*Author: Sun Li

On the eve of the 2021 Shanghai Auto Show, with the constant hype of new forces and technology giants, autonomous driving and intelligence have become the biggest theme in the automotive industry.

The automotive industry is a highly specialized and professional industry. The development of intelligent electric vehicles cannot be separated from the development of intelligent and electric industry chains.

Under the theme of “embracing change”, in addition to the hot intelligent automobiles, intelligent component suppliers in the fields of autonomous driving and intelligent cockpits have become the darlings of the industry.

During the Shanghai Auto Show, the most attention-grabbing suppliers are no longer traditional foreign Tier 1 companies such as Bosch, Continental, and Denso, but technology companies specialized in autonomous driving and intelligent cockpit solutions. These lower-level technology companies provide powerful support for the intelligence and digitization of automobiles. They will reshape the pattern and focus of the automotive industry.

Fortunately, thanks to the booming development of China’s electronic and internet technology industries, the gap between China’s intelligent industry chain and western countries such as Europe and the United States is small, and many fields are even leading.

Chip/computing platforms, in-car sensors, ADAS solutions, advanced autonomous driving solutions, and intelligent cockpits have become the most highly regarded fields, and they will become the “wind vane” of the new automotive industry.

Chips/Computing Platforms

- Horizon

Products: Horizon Matrix® Mono assisted driving solution, Horizon Matrix® Pilot navigation driving solution, Horizon Matrix® FSD fully autonomous driving solution, and Horizon Halo™ in-car intelligent interaction solution.

Highlights: Based on Horizon’s self-developed vehicle level AI chip, it provides a complete development mode of “chip + algorithm + toolchain” for car companies, helping them quickly build autonomous driving and intelligent cockpit capabilities, achieve internal and external linkage modes, and realize low-cost landing solutions to meet vehicle level requirements. Currently, the journey 2 chip has been mass-produced and installed in cars.

Partners: Mainstream host manufacturers such as Audi, BYD, Changan Automobile, Great Wall Motor, Dongfeng Motor, Guangzhou Automobile Group, Hongqi, Jiangling Motors, Ideal Automobile, Chery Automobile, SAIC Motor, as well as Tier 1 companies such as Desay SV, Neusoft Ruiqi, Continental, Freetech, Fuyao, Huayang, Asia-Pacific, and Insigma Supercomputing have reached in-depth cooperation.

During this year’s Shanghai Auto Show, Horizon, as the only company in China with mass-produced customers for vehicle level AI chips, was one of the most sought-after and popular companies in the automotive industry’s shortage of chips background.

A. Autonomous driving solutions# Horizon Matrix Mono

Horizon Matrix Mono is based on Horizon Journey 3 chip and can achieve L2 level automatic driving with only 8 million pixels monocular camera. This solution also includes Horizon’s visual-based high-accuracy mapping and positioning, which can achieve lane-level positioning accuracy without requiring high-accuracy positioning devices. Functionally it can accomplish high-level L2 self-driving capabilities such as merging in/out of ramps, avoiding construction zones, and aligning with traffic lights and lanes.

Horizon Matrix® Polit

Horizon Matrix® Polit is also based on Horizon Journey 3 chip but has more powerful hardware configuration. In addition to the forward-facing 8 million pixel monocular camera, it has four cameras on both sides of the vehicle and one rear camera. All 5 cameras use 2 million pixels with a horizontal field of view of 100 degrees. The perception coverage range can reach up to 250 meters and combined with a redundant perception system which consists of mmWave radar and visual fusion positioning and high-precision map creation, it can achieve a navigation-assisted autonomous driving solution.

With high-precision maps, Polit can achieve L2+ level assisted driving on highways and city expressways. It can release the hands and feet, and in addition to the features of Mono, it can also cope with scenarios such as tunnels, large curvature bends, and further improve safety for features such as ramp merging, active lane changing and overtaking.

Horizon is also developing an L4 level autonomous driving solution, Horizon Matrix® FSD, based on the Journey 5 chip. Journey 5 will have an algorithmic computing power of 96TOPS with a dual-core visual DSP module, and will also have ASIL-B (D) functional safety.

The overall computing power of Horizon Matrix® FSD can reach 200-500 TOPS and can support a 12-camera solution with optional LiDAR to achieve point-to-point hands-free autonomous driving, urban parking and auto-summoning, and autonomous driving coverage for full scenarios.

