This article is reproduced from the autocarweekly account on WeChat.

Author: Financial World Old Li

During the Shanghai Auto Show, Huawei and major car companies successively showcased their strength in autonomous driving. Especially for Huawei, it stood out with a dazzling full-stack solution, regardless of how much of it is just for show and how much is genuine. At least in terms of momentum and patriotic enthusiasm, Huawei won.

Perhaps due to the aggressive promotion of autonomous driving in China, on May 3rd, SAE* (Society of Automotive Engineers)* updated the autonomous driving classification standard for the fourth time in seven years, specifically redefining L3 and L4. SAE also collaborated with ISO (International Organization for Standardization) in this update, which will have a significant impact on the industry.

The update came after the end of the May Day holiday, possibly due to little attention paid by the industry and the media due to exhaustion from the earlier busy period. However, capital markets never take a break, and analysts at Old Li’s institution began to investigate on the same day. Under the new classification, L3 is stable, while L4 is in trouble, making investors quite concerned.

Autonomous driving: Are car companies the biggest swindlers?

Before discussing autonomous driving, Old Li would like to share a small story. When he just started investing, his master taught him two principles to follow while working, which I am sure many investors are familiar with:

First, looking at the industry is like looking at a tree. You must learn to look from the bottom, from the top, and from the sky.

Second, regardless of how tempting the market is, always operate according to principles.

These two principles are closely related to the autonomous driving industry today. The first determines what level the industry has developed to, and the second decides how capital is invested and withdrawn. The development of autonomous driving in 2021 revolves around these two principles. The industry is just the surface, while capital is the driving force.

Autonomous driving is like a small tree, with users seeing a lush tree from the bottom, practitioners seeing the branches and vines from above, and investors always wanting to see from the sky, concerned about how tall the tree can ultimately grow, without caring much about how it will get there.

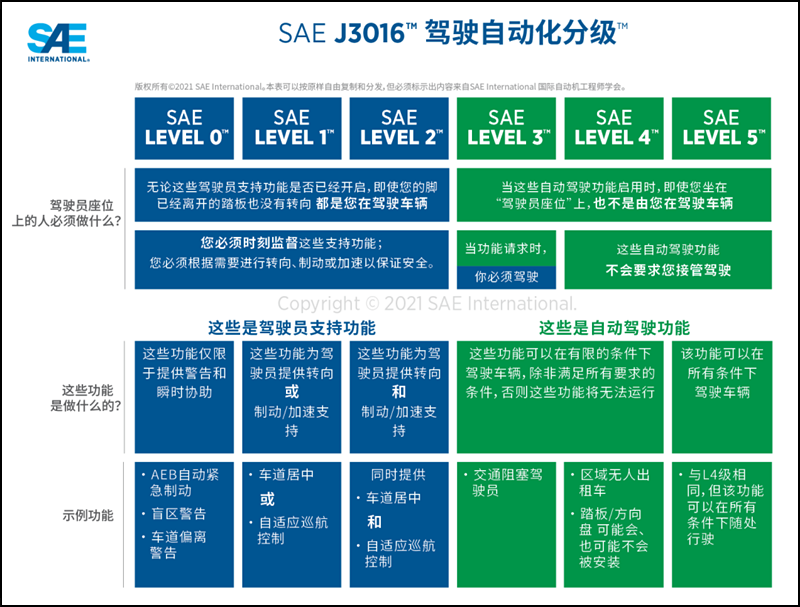

Autonomous driving classification is like the different stages of tree growth. The autonomous driving classification rules formulated by SAE International, known to the industry and users, consist of six levels from L0 to L5.Traditional industry giants in the automotive industry all have a deep affection for SAE. Whether it’s Ford, General Motors, Toyota, Volkswagen, or the four Tier1 companies – Autoliv, Bosch, Continental, and Delphi – they all regard SAE’s grading system as the norm. Domestic auto companies, in order to seize the high point of public opinion, naturally follow suit.

