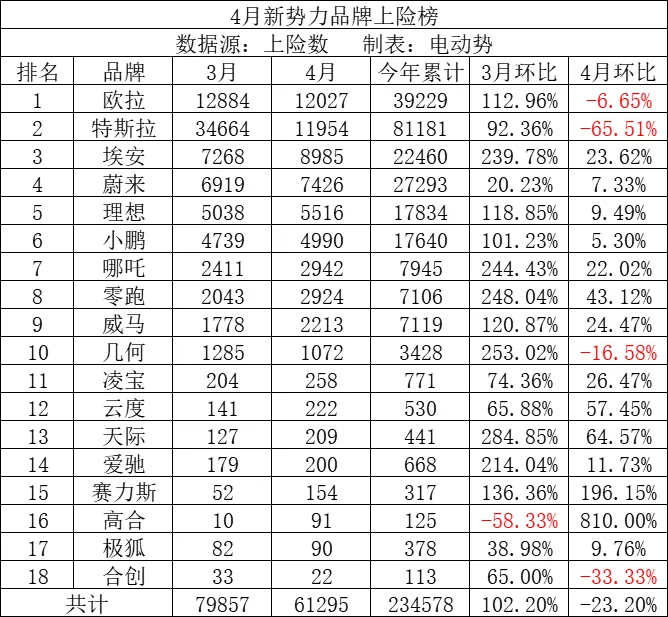

The Shanghai Auto Show’s consumer rights incident shocked the industry and left Tesla in a maelstrom. In the eyes of many insiders, the lack of confidence in Tesla’s braking system has directly affected terminal sales. According to Electric Power statistics, the actual sales volume of Tesla’s terminal insurance in April was 11,954, a month-on-month decrease of 65.51%.

Considering that Tesla’s terminal insurance was reduced by 22,710 month-on-month in April, the total number of new energy brands also decreased, by 23.2%, compared to March’s increase of 102.2%. Of course, the sharp increase in March and the fewer working days in February due to the Lunar New Year celebrations is relevant, but the impact of Tesla on the total fluctuation of new energy brands cannot be ignored.

Brand Rankings

Compared to February, the most significant change in the brand rankings for March is that the growth rates have decreased across the board. Eleven brands that had month-on-month growth rates of more than 100% in March, and only two brands exceeded this rate in April, which were Siles and GAC with lower bases. On the other hand, compared to March’s single drop of GAC, there were four winners in April: Ora, Tesla, Geometry, and Hozon, which had experienced a certain drop in the month-on-month increase rate.

The direct impact of Tesla’s decline is the consumer rights incident, but it is noteworthy that the incident occurred on April 19th, with further escalation at the end of the month. In other words, Tesla sales were not affected by consumer rights claims for three-quarters of the month, so Tesla’s sharp decline in April’s terminal insurance was not entirely due to the effects of the incident, which differs from the conclusions reached by the industry.

In fact, those familiar with Tesla’s global delivery rules should know that the beginning of each quarter is a low point in Tesla’s deliveries, with the end of the quarter being the peak period. Therefore, the data for the next two months will truly reflect the impact of this consumer rights incident on Tesla’s terminal sales.

Other brands’ sales did not significantly increase in April, which also demonstrates this point. Although Tesla’s terminal insurance plummeted month-on-month in April, related brands did not achieve significant growth. In April, NIO had a month-on-month increase rate of only 7.3%, Xpeng had an increase rate of 5.3%, and Li Auto had an increase rate of 9.4%, while Ora, who won the championship, had a month-on-month decrease of 6.6%.

This indicates that although the consumer rights incident affected the confidence of potential Tesla vehicle owners, they have not yet obviously shifted to other brands. Of course, the true impact may have not yet occurred. Currently, NIO, Xpeng, and Li Auto are all experiencing sales bottlenecks, which brands receive significant growth in the next few months, may show that these prospective Tesla owners have shown their favor.Although WEY Xiaoli did not achieve the expected growth, Guangqi Aion saw significant growth. Among the TOP6 brands of new forces in April, Guangqi Aion grew by 23.62% MoM, achieving the highest growth rate.

In the past two years, Guangqi Aion’s reputation has been controversial in the industry, but its performance at the end of the terminal is indeed impressive. At the current trend, it is not a dream to become the first brand of new forces. Moreover, Guangqi Aion’s main model is the mid-to-high-end AION S, which had a terminal insurance of up to 7020 vehicles in July, making it the best-selling domestic mid-to-high-end pure electric sedan.

