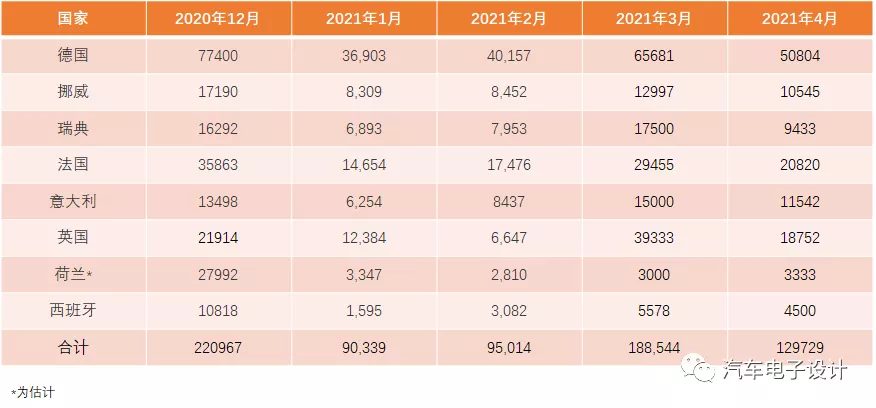

After the first day following the festival, the sales data of new energy vehicles in major European countries in April has been released. The total number of registered new energy vehicles in these countries (Germany, France, UK, Norway, Sweden, Netherlands, Italy, and Spain) reached 129,700, and the overall scale of Europe will be around 152,600.

Overview of New Energy Vehicle Data in Europe

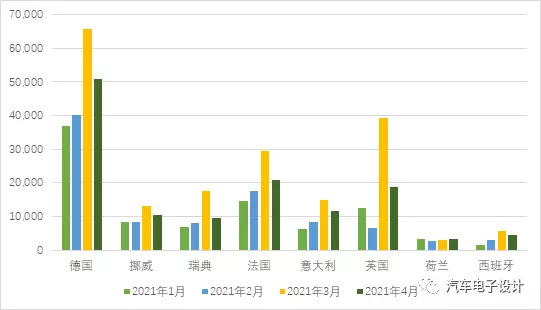

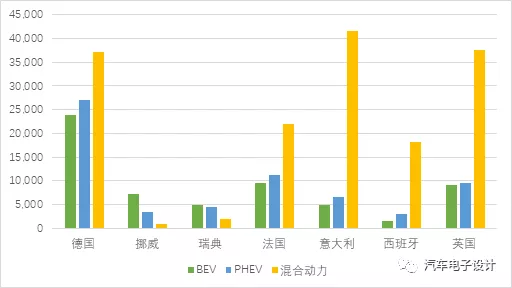

1) Monthly Data Comparison

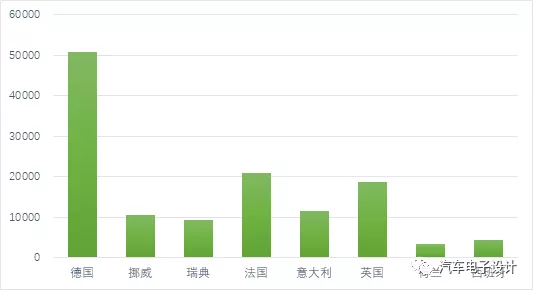

In terms of new energy vehicles, the sales numbers in Germany, Norway, Sweden, France, Italy, UK, Spain, and the Netherlands were 50,804, 10,545, 9,433, 20,820, 11,542, 18,752, 3,333, and 4,500 respectively in April. Currently, most companies have quarterly fluctuations (Tesla does not sell cars in Europe in April, so the basic data from March has a difference of at least 20,000 from Tesla’s perspective). Therefore, there was a slight decline from March to April.

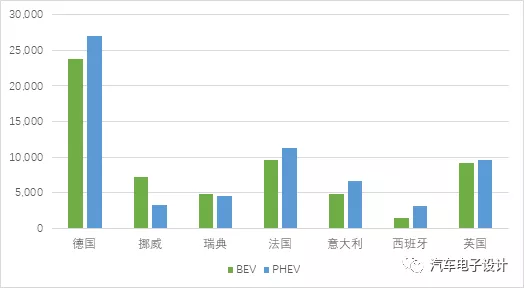

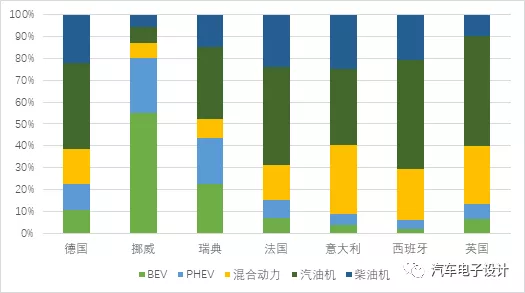

2) Comparison of BEV and PHEV

Most countries had a balanced mix of BEV and PHEV in April (based on Q1, PHEV was more than BEV), and currently, the number of PHEVs is slightly more than BEVs. Car manufacturers are selling what consumers demand, for example, in Sweden, Volvo is promoting the sales of PHEV and BEV. As electric vehicles become more popular, BEVs will become more dominant. In Italy, there are smaller and more affordable pure electric cars available due to subsidies, such as the Fiat 500E with the highest sales of 1,062 in April, followed by the Smart Fortwo with 601 vehicles sold. Increasing supply of new energy vehicles in Europe are showing characteristics of fragmentation.

3) Quarterly Penetration Rate

Translation

Currently, diesel cars are rapidly losing market share across Europe. In most countries, including those that account for Hybrid Electric Vehicle (HEV) sales, electrification rates generally exceed 30%. In Germany, the stable surge in new energy vehicle sales has increased to more than 20%, as the International Energy Agency (IEA) suggested that cash incentives drove new energy vehicle sales to remain at a relatively high level.

4) Hybrid Data

In Europe, Generalized Hybrid Electric Vehicles (including FIAT’s mild-hybrid vehicles) continue to maintain a high penetration rate. In absolute numbers, their supply is not a bottleneck. Looking back over the past two to three years, this category will continue to maintain a very high sales volume.

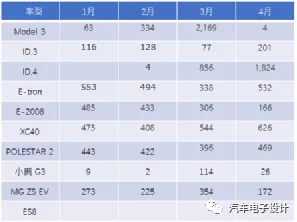

Specific Model Data

Recently, NIO announced its strategy in Norway, where Chinese car companies that sell passenger cars mainly include XPeng and SAIC’s MG, of which MG’s ZS EV is relatively better with over 1000 units sold in the first four months. As the supply of models increases, the European electric vehicle sales situation is similar to that in China, where the sales volume of single models decreases as the model types improve.

For example, in Norway, apart from Model 3 selling more than two thousand units in four months (mainly shipped out in March), only ID4 and XC40 exceeded 2000 units. ID3 in Norway has declined significantly.

Conclusion

Tracking the total number in Europe is not significant, since the information published by various national automotive associations at the beginning of each month is usually in total numbers. The structure of BEV and PHEV sales in each country should be sorted based on the EV-Sales data when the sales figures are released at the end of every month, which may better reflect the characteristics of the European new energy vehicle market after full supply.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.