Due to the lack of clear grading in the first three rounds of SAE grading, before this update, the levels of many vehicles were between L2 and L3. All enterprises wanted to highlight themselves and move faster in the field of autonomous driving, leading to a variety of advertising approaches. The aggressive marketing of major automotive companies has created an embarrassing situation for the classification of autonomous driving: professional marketing personnel are not professional enough, and ordinary consumers cannot distinguish.

After soliciting opinions from research and development, the marketing teams of major automotive companies have launched a series of promotions:

Great Wall Motors: The WEY brand achieved L2.9 in 2020 and L3 autonomous driving in 2021.

Changan Automobile: Taking the UNI-T as an example, it can achieve L3 at low speeds and L2 at high speeds. Specifically, when the vehicle is traveling at a speed of less than 40 km/h in a high-speed scenario, the autonomous driving function helps the driver to free their hands and eyes. If an accident occurs, the manufacturer is responsible. If the speed is higher than 40 km/h, only hands can be freed, not eyes, and the driver is responsible for any accidents.

Of course, Changan Automobile also wants to point out that this is “mass-produced technology, not mass-produced configuration”, which means this technology cannot be installed on all vehicles.

Compared with Changan Automobile, Ideal Auto knows how to play hard to get. They claim to release autonomous driving models between L2-L4 in 2020-2021. As to whether it is L2 or L4, you will have to guess yourself.

Of course, Geely, SAIC, GAC, and other automotive companies have also launched “gorgeous” combinations, which are too numerous to be listed here. In the end, ordinary consumers are still confused: whether the car manufacturers are referring to L2.X or the timeline for achieving L3 is still puzzling. This is exactly the result that the automobile companies want – consumers being unable to comprehend is the best outcome they expect.Why do car companies expect this situation? This is directly related to SAE’s autonomous driving classification. Prior to this update, SAE’s definition of Level 3 was rather vague, as it was defined as “the driver can release their hands and feet” but without a clear description of the scenario, so car companies had more freedom to define it on their own. Without a unified standard, this made it more difficult for users to understand, which allowed for more of a grey area.

This classification update has refined this issue and explicitly states that when Level 3 autonomous driving vehicles make a functional request, the driver must take control. Although the scenario is not clearly defined, the new classification reduces the difficulty of Level 3 implementation, meaning that the majority of L2.X car companies can now achieve Level 3 under the new regulations.

Similarly, while Level 3 is now easier after the classification update, Level 4 is now harder. The new regulations require that in Level 4 scenarios, the vehicle will not request any takeover by the driver, and although it is not specified in writing, it implies that if there is an accident with a Level 4 vehicle, the responsibility lies solely with the car company.

Scenario over classification: Is capital more anxious than car companies?

As previously mentioned, most car companies use scenarios to determine the level of their autonomous driving functionality from L2 to L4, as SAE’s classification method does not specify the application scenario. As an innovation fighter, Musk has never followed the rules and regulations of international organizations, so naturally he doesn’t take SAE’s classification system seriously. Rather than using classification, Musk promotes scenario-based autonomy. In Li’s opinion, Musk may know that Tesla cannot achieve the same level of autonomy as L3/L4, so he has created his own set of definitions, thus creating the impression that Tesla’s FSD is an incredible feat. From the current perspective, this strategy has been successful, and prior to the Shanghai Auto Show, industry insiders and casual observers alike thought that Tesla’s FSD was unmatched.

As the Chinese version of Tesla, Xpeng does not rely on SAE classification and instead defines their own levels of autonomous driving functionality, such as XPilot3.0 and XPilot3.5. The advanced autonomous driving function with laser radar in the P5 is XPilot3.5, while the version without laser radar is XPilot3.0. Both versions meet Level 3 requirements in certain scenarios, such as automatically overtaking on highways and certain city expressways, automatic speed limit adjustments, automatic transition between highways, automatic entrance and exit ramp navigation, as well as automatic merging in traffic cones, avoiding large trucks, reminding of overtaking at night, avoiding broken down vehicles and adaptive cruise control in congested roads, etc.

