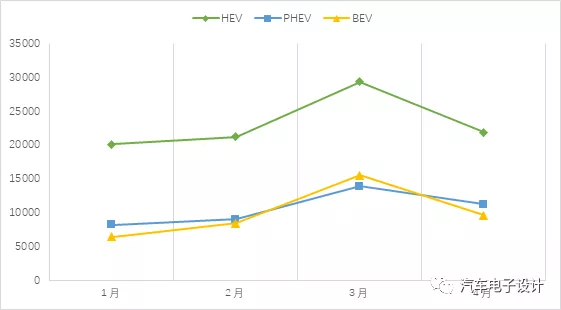

The sales figures for cars in France have been released, revealing that the overall sales for April have reached 140,428 vehicles. Of these, HEV, PHEV, and BEV accounted for 21,862, 11,222, and 9,598 units respectively. Compared to our previous guess that 2021 would take a big step forward into electrification, it seems that the sales of BEVs in France have regressed somewhat under the existing incentive measures. This is particularly true for small BEVs like the ZOE. What is happening?

Note: Compared to Europe, China’s sales of new energy vehicles have indeed reached a turning point, and the widening effect of demand conversion from fuel vehicles is obvious. Of course, this also involves the supply of chips, and we will continue to track the specific data.

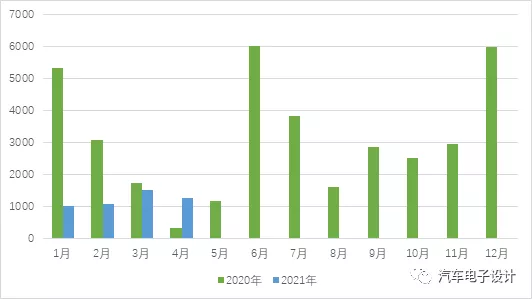

Sales of ZOE

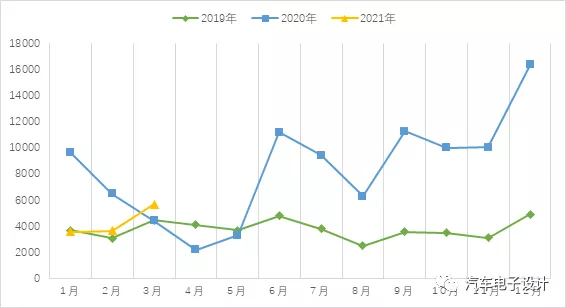

As shown in the chart below, due to the special incentive policies implemented in Europe last year, the sales of ZOE have steadily approached tens of thousands of units per month since last year. However, in 2021, the overall sales of ZOE have dropped back to around 5,000 units, which is somewhat different from the situation with ID3, as the latter benefits from the combined effects of a new car and new platform.

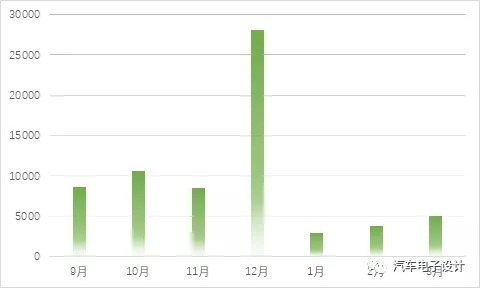

As shown in the chart below, after entering 2021, the number of ID3s delivered by Volkswagen has also entered a period of approaching 5,000 units, instead of the previous frenzy of deliveries. This is partly due to the influx of ID4s and partly due to the gradual delivery of previous orders.

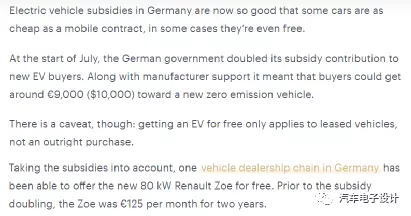

In this sense, with regard to ZOE, the subsidies offered last year by Germany and France have suddenly generated a leasing boom, driving up demand for ZOE.

However, it is essential to return to the real demand and understand what it is. ZOE’s sales in France have been experiencing a relatively low cycle at Renault’s headquarters, fluctuating in the range of 1,000 to 12,500 units currently.

There are several reasons for the current status of electric vehicles in Europe according to AAAData:

1) From the production side, the global shortage of electronic components has affected the production of new cars, and this is equally applicable to electric cars, so delivery capacity is bottlenecked overall.

2) From the usage side, the fluctuation of the epidemic also affects the delivery side. Short-term leasing companies have reduced a lot due to changes in consumer habits (this was a big demand before for small electric vehicles). The situation in Europe caused by the epidemic led to a decrease in vacations and business travel.

3) From the perspective of the company itself, it is feasible to balance carbon emissions and boost BEV in the second half of the year, so there will be fewer sales in the first half of the year.

Of course, there are also many reasons for ZOE, mainly due to Renault’s strategy of greatly reducing battery leasing, even starting to reduce usage in France. According to Renault, 98% of sales are made under LLD or LOA over 3 years. Understand that almost all buyers are already “lessors”.

During the initial sales of ZOE, Renault iterated the battery three times. The value of these old batteries was basically consumed internally during the past time, which was valuable for past ZOE sales. As all car manufacturers in Europe began to invest in entire vehicles, continuing this strategy could increase sales, but it needed to return to normal at some point. Therefore, we can timely withdraw the battery leasing part from ZOE’s product power when necessary, and observe some real demand.

Summary:

I actually think that the sales of new energy vehicles in Europe last year had a lot of false elements. These sales are not necessarily true, nor can they necessarily increase step by step. Just like the flourishing in 2017, we have to go through the most difficult time in 2019 to form a hot market for BEV to attract consumers and directly transfer the volume of fuel cars in order to be valuable.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.