*Author: Lingfang Wang

Tesla lost its dominance as Chinese automakers take the lead.

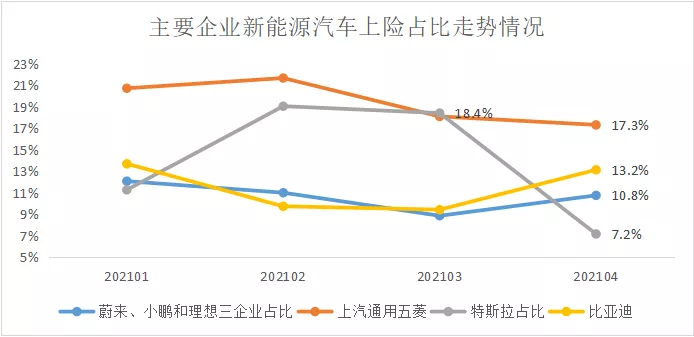

In April, SAIC-GM-Wuling, BYD, and Great Wall Motor surpassed Tesla in terms of insurance policies for their vehicles.

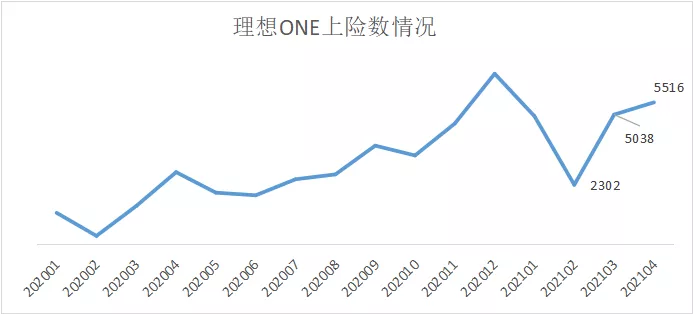

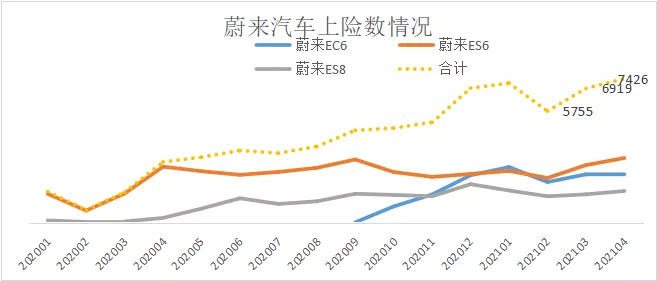

The top three new energy vehicle (NEV) startups, NIO, XPeng, and Li Auto, are steadily increasing, especially Li Auto’s growth rate. In contrast, Tesla experienced a sharp decline in its insurance policies.

The concentration of the A00 vehicle market has slightly decreased, with more companies joining the competition. However, the proportion of vehicle models continues to expand.

It is worth noting that there is a recovery in the operation of vehicles, with a significant upward trend in March and April.

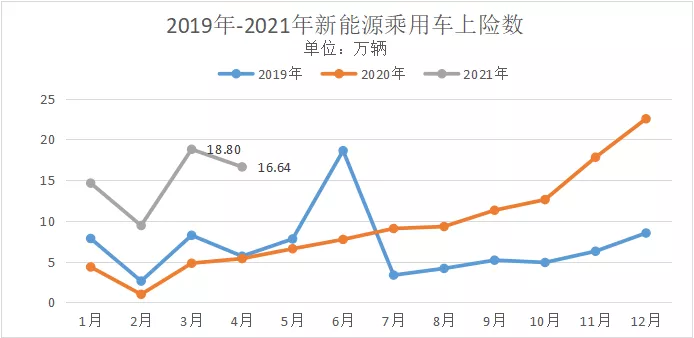

In April, the number of NEVs insured was 166,400, an increase of 208.8% YoY but a decrease of 11.5% MoM.

The decrease in the number of NEVs being insured is likely due to the impact of the supply chain, such as the shortage of chips affecting Great Wall Motor’s Haval Black Cat.

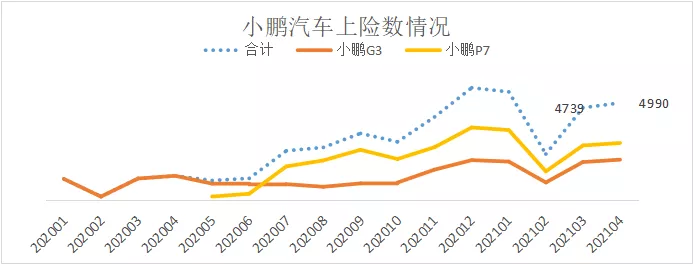

Top Three NEV Startups See Steady Growth

In April, SAIC-GM-Wuling’s NEVs had 28,800 insurance policies, accounting for 17.3% of the market share, BYD’s NEVs had 21,900 insurance policies, accounting for 13.2% of the market share, and NIO, XPeng, and Li Auto had a total of 17,900 insurance policies, accounting for 10.8% of the market share. Tesla’s insurance policies were 12,000, with a market share drop from 18.4% in March to 7.2%.

