This article is reproduced from the author Yin Wei on Zhihu.

As an autonomous driving system manager, I will analyze the overall situation of car-making 2.0 from the perspective of the industry chain.

The Second Wave of Car-Making Army

Currently, Baidu, DJI, Xiaomi, and other companies have announced their entry into the “car-making army”. This is already the second wave of car-making wave. If the first wave was the entry of more start-up car companies, the whole process was a bit shy and ignorant. However, the entrants in this second wave are all internet giants who have arrived well-prepared.

This means that the Internet industry already has a deeper understanding of the feasibility of car making. This is mainly due to the change in the vehicle architecture. First of all, the structural simplification brought by electric vehicles makes the car-making process essential and simplified compared to traditional fuel vehicles. You can refer to my answer to “What is the future direction of automotive development?” on Zhihu.

Then, the centralized electronic and electrical architecture has accelerated the process of “software-defined cars”, and software development has gained an unprecedented share in the whole vehicle. You can refer to my answer to “How to understand ‘software-defined cars’?” on Zhihu.

The background has been answered in the above two articles, and I will not repeat it here. The core is that these two forces are superimposed, which has caused a large number of Internet companies to start operating in car-making business.

From the user’s perspective, “vehicle intelligence” will define the next generation of intelligent driving, and users are no longer satisfied with engine performance, overall vehicle assembly quality and other dimensions, but begin to treat intelligence as another important dimension in choosing a car.

Comparison between New and Old Industry Chain

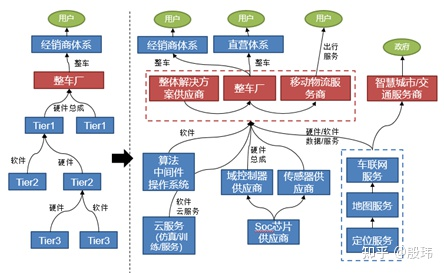

In the era of car-making 2.0, the change in the automotive industry landscape is fundamental. The saying “making elephants dance” that was often said in the Internet industry has finally come to the automotive industry. With the intervention of the Internet, the composition of the automotive industry chain is also changing. As shown in the figure below, in the past, the entire vehicle factory had a complete supply chain system, and most of the cooperation between the vehicle factory and suppliers was based on “hardware assembly”.

If ADAS function is needed, install an ADAS controller. If you need window lifting, install a window controller. Through the orderly organization of the CAN network, most of the electronic functions required by the vehicle are formed. Although the actual situation is very complicated, it is simply understood to be such a process. The left side shows the supplier relationship in the past automotive industry.

OEM (host factory/vehicle factory) is responsible for developing, manufacturing, and selling cars. Downward are the first-level suppliers of automotive parts (Tier 1), second-level suppliers (Tier2), etc. Among them, OEM is widely known as various vehicle factories, such as SAIC Volkswagen, SAIC General Motors, FAW Volkswagen and other car factories.# Tier1 and Tier2 Automotive Suppliers in the Industry Evolution

Tier1 refers to level one component suppliers who hold real core automotive technology, such as Bosch, ZF/TRW, Continental, Aptiv, and Valeo.

Tier2 refers to the suppliers that provide components to Tier1 suppliers from various dimensions. Taking the semiconductor chip industry as an example, it includes chip manufacturers like Texas Instruments (TI), Renesas Electronics, Infineon Technologies, and NXP Semiconductors.

Nowadays, the cooperation on the right side of the figure is becoming more and more popular. The industry chain is facing a complete reshuffle, and the rules of this transformation are very clear. It mainly reflects the following aspects.

Abandoning Hardware Assembly and Moving Towards Software and Hardware Integration

The favorite solution for the previous suppliers is the hardware and software solutions. The complexity of the function realization is controllable as long as the automaker solves the CAN network, power management, and thermal management whole vehicle adaptation. The relationship between the automaker and the supplier is as follows: whole vehicle function = Tier 1A (software and hardware) + Tier 1B (software and hardware) + Tier 1C (software and hardware).

On the centralized domain controller of the “software-defined car,” it becomes: whole vehicle function = Tier 1A (hardware) * Tier 1B (operating system / OTA) * (OEM (software) + Tier 1D (software) + Tier 1E (software)).

From this formula, we can see that the cooperation section has shifted from hardware assembly to software and hardware integration. The main line of the previous industry chain no longer exists, and the entire vertical Industry chain links such as chips, domain controllers, software become the new main line.

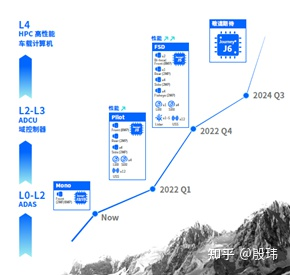

Starting from the networked function, TBOX-》OTA upgrade, from the intelligent function, applying algorithms (deep learning)-》 middleware-》 operating system-》 domain controller-》 chip SOC-》 chip, the consolidation of the whole vehicle controller has caused ECU, MCU, and VCU, which used to operate independently, to gradually lose their market. Suppliers must either sell software IP or sell hardware devices, and all designs must be integrated on a larger platform. Although some controllers are still very independent, such as DMS, infotainment instrument clusters, and map controllers. However, gradual integration and unification is a trend, and companies in the entire electric/electronic architecture critical path have opportunities for development.

Building a Diversified and Flexible Integration System

Under the new industry cooperation model, different from the previous simple shelf hardware products, the industry cooperation presents the characteristics of “diversified and flexible” integration. Similar to the “T” type composite knowledge system, the integrated suppliers also need a T-shaped composite integration system.

It’s so hard to hire some engineers of self-driving technology. Why is it so hard? Where have all the talents gone? (www.zhihu.com)# Integration Strategy of Horizon: Chips as the Core Business

Horizon’s integration strategy in the automotive industry is centered around chips, providing a range of options for Level 1-4 autonomous driving chips that correspond to their Journey 1-5 chip products. Chips can be integrated horizontally into multiple vehicle solutions. The company also focuses on vertical integration, supporting chip development with basic SDKs, AI algorithm-related SDKs or APIs, environmental perception algorithms, and key domain controller hardware, as well as overall intelligent driving solutions.

With this foundation, Horizon plans to cooperate with various vehicle manufacturers and suppliers at different levels, providing corresponding cross-sectional cooperation for any level of demand.

By positioning itself as the “lowest common denominator” in industry integration with its core business, Horizon can expand both horizontally and vertically to find stable cooperation positions and define beneficial industry roles in new industry segments. Furthermore, the new system will resolve the differentiation outputs that were difficult to achieve in the previous supply chain system.

Summary

In the era of car manufacturing 2.0, structural changes in electronics, electric architectures, domain controllers, chips, and more are the origin. By building upon these changes, users can rapidly iterate and improve upon intelligent driving experiences. Companies in the industry need to find their own positioning and new cooperation models that balance scalability and differentiation to keep up with the new environment.

If you are interested in autonomous driving, please follow us.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.