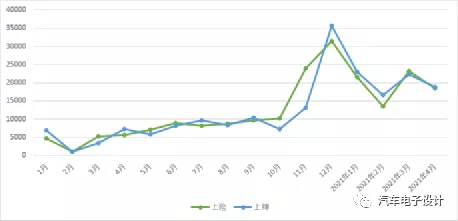

The issue of licensing micro electric vehicles in Shanghai remains uncertain recently. The data for license and insurance registration in April has been released, showing a clear decrease in demand since the peak in November last year.

In April, there were 18,865 license registrations and 18,403 insurance registrations, reflecting the decline in demand since November. However, within the past 4 months, there were 80,000 new energy license plates issued. Taking into account the previous 6 months since the implementation of the new policy in October last year, there were a total of 130,000 license plates issued. This has imposed considerable pressure on urban traffic, especially on urban elevated highways.

Structural Changes in April

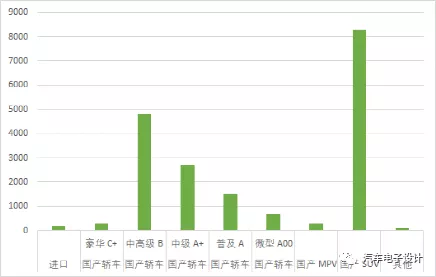

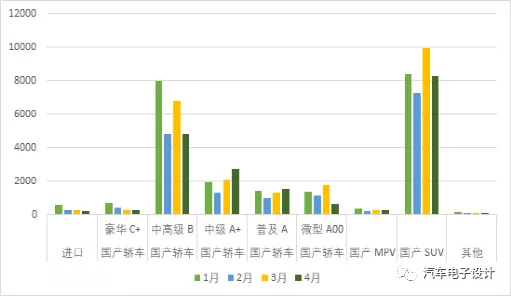

Of the 18,000 registrations in April, micro electric vehicles accounted for 655 units (probably applied at the end of March and processed in early April), while in the previous three months (January to March), micro cars in Shanghai had 1,396, 1,171, and 1,758 license registrations respectively. Due to the peak of the Model 3 Tesla delivery passing, SUVs made up the largest share in April, reaching 8293 units.

Note: It is expected that no micro A00 electric car will be registered in May.

From the trend of the past 4 months, it seems that the managers aim to shift more resources towards mid-level and high-end cars, with 2,694 and 4,826 registrations respectively in April. Currently, a total of 4,980 micro A00 electric vehicles have been licensed in Shanghai in 2021. Without restrictions, the demand could exceed 20,000 this year, which is too high for the over 10,000 vehicle quotas issued in Shanghai every month.

As for the top five selling brands of electric vehicles in Shanghai in the past six months, they were Tesla (31,356 units), Roewe (19,902 units), BYD (17,226 units), Volkswagen (7,560 units), and Nio (9,480 units), with a year-on-year increase of 115%, 84%, 214%, 129%, and 161% respectively. No clear preference has been observed in the sales distribution among these brands.

Prosperous Half YearFrom November last year to April this year, the sales of new energy vehicles in Shanghai reached a historical high of 132,200 vehicles (with an average sales volume of 22,000 vehicles, which was less than 10,000 before), a year-on-year increase of 349.1%, which made the penetration rate of new energy vehicles in Shanghai reach 32%, an increase of 20 percentage points year-on-year.

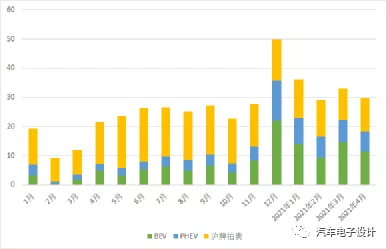

In fact, as shown in the following figure, the new energy vehicle market in Shanghai has undergone a major transformation since 2020. Prior to 2019, plug-in hybrid electric vehicles dominated the Shanghai market for a long period of time.

In the six months since November last year, the growth of pure electric vehicles exceeded that of plug-in hybrid models. In the past six months, 81,600 pure electric vehicles were sold, a year-on-year increase of 407%, and 50,600 plug-in hybrid vehicles were sold, a year-on-year increase of 279% (the proportion of pure electric vehicles increased from 57% to 62%, while the proportion of plug-in hybrid models decreased from 43% to 38%).

From this perspective, the 13,550 units of plug-in hybrids sold in December last year have already reached a historical peak. The sales of plug-in hybrid vehicles in the past three months have been maintained at around 6,000 units, from 5,007 in February to 7,455 in March, and 6,971 in April.

Note: The ideal extended range is not high in Shanghai, which is also a very interesting phenomenon. We have the opportunity to analyze the distribution of the Ideal ONE and the insurance data in Shanghai separately.

Summary

After writing these data, it can objectively reflect the huge role and limitations of urban management guidance on new energy vehicles. In the national monthly insurance data ranking of new energy vehicles, Shanghai has been ranked first for several consecutive months, and even exceeded the sum of the second and third places (Shanghai’s insured vehicles reached 132,200, while Beijing and Shenzhen combined only had 110,300). In 2020, the penetration rate of new energy vehicles in Shanghai has reached 20%, and it will be over 30% this year.

I tend to think that this kind of individual license plate issuance may need to be moderately slowed down, and the transition to pure electric vehicles in the taxi and ride-hailing industry will gradually shift the next wave of increments to the 2B (business-to-business) field.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.