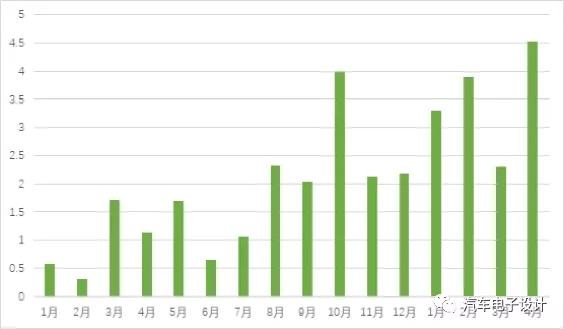

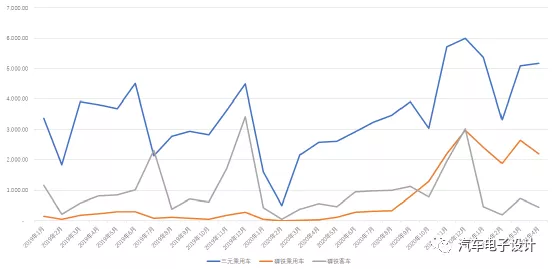

After the data release by the China Association of Automobile Manufacturers, I believe that some of the content can now be explained. In fact, compared with the data from the Innovation Alliance for the Domestic Chinese Automobile Power Battery Industry, insurance data, and SNE’s data, there is already a significant deviation in the domestic battery production and installation volume. There are several factors: one is that similar to Tesla, which exported batteries with Chinese origin to Europe, these batteries did not have a corresponding number counted in China, and the total amount can be calculated by SNE’s data based on the global vehicle*installation volume; second is the direct export of batteries to European car companies for use, which also makes the battery production continue to be greater than the installation volume; the last factor is battery storage + special purposes (maintenance, battery swap), several elements have led to a difference of 33.8 GWh since 2020.

Production Overview

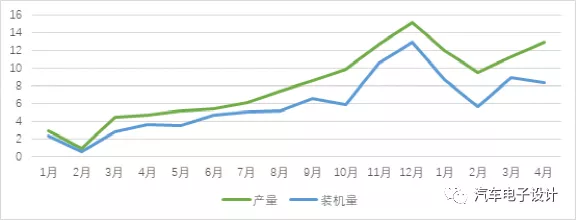

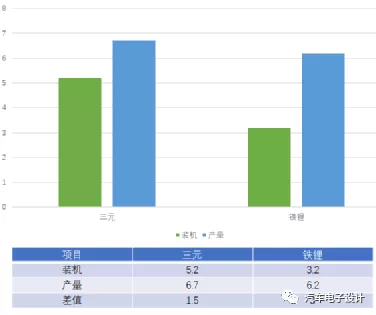

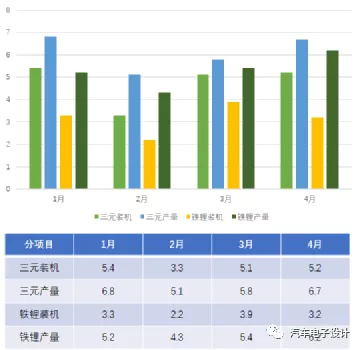

In April, the production of power batteries totaled 12.9 GWh, a year-on-year increase of 173.7%. The production of ternary batteries was 6.7 GWh, accounting for 51.9% of the total production, a year-on-year increase of 134.3%; the production of lithium iron phosphate batteries was 6.2 GWh, accounting for 47.9% of the total production, a year-on-year increase of 235.4%.

In April, the installed capacity of power batteries was 8.4 GWh, a year-on-year increase of 134.0%. The installed capacity for ternary batteries was 5.2 GWh, a year-on-year increase of 97.3% and a month-on-month increase of 1.5%; the installed capacity for lithium iron phosphate batteries was 3.2 GWh, a year-on-year increase of 244.5% and a month-on-month decrease of 17.6%.

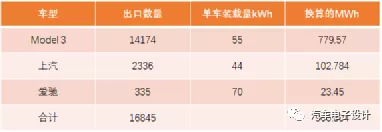

We can see that the difference of ternary batteries is mostly due to the excess of exported batteries, and the difference of lithium iron phosphate batteries is due to both stocking up and exporting more. In April, the China Association of Automobile Manufacturers exported a total of 107,000 passenger cars, of which 16% were new energy vehicles, or 17,120 vehicles, including 14,174 exported by Tesla China, 2,378 new energy vehicles exported by SAIC Passenger Vehicle, and 335 exported by AIWAYS. The corresponding number for lithium iron phosphate batteries was 780 MWh, which means that a potential 2 GWh of lithium iron phosphate will be used later.

There is one thing to note that the production of lithium iron phosphate has been consistently higher than the installation this year and a large amount of it may have entered the buffer stock for later installation.

Of course, this is a deduction. With 2.2 GWh of lithium iron phosphate for passenger cars and 0.8 GWh for exports loaded in April, the trend of the production volume exceeding the installation volume indicates a higher demand for lithium iron phosphate in the future. On the other hand, the demand for iron phosphate may increase gradually as buses recover.

Ternary and Lithium Iron Phosphate

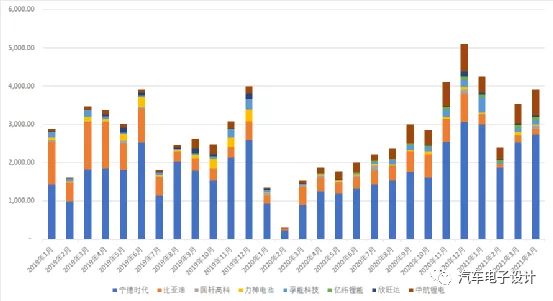

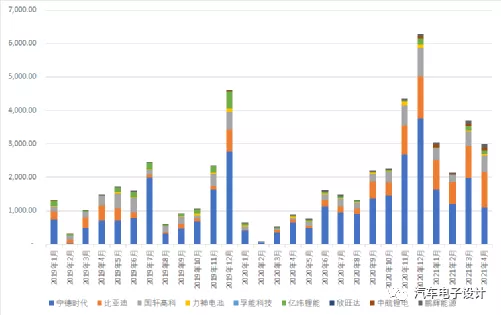

In this topic, as BYD strategically shifts from the ternary route to the lithium iron phosphate route, the main companies in the ternary route are currently mainly CATL.

After experiencing a low point in 2020 for 6 months, BYD still dominates the lithium iron phosphate market, which has a relatively high installation volume in China. CATL is the second largest company, followed by Guoxuan.

Conclusion:

When looking at monthly data, it is necessary to consider the overall environment. I think it might be more effective to match battery companies with auto companies in the future analysis.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.