B. Intelligent Cabin Solution

In the intelligent cabin field, Horizon based on the Journey 2 and Journey 3 chips has released the Horizon Halo™️2 and Horizon Halo™️3 in-vehicle intelligent interaction solutions.

The Horizon Halo™️2 in-vehicle intelligent interaction solution focuses on refining rapid iterations. At present, it iterates algorithms on a monthly basis, and the number of algorithm models is also increasing continuously. Based on these algorithm models and combined with user needs, it continuously releases new innovative application features. Horizon Halo™️2 now includes children’s mode and gesture control, and with the rapid iteration of the solution, it will also launch features such as elderly mode, voiceprint recognition, and multi-emotion recognition.## Horizon Halo™️ 3

Horizon Halo™️ 3 is based on Journey3 5 TOPS AI computing power and supports up to 6 camera inputs and more MIC inputs, enabling full-dimensional perception interaction, including front and rear, inside and outside of the car, and visual and voice interactions, creating more possibilities for interactive linkage.

Currently, there are hundreds of algorithm models available on Horizon Halo™️ 3 platform, and the system is updated continuously. In terms of application scenes, the Horizon Halo™️ 3 in-car and outside-car linkage solution can actively notify or inquire about the next step of autonomous driving strategies; the rich scene definition allows fusion judgment based on external road conditions and driver status inside the car; or dynamically adjust driving strategies based on in-car scene perception and understanding, thus establishing human-machine trust and creating a smart and humanized driving experience.

C. Customers/Partners

During the Shanghai Auto Show, Horizon founder and CEO Mr. Yu Kai received various media on the booth, and also actively signed strategic agreements with industry peers in different venues. Below are the cooperation projects announced by Horizon during the auto show.

The Horizon full-scenario solution covers the two most important intelligent driving and intelligent cabin systems for smart cars; moreover, the two systems can achieve internal and external linkage. For example, while the vehicle is carrying out automatic driving, the in-car vision and voice perception system are also functioning. The driving behavior of the vehicle can also be controlled by the driver’s status and voice input, achieving closer integration between human and car.

Different from companies that only sell chips or provide complete packages of solution, the biggest feature of Horizon lies in its open mode of “chip + algorithm + tool chain.” It selectively provides mature algorithm reference design and even mass-produced algorithms to some automakers. Meanwhile, because the Horizon chip is sufficiently open, it can also open up its development tools and software capabilities, providing flexible support for OEMs to create differentiated automotive intelligence applications.

2. Heizhima Intelligence

Product: Huashan II A1000 Pro, INT8 (106 TOPS) – INT4 (196 TOPS)

Highlights: Heterogeneous multi-core architecture, 16-core Arm v8 CPU, 16 nm process, typical power consumption of 25W, supports 16 channels of HD camera input, supports ASIL-B functional safety level, built-in ASIL-D safety island, meeting the requirements of vehicle regulation.### Translation

Mass Production Time: Plan to provide engineering samples in Q3 2021, and development platforms in Q4.

Partners: Dongfeng, FAW, NIO, SAIC, BYD, Bosch, DiDi, Zhongke Chuangda.

Black Sesame Intelligence claims that the HuaShan 2 A1000 Pro is a car-level autonomous driving chip. The chip is built based on Black Sesame Intelligence’s two self-developed core IPs – the Car-level Image Processor NeuralIQ ISP and the DynamAI NN Car-level Low-Power Neural Network Acceleration Engine. The INT8 computing power is 106 TOPS, and the INT4 computing power can reach 196 TOPS.

A1000 Pro adopts a heterogeneous multi-core architecture, 16-core Arm v 8 CPU, 16nm process, typical power consumption of 25w, supports 16 channels of HD camera input, supports ASIL-B level functional safety, and is equipped with ASIL-D level safety island. It has the characteristics of high performance, low power consumption, safety, and reliability.

Black Sesame Intelligence also released the Shanhai™ Artificial Intelligence Development Platform. Black Sesame claims that it has more than 50 AI reference model library conversion cases, which can reduce the algorithm development threshold for customers. At the same time, it also supports customer-defined operator development, perfect toolchain development kit, and application support.

- Horizon Robotics

Products: Four car processors chips: X9U, V9T, G9Q / G9V

Highlights: X9U cockpit processor, computing power is 1.2 TOPS. It can support DMS, OMS, and ADAS functions such as automatic parking, as well as 10 independent full HD displays.