However, even so, XPeng Motors never claimed to have fully realized L3, because currently, L3 is not matured in both legal and technical aspects, and companies are not willing to take risks. Although technology cannot achieve it, XPeng Motors’ marketing strategy is clear. Since the traditional automotive companies’ marketing campaign for L2.5 or L2.X is not innovative, XPeng Motors learned from Tesla and explored new ways, while also organizing nationwide autonomous driving experience events.

Companies can use different methods to delay the time, but capital does not have the patience for it.

According to investment logic, the expected value of each new technology tends to be greatly exaggerated when it first appears, and the expectations for autonomous driving are even higher. This is a technology that can thoroughly change humans. The logic of autonomous driving is different from that of electrification, especially the power battery technology, which is relatively mature. Companies are solving the problem from 1 to 100, while autonomous driving enterprises are solving the problem from 0 to 1.

The industry that develops from 0 to 1 often has two bottlenecks, one is technology, and the other is money. Autonomous driving is a costly entrepreneurial competition. In the past five years, major institutions have invested a lot of money, but the results have been minimal. Mr. Li, like some of his peers, has been discussing with others, and since last year, some financial investment institutions’ attitude towards autonomous driving is quietly changing: Financial investment institutions are currently at a node where their attitudes are shifting from complete support to differentiation.

Three years ago, whether it was Xiaoma or Momenta, whether it was a hardware company or a software company, the financing environment was very good, but it has changed in recent years. The technology is not yet mature, and companies are taking too long to mass-produce. People are losing patience. Although industrial investment (major automakers) has invested a lot in autonomous driving, financial investment institutions are becoming more rational. Financial investment institutions only look at whether autonomous driving can be mass-produced commercially. Companies cannot achieve SAE’s L3, and it is difficult to achieve commercialized mass production in all scenarios.

Capital has always been merciless. In the cycle of funds, early investors want to exit, there are only two ways: either the invested companies IPO, or the companies accelerate mass production and create a hot market environment, allowing new investors to come in and take over, even if the entrepreneurs are begging on their knees, investors must get their money back.

Under the context, capital is pushing the pattern of autonomous driving in 2021: companies like TuSimple and IMa Technology are eager for IPO, while firms like Pony.ai are starting to produce single-scene mass production. Smart mass production enterprises use a special scene + level-based approach, such as L3 level highway conditional autonomous driving, L4 level autonomous valet parking, automatic driving in mining areas, and unmanned end-to-end delivery, which will be implemented in 2021. Competition in these segmented scenarios is fierce, and market imagination is limited. Some companies are pushed by capital rather than doing it themselves.

Under the context, capital is pushing the pattern of autonomous driving in 2021: companies like TuSimple and IMa Technology are eager for IPO, while firms like Pony.ai are starting to produce single-scene mass production. Smart mass production enterprises use a special scene + level-based approach, such as L3 level highway conditional autonomous driving, L4 level autonomous valet parking, automatic driving in mining areas, and unmanned end-to-end delivery, which will be implemented in 2021. Competition in these segmented scenarios is fierce, and market imagination is limited. Some companies are pushed by capital rather than doing it themselves.

How can automobile companies promote their products and users distinguish them?

Before SAE updated its classification, the full-scene L3 of major auto companies and start-ups was only in press releases and launch events and could not be mass-produced. There are two reasons:

First, current technology cannot achieve full redundancy for perception, decision-making, and execution. Although major companies have redundancies, personnel still have to take over at critical moments. Major automakers sell futures and make autonomous driving an optional package. For example, a domestic autonomous brand claims how it has achieved L3, but without full redundancy, industry professionals remain silent.

