Introduction

Aside from incidents like the Tesla brake incident and the Evergrande chassis controversy, the biggest buzz at this year’s car show has been surrounding the trend of self-driving technology in the form of autonomous driving. Particularly, the videos of vehicles equipped with Huawei’s autonomous driving technology have caused widespread discussions. I believe that this matter needs to be divided into several categories:

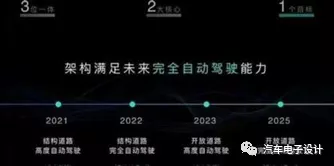

1) As previously mentioned, the autonomous driving branch requires high hardware and software costs. There are two approaches to this path: one is through services like Robot Taxi and the other is through vehicles with added premiums and pay-to-board services. Currently, the second path appears to have a significant draw for new players in the tech giant and new car manufacturing fields, which is a shortcut to overturning traditional car companies.

2) Currently, traditional car companies are responding with mixed results. Global car companies, as representatives of the industry, are mainly responding to the pressure brought by electric vehicles and have not shown any new development in terms of autonomous driving and intelligentization at the Shanghai Auto Show. They are mainly focused on the L2+ level. Domestic car companies, facing the requirement of empowering electric vehicles, regardless of whether they are Geely, SAIC, or Great Wall, are planning to operate independent brands and independent companies, and their development of autonomous driving is quite eye-catching.

3) Tech giants, starting with Huawei, have now entered the field of autonomous driving after DJI’s addition to the autonomous driving fleet. With these new recruits, it is expected that there will be more exciting updates.

4) Automotive manufacturers: the exhibition of automotive components can be divided into domestic and foreign companies. After experiencing the impact of the epidemic, it has been a difficult period for foreign automobile parts companies. Therefore, the autonomous driving components showcased at this year’s event did not comprise a particularly robust product line. In terms of autonomous driving, there are many products, but for traditional automotive parts companies selling complete solutions, it is difficult to compete. In the domestic parts market, the hottest products are enterprises represented by LiDAR. I think the above contents are more typical and will be discussed in the following section.

Car Companies

Overall, more radical car companies have added LiDAR perception as a point of differentiation (in a year, everyone’s likely to be using LiDAR).

Among new car manufacturing enterprises, P5 and ET7 are two vehicle models that have deployed LiDAR.

As a volume-oriented car model, P5 has the latest hardware configuration and the XPILOT 3.5 self-driving system that XPeng plans to iterate through. In terms of perception hardware, P5 and P7 both have the same specifications: 13 cameras, 12 ultrasonic radars, 5 millimeter-wave radars, and an auxiliary driving chip from NVIDIA’s DRIVE Xavier.## P5 adds two Livox customized laser radars on both sides of the front bumper, which can assist NGP navigation in urban roads by adding redundancy on both sides and effectively recognizing pedestrians, bicycles, and electric bicycles.

As for ET7, the front laser radar is embedded in the roof along with two side cameras, forming a horn-shaped structure. The image cameras are divided into a high-positioned front camera and two high-positioned side front cameras, which work together with the laser radar to provide a good vision. The back camera is positioned higher and has a better view of the back, which can recognize and predict the intentions of rear vehicles better.

From the supercomputing platform perspective, NIO uses four NVIDIA Drive Orin chips, which will fall behind with NVIDIA’s release of new chips.

Compared with traditional companies, Geely and SAIC are catching up more actively. SAIC has two lines, R-TECH and Zhi Ji, with R-TECH focusing on promotion, and the concept car ES33 deploying NVIDIA Orin computing platform, Luminar laser radar, and ZF 4D millimeter wave radar (with increased vertical resolution data dimension). Zhi Ji’s L7 contains multiple intelligent driving solutions, which can achieve door-to-door navigation and intelligent driving in urban traffic environments.

Geely’s ZEEKR 001, built on the SEA platform, is equipped with the Copilot autonomous driving assistance system, with the first two Mobileye EyeQ5H chips and SuperVision visual perception algorithms (currently based on L2.5).

Note: For companies that were not mentioned, they can be added later. A comparison table may also be more suitable, but due to time constraints, this incomplete list will suffice for now.

Conclusion

Today, I took my daughter for a Go exam and then to an English class, so I will stop here for now. Autonomous driving is currently a major point of differentiation in the automotive industry. However, it is worth noting that auto shows are not the best venue to showcase the experiential capabilities of autonomous driving.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.