Author: Kaijun Qiu

As expected, the performance of XPeng Motors in the first quarter continues to improve.

Surprisingly, XPeng Motors saw an increase in gross profit due to the recognition of XPILOT software revenue and a decrease in the cost of lithium iron phosphate batteries.

On May 13th, XPeng Motors released its unaudited financial data for the first quarter of 2021. The performance continued to improve:

-

The total delivery volume reached 13,340 units, an increase of 487.4% compared to the same period in 2020 with 2,271 units.

-

Total revenue was RMB 2.951 billion, an increase of 616.1% compared to the same period in 2020 at RMB 4.12 billion.

-

Gross profit margin was 11.2%, while it was -4.8% in the same period last year and 7.4% in the fourth quarter of 2020.

At the evening performance conference call, Dennis Lu, the Vice President of Accounting and Finance at XPeng Motors, explained the reason for the increase in gross profit: the decrease in material costs and the sales revenue recognition of XPILOT software. The main factor in reducing material costs was lithium iron phosphate, and XPeng Motors’ chairman, He XPeng, and other executives stated clearly that the production capacity of lithium iron phosphate battery cells will continue to increase, sales contribution will also increase, and continue to help improve gross profit.

The first quarter report and conference call fully revealed XPeng Motors’ various developments, and we raised a few key points to pay attention to.

A Unique Offer in China: Separate Charges for Automatic Driving Software

From the official announcement of the first quarterly report, to the performance conference call, to the investor Q&A, XPeng Motors emphasized its advantages in autonomous driving, especially XPILOT.

The biggest highlight is the first recognition of XPILOT software revenue in the entire vehicle revenue.

In the Q&A session, XPeng management revealed that in the first quarter, the revenue from XPILOT 3.0 was RMB 80 million, of which RMB 50 million was revenue from last year, and the rest was revenue from this year. The software accounts for 2.5% of total revenue.

The management team said that because the NGP expedition from Guangzhou to Beijing was very successful, both XPeng’s hardware and XPILOT software had a significant increase in sales volume in March and April. They believe that the penetration rate will further increase in the second quarter.

He XPeng is also looking forward to this: “With our rapidly iterating full-stack self-developed capabilities and strong closed-loop data capabilities, we believe that XPILOT software monetization will become a sustainable source of income for us, in addition to the sales of entire vehicle hardware.”Xpeng’s XPILOT autonomous driving system has indeed gained more recognition from consumers. In the first quarter of 2021, 96% of P7s delivered supported either XPILOT 2.5 or XPILOT 3.0.

Since delivering the P7s in June of last year, Xpeng has delivered more than 23,000 P7s. Among them, the cumulative payment rate for XPILOT 3.0 exceeded 20%, reaching approximately 25% in March of this year.

He XPeng also stated that in the near future, Xpeng will enhance the coverage of various road scenarios and achieve end-to-end autonomous driving assistance capability through the next generation of XPILOT 3.5 and XPILOT 4.0, thus making Xpeng’s brand positioning in smart technology more deeply ingrained in people’s minds.

During the Q&A, He XPeng also responded to challenges from smart driving players such as Huawei.

He XPeng shared his evaluation logic for different autonomous driving systems on the current market.

In addition to comparing the functions and performance of an autonomous driving system, He XPeng believes that attention also needs to be paid to several other issues: first, the comprehensive cost of hardware and software; second, the usable range and scenario; third, the feedback from the data used by users, which comes from a good user experience. The combination of these factors will ultimately form a different evaluation system for autonomous driving.

“We see some videos or systems that demonstrate quite good capabilities, but we believe that they may have achieved results in a relatively small and partial range and at a relatively high cost.” He XPeng said, the goal of XPILOT 3.5 and 4.0 is to achieve safe and good data experience in the broadest possible range at the most limited cost and to achieve the best autonomous driving capability within this range. “So we think about balancing the art of autonomous driving, from high-speed NGP to city arterial NGP to global NGP, from China to the world. The logic is different.”

In short, Xpeng believes that its autonomous driving capabilities are still leading, and there are advantages in terms of economic efficiency.

To maintain its edge, Xpeng needs to continue to invest in R&D. The first quarter report shows that Xpeng’s R&D expenses reached 535.1 million yuan, a year-on-year increase of 72.2%, compared to 310.8 million yuan in R&D expenses in the same period last year, and an increase of 16.3% from the previous quarter, which was 460 million yuan.

The management explained that the reasons for the growth included: an increase in R&D team personnel, hence the increase in personnel expenses; the development costs related to the P5 model increased; and the cost of equity incentives.

Recognition for LFP

The gross profit increase in the first quarter report also credits LFP.