Second, domestic laws are imperfect. The Road Traffic Safety Law does not allow vehicles to drive with both hands off the steering wheel, which conflicts with L3 autonomous driving. In addition, once a traffic accident occurs, there is no law to refer to in determining the responsible person.

Has the status quo improved after this SAE upgrade? The answer is yes. Although L4 is more difficult, it is certain that various companies will achieve L3 this year.

Last week, Mr. Li visited several traditional automakers and new forces, and some automakers are now unsure how to promote further. A leader of a new force jokingly said that “before, they sold dog meat under the banner of a dog’s head, but now they sell dog meat under the banner of a sheep’s head” in plain language. The technology of autonomous driving itself has not changed. Previously, automakers could only promote L2.X, but now they can try to promote L3.

Before and after the classification update, there is no big difference in the technical level of the enterprises, but now everyone is more likely to say that they are “L3,” which is good for them. Those previous ambitious claims can now be realized, but sadly, perhaps because of the holidays, although this SAE classification update and the national standard have clearly increased the demand for driver takeover capabilities monitoring and risk mitigation strategies at the L3 level, which greatly reduces the threshold, the industry does not have enough attention.# Automatic Driving and the Responsibility of Auto Companies

An old friend of Li who runs a traditional enterprise in the automotive industry expressed that even if all-round L3 is achieved, major companies dare not claim that they have fully realized it. The main reason is that neither the SAE classification standard nor the national standard of “Automotive Driving Automation Classification” of the Ministry of Industry and Information Technology have legal effects, which makes it impossible to determine the responsible party of automatic driving.

Earlier this year, Li attended several discussions on automatic driving laws and regulations organized by ministries and relevant institutions. Although various aspects of the division of responsibilities between automatic driving drivers and car manufacturers were discussed, they did not form a unified opinion, and the views of the legal and industrial sectors were even more disparate.

The immaturity of the law does not mean that companies cannot promote automatic driving, nor does it mean that the promotion of automatic driving by companies is non-compliant. In the current situation where product USPs are increasingly converging, automatic driving will definitely become a key point of differentiation for car companies’ future products. This year, the Geely Fox project team boasted about their automatic driving technology in cooperation with Huawei.

From a technological perspective, no company has completely opened up a gap in automatic driving at this stage. If the ultimate goal of automatic driving is viewed as 100 points, the best companies currently achieve 50 points, while others can achieve 30 points. Regardless of the underlying technology and algorithms, the end-user experience for C-side users may only be around 20 points, and the difference is not significant.

Friends familiar with Tesla’s FSD know that it is not as strong as the legend, but the marketing of automatic driving will bring sound and a feeling of first impressions to users. Before the Shanghai Auto Show, many users believed that FSD could do anything.

Now, the myth has been broken. From ordinary users to industry insiders, everyone has discussed the automatic parking system (AP) and the brakes. The entire autonomous driving industry is faced with being reshaped. At the new starting line, every car company has the opportunity to take the lead. The key is how the story is told.

In his visits last week, Li shared his viewpoints with many car company friends: the biggest advantage and risk of automatic driving come from the system’s ability to replace human drivers. From the perspective of the implementation path, the simpler the road environment and the more standardized the operating process, the more likely it can be mass-produced and provide a user experience, such as the previously mentioned parking. From the perspective of the driving entity, the more capable it is to replace drivers in scenarios involving driver fatigue and high-risk operations, the more it has substitute value, such as long-distance high-speed warnings and driving.

As an ordinary user, how can responsibility be assigned? It’s simple, check the user agreement and open the vehicle manual to see if the company wants to take the initiative to assume automatic driving responsibility. Tesla writes in its AP introduction, “Do not rely on AP to ensure your safety. Drivers must remain vigilant, drive safely and control the vehicle.”From the user’s perspective, telling a good story is essential in getting them to open the car manual. The story needs to be captivating and engaging to capture their attention.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.