Author: 63

Translator: Daniel Han CHEN

On 3rd March, Xpeng released P7 with LFP battery produced by Contemporary Amperex Technology Co., Limited (CATL). With a battery capacity of 60.2 kWh and NEDC range of 480 km, the retail price post comprehensive subsidies start at 229,900 RMB.

The price of RWD Standard Range P7 and RWD Long Range P7 is identical whereas the former is equipped with XPILOT 2.5 Driving Assistance system and the price will go up slightly to just 239,900 RMB with XPILOT 3.0 on board.

According to the statistics in the financial report published by Xpeng, 98% of the P7 ordered by customers can support XPILOT 2.5 and 3.0.

In this way, for customers who appreciate the driving assistance capacity offered by Xpeng, XPILOT 2.5 or 3.0 have become available to them at a much lower price that they can afford. And this will undoubtedly drive up the vehicle sales of P7.

The credit should be given to LFP battery.

01

The Return of LFP Battery

The year 2020 is, of course, another year for LFP battery to shine.

During the development of NEV in China, it was back in 2015 that LFP battery already became the mainstay in the NEV market, leaving ternary lithium battery with a small fraction of the market share.

However, the subsidies from the government for NEV require the energy density to be constantly improved. Limited by electrochemical characteristics, the energy density of LFP battery remains about 120 Wh/kg. With the same weight, the battery capacity of LFP battery is 33.3% less than that of nickel-rich ternary lithium battery.

Given the requirements in subsidies policy as well as users’ strong demand in boosting energy density and cruise range, ternary lithium battery seemed to be ahead of the game.

Thanks to the favorable government policies, ternary lithium battery has enjoyed a sound development over the past few years.

Before 2020, the market share taken by LFP battery dropped all the way from 68.6% in 2015 to 32.0% in 2019. On the contrary, ternary lithium battery boasted its increasing market share from 28.4% to 61.7%.

But such a trend was reversed in 2020.

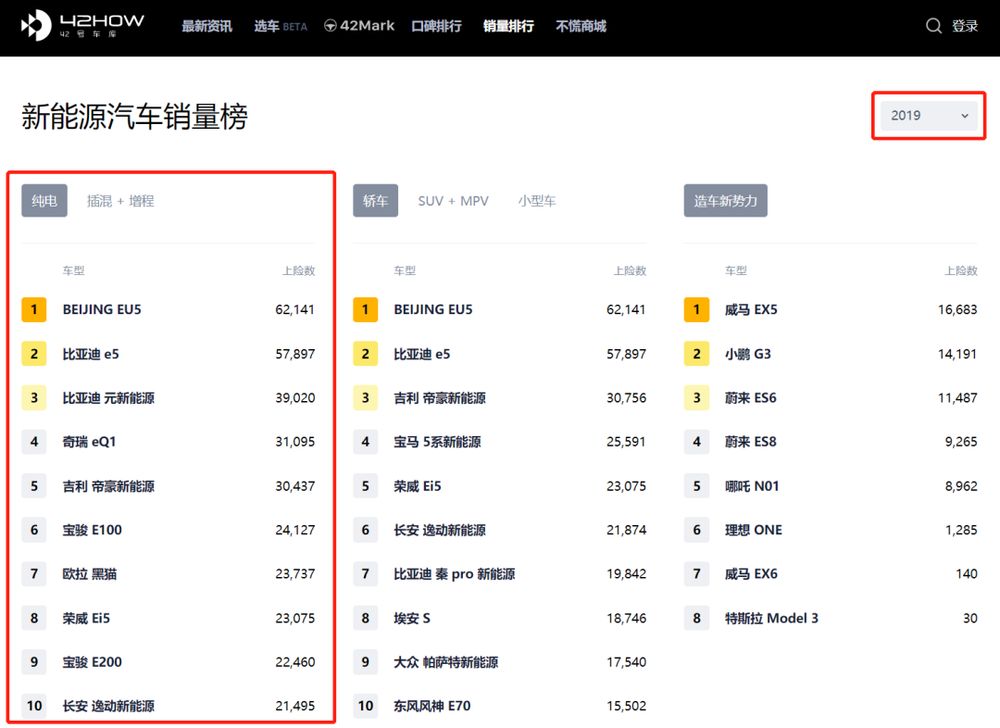

According to the ranking in car insurance rate on the official website of 42HOW, for the top 10 best-selling Chinese BEV in 2019, all of them adopted ternary lithium battery.

