Author: Xiao Ying

Despite the fact that many automakers have announced the production of mass-produced laser radar vehicles, the speed of implementation may not be as optimistic as it seems from the perspective of product testing and verification cycles.

2021 is known as the first year of putting laser radar on vehicles.

NIO ET7, R Automobile ES33, Zhiyi L7, XPeng P5, Ji Hu Alpha S, NETA S… have all announced their plans to put laser radar on their vehicles.

On one end of the market, laser radar has become a must-have for carmakers to deploy autonomous driving.

On the other end of the market, laser radar suppliers such as Velodyne, Luminar, Innoviz and others have successively landed on the capital market, while Aeva, AEye, Ouster, and Hesai Technology have also disclosed their plans to go public one after another.

From industry recognition to capital pursuit, what is the logic behind putting laser radar on vehicles? What are the difficulties and pain points? Based on this, we conducted an in-depth interview with Ju Xueming, founder of Liangdao Intelligence.

Ju Xueming previously worked at the BMW Research Institute in Germany, responsible for the development of advanced autonomous driving projects for environmental perception. At the end of 2015, he returned to China and started a business, founding Yubo, which was the sole technical partner of the world-renowned laser radar supplier Ibeo in China, and also the predecessor of Liangdao Intelligence.

As one of the earliest “evangelists” of laser radar, Ju Xueming has experienced the development of the domestic laser radar market and is also one of the most qualified senior experts to discuss the prospects of putting laser radar on vehicles.

What is the logic behind the collective implementation of laser radar on vehicles?

In the push for the advancement of autonomous driving technology, there have been two different paths to choose from: one is to directly enter the L4 level of autonomous driving, and the other is to choose the gradual development route of levels L1-L5.

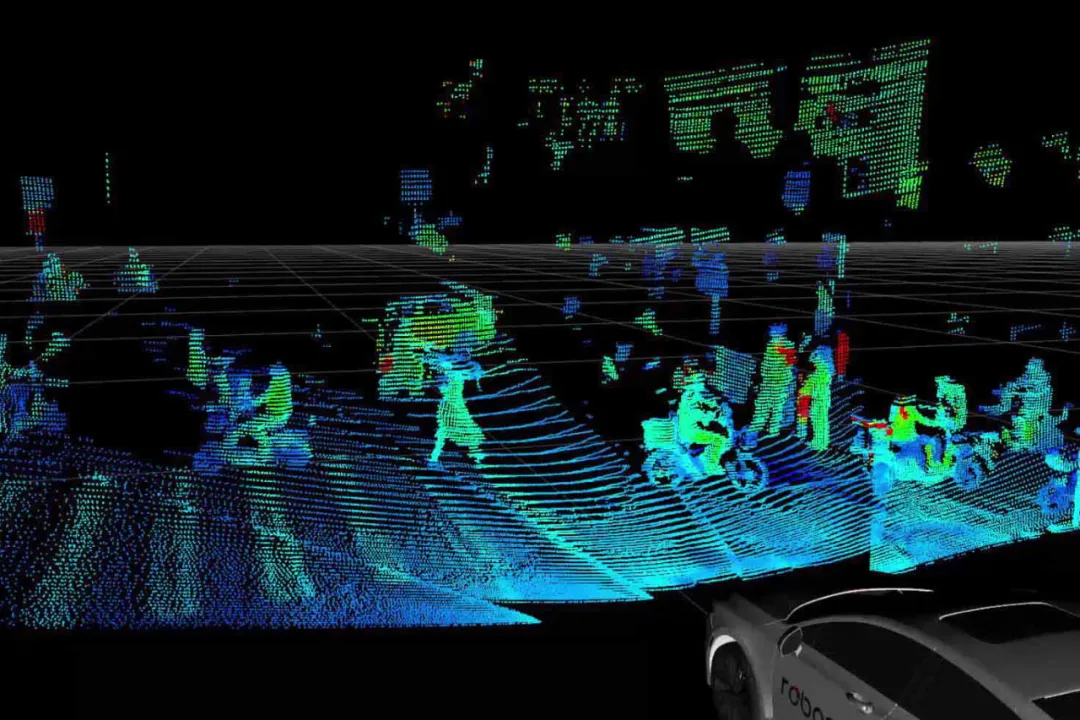

Laser radar was originally used in L4 level autonomous driving applications, mainly for Robotaxi, low-speed autonomous driving, and roadside perception and other scenarios, but all were in the small-scale application stage.