In April, Li Auto’s ONE had 5,516 insurance policies, with a MoM growth of 9.5%. The data in March was 119%, indicating that consumer acceptance of Li Auto is still increasing.

In April, NIO’s insurance policies were 7,426, with a MoM growth of 7.3%. In March, the growth rate was 20%.

In April, XPeng’s insurance policies were 4,990, with a MoM growth of 4.6%. In March, the data was 91%.

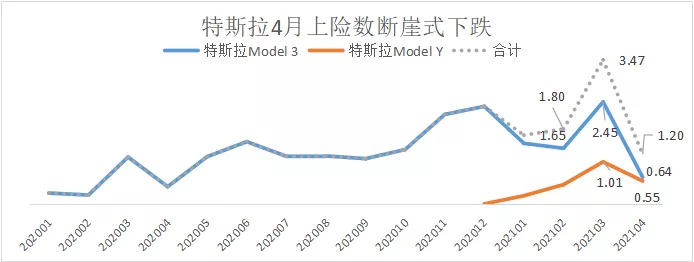

Sharp Decline in Tesla’s Insured Cars

In April, the number of insured Tesla cars dropped significantly by 65.5% compared to the previous month, totaling 12,000 vehicles. However, compared to the same period last year the figure rose by 187.8%. Tesla’s market share also declined from 18.4% in March to 7.2%.

The decline of Tesla’s sales may be related to a series of accidents and protests at the Shanghai Auto Show. However, Tesla’s official explanation is that the Model Y production line at the Shanghai Super Factory stopped for two weeks in April to upgrade production efficiency and quality, causing fluctuations in sales figures.

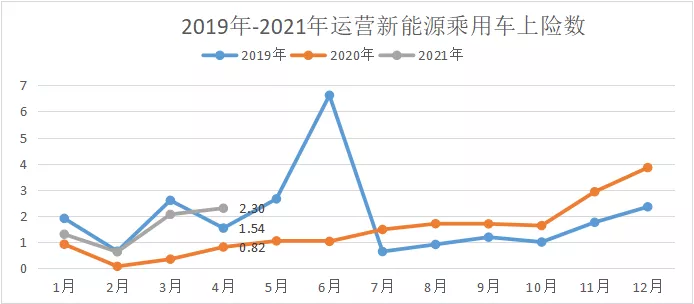

Recovery of Operating Vehicles

“Since July last year, the number of insured new energy vehicles used for commercial purposes has been recovering, showing an upward trend,” according to the analysis. In April, the number of insured commercial vehicles reached 23,000, a 11.4% increase from the previous month, and higher than the figures for the corresponding period in 2019 and 2020. In March, the number of insured commercial vehicles reached 20,000, a 230% increase from the previous month.

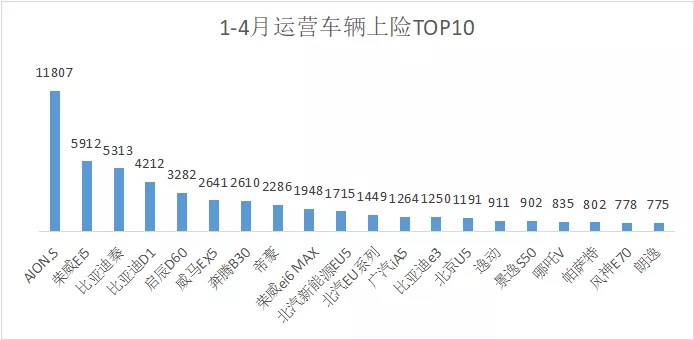

Looking at the first four months, Aion.S of GAC Motor had the highest number of insured commercial vehicles, reaching 11,800 with a 20% increase month-over-month. The runner-up was the Roewe Ei5 with 5,912 units sold.

For April, the commercial vehicles with the highest month-over-month growth in insured cars were Fengshen E70, which rose by nearly 27 times from 26 in March to 725 in April. Passat went from 206 in March to 469 in April, growing more than twice as much. In addition, the insured cars of WM EX5, Yidong, and Langyi all grew more than 60% month-over-month.