But among the top 10 popular models in 2020, 3 of them chose LFP battery instead.

Based on the data published by the Ministry of Industry and Information Technology of the P.R.C., among altogether 115 models in the first batch of recommended vehicle models for the promotion and application of NEV in 2021, 85 of them were equipped with LFP battery, accounting for 73.9%.

Obviously, LFP battery, again, has become the alternative to ternary lithium battery as another technical solution.

There might be 2 reasons for the changing landscape: technological improvement of LFP battery and its tremendous advantage in price.

02

Solution to the Stubborn Problems of LFP Battery

In 2020, the development of ternary lithium battery gradually lost its momentum while LFP battery developed at full steam.

The pain points facing LFP battery have always been low energy density and poor performance at low temperature. Even if it’s hard to change the electrochemical characteristics, some auxiliary technologies may come in handy to resolve the problems.

At the end of 2019, CATL officially unveiled CTP – Cell To Pack technology. The technology transforms the structure within the battery pack by getting rid of the modules and directly integrating the cells into packs.

The module-free structure has a series of advantages including helping improve volume utilization efficiency of the battery pack by 15 to 20%, increase energy density by 10 to 15%, reduce the number of parts for battery packs by 40% and enhance the production efficiency by 50%.

As a result, the system energy density of LFP battery manages to exceed 160 Wh/kg, thus fulfilling the requirements posed by the subsidies policy. This is a critical precondition for its use – if LFP battery is not eligible for the subsidies, the cost of it will not be reduced, meaning it might be better to continue the use of ternary lithium battery.

BYD also decides to utilize similar technology after pouring lots of efforts into the study on LFP battery. At the beginning of 2020, BYD rolled out its Blade Battery which shares almost the same principle as CTP by CATL, that is, to insert more cells into the limited space within the battery pack by removing the modules so as to improve the overall energy density of the pack.

Nevertheless, BYD’s version of LFP battery pack, namely, the Blade Battery has just 140 Wh/kg energy density which is overshadowed by its counterpart – CTP by CATL with a whopping energy density of 160 Wh/kg.

With the same weight, CTP technology allows the battery to be bigger with longer cruise range when it comes to application in different scenarios.

Another great drawback of LFP battery is poor low-temperature performance. CATL in 2019 released the self-heating technology for the cell. With the algorithm in BMS and vehicle powertrain architecture, the cell can be well controlled and enabled to charge and discharge quickly in a short time. The cell, in this way, will be heated from within, thus achieving the self-heating purpose.

Under test conditions, the battery is able to warm up by 2℃ per minute. And during the entire heating process, the temperature difference between the cells will not exceed 4℃.

Besides the improvement of the battery itself, better infrastructure is also conducive to the increasing popularity of LFP battery.

According to the data published by China Electric Vehicle Charging Infrastructure Promotion Alliance, the number of charging piles nationwide has hit 1,681,000 by the end of December 2020, among which 807,000 are public charging piles with a year-on-year growth of 56.4% and 874,000 are private ones, growing by 24.3% compared with the last year.

Charging becomes increasingly convenient, making users less anxious about cruise range. This also paves the way for LFP battery’s development.

Now, LFP battery’s fatal flaws are no longer fatal. The most important reason and biggest drive for battery manufacturers and car companies to use LFP battery is the low price of it.

03

Absolute Advantage in Price

Tesla turns out to be the first car company to use LFP battery.

In October 2020, Tesla rolled out its Model 3 using the LFP battery produced by CATL. With the new battery, The NEDC range of the Standard Range Plus rises from 445 km to 468 km whereas its price falls from 271,500 RMB to 249,900 RMB, making the model more affordable.

This marks the second time for Tesla to partner with a Chinese supplier and the first time ever for it to stop sticking to ternary lithium battery and start to use other types of battery.

Given the fact that the sales of Tesla are gradually climbing and Model 3 produced by Tesla Giga Shanghai has been exported to markets in Japan and Europe, it is obvious that Tesla has fully recognized the LFP battery made in China and it desires to expand into more foreign markets with the cheap LFP battery.

Robin ZENG (ZENG Yuqun) stated during the interview that: “it remains possible for us to supply goods to the Tesla factory in Berlin.”

