*Author: Tian Hui

-

BAIC EU series can be replaced with new energy vehicles from BAIC New Energy, with a manufacturer subsidy of 20,000 yuan;

-

Old BYD new energy vehicles can be replaced with Han EV and also receive a manufacturer subsidy of 20,000 yuan;

-

Even harsher is Jianghuai Automobile: they will repurchase old electric vehicle models at their original prices, with the only condition being the purchase of a Sihao E20X…

This behavior of snatching replacement customers at great cost appeared recently in Beijing.

Starting from the “Thousand Cars in Ten Cities” New Energy Vehicle Demonstration Project in 2009, the Chinese electric vehicle market has been in operation for more than 10 years. Consumers who purchased electric vehicles in the early days have gradually entered the replacement consumption cycle. At the same time, with the general improvement in electric vehicle product quality, the situation where multiple-car families replace their fuel-powered car with an electric vehicle has also begun to emerge.

Under multiple favorable factors, the electric vehicle replacement market is gradually beginning to take off. This is an incremental market outside of the fixed 60,000 new energy vehicle indicators added annually in Beijing, and it is a cake that many electric vehicle companies are competing for.

Beijing, due to its purchase restrictions, has created a private electric vehicle consumption market, setting an example for the national electric vehicle market. The competitive strategy of the electric vehicle replacement market will ultimately be valued and emulated by the entire industry.

And Beijing’s experience in the replacement market is that the key to competition lies not in replacement stimulus policies, but in the product power of new cars. Replacement subsidies or tactics may not be effective.

Electric Cars for Electric Cars, More Subsidies for Same Brand

Replace your old car with a new one at the original price after two years of use!

It sounds unbelievable, especially for fast-depreciating electric vehicles. But it is true: JAC electric vehicle owners can enjoy this benefit.

In April, JAC Motors launched an old car replacement activity at the original price.

In a text message sent to old electric vehicle owners by JAC Motors, JAC Motors promised to repurchase old cars at the highest original price and replace them with new ones.

After further information was obtained from the official 400 telephone line, Electric Vehicle Observer learned that the iEV6E Time Version/High Voltage Version models can be replaced with the Sihao E20X brand model at the original price, and the iEV4 and iEV5 models mentioned in the text message cannot be replaced at the original price, but receive larger replacement subsidies.

Taking the iEV5 as an example, this classic electric vehicle model was launched in 2015 with a range of less than 200 kilometers and a post-subsidy selling price of 95,800 yuan. In this replacement activity, the manufacturer will repurchase it for approximately 58,000 yuan, while its estimated value on the second-hand car market is less than 20,000 yuan.

Jianghuai’s significant subsidies clearly demonstrate their hope to boost sales of the Sihao E20X model. This small pure electric SUV has a range of 400 kilometers and needs an urgent sales boost.

Jianghuai’s significant subsidies clearly demonstrate their hope to boost sales of the Sihao E20X model. This small pure electric SUV has a range of 400 kilometers and needs an urgent sales boost.

Like many established electric car enterprises offering significant trade-in subsidies, such as the former annual electric car sales champion, BAIC New Energy, which has also implemented a large trade-in subsidy policy to meet the replacement needs of early car owners.

For the BAIC EV series models, which have a range of less than 200 kilometers, BAIC New Energy offers a trade-in subsidy of 15,000 yuan ($2,329), while for EU series models with a range exceeding 250 kilometers, they offer a trade-in subsidy of 20,000 yuan ($3,106).

At a BAIC New Energy 4S store visited by “Electric Car Observer,” a salesperson calculated the bill for us.

Taking my 2015 BAIC EV160 as an example, this pure electric car with a range of 160 kilometers can enjoy a trade-in subsidy of 15,000 yuan at BAIC New Energy stores. The old car will be auctioned on the designated second-hand car auction app at BAIC Langgu, and the actual auction price will be used as the old car’s residual value. However, according to the salesperson, the residual value of the EV160 is not high, and the highest price will not exceed 10,000 yuan ($1,550).

If you choose not to trade-in at the 4S store and instead consign the EV160 to the used car market, after inquiring with multiple used car dealers, the average residual value offered is around 7,000 yuan ($1,087).

Obviously, it is more suitable to conduct trade-ins within the same brand at the 4S store.

Mr. Xu, a car owner, exchanged his EV200 for a BEIJING-EX3 model. After comprehensive trade-in subsidies, old car discounts, and new car discounts, Mr. Xu spent only 74,000 yuan ($11,486) to exchange his EV200 with a range of 200 kilometers for the EX3 model with a range of 500 kilometers. The official price of the BEIJING-EX3 is 123,900 yuan ($19,208).

