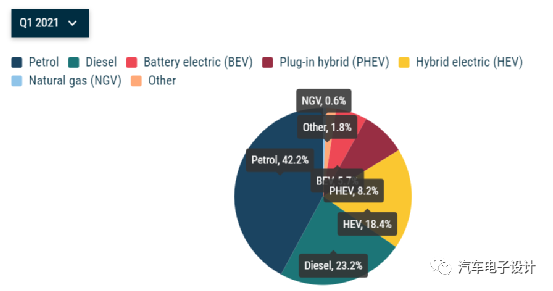

AECA’s fairly comprehensive data has emerged, allowing us to take a closer look at Europe’s situation. In the first quarter of 2021, new car registrations in Europe rose 0.9% year-on-year to 3.08 million. In terms of traditional power, diesel sales fell 20.1% compared to the same period last year, with EU sales reaching 593,500 units and a market share of 23.2% (down from 29.9% in Q1 2020). Demand for gasoline vehicles continued to decline, with sales dropping 16.9% from 1.3 million units in Q1 2020 to 1.1 million units in Q1 2021 (with market share falling from 52.3% to 42.2%).

Overall Overview

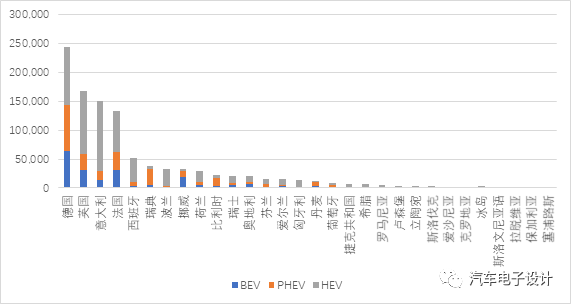

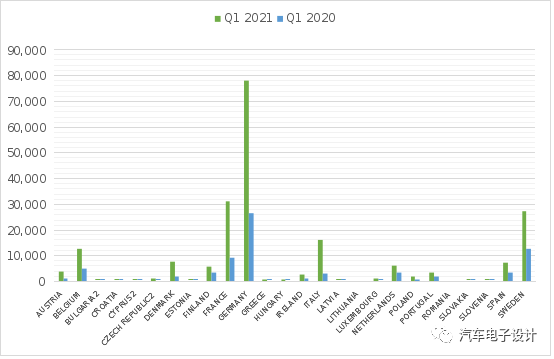

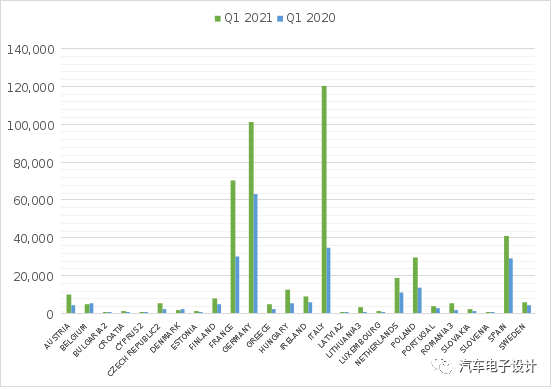

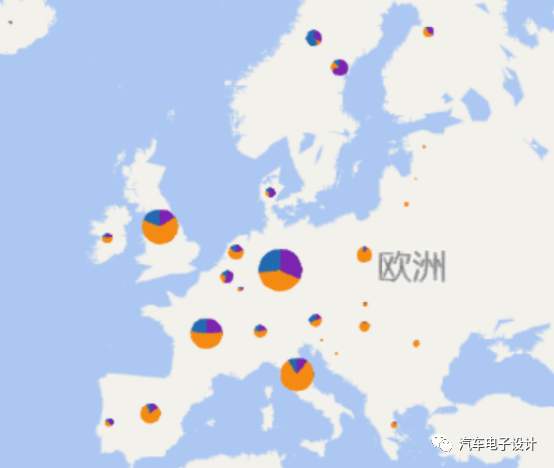

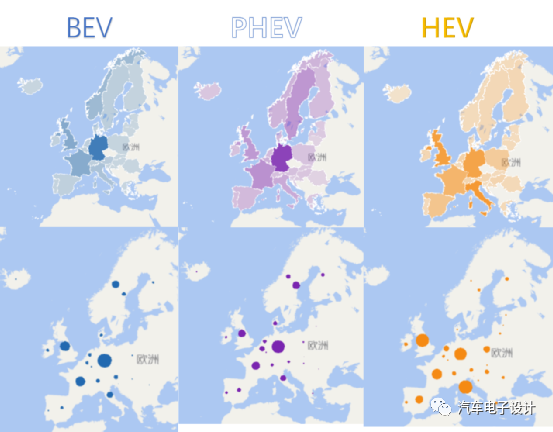

In Q1 this year, the total xEV market in Europe surged to 800,000, with the most prominent one being hybrid electric vehicles (HEVs), where the market penetration rate has reached 18.4% in Europe (up 101.6% year-on-year, reaching 469,784 units), pure electric vehicles (BEVs) at 5.7% (up 59.1%, reaching 146,185 units), and plug-in hybrid electric vehicles (PHEVs) at 8.2% (up 175.0%, with a total of 208,389 units). Looking at the proportional structure, nearly 470,000 HEVs are concentrated in Germany, the United Kingdom, Italy, and France, while Spain also has a considerable number of HEVs.

Note: HEVs have risen significantly in several countries, including Italy (+246.8%), France (+135.0%), Germany (+60.5%), and Spain (+39.4%)

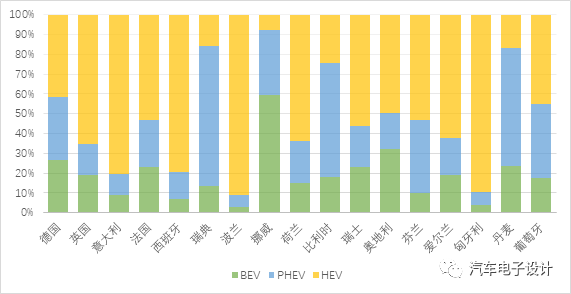

I’ve put HEVs, PHEVs, and BEVs all together so we can compare and see the current state of Europe. From these countries, except for Norway, Denmark, and Sweden, who may be able to skip HEVs and directly enter the era of BEVs and PHEVs, most of the larger European countries still need to transition using HEVs.

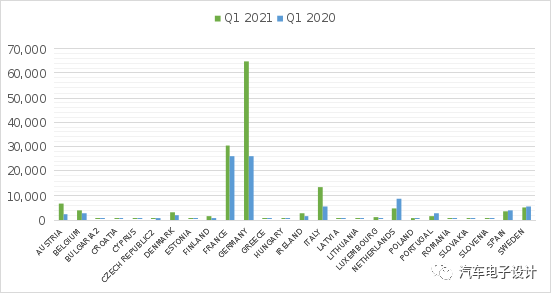