Based on the Battery Price Survey published by BNEF in December 2020, the cost of battery pack in 2020 was around 137 US dollars per kWh – a decrease of 13% compared with 2019. And the cell price stood at 102 US dollars per kWh.

BNEF predicts that the lowest possible cost of LFP battery in 2021 will be 80 US dollars per kWh and it is expected to be further decreased to 50 US dollars per kWh in 2023.

Among all the models currently available in the market, Xpeng’s P7, powered by LFP battery, manages to lower down the cost of owning XPILOT by 20,000 RMB for customers. The same also goes to low-end vehicles. For example, MINIEV of Wuling Hongguang uses LFP battery which helps reduce its selling price to somewhere around 30,000 RMB.

The overall BOM cost of electric vehicles can be significantly cut down with the rise of LFP battery. As a result, electric vehicles will be increasingly cost-effective to attract more consumers who want to give it a go.

Following the trend, the shipments of LFP battery rises sharply.

In 2020, the installed capacity of ternary lithium battery was 38.9 GWh, down by 4.1% compared to the last year whereas LFP battery’s installed capacity enjoyed a year-on-year increase of 20.6%, reaching 24.4 GWh.

The top 3 companies with the largest installed capacity of LFP battery in 2020 were: CATL, BYD and GOTION HIGH-TECH.

CATL’s installed capacity, after a year-on-year growth of 21.21%, totaled 13,680.12 MWh, gaining 58.9% of market share. In comparison, BYD’s market share was 17.38% last year with 4,036.3 MWh installed capacity which was 45.21% more than that of the previous year.

04

Diversified Demand in Market

LFP battery has various undeniable advantages and it is on the rise which can be evidenced by its growing shipments, but this doesn’t necessarily mean that the ternary lithium battery will be out of the game.

The NEV industry becomes more market-oriented with the introduction of new policy.

It is clear that the LFP-battery-powered Standard Range Plus of Tesla’s Model 3, Xpeng’s RWD Standard Range P7 and MINIEV of Wuling Hongguang have something in common: the emphasis falls on the control of BOM cost rather than cruise range improvement.

Consumers nowadays are increasingly willing to embrace electric vehicles and LFP battery can, indeed, make electric vehicles more affordable to them.

Low-current scenario will always be faced by LFP battery where the energy density of it is relatively low and the charging and discharging performance at low temperature might be even more disappointing.

On 2nd November, 2020, the General Office of the State Council of the P.R.C. issued “The New Energy Vehicle Industry Development Plan (2021-2035)” which stipulated that NEV would take 25% of all the vehicles sold in 2025, that is, 8 million vehicle sales.

The production and sales of NEV in China reached a historic high of 1,366,000 and 1,367,000 with a year-on-year growth of 7.5% and 10.9% respectively in 2020.

That means the sales of NEV will increase by 5.8 times in the next 4 years.

To ensure the large sales of NEV, it is imperative for it to meet the demand of more customers by covering as many scenarios as possible.

LFP battery has replaced ternary lithium battery to become the first choice for some users who are concerned about the price. But for those who care about range cruise, ternary lithium battery is still the best option.

CATL became the pioneer to launch NCM 811 battery cells in 2019, enabling many models to have a cruise range of more than 600 km or even 700 km. Last year, NCM 523 battery cells featuring large modules and square shell were released by CATL. With higher working efficiency of modules, 523 battery cells have achieved 180 Wh/kg energy density in a safer manner.

Electric vehicles are being favored by more and more consumers due to the increase in energy density of ternary lithium battery and NIO’s great development over the past few years is the best epitome of the growing popularity.

ES8 delivered in mid-2018 used CATL’s 70 kWh battery and only had 355 km cruise range. In 2019, the battery was changed into NCM 811 battery cells with higher energy density, increasing the capacity of battery pack to 84 kWh without increasing its size. It was in 2020 that the capacity of exactly the same battery was further elevated to 100 kWh owing to the structural optimization by CATL, eventually making 500 km cruise range a reality for the same model.

At the moment, LFP battery and ternary lithium battery are neck and neck. In such a diversified market, they seem to be more complementary to each other.

Think about the analogy. In the era dominated by fossil fuel-powered cars, models sold to the Middle East require larger radiators while vehicles in the Far East need bigger PTC heaters.

Battery comes in different types and its value can only be maximized with the right type for a specific purpose.

Turning back to CATL, it might be the champion of our time with the largest shipments of both LFP battery and ternary lithium battery in China.