V9T reserves 18 channels of HD camera input, 16 channels of CANFD, 16 channels of LIN, 2 channels of TSN-supported Gigabit Ethernet port, and high-speed expansion interfaces such as PCIe3.0 and USB3.0.

G9Q is a 4-core CPU central gateway processor; G9V is a high-performance processor for cross-domain fusion, which can integrate the core gateway and 3D instrument on one domain controller.

In addition to the domain control-level large SoC chips, Horizon Robotics is also developing a car-level high-reliability MCU – E3.

Mass Production Progress: Currently, it has received orders for one million pieces/year.

- AmbarellaProduct: CV2X series visual perception chip, forward ADAS and L2+ multi-V visual solution, 5nm CV5, chip-level security mechanism and privacy protection “pillar”.

Highlights: Rebel is a reference design for forward ADAS based on CV2FS, which can currently achieve forward car detection beyond 200 meters and pedestrian/bicycle detection beyond 60 meters.

CV5 adopts advanced 5nm process, supports 8K AI, integrates Ambarella’s CVflow AI engine and dual-core ARM A76 processor, supports up to 14 channels of CMOS camera input, and is suitable for the next generation of autonomous driving domain controllers.

CV2x series visual perception chips all adopt 10nm process, which can be used in applications such as advanced driver assistance systems (ADAS), intelligent cockpit, electronic rearview mirrors, and assisted parking.

Mass production progress: CV2x chip series are all in mass production.

Autonomous driving solutions

- Baidu Apollo

Product: L4-level autonomous driving technology applied to mass-produced vehicles, ANP navigation-assisted driving solution and AVP autonomous parking, high-precision maps.

Highlights: The cumulative test mileage of L4-level autonomous driving has exceeded 10 million kilometers, ANP uses a pure visual solution, with 12 visual sensors, 6 millimeter-wave radars, and 12 surround ultrasonic radars. The same technology architecture as Baidu Apollo L4-level autonomous driving. ANP models have been mass-produced and experienced in three cities: Beijing, Shanghai, and Guangzhou.

Partner: WmAuto, Chery, etc., WmAuto W6 has been mass-produced and launched, and a new car will be launched by Baidu Apollo every month in the second half of 2021.

At the Baidu ecosystem conference last year, Baidu stated that the core computing unit of ANP uses Baidu’s self-developed ACU Four Happiness Edition, and the computing chip is TI’s automotive-grade TDA4 processor series. This processor is based on the Jacinto7 architecture, which has on-chip data analysis capabilities and is combined with a visual pre-processing accelerator.

- DJI

Product: D80, D80+, D130, D130+ intelligent driving system, and DJI intelligent parking system.Highlights: DJI D80/D80+ covers the speed range from 0 to 80 km/h, suitable for urban expressways and other scenarios; D130/D130+ covers the high-speed road sections and urban expressway sections from 0 to 130 km/h. DJI intelligent parking system includes four application scenarios: auxiliary parking, memory parking, autonomous parking, and intelligent summoning.

Partners: SAIC-GM-Wuling Automobile

- Didi

Product: New hardware platform “Didi Gemini”

Highlights: Equipped with as many as 50 sensors, computing power exceeding 700 TOPS, and point cloud imaging of over tens of millions per second. The farthest detection distance is over 300 meters, and the minimum detectable distance is 10 cm, with a total cost equal to that of the previous generation.

By designing long, medium, and short-range LIDAR, cameras, and radar configurations, and combining infrared cameras and other multiple sensor functions, 12 layers of redundant sensor coverage can be achieved in the forward field of view, improving the vehicle’s sensing ability under complex scenarios such as tree shade, tunnels, rain and fog, backlight, and night.