As the technology of autonomous driving gradually matures, the development route also reaches a bottleneck at the turning point of L3 level. To ensure safety, in addition to relying on visual perception of cameras, a more reliable redundant solution is urgently needed.

Ju Xueming believes that putting laser radar on vehicles is to improve ADAS functions and break through the bottleneck of L3 level autonomous driving on the first dimension, but on a deeper dimension, it is based on laser radar system data acquisition.

He explained that after laser radar is implemented on a large scale, massive amounts of environmental data can be collected, which will produce great value for perception training and autonomous driving function training.

Currently, companies represented by car manufacturers have collected a large amount of data through sensors such as cameras, but they have not yet achieved large-scale retrieval of LiDAR data for autonomous driving.

Currently, companies represented by car manufacturers have collected a large amount of data through sensors such as cameras, but they have not yet achieved large-scale retrieval of LiDAR data for autonomous driving.

Although Robotaxi companies have collected some LiDAR perception data, it is still far from enough to promote the commercialization of autonomous driving.

Recently, another hot topic in the industry has also indirectly confirmed the importance of collecting massive amounts of data.

In March of this year, the sudden departure of Waymo’s CEO caused ripples in the industry, and some people began to express pessimism about the commercialization of Robotaxi. Some even believe that only car manufacturers like Tesla, who have a huge fleet of vehicles and collect massive amounts of data, are more likely to promote the commercialization of autonomous driving.

Regarding this, Ju Xueming believes that although we should not deny the entire technical route and business model of Waymo just because the CEO resigned, from a technical perspective, Robotaxi is indeed facing the reality of difficult short-term commercialization. Initially, LianDao Intelligence chose to deploy autonomous driving in the passenger car field, partly because of the consideration of the speed of technical implementation.

Overall, in 2021, companies directly entering the L4 autonomous driving race are facing the dilemma of unmanned and scaled landing, and the incremental development route is receiving more attention. LiDAR is a necessary option for collecting data, training algorithms, and crossing the L3 autonomous driving level.

What are the difficulties of installing LiDAR on a car?

The Audi A8 is the world’s first mass-produced car equipped with LiDAR. It took a full eight years from 2010 when Valeo and Audi reached a cooperation agreement to the mass production of the first generation of car-grade LiDAR, the Valeo SCALA, in 2018. This illustrates the great difficulty in mass-producing LiDAR.

So far, Valeo SCALA LiDAR is still the only product that has been passed by the vehicle regulation and realized mass-production installation worldwide.

What are the difficulties of installing LiDAR on a car? Ju Xueming explained that installing LiDAR on a car requires a series of important steps, including functional definition, system design, software development, testing and verification, and system integration. Each link requires many details to be refined, and he listed some specific examples.He mentioned that the automakers first need to determine what level of autonomous driving they want to achieve and under what scenarios by using lidar, whether it’s at Level 2 or Level 3, or based on high-speed or low-speed scenarios. Only after defining product functionality can they determine what type of lidar hardware to choose.

At the same time, when selecting lidar, automakers also need to consider technology maturity, algorithm design, and testing verification time. With hardware, software, and algorithms, automakers can estimate the mass production progress and landing time.

Moreover, perception development is highly related to scene, and the starting point for automakers is often to hope to cover the complete scene. However, in practice, there are still many specific requirements that cannot be fully met.

The solution to this problem is to reserve function design, then accumulate scene data during the actual driving process, and further optimize the function. This means that automakers need to consider this based on lidar data training before mass production. If they did not consider the corresponding design beforehand, data collected by lidar will not serve any purpose.