Although exchanging within the same brand can enjoy the maximum trade-in subsidy, not all consumers are willing to do so. Considering the insufficiencies of early models from car companies in terms of range and product quality, many loyal customers have felt betrayed. Most car owners did not choose to exchange within the same brand but switched to other brands.

Cross-brand Purchasing: Reputation is More Important than Subsidies

Car owners are more concerned about reputation when trading in old cars for new ones.Mr. Jian, a car owner, replaced his 4-year-old Jianghuai iEV5 with a BYD Qin Pro EV, giving up the 30,000 yuan replacement subsidy provided by Jianghuai. Mr. Jian’s reason for choosing the Qin Pro EV is its fast charging speed.

As he did not have personal charging facilities, Mr. Jian valued the DC fast charging capability. The charging slow performance of the Jianghuai iEV series has caused Mr. Jian to suffer in the bitterly cold Beijing winter nights.

During his charging at a station, Mr. Jian found that the BYD models generally had shorter charging times. After consulting with several charging owners, he finally decided to replace his iEV5 with the faster-charging BYD Qin Pro EV.

Another potential reason for not choosing the same brand for replacement is the lack of trust in the three-electric technology. Mr. Jian’s previous iEV5 vehicle had a number of spontaneous combustion incidents before being forced to recall due to defects in the power battery by market supervision authorities.

Like Mr. Jian, some early new energy vehicle owners have experienced problems such as reduced cruising range, slow charging speed, and abnormal braking. Therefore, in the process of replacing their vehicles, despite the generous same-brand replacement subsidies offered by car manufacturers, they still choose to replace them with other brand electric vehicles.

BYD and Tesla have become the two manufacturers that benefit most from cross-brand replacements.

The replacement subsidies offered by BYD are classified into different levels, including same-brand replacements, new energy vehicles for new energy vehicles, and cross-brand replacements.

BYD offers a 20,000 yuan replacement subsidy for replacing old BYD new energy vehicles with Tanghan models costing over 200,000 yuan, whereas a subsidy of only 10,000 yuan is offered for replacing with the Qin series priced over 10,000 yuan.

The replacement subsidy for cross-brand replacements of BYD new energy vehicles is as low as 8,000 yuan.

Although the subsidy classification seems somewhat complicated, BYD has leveraged the word-of-mouth advantage of its electric vehicle veteran owners and was the first to reap the benefits of electric vehicle replacements.

Mr. Geng, another car owner, replaced his EV160 model with a BYD Tang EV model. As he replaced his car earlier, he did not even benefit from the cross-brand replacement subsidy provided by BYD.

The main reason for giving up the replacement subsidy and purchasing another brand model is that Mr. Geng was concerned about the braking system of the EV160 model. EV160 was forced to recall due to problems with the braking pump as required by the quality inspection department.

Another car manufacturer that has benefited from replacement subsidies is Tesla.Mr. Wang, a former owner of a BAIC EU series electric car, replaced his 2-year-old EU model with a Tesla Model 3 long-range model when Tesla reduced the price to RMB 300,000.

There were multiple reasons for Mr. Wang’s decision to replace his BAIC with a Tesla. Firstly, he was concerned about the quality of BAIC EU series products, and secondly, he wanted to experience intelligent electric cars while upgrading his consumption with a luxury brand.

Finally, the reason that convinced Mr. Wang to switch from BAIC to Tesla Model 3 was the vast number of self-uploaded Model 3 autopilot videos posted on the Internet, which proved the superiority of Tesla’s autopilot system, and this greatly attracted Mr. Wang.

New energy vehicle manufacturers wooing fossil-fuel vehicle owners

Intelligent electric cars with certain brand influence and no license plate restrictions are becoming the new favorites in the Beijing auto market.

Both Tesla, NIO, and XPeng have noticed this trend and have launched exchange subsidies for fossil-fuel cars with Beijing plates. (Ideal cars are limited to driving one day a week because they can also use gasoline.)

Tesla’s preferential policies are subject to frequent changes. Currently, they are offering about RMB 11,000 in loan interest subsidies for owners of cars with Beijing plates who exchange their petrol cars for a Model Y.

XPeng is offering subsidies of up to RMB 22,000 for owners of petrol cars with Beijing plates who exchange their cars for a P7.

NIO is offering a boutique option package worth RMB 15,000 for owners of petrol cars with Beijing plates who exchange their cars for a NIO electric vehicle, which can be used to purchase extra options during the car purchasing process.

From the number of insured cars, this is an effective approach. The effects of new energy vehicle brands on the fossil-fuel vehicle market are gradually showing, as can be seen from the number of insured EVs in the Beijing area.

Beijing issues 60,000 electric vehicle licenses every year, and the number of insured electric cars reached 86,000 in 2020. Besides the number of old electric car owners who replaced their cars, there is a large portion of fossil-fuel car owners who switched to electric cars.