Electric VehiclesCompared to the first quarter of 2020, pure electric vehicles in Europe grew by 59.1% to 146,185 units, which was still largely driven by governmental support for zero-emission vehicles. This is reflected in the year-on-year growth with Germany (+149.0%) and Italy (+145.6%) leading the way. However, the Netherlands saw a significant decline and demand in Spain (-12.6%) and France remained largely flat.

Plug-in Hybrid Electric Vehicles (PHEV)

Plug-in hybrid electric vehicles (PHEV) were a big surprise this year with a very significant growth rate of 175.0%, totaling 208,389 units. Italy had the largest increase, registering 16,103 PHEV in Q1, a YoY growth of 445.7%. Germany (+195.4%), France (+231.4%) and Spain (+116.1%) also showed strong performance in PHEV.

Hybrid Electric Vehicles (HEV)

In the short term, European automakers may still rely on hybrid electric vehicles (including 48V mild hybrids) to make the transition. In Q1, 469,784 HEVs were registered in Europe, a YoY growth of 101.6%. The biggest markets for HEVs showed strong growth rates, including Italy (+246.8%), France (+135.0%), Germany (+60.5%) and Spain (+39.4%).

Map Visualization

Using a three-dimensional map, we can see the distribution of electric vehicles across Europe by type.

I think it is inevitable for Volkswagen to choose 48V+BEV, Toyota to choose HEV, and Daimler and BMW to choose 48V standard configuration with PHEV+BEV. Because these markets are concentrated in a few main markets and consumers will not all choose such as HEV and PHEV. Without subsidies and other factors, consumers will still choose HEV in the short term because it is more flexible.

I think it is inevitable for Volkswagen to choose 48V+BEV, Toyota to choose HEV, and Daimler and BMW to choose 48V standard configuration with PHEV+BEV. Because these markets are concentrated in a few main markets and consumers will not all choose such as HEV and PHEV. Without subsidies and other factors, consumers will still choose HEV in the short term because it is more flexible.

Conclusion:

AECA’s data is quite comprehensive, although it was released relatively late and can be used as a reference.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.