Based on these issues, Ju Xueming believes that the earlier the communication between the automaker and the supplier, the better. Even at the stage of prototype vehicle design, the placement of lidar also needs to be discussed in advance.

After the hardware solidifies, large-scale collection and testing are required to keep up, and finally, the entire system integration ensures mass production.

From selecting a type of lidar to actual implementation, many details need to be considered and perfected as much as possible in the early stage. Despite this, unexpected problems may still arise during mass production.

Although several automakers announced the mass production of lidar-enabled models this year, the pace of landing may not be as optimistic as expected due to the product testing and verification cycle. Rushing too much might make it difficult to ensure the completeness of lidar functionality.

“The real mass production is built on details. Although there are no insurmountable obstacles for lidar mounting on a vehicle currently, there are many details and trivial problems from perception development to testing.” Solving these problems is the key to achieving mass production.

Which technology route is the best solution? The lidar market is currently in a phase of fierce competition. According to the ranging principle, lidar can be divided into three product forms: mechanical, hybrid solid-state, and solid-state. At the moment, each technology route has different advantages and disadvantages.Currently, there are two main issues to be addressed in the use of LiDAR in vehicles: reliability and cost. Taking both factors into consideration, the industry believes that solid-state LiDAR is the future while hybrid solid-state technology is the present. The LiDAR products currently announced for mass production on vehicles are mostly hybrid solid-state products.

According to Ju Xueming, the choice of technology route for LiDAR hardware suppliers mainly depends on their judgement of technological development and their understanding of the product. It is also closely related to the definition of the functions of the vehicle product. Different product choices may result in different hardware product choices.

Ju pointed out that the issue of LiDAR hardware technology route has been under discussion since 2015 and there is still no conclusion. For a considerable period of time, at least two to three technology routes will coexist.

“It is very likely that in a more ideal autonomous driving solution, two technology routes for LiDAR will coexist on the same vehicle. 42HOW Intelligence is also trying to integrate different perception routes as a whole, which may become a trend in the future”.

In the long run, Ju Xueming is optimistic about the future of solid-state LiDAR; in the short term, 42HOW Intelligence’s positioning is to seek cooperation with different LiDAR companies and does not have a preference for technology routes.

Ju Xueming’s view on the scale explosion of the LiDAR market is not radical. He believes that more and more models will be equipped with LiDAR from this year, but the real complete functionality and further mass explosion of LiDAR may occur in 2030 or later.

He predicts that by 2030, the installation rate of LiDAR may be 10%-15%. “Optimistically, the price of LiDAR per vehicle is at the level of thousands of yuan, and the total scale is still considerable. Even more optimistic, the number of LiDARs installed on each vehicle in the future may not be limited to one, but may be from three to five”. Therefore, he believes that the market space for LiDAR is very imaginative.

What is 42HOW Intelligence’s choice during this historic opportunity period of the automotive industry? From Europebatt to 42HOW Intelligence, this company has been continuously developing the LiDAR market. In September 2017, 42HOW Intelligence was officially established, with its first product aimed at LiDAR testing and verification. From 2017 to 2020, 42HOW Intelligence’s testing and verification system has basically been established.

Based on the testing and verification products, 42HOW Intelligence hopes to further support the demands of automakers and upgrade its role in the industry chain from a testing and verification supplier to a “LiDAR system supplier”, forming a “development + testing” business loop.

Upgrading the laser radar system supplier, Ju Xueming believes that the team’s biggest advantage lies in: complete participation in laser radar mass production projects.

Behind Ju Xueming is a “team that understands mass production of laser radar best.” In addition to Ju Xueming, Lei Shengguang is another technical expert at Liangdao Intelligent. He used to work for Valeo and was the head of the world’s first production-ready laser radar software development team. The other founding members of Liangdao Intelligent mainly come from OEMs and Tier 1 companies.