Model Ranking

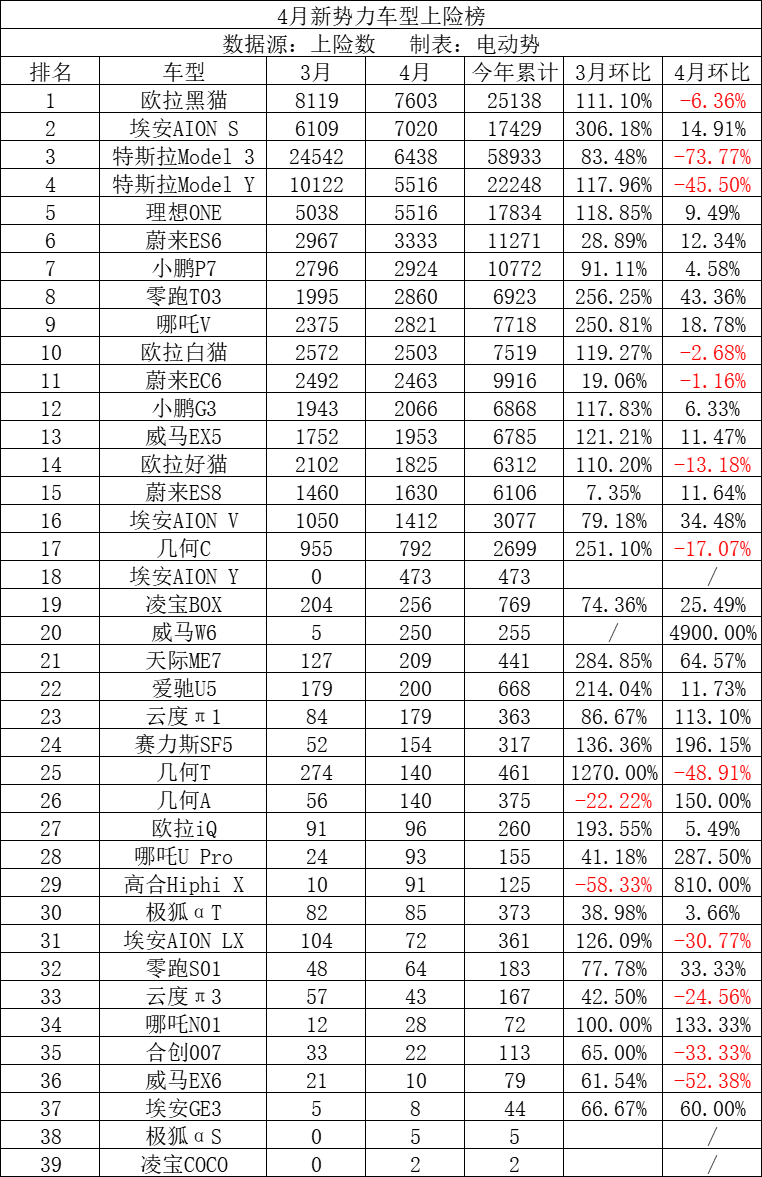

Consistent with the changes in the brand rankings, the top two positions of the April model rankings also welcomed new faces: the Ora Black Cat and the Guangqi Aion AION S, with the former surpassing Tesla Model 3 for the first time to take the top spot.

In the 2021 Black Cat, Ora increased its maximum cruising range to 405 kilometers and its driving motor power to 45 kilowatts. Although some core parameters are close to or even exceed the benchmark of the same level, such as the Leapmotor T03, the guidance price of the former is as high as 80,000 yuan, which is two thousand yuan more expensive than the latter, indicating that the problem of product competitiveness still needs to be solved.

After Tesla Model 3/Y, the leader of the first batch of new force brand models are three major internet new forces, namely the Idean ONE, NIO ES6, and XPeng P3, which are in a very stable position. Following them are the Leapmotor T03 and NETA V, which have strong momentum and ranked first and second in April’s MoM growth among the TOP10 new forces. If they can solve the problems of marketing and channel quantity, they can achieve even greater breakthroughs.

Beyond the top 10 are NIO EC6, XPeng G3, WM EX5, Ora Good Cat, NIO ES8, and Aion V, whose sales and rankings are also very stable. Except for two NIO models, the other four are A-class market with prices of more than ten thousand yuan, which is also a low-lying area in the pure electric market, and it is difficult to achieve greater breakthroughs in sales.

Whether the A-class pure electric market can emerge from the downturn depends on two models: Guangqi Aion Y and NETA U Pro, whose performance-price ratio has been significantly improved and is almost comparable to that of the same level of fuel vehicles, meaning that the era of electric vehicle popularization is coming. In April, the Guangqi Aion Y and the NETA U Pro were delivered in their first month. The former had an insurance number of 473 vehicles since its earlier launch, while the latter had an insurance number of 93 vehicles since its later launch, and it is expected to achieve significant growth in the next few months.Following are the Wey W6, Skywell ME7, and Aiways U5. The Wey W6 has just been delivered and is currently climbing uphill. Despite good orders, its positioning and pricing are generally higher than that of the EX5, taking an intelligent route, and stuck in the most difficult market of around 200,000 yuan. It is unlikely that the subsequent sales will exceed the EX5. The Skywell ME7 and Aiways U5 suffer from similar issues, both coming from pure electric platforms, taking a route of refined and high-quality products. However, the price-to-performance ratio is not attractive, and the new energy market is still in its infancy, meaning that there are limited opportunities.

Lastly, there are the Seres SF5, GAC Aion X, Jidu Auto αT/αS, Enovate ME7 / Human Horizons HiPhi X / Leap Motor T03. If NIO and IDEAL are breakthroughs and models for new forces in the high-end sector, then these models are negative examples of rashly going upscale. One may wonder why they failed to develop well, even though their products’ performance was not inferior but even stronger than that of NIO and IDEAL?

This brings us back to a core question: how to establish a high-end new energy vehicle brand? In fact, it is simple- the key is to establish a comprehensive system for new energy vehicles, rather than just producing a product. The new energy market, still in the developmental stage, means that the product is not the only key to opening up the market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.