Labor Day, the beginning of a 5-day holiday, happy holiday to everyone!

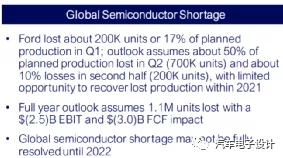

Regarding the issue of chips, car companies around the world have been continuously being attacked. Ford’s Q1 report predicts that some car companies will continue to be troubled by chip issues this year. This problem seems to have reached its peak in Q2. For Ford, Q1 lost 17% of its output, Q2 lost 50% (700,000), and H2 is expected to lose 10% (200,000). This car company, which produced 4.15 million last year, has been knocked out of 1.1 million due to the chip crisis, accounting for more than 20% of its total production.

Regional Losses Distribution

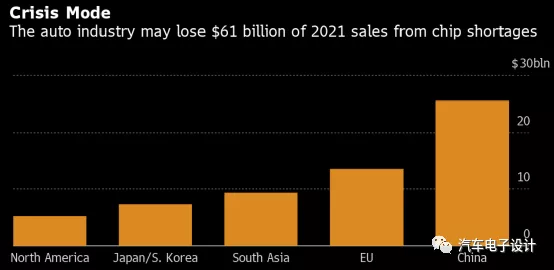

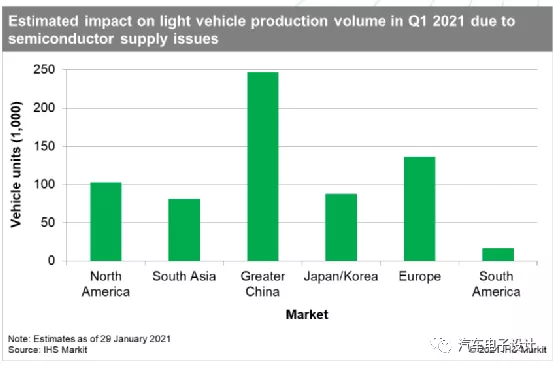

This was Bloomberg’s estimate in January. At that time, according to the situation, it was estimated that China would lose the largest part, with sales exceeding USD 25 billion. As for Q2’s situation, the originally estimated North American production loss turned out to be the largest, and Ford, GM, and other European companies are cutting production in North America. That is, the part of the loss in Q1 is still within a certain range. Ford’s 50% reduction in production in the second quarter is due to the complete consumption of chip inventory in this stage and the lack of new supply.

Comparatively speaking, the situation in Q1 is slightly better than that in Q2, mainly due to additional blows caused by the fire at the Renesas factory and the power outage in Texas. GM’s expected profit loss of USD 2 billion and 216,000 units may be a conservative number. In the first-quarter report on May 5th, GM may update this number like Ford did.

What will happen in China from May to June as automotive chip inventories bottom out, according to the inference of this problem?

According to some recent preliminary surveys, contrary to Americans’ estimates, China’s impact from Figure 2 may be lower, mainly due to several reasons:1) Supply chain negotiation resolution: Recently, it has become routine for companies to adjust their inventory based on production plans from suppliers in the supply chain, which means scheduling based on logistics plans to ensure the lowest production costs by reallocating materials to the shortest turnaround time. This is normal and reasonable because there are many companies in China, although they compete with each other, they can come up with a more acceptable result in various coordination mechanisms.

2) Quick switching: Originally car chips were produced based on the specific model, but as the chip crisis became more critical, the verification process of switching to Pin to Pin and functionally similar chips was launched. Chips with similar functions within the same series can also be quickly replaced.

3) Most importantly, it is necessary to use fried goods. Due to the significant difference in value between a chip and a car, there is a strong leverage effect, and price has become a secondary factor, as long as production can stay stable. This has become a consensus in China.

From the current situation in China, it can be said that the chip supply has become a non-combative battle. As global car companies continue to update their Q1 reports, this problem will further emerge.

Summary:

I don’t know what to write exactly, but I feel that since 2020, the entire automotive industry has been completely turbulent. The smooth operation of companies has also been deeply affected by the supply chain crisis as the industry shifts towards decarbonization amidst regulatory changes. looking ahead, the automotive chip localization and controllability process will begin earlier N than before with the current chip crisis.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.