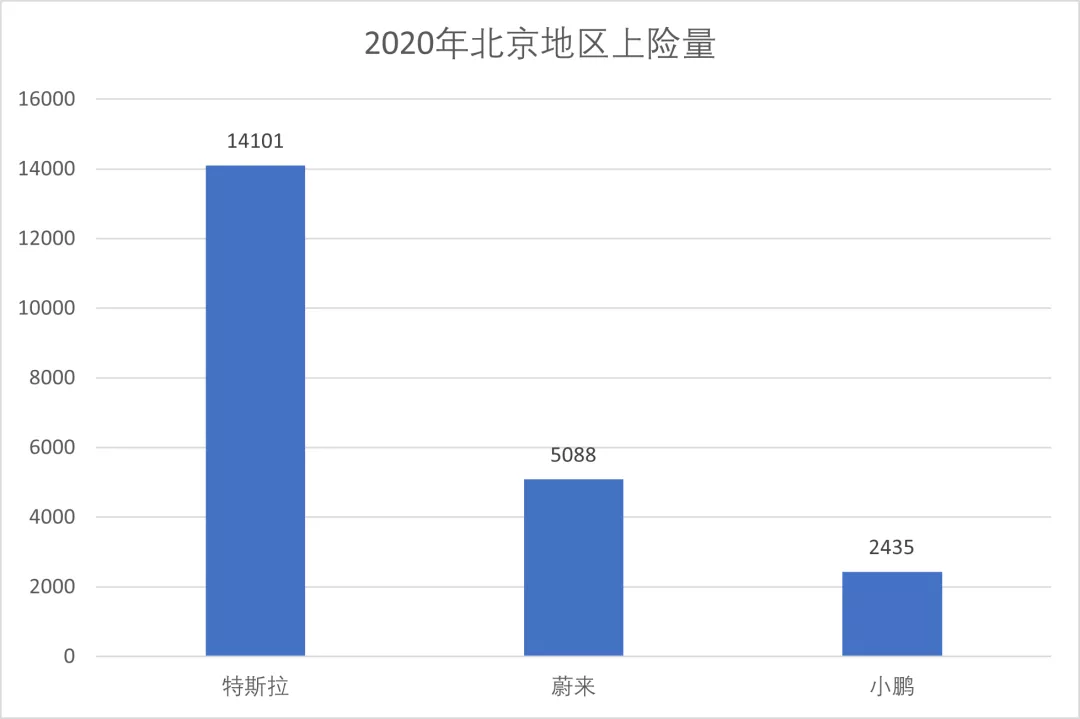

The three new energy vehicle brands had more than 21,500 insured cars in Beijing in 2020. Many of these new customers were those who had exchanged their fossil-fuel cars for electric cars.

Tesla Model 3 has become the most insured pure electric vehicle in Beijing, with over 14,000 insured vehicles in 2020.

Tesla Model 3 has become the most insured pure electric vehicle in Beijing, with over 14,000 insured vehicles in 2020.

NIO had over 5,000 insured vehicles in Beijing in 2020, with XPeng Motors having nearly 2,500.

Why do car owners give up the convenience of fueling and use valuable fuel vehicle quotas to buy electric vehicles?

Consumer feedback provides an explanation: these brands are not only electric, but also intelligent vehicles, representing a trendy way of travel.

Mr. Lin, a Tesla owner, traded his only fuel vehicle for a Model 3, and he is very satisfied with the AutoPilot function, which has eased his traffic anxiety.

After purchasing the XPeng P7, Mr. Zhang, a XPeng owner, sold his fuel car, making the P7 the only vehicle used in his family. He speaks highly of XPeng, especially of its intelligent voice interaction function, which is adored by his children.

Product is King

Despite lucrative replacement subsidies offered by Beijing’s electric vehicle companies, ranging from 10,000 to 30,000 RMB, they have not become the magic bullet for attracting replacement customers.

Beijing consumers, who are not worried about money, value product quality more.

In 2018, BAIC New Energy’s insured vehicles in Beijing reached 25,000 units, but in 2020, this number decreased by nearly 10,000 to 15,000 units. This trend is continuing. A large number of consumers who owned BAIC cars in 2014 and 2015 did not choose BAIC again when they entered the replacement cycle in 2020.

In contrast, in the sales surge of the Tesla Model 3, many were replaced by fuel vehicles.

If the product isn’t good enough, even the best replacement policy won’t keep old customers. Only if the product is good enough, will even fuel car owners “abandon their oil for electricity”. At a time when electric vehicles are beginning to become more widely adopted, product quality is the core competitiveness that attracts consumers to buy, and replacement subsidies are ultimately a temporary measure.

If a replacement policy doesn’t have the support of product quality, it won’t have any effect as a marketing tool.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.