Overview of China’s new EV startups in the first four months of 2020

The success of China’s new EV startups has put great pressure on traditional automakers. In this report, we will summarize the data for the first four months of the year to evaluate the competitive landscape.

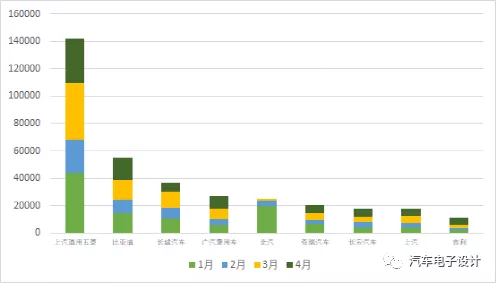

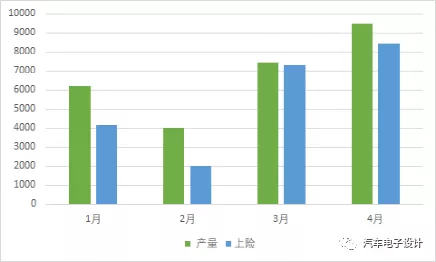

Firstly, let’s look at the production data for the first four months. This reflects the automakers’ demand for the future (production is usually 1-1.5 months ahead of sales).

Note: we will separate PHEVs for a separate analysis.

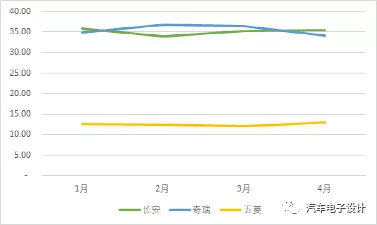

Overall, SAIC-GM-Wuling had a relatively fast turnover with production slightly decreasing to 32,233 units in April from 41,223 units. The corresponding battery demand for these units was 1.778 GWh with an average energy consumption of 12.53 kWh per unit. This production method is difficult to replicate and somewhat similar to Chery and Chang’an.

Chery produced 20,691 units with a battery capacity of 728.47 MWh and an average energy consumption of 35 kWh; Chang’an produced 18,134 units with a battery capacity of 643.63 MWh, both selling A00-class cars with a 300 km range (after subsidies).

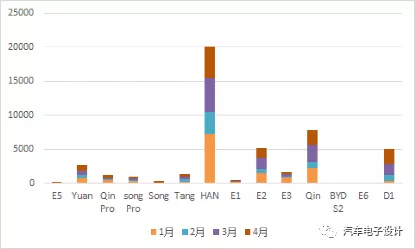

BYD also had a good EV production with 55,000 units in the first four months, consuming 3.76 GWh batteries and an average energy consumption of 68 kWh per unit. The corresponding sales data was 46,957, with some lag effect. The energy consumption per unit was somewhat unstable for January to April, at 70.21 kWh, 67.91 kWh, 72.32 kWh, and 63.52 kWh, respectively.

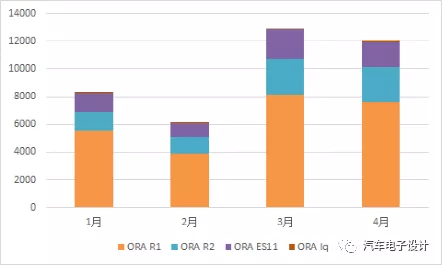

Great Wall Motor had a decrease in production in April, producing only 6,420 BEVs compared to the peak of 12,000 units in November and December last year. The total production for the first four months was 36,700 units, less than the sales data of 39,000 units, due to some special circumstances.

The production capacity expansion of GAC has been relatively rapid recently. In April, the output increased to 9,478 units, which is a prominent enterprise in the recent period. From the perspective of output, it is also increasing inventory and vigorously pushing outward.

The production capacity expansion of GAC has been relatively rapid recently. In April, the output increased to 9,478 units, which is a prominent enterprise in the recent period. From the perspective of output, it is also increasing inventory and vigorously pushing outward.

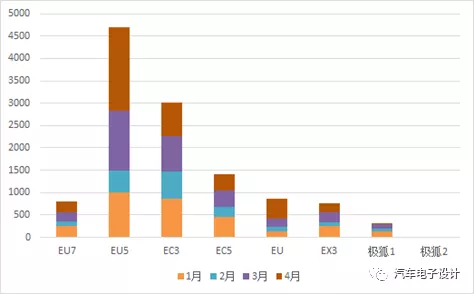

BAIC’s production situation is somewhat special. It produced 20,000 units in January, and then consumed 12,000 units in four months (fluctuating between 2,000 and 4,000 units per month). The cumulative registration of ArcFox Alpha T is 293 units.

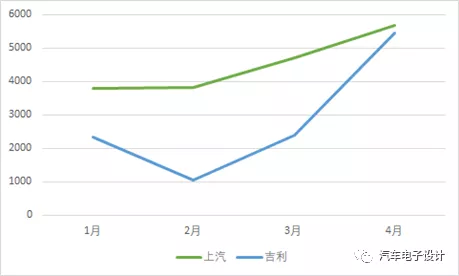

Finally, let’s take a look at the pure electric production of SAIC and Geely. These two companies are almost similar in layout. The corresponding pairs are Roewe/MG and Maple Leaf for Dihao, R Automobile for Geometry, and IM for Jetson, all of which are moving from the B-end to the C-end brand. From the perspective of these four months, the production capacity planning of BEVs steadily increased.

SUMMARY

After writing this, we can make a systematic summary of the performance of second-tier battery companies in April 2021 and analyze the trend of the relationship between automakers and battery suppliers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.