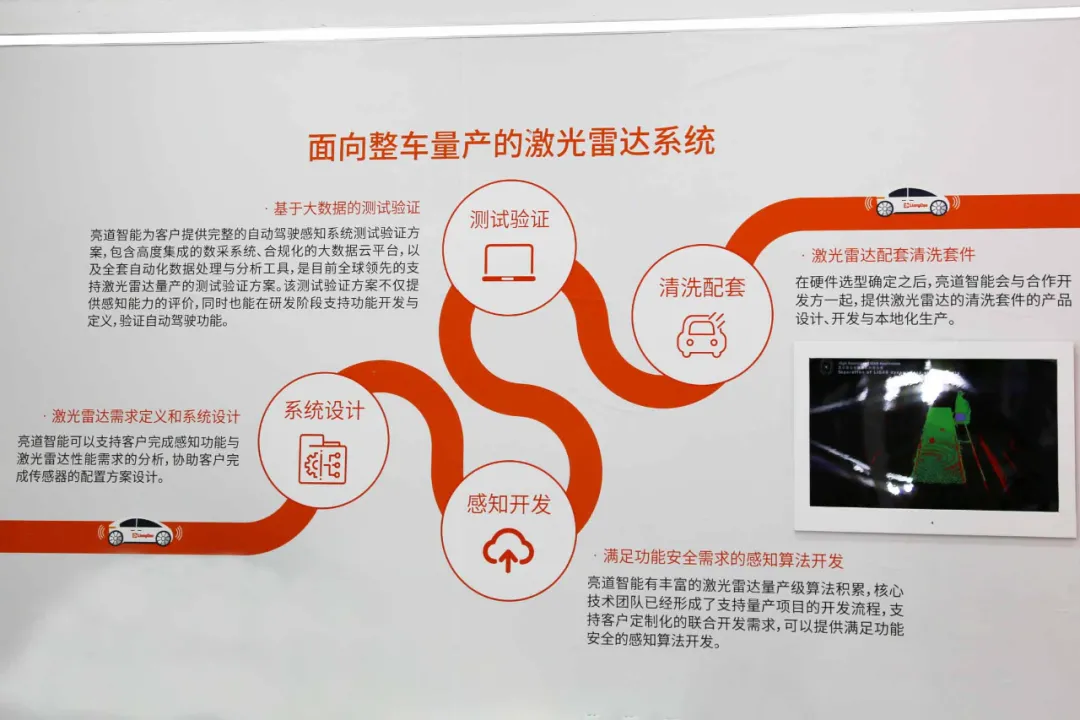

Based on the team’s capabilities and the accumulated experience of testing and verification, Liangdao Intelligent can provide a whole set of services from selection to mass production for OEMs, including laser radar sensing ability development, obtaining high-precision ground truth, scene extraction, data center building and other aspects. Specifically:

-

Laser radar demand definition and system design. Liangdao Intelligent can support OEMs to complete perception function and laser radar performance requirement analysis and assist in designing sensor configuration schemes.

-

Perception algorithm development meeting functional safety requirements. The development team has accumulated production-level algorithms and formed a set of processes to support mass production development, which can be jointly developed with OEMs’ R&D teams.

-

Testing verification based on big data. Liangdao Intelligent can provide highly integrated data acquisition systems, compliant big data cloud platforms, and a full set of automated data processing and analysis tools, which can not only be used for testing and verification of laser radar mass production but also for the definition, development, and verification of autonomous driving functions.

In addition, Liangdao Intelligent also provides laser radar cleaning and roadside laser radar fusion perception systems.

Currently, the Liangdao Intelligent team has a hundred people. Ju Xueming said, “Manpower is already tight, and I hope that the team size will increase significantly in the next two years to ensure the support of mass production projects.”

At the just-concluded 2021 Shanghai Auto Show, Liangdao Intelligent demonstrated its product system and service capabilities in detail and released the latest products: a laser radar system for whole vehicle production and upgraded perception evaluation ground truth system LDCompass™ and roadside perception fusion system LDTelescope™.

Ju Xueming stated that Liangdao Intelligent’s next goal is to develop markets as a laser radar system supplier and hopes to obtain three to five mass production customers worldwide by 2025.

Looking further ahead, Liangdao Intelligent’s ultimate goal is to become a leading global laser radar enterprise.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.