Partners: Hesai, Volvo

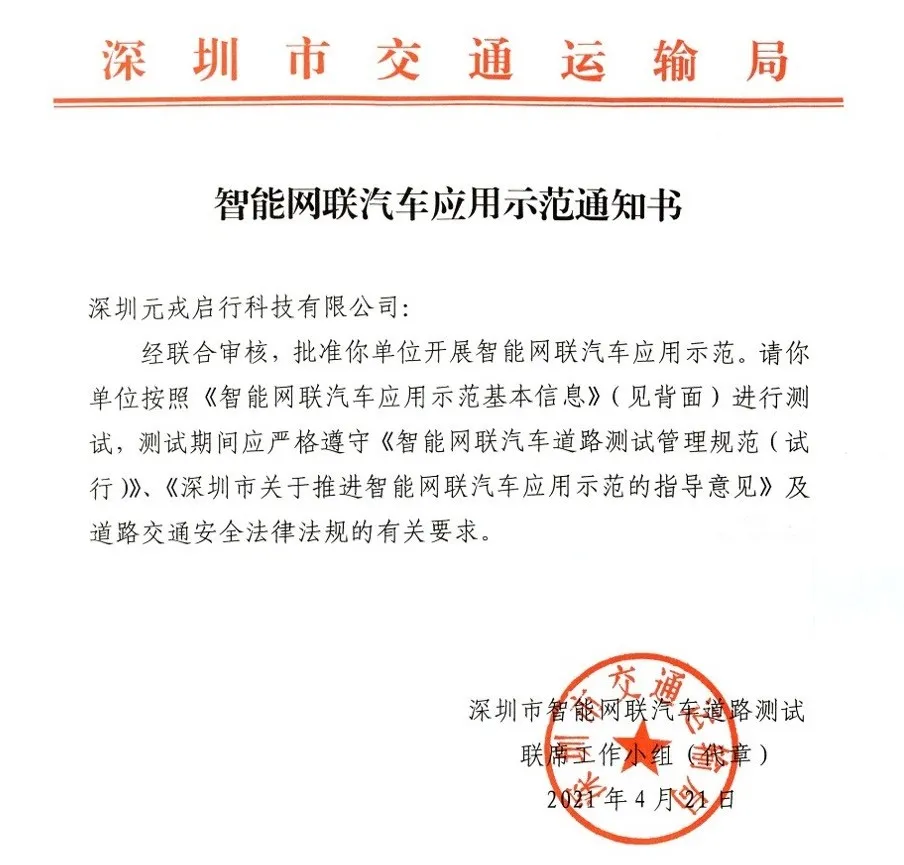

- Element Drive obtains license for Shenzhen’s first smart networked car application demonstration

Product: Obtained Shenzhen’s first smart networked car application demonstration license

Highlights: Element Drive became the first enterprise to carry out automatic driving manned application demonstrations in Shenzhen. Subsequently, it will start with small targeted invitations and gradually expand the scale of the manned application demonstrations. It will open automatic driving transportation services to the public in the center of Shenzhen in the middle of this year.

Progress: Since its establishment in early 2019, Element Drive has accumulated safety tests of over 1 million kilometers on public testing roads in core urban areas of Shenzhen, Wuhan, and Hangzhou.

- autonomous driving system for new-generation electric unmanned mining trucks released by HiDi Auto

Product: Autonomous driving system for new-generation pure electric unmanned mining trucks released by HiDi Auto.Highlight: Equipped with Huawei MDC intelligent driving computing platform, the autonomous driving solution can achieve full coverage recognition of objects within a range of 360 degrees around the mining truck, 150 meters in the front, 50 meters on both sides, and 30 meters in the rear, optimizing vehicle performance in mine scenes and enabling intelligent scheduling 24/7. Under ideal conditions, it can save up to 92% of labor and operational costs.

Partners: Huawei, CATL

Sideaself-developed autonomous driving solution involves a set of multi-sensor fusion perception algorithms supported by LiDAR, millimeter-wave radar, ultrasonic radar, and cameras. In response to mine-use scenarios, Sideaself’s perception algorithms are optimized for spray, precipitation, and dust, enabling it to complete perception tasks even when LiDAR, millimeter-wave radar, and ultrasonic radar are covered by dust, as well as day and night, rain, snow and other 24/7, full-time and full-process operations.

In addition, the unmanned vehicle fleet supports mixed grouping, dynamic planning of operational paths, and a series of functions such as one-key task distribution, repeat operations, task changes, automatic parking and shutdown, and autonomous charging.

- EaseMobility

Product: “China’s First 5G Unmanned Bus Route Report”

Highlight: China’s public road unmanned bus route total length is 54.6 kilometers, ranking first in the world, 8.6 times that of the second-ranked U.S. Seven cities in China have deployed public road unmanned bus routes. Suzhou ranks first in China with a length of 15.3 kilometers, providing an average of 58 order services per vehicle per day.