A00 Class Insured Cars Account for Approximately 40%

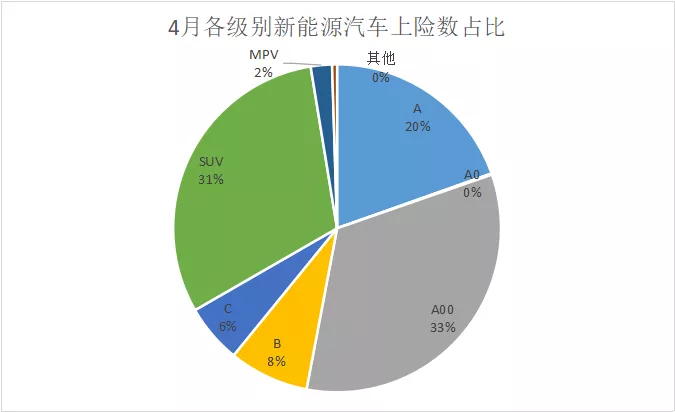

In April, among insured new energy vehicles, A00 class accounted for over 55,000 vehicles, or one-third of the total, followed by SUVs, which accounted for 31%.

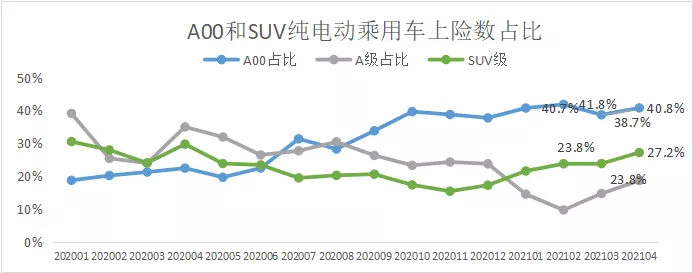

In April, according to the data from Shangxianshuang, A00-class electric vehicles once again increased their market share and now reach 40.8%. The other two types of vehicles with high market share are A-class and SUV vehicles, accounting for 23.8% and 27.2% respectively.

Looking at A00-class vehicles, SAIC-GM-Wuling remained the biggest winner in April with a Shangxianshuang count of 28,600 vehicles, 2.8 times the count of the second Long Range vehicle.

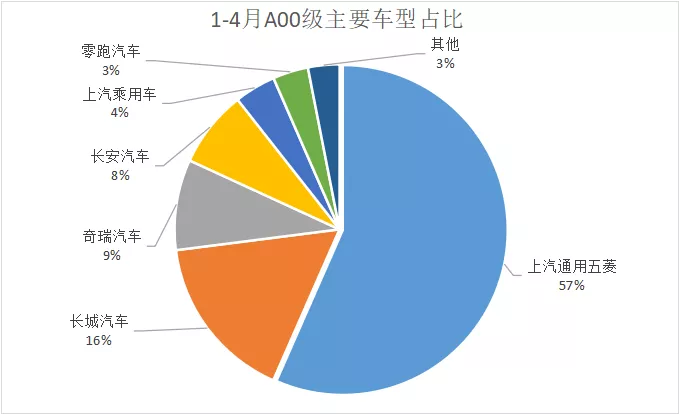

However, in April, SAIC-GM-Wuling’s market share in A00-class vehicles reached 51.6%, down from 54.6% in March, indicating an increase in competitive vehicles in this field.

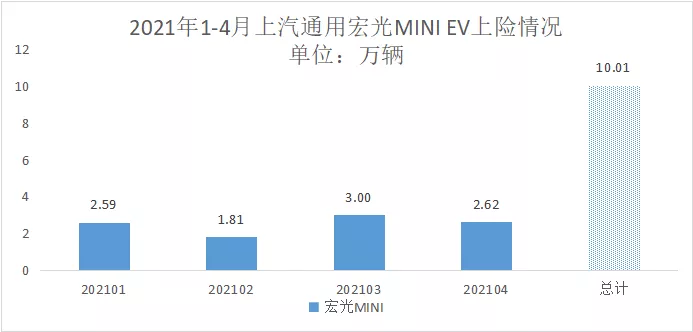

From January to April, SAIC-GM-Wuling had 112,700 insured A00-class vehicles, accounting for 57%; Long Range had 32,600, accounting for 16%; Chery, Changan, SAIC, and Leapmotor had 17,600, 15,000, 8,000, and 6,900 insured vehicles, respectively.

According to Shangxianshuang data, from January to April, 23 companies and 45 car models of A00-class electric vehicles were insured.

Overall, as various automakers continue to launch A00-class vehicles, the market share of this type of vehicle is expected to continue to increase; the recovery of operating vehicles has already emerged and will also become an important support for future market growth.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.