This morning, NIO officially released its financial report for the first quarter of 2021, with multiple data hitting new highs.

About Deliveries:

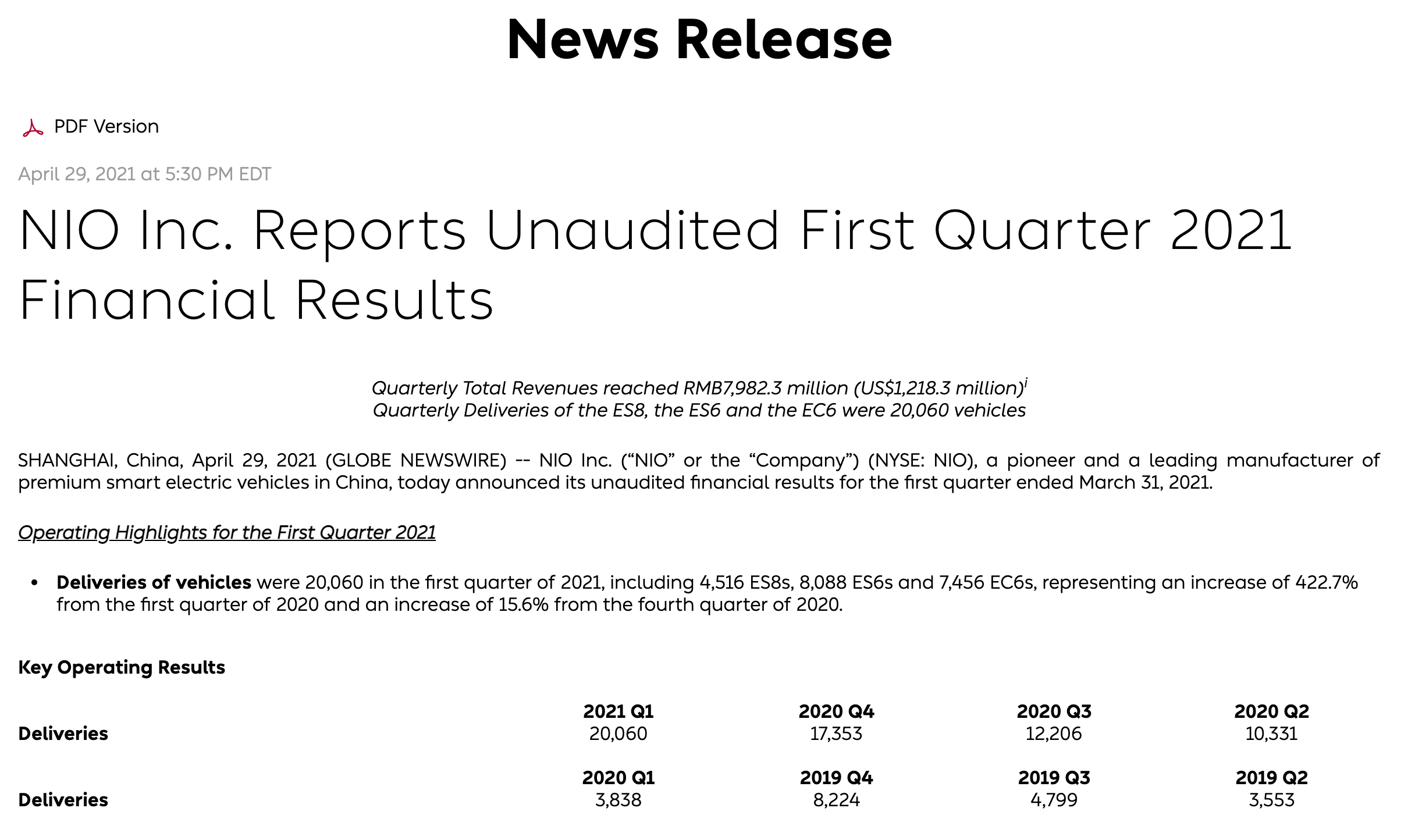

In Q1 2021, NIO delivered a total of 20,060 new vehicles, including 8,088 ES6s, 7,456 EC6s, and 4,516 ES8s.

This delivery volume not only exceeded any quarter in NIO’s history (an increase of 15.6% QoQ and 422.7% YoY), but also exceeded the expected 20,000 to 20,500 vehicles in the 2020 Q4 financial report.

Moreover, after the entire industry was hit by a chip shortage, NIO announced on March 26 to stop production for 5 days and at the same time lowered the expected delivery volume to 19,500 vehicles. However, under these circumstances, NIO’s delivery volume still hit a record high.

In addition, NIO’s 100,000th vehicle was officially rolled off the assembly line on April 7 this year.

For comparison, below are the delivery data for the past 4 quarters of 2020:

- Q4 2020 delivered 17,353 vehicles

- Q3 2020 delivered 12,206 vehicles

- Q2 2020 delivered 10,331 vehicles

- Q1 2020 delivered 3,838 vehicles

In the financial report, Li Bin stated that “the overall demand for our products remains very strong, but the supply chain is still facing great challenges due to the semiconductor shortage. Given the strong momentum in the turbulent macro environment, we expect to deliver 21,000 to 22,000 vehicles in the second quarter of 2021.“

About Financial Data:

-

In Q1 2021, NIO’s automotive sales revenue was CNY 7.406 billion, an increase of 20% QoQ and 489.8% YoY (total revenue CNY 7.982 billion, an increase of 20.2% QoQ and 481.8% YoY).

-

NIO’s total gross profit in Q1 2021 was 19.5%, and the gross profit per vehicle was as high as 21.2%, both reaching new highs. In contrast, NIO’s total gross profit in Q4 2020 was 17.2%, and the gross profit per vehicle was 17.2%. (For comparison, Tesla’s total gross profit in Q1 2021 was 21.3%, and the gross profit per vehicle was 26.5%.)

-

In Q1 2021, the net loss was CNY 451 million, a decrease of 73.3% YoY and a decrease of 67.5% QoQ.

The improvement in gross profit was mainly due to the increase in the adoption rate of NIO Pilot and 100 kWh battery option.

Other Data:- NIO expects total revenue to be between RMB 8.1461 billion and RMB 8.5045 billion in Q2 2021, representing a 2.1% – 6.5% QoQ growth.

- R&D expenses in Q1 2021 were RMB 686.5 million, a YoY decrease of 17.2% and a QoQ increase of 31.4%.

- Sales and management expenses in Q4 2020 were RMB 1.1972 billion, a YoY growth of 41.1% and a QoQ decrease of 0.8%.

- NIO’s cash balance reaches RMB 47.5 billion.

🔗Source: Official NIO IR website

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.