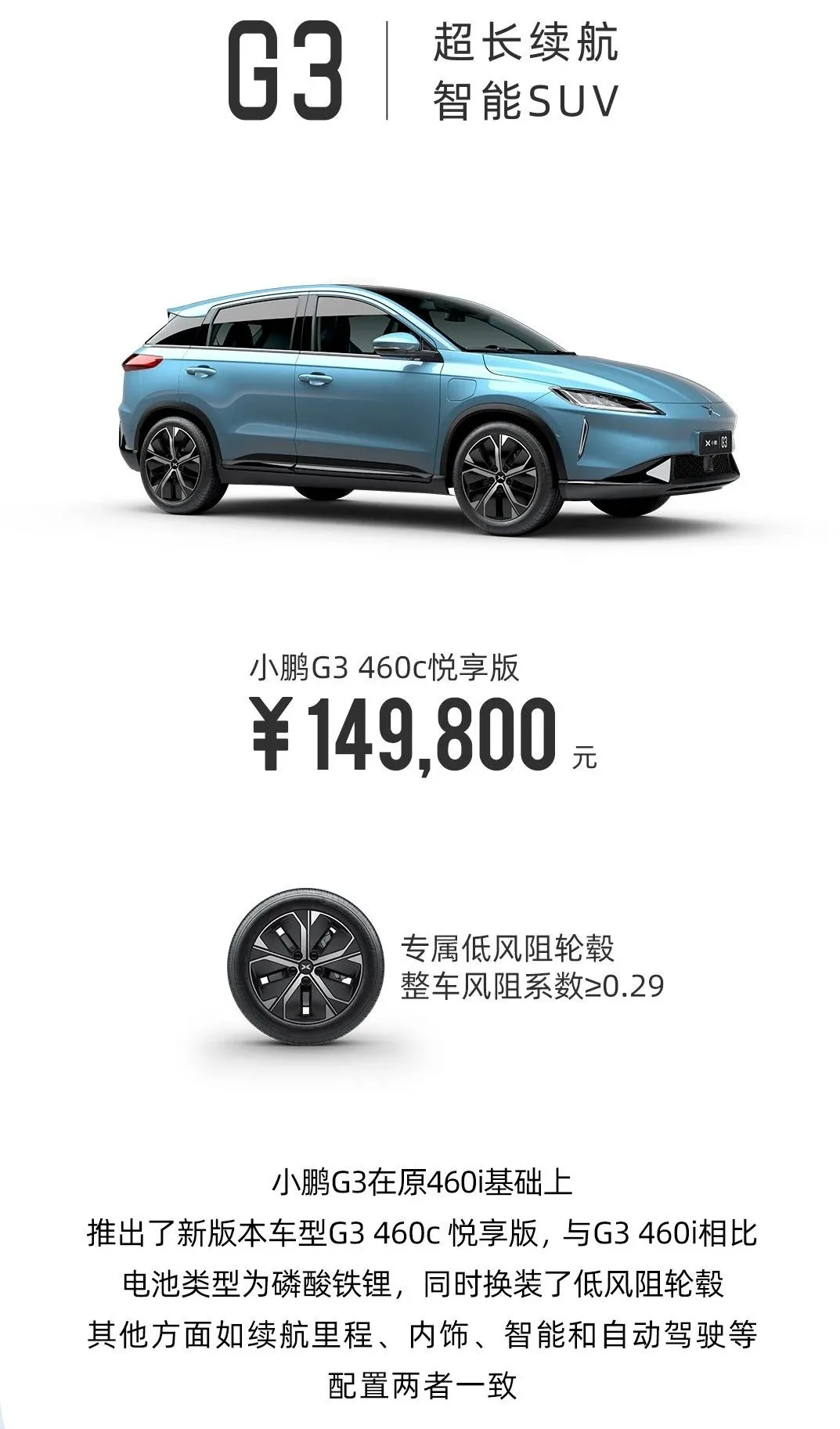

In response to questions from investors, Xpeng’s management stated that the decline in raw material prices was mainly due to the decline in battery prices.For the increase of G3 gross profit, it is also due to the decrease in raw material prices. “As you can see, we can also use lithium iron phosphate batteries on the G3 models now.”

However, they also emphasized that “whether it is lithium iron phosphate or ternary batteries, we have a very competitive advantage in terms of year-on-year comparison… Our costs are very well-controlled.”

He XPeng also responded to the issue of lithium iron phosphate. He revealed that the lithium iron phosphate models are gradually being delivered, and the current volume is still relatively small. “We believe that the ramp-up of the battery cells also needs a quarter, and it may not climb to a relatively comfortable situation until the third quarter. Today, the demand for lithium iron phosphate models is higher than our original expectations, and we believe that the battery cell problem will be better solved in the third and fourth quarters.”

In terms of demand, He XPeng said that whether it is G3 or P7, the demand for lithium iron phosphate batteries is rapidly increasing, and has exceeded the originally planned 10% for G3 and 20% for P7. “We are quite confident that the proportion of lithium iron phosphate will increase further, and the gross margin will also increase.“

Optimistic sales, large-scale capacity expansion

In the first quarter of the sales offseason, XPeng Motors delivered 13,340 vehicles, with greater expectations for the future.

In the second quarter, XPeng Motors expects to deliver 15,500 to 16,000 vehicles, a year-on-year increase of about 380.2% to 395.7%. Total revenue is expected to be between RMB 3.4 billion and RMB 3.5 billion, a year-on-year increase of about 475.5% to 492.4%.

In the first month of the second quarter, XPeng Motors performed well. XPeng’s total deliveries in April reached 5,147 vehicles, a year-on-year increase of 285.3%. This includes 2,995 smart electric cars P7 and 2,152 compact SUV G3. As of April 30, 2021, the cumulative delivery volume for the year has reached 18,487 vehicles, a year-on-year increase of 412.5%.

Based on this estimate, XPeng Motors can deliver more than 60,000 cars this year. However, XPeng’s expectations are of course even higher.

On April 8th, XPeng signed a contract with Wuhan City to build a new factory with a capacity of 100,000 vehicles in Wuhan.

So far, XPeng Motors has three factories in use or under construction. The production line renovation of the Zhaoqing factory for P5 and P7 joint production has been completed, and the P5 prototype is under trial production. “We believe that with the joint production of P7, P5, and the new G3, manufacturing costs will be greatly reduced.” He XPeng said.

XPeng also said that the design capacity of the three factories in Zhaoqing, Guangzhou and Wuhan of XPeng Motors will reach a total of 300,000 vehicles, which can reach a peak capacity of nearly 500,000 vehicles with moderate transformation and an increase in shifts, laying a foundation for the arrival of full intelligence in the automotive industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.