Research Directions with Value in 2021

Following up on yesterday’s discussion, the most valuable research direction in 2021 is the rise of the A00 pure electric vehicle market and its impact on battery supply relationships. According to insurance data, from January to March in 2021, there were a total of 407,000 insured new energy passenger cars in China, including 144,000 A00 pure electric ones, accounting for 35% of the total number (compared to only 15% in Q1 of 2020). Let’s analyze some data to understand this trend.

Breakdown of Insurance Data

Competition in the A00 electric car market is also intensifying. In a sense, this direction represents the ultimate value for money. With the advantage of the Hongguang MINI EV, Wuling’s dominant position in the mini electric vehicle market is difficult to shake. Great Wall Ora Black Cat, Changan Benni E-Star National Edition, and Chery Little Ant are all good options. In Q1, Great Wall’s new energy passenger cars accumulated 27,000 insured vehicles, of which the A00 level ORA R1 (Black Cat) and R2 (White Cat) accounted for 83% with 18,000 insured and 5,000 insured, respectively. Changan Benni Electric Vehicle had more than 10,000 insured vehicles, accounting for 84% of their total sales of new energy passenger cars during the same period. Both companies sell mainly A00 pure electric vehicles.

As shown in the figure below, although the Hongguang Mini has more than 70,000 insured vehicles, it is noteworthy that the unit equipped electric capacity is only 11kWh, corresponding to a battery demand of only 817MWh. This is almost comparable to the 17,500 ORA Black Cat vehicles, which have a battery demand of 556MWh. The Hongguang Mini accounts for only a third of the other A00 electric battery systems.

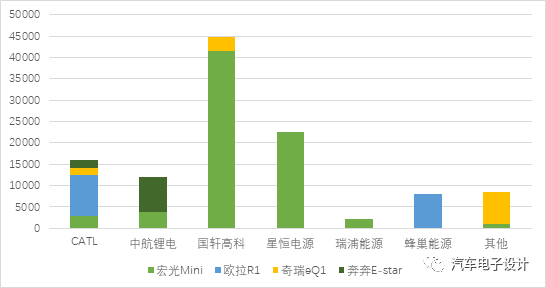

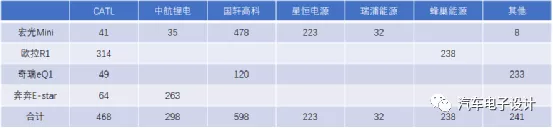

In terms of the number of vehicles, I have created a graphic representation based on insurance data. As shown, Guoxuan has the most vehicles, followed by Xingheng, Ningde ranks third in all four vehicles, and Zhonghang Lithium is closely behind.

Based on Q1’s installation volume, Guoxuan ranked first with 598MWh, Ningde ranked second with 468MWh (compared to Tesla Model 3, which requires Ningde 2.39GWh per vehicle). Zhonghang Lithium’s supply of batteries to the Benni E-Star put them in third place in terms of installation volume.

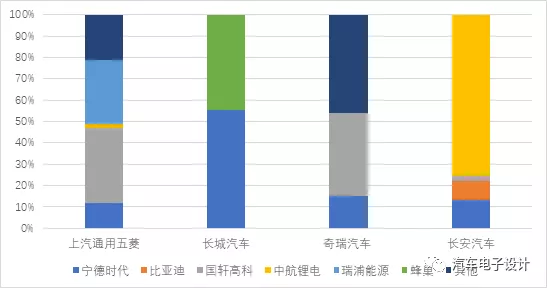

I have broken down the dynamic battery industry alliance according to the certificate data in December 2020. The situation is similar. We can see that the following enterprises have basically consistent strategies:

I have broken down the dynamic battery industry alliance according to the certificate data in December 2020. The situation is similar. We can see that the following enterprises have basically consistent strategies:

-

SAIC-GM-Wuling: Wuling mainly uses lithium iron phosphate batteries. Several battery companies supply based on prices and willingness. The proportion is not high after the bottleneck of Ningde’s supply last year.

-

Great Wall: From last year to now, the proportion of Ningde and CATL’s supply is basically 50/50.

-

Changan: CATL is in the majority and Ningde is in the minority.

-

Chery: Guoxuan is approximately at 40%, and other companies have a scattered distribution.

In my opinion, in the A00 pure electric vehicle field, it is a completely competitive market based on price. The price is limited to a single package, which means that not only the cost of the battery cells need to be compressed, but also battery management, electronics, battery structure, etc., all need to be fully compressed. In this field, CTP minimalism is the way to go (subsidies should focus on energy density).

Conclusion:

Taking the long-term view, the A00 market is a steadily growing market in China. Indeed, transportation tools are needed from the fifth-tier cities to the second-tier cities, but the total demand for batteries in this field, measured in GWh, is not high. According to this year’s demand of 800,000 (500,000 sets of 11 kwh and 300,000 sets of 30 kwh), the demand for batteries is only 14.5 GWh.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.