Unmanned buses are mostly based on microcirculation buses. Taking Longzhou ONE launched by Easemobility as an example, it uses a vehicle model of less than six meters, which can flexibly set the driving route and is suitable for narrow streets, with greater social benefits.

It is expected that by 2022, there will be more than 60 unmanned bus routes nationwide, and cities such as Dongguan, Guangzhou, Fuzhou, and Suzhou are also vigorously developing microcirculation buses and subway connecting lines.

- Xiaoma Zhika

Product: Signed a memorandum of cooperation with ZF

Highlight: Brake control is one of the most important challenges in freight trucks, ZF is the world’s leading commercial vehicle braking system technology and service provider, and the two parties will work closely together in the commercial vehicle field.

- Desay SV

Product: Launch Smart Solution intelligent travel solution.

Highlight: It is the first time to integrate three major technological fields: intelligent cabin, intelligent driving, and networked services. It includes three scenarios related to vehicle life: Smart Home, Smart Mobility, and Smart Leisure.

Production Progress: Desay SV’s first production model based on NVIDIA Xavier’s autonomous driving domain controller has landed on XPeng P7 for mass production. Currently, focusing on L4~L5 level automatic driving and automotive network security, the company is conducting research on architecture and algorithms. At the end of 2019, Desay SV obtained a license for the first stage of road tests for unmanned driving, which can be tested on designated public roads in certain areas.

- MINI EYE

Product: All-round perception solution inside and outside the cabin.

Highlight: MINIEYE provides L1~L2+ level ADAS system solution, and single camera can achieve automatic emergency braking (AEB) and adaptive cruise control (ACC), while multi-sensor fusion can achieve highway cruise (HWP) and traffic congestion cruise (TJP). Previously, the L2+ project solution of MINIEYE was developed based on Huawei MDC intelligent driving computing platform.

DMS and OMS products inside the cabin, in addition to traditional monitoring functions, focus on creating interactive functions inside the cabin.

Partners: Commercial vehicle manufacturers such as Dongfeng, Liuzhou, Sinotruk, and Shaanxi Auto, with total shipments of nearly 100,000 sets of DMS systems in Q1 2021; passenger cars include BYD, JAC, JMC, and new car-making forces.

- Momenta

Products: Two software solutions: autonomous parking system (AVP) and parking lot map navigation products; based on Horizon J3 and TI TDA4, three full-stack hardware and software solutions.

Highlight: Low-speed autonomous driving system AVP and map solutions: Using four million pixel fisheye cameras and 12-channel ultrasonic radars installed on vehicles, it is possible to complete map acquisition and production for a 10,000-square-meter parking lot with 300 parking spaces within one hour.# Parking Map Navigation Product:

As a vehicle enters the parking lot, the system will cut into the parking navigation provided by FollowMe Technology from the navigation map, achieving accurate navigation up to the parking space level and covering navigation blind spots within the parking lot.

SenseAuto Intelligent Cabin Solution:

Features: One-stop cabin solution, including DMS (Driver Monitoring System), OMS (Occupant Monitoring System), keyless entry, virtual driving companion, and in-car AR entertainment.

Partner: Great Wall WEY, Chery Jetour, NIO and more than 30 domestic and international partners since 2018. The designated mass production project has already covered more than 13 million vehicles.

Vehicle sensors:

Hesai:

Product: Hesai Pandar 128 LIDAR

Features: The flagship product of Hesai can reach a resolution of up to 0.1° with “true image level” and has features such as high point cloud density, active interference resistance, and high reliability.

Partner: Didi

Qianxun Positioning:

Product: Qianxun Positioning proposes an “automotive high precision positioning industrialized system.”

Features: Based on the Beidou satellite system (compatible with GPS, GLONASS, Galileo), Qianxun Positioning utilizes a worldwide ground station network, independently developed positioning algorithm, and a large-scale internet service platform to provide users with centimeter-level positioning, millimeter-level perception, and nanosecond-level timing space intelligent services. The evaluation can be completed in as fast as one month, adaptation in three months or less, and mass production can be achieved in six months.

Partner: GAC New Energy Aion V, Aion LX, XPeng P7, Hongqi HS5, Hongqi H9, Hongqi E-HS9, SAIC Buick GL8 Avenir Avia.

