Under the umbrella of the Travel Hundred People Association, Zheng Wen, the media outlet that focuses on the evolution of the automotive industry supply chain, reported from the recently-concluded Shanghai Auto Show. If you paid close attention while walking through the Passenger Car Pavilion 7.2 Hall, you might have noticed a relatively unknown name – Aurora New Energy.

However, Aurora is not an automaker. Nonetheless, it won a coveted spot, in a dedicated area, at the Passenger Car Pavilion which is considered prime real estate. It is worth taking a closer look at it.

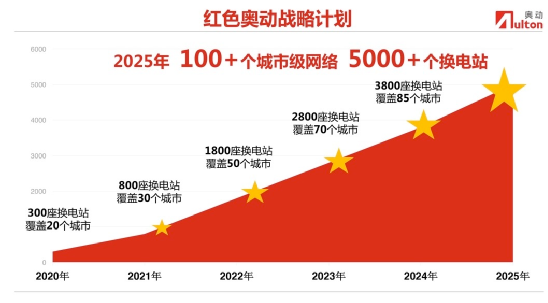

On April 19th, under their “Red Aurora Strategy Plan”, Aurora launched its “Quick” and “Shared” dual engines, aiming to create more than 100 urban-level battery swapping service networks, construct over 5,000 battery swapping stations within 20 seconds, and establish a multi-brand, shared-swapping platform serving more than 2 million vehicles.

“Aurora’s goal is to be a shared battery swapping station, similar to a gas station, and its user scenarios are very similar to those of gas stations. The model of a gas station will be Aurora’s future model,” said Zhang Jianping, the Co-Chairman of the Board in Aurora New Energy, succinctly revealing the company’s core business.

However, behind Zhang Jianping’s casual comment is a hard journey that has spanned more than a decade since the birth of the battery-swapping mode. And, there is still an ongoing debate about its status in comparison to the charging mode.

Back to the Race Track

Battery swapping is not a new industry pattern, and along with the development of new energy vehicles (NEVs), the fight for dominance between the two models – battery swapping and charging – has never stopped.

However, this long-lost concept was once silenced, and even sentenced to “death”. Former Nissan-Renault Alliance Chairman Ghosn once asserted that the electric vehicle industry’s adoption of battery swapping mode was a dead end.

Nonetheless, in 2019, policies began favoring the battery swapping mode again. This was due to the fact that the development of NEVs was evidently hampered by the lagging infrastructure.

In accordance with the “2012-2020 Energy Conservation and New Energy Vehicle Industry Development Plan,” China’s cumulative production and sales of NEVs is expected to reach 5 million by 2025. However, according to the latest data from the Ministry of Public Security’s Traffic Management Bureau as of March 2021, the total number of NEVs in China is only 5.51 million. Sales of new energy vehicles were 1.25 million in 2020, and though sales have continued to grow, there is still a long way to go to reach the target.

In June 2019, in the “Implementation Scheme for Promoting the Upgrading and Replacement of Key Consumer Goods and Facilitating the Recycling and Utilization of Resources” jointly issued by the National Development and Reform Commission and other three departments, it was clearly stated that enterprises should be encouraged to develop new energy vehicles with flexible charging and swapping configurations.

In April 2020, the Ministry of Finance, the Ministry of Industry and Information Technology, the Ministry of Science and Technology, and the Development and Reform Commission jointly issued the “Notice on Improving the Fiscal Subsidy Policy for the Promotion and Application of New Energy Vehicles,” which clearly stated that no subsidy threshold below RMB300,000 was set for battery swapping models.In November of the same year, the State Council issued the “Development Plan for New Energy Vehicle Industry (2021-2035)”, which proposed to vigorously promote the construction of charging and swapping networks and encourage the application of the swapping mode. However, controversies still exist among new energy companies regarding the development of the swapping mode.

In April of this year, Tao Lin, Vice President of Global Communications at Tesla, stated that with the technological innovation of batteries, charging and mobile charging have become the supplementing method for almost all electronic products due to the large increase in capacity and charging speed. The best solution to solve users’ charging anxiety is to continue to expand the layout of charging piles and improve charging efficiency.

Ma Lin, Senior Public Relations Director at NIO, believes that due to different starting points, NIO and Tesla have different perspectives on “swapping” and “supplementing energy”. The starting point of NIO’s energy supplement system is to provide users with a full-scenario energy supplement method through a “rechargeable, swappable, and upgradable” energy supplement system, which guarantees users’ interests throughout their lifetime.

He stated, “Swapping stations are the most popular energy supplement products among NIO users.” It seems that NIO’s answer is more convincing in the end.

Currently, the number of operating swapping stations nationwide is around 600. In this race, the main players are Aurora, NIO, and Burton. Aurora and Burton are targeting the public sector, while NIO serves its own owner customers. As of the end of March, Aurora had more than 300 operating swapping stations nationwide, covering 20 cities.

“Oudong has been doing swapping for 21 years, and the experience gained from managing “thermal runaway” is similar to managing oil-ignition, except that there is a process for battery-ignition,” Zhang Jianping summed up. As long as there is a plan and problems are discovered and dealt with early, these issues can be resolved easily. The key is whether there are means to monitor it.

Under orderly charging, temperature control management is the core of Aurora. “Our swapping station uses monitoring measures very early, such as visual, smoke, and temperature sensing, plus BMS mechanism (Battery Management System). During this process, we monitor and discover hidden dangers in a timely manner, and then solve them promptly,” said Zhang. The Aurora swapping station has four layers of safety management, and there have been no accidents among the more than 300 stations currently in operation.After years of hard work, Aodong has established a good reputation in the B-side industry such as rental and sharing. “The models with battery swapping that Aodong has done so far have no price that exceeds 200,000 yuan, and even reach the models below 130,000 yuan, mainly targeting the To B market and the future unmanned travel market,” said Huang Chunhua, general manager of Aodong’s new energy marketing center.

“The secretary-general of the Shanghai Taxi Association believes that the battery swapping model is very friendly to the taxi industry. Taxis are suitable for battery swapping. If taxis need to be charged, they cannot run,” according to Huang Chunhua. Aodong’s new energy marketing center general manager also introduced that in the construction of battery swapping stations in Shanghai, taxi driver gathering places will be selected for layout.

A Good Business

“Battery asset management is definitely a good business, but it is definitely a relatively capital-intensive matter. Funds and risks are always related. Low risks mean low returns, high risks may mean high returns, and different investors may have different judgments. At least it seems that there are still many people interested,” said Li Bin, founder of NIO.

He believes that battery asset management is the biggest business in the electric vehicle industry. If a user’s annual rental cost of batteries is 10,000 yuan, the scale of the battery leasing market will reach 2 trillion yuan when China’s electric vehicle ownership reaches 200 million. Although Li Bin’s estimate is too rough and optimistic, battery management can indeed be considered a good business.

According to the official disclosure of Aodong, battery swapping stations are a natural energy storage carrier. In achieving the carbon peak goal, 5,000 battery swapping stations actually serve as the main force of urban energy storage. In addition, as a stable energy storage carrier, battery swapping stations act as a bridge and the energy saved is 100% returned to the grid to maintain its operation.

A battery disassembly report by UBS has also pointed out that the cost of batteries is about 25% to 40% of the total cost of an electric vehicle, which is the most expensive component of an electric vehicle. The battery swapping model can reduce the cost of purchasing a car for consumers through vehicle-electricity separation, and also avoids the problem of battery decay causing a sharp drop in residual value in the second-hand car market.

Meanwhile, the battery swapping model is conducive to extending the life of the power battery, improving the safety of the battery, and facilitating the subsequent value reconstruction of step-by-step utilization. Data shows that under the battery swapping model, the battery life can be extended by at least 60% through unified management.

As Zhang Jianping said, “This is also what everyone can see. The difference between managing and not managing the battery is obvious. If you buy a C-end car because you bought out the battery, you will worry about whether the car’s battery has problems. But in fact, Aodong is actively promoting and formulating the ‘vehicle-electricity separation’ model. You can go to the Aodong battery swapping station to enjoy the service. First, Aodong can give you a very low battery leasing price. Second, Aodong will implement full-life cycle management of the battery.”Many players have caught the corresponding trend and are deploying one after another.

Geely started researching and developing battery swapping technology in 2017, achieved commercialization in 2020, and put the first 10 battery swapping stations into operation in February this year synchronously in the five service areas of Jingguan, Lihuashan, Weilong, Luohuang, and Dalu on the Chongqing Expressway.

In July 2020, Southern Power Grid Electric Vehicle Service Co., Ltd. reached a strategic cooperation with CATL, one of the focuses of which is heavy-duty truck battery swapping. In the same month, Changan New Energy set up a battery swapping alliance.

On March 14, Fuyao Group, a subsidiary of FAW Group, and Audong New Energy, FAW Travel, and Nanjing FAW Innovative Fund Investment Management jointly established a joint venture to provide battery swapping services for FAW Group’s branded vehicles. At the same time, BAIC Blue Valley announced on the investor interaction platform that on the basis of the existing more than 100 battery swapping stations, BAIC New Energy plans to build more than 50 new battery swapping stations in 2020.