The ADAS controller based on a single TDA4 can simultaneously run 5 routes of target detection and 1 route of LiDAR point clouds. The system can also support background synchronization while these networks are computing and offer the ability to record 5 real-time videos.## 2. Velodyne

Products: Velodyne Alpha Prime™, Velarray H800, Velarray M1600, Velabit™ – four Lidar products

Highlights:

- Velodyne Alpha Prime™: 300m detection range, high resolution and wide field of view

- Velarray H800: automotive-grade solid-state Lidar sensor, using micro-lidar array architecture (MLA), designed for safe navigation and collision avoidance in ADAS and autonomous driving applications with long-distance perception and wide field of view

- Velarray M1600: specifically designed for mobile robot applications, with near-field perception function and MLA architecture from Velodyne

- Velabit™: Velodyne’s smallest sensor, mid-range Lidar, adjustable according to different use cases, can be embedded in any position on vehicles, robots, drones (UAVs), and infrastructure

Partner: Hyundai Motor Company

3. TUS International

Product: Intelligent roof solution with fused Lidar, in cooperation with Baidu and AutoX

Highlights: TUS International and WIBU-Systems cooperate to embed the RS-LiDAR-M1 Lidar into the panoramic roof, reducing the complexity of combined installation and protecting the elegance and integrity of the vehicle’s design.

M1 provides a 0.1° – 0.2° ultra-high resolution point cloud in 120° x 25° FOV and a detection range of up to 150M@10%.

TUS International claims that the SOP version of M1 has fully met the OEM’s Lidar requirements and has successfully passed reliability tests such as vibration, impact, EMC electromagnetic compatibility, eye safety, chemical corrosion resistance, salt fog, high and low-temperature humidity tests.

Partners: Weibasen, Baidu, AutoX

Delivery Time: In March of this year, RoboSense completed the automotive-grade solid-state Lidar production line, and M1 will start mass production and delivery at a fixed point in Q2.

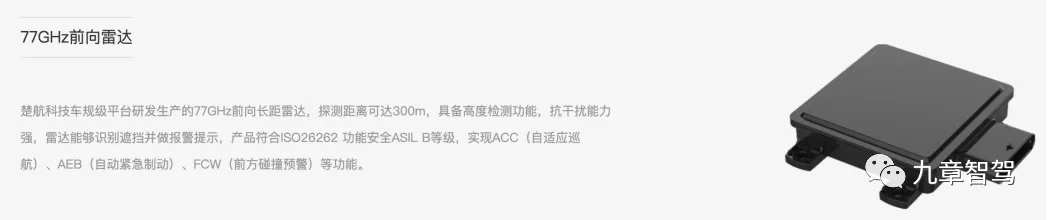

4. Chuhang TechnologyProduct: In-car Vital Sign Detection Millimeter Wave Radar, 77 GHz Automotive-grade Front Long-range Radar

Highlights: The in-car vital sign detection millimeter wave radar can provide real-time heartbeat and breathing safety monitoring for drivers, which can avoid dangerous driving caused by sudden physical discomfort. It can also provide seating detection for rear passengers or pets.

The independently researched and developed 77 GHz millimeter wave radar product has a maximum detection distance of 300 m for forward long-range radar.

Partners: Anqing has built a radar production base with an annual production capacity of more than 450,000 units, and has received volume production orders for multiple commercial vehicles and passenger vehicles.

Product: Provides testing and verification during the development of autonomous driving

Highlights: As a supplier of Lidar systems, Liangdao Intelligent has the ability to develop Lidar sensing, obtain high-precision truth values, extract scenes, and construct data centers. It provides vehicle-level testing and verification services for automakers and autonomous driving suppliers.

Partners: In collaboration with FEV, it is developing ADAS and autonomous driving functions that are compatible with the local driving environment in the Chinese market. It has long-term cooperation with Great Wall Motors, Audi, VW, Magna, Navinfo, FEV, Ibeo, Ouster, and NVIDIA.

Conclusion

Overall, at this year’s auto show, China’s local autonomous driving supply chain companies are more eye-catching than foreign companies, especially as DJI is located in the same exhibition hall as Valeo and Autoliv, with about three times the traffic density on its booth compared to the latter.

As the production process of front-loading autonomous driving accelerates, the supply chain pattern will be further reshuffled. We will continue to pay attention and launch an updated version of the autonomous driving supply chain inventory at the Guangzhou Auto Show in November.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.