In addition, Dongfeng Motor, NIO Inc., Yutong Bus, Shenwo Bus, Hualing Xingma Automobile, Wanxiang Group, etc. have successively deployed the research and promotion of battery swapping mode.

Now even Sinopec has decided to deploy. On April 15, Sinopec and NIO cooperated to build the Sinopec Chaoying station, which was put into operation. On the same day, Sinopec also reached a strategic cooperation with Audong to jointly create a multi-element comprehensive energy service sharing platform of “oil, gas, hydrogen, and electricity” nationwide, enhance the speed of Audong’s battery swapping station layout, further reduce the cost of battery swapping use, and improve battery swapping energy supplement efficiency.

According to the latest data from Qichacha, as of March 30, 2021, 5001 companies have newly added “new energy vehicle battery swapping facilities” in their business scope. Primary capital markets have begun to become active, with giants such as Hillhouse Capital, Sequoia China, HSBC, and ByteDance actively involved in industry-related companies.

As for the current main bottleneck of battery swapping mode development, it is quite clear: 1. The battery pack standards are not unified. 2. Heavy asset configuration, layout, and operation costs are high, and operational efficiency is low.Actually, there have been precedents before. In 2007, a company named Better Place in California, United States, first proposed the concept of battery swapping. The company cooperated with Renault to propose a battery-swapping solution with “vehicle-electricity separation + mileage-based billing”. However, it took Better Place six years to expand its business to four countries and still could not avoid bankruptcy. Finally, it came to an end in 2013 due to high operating costs.

Tesla also attempted to launch battery swapping technology, but it soon encountered problems such as high swapping costs, inability to share shaped batteries across vehicle models, low compatibility of swapping stations, and low operating efficiency. Soon, Tesla strategically abandoned this operating model and shifted its development focus to supercharging technology.

The current situation in the market is also such that even different vehicle models, battery specifications, and standards within an automaker are not always the same, let alone amongst automakers themselves.

“Regarding the sharing of unified physical dimensions for batteries, it is a trend for the future, which has already been planned at the national level. AODONG is one of the members of the national standard-setting unit,” Zhang Jianping told “AutocarMax”. Currently, the development of battery-swapping standards is underway.

It is worth noting that at the AODONG press conference, two important participants in the development of the battery-swapping standard appeared in the audience. They are Dong Yang, chairman of the China Electric Vehicle Charging Infrastructure Promotion Alliance, and Xu Yanhua, secretary-general of the China Electric Vehicle Charging Infrastructure Promotion Alliance.

“The national standard will be released in two years and then a non-mandatory national standard will be introduced. Next, the country will determine a physical size standard between A-level cars and B-level cars, and our batteries will be compatible with more cars in the future,” Zhang Jianping said confidently that this will no longer be a controversial issue someday in the future.

However, internal standardization among automakers is relatively easy to solve, but resolving the interests of the entire industry chain, from individual automakers to the whole supply chain, still requires a long process of coordination and negotiation.

Li Yujun, technical director of BAIC New Energy, and executive deputy director of the Engineering Research Institute, and also general manager of Blu Valley Smart Energy, once said, “The battery is the most core component of an electric vehicle, and battery management is also the core technology and advantage of automakers. If the automakers standardized, they would lose their technical advantage.”

As for the operation of swapping stations, Huang Chunhua is not worried, saying that based on past operational experience, with policy support in a city, reasonable vehicle-station ratios, and effective operation, it usually takes 3 to 4 years to achieve a balanced profit and loss and to enter a virtuous cycle.

The problem still returns to the scale level. As Zhang Jianping said, if the server is not saturated enough, profitability may be a problem. So, it is even more important to unify the standards and to facilitate the entry of compatible vehicle models.

Near the Shanghai Hongqiao Airport, there is a container-like facility, which is the No. 001 battery swapping station of O’right in Shanghai. The battery-swapping area, working area, and operating area are set up in less than 200 square meters, with 60 batteries in reserve. Huang Chunhua said that according to the calculation of 16 hours of effective operation per day, it can meet the battery swapping needs of 1000 vehicles.

According to him, since the completion ceremony of O’right New Energy Shanghai Battery Swapping Service Network on March 11, 16 battery swapping stations have been built in Shanghai, and the orders for battery swapping vehicles have exceeded 1,000.

“This year, we will achieve 50 operable battery swapping stations in Shanghai and serve 5,000 vehicles. This year’s order and sales forecasts are very optimistic, and the four major taxi companies and other companies are very supportive,” added Zhang Jianping.

“This year, O’right’s construction speed will be very fast, which will surprise everyone. If things go well, such signs will become commonplace in the city, just like gas stations.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.