In the previous decade, startup automakers were active in the venture capital market.

Now, the situation is changing.

The game of electric vehicle startups: lively in China and the United States, cold in Europe

Automobiles are an important symbol of industrial power, and major countries will use finance, politics, law, industrial policies, and other means to protect and support their domestic automobile brands.

From the geopolitical perspective of the global automobile industry, North America and China have cultivated very successful new electric vehicle brands in the past decade, and there are a bunch of substitutes fighting for the main position.

However, Europe, which is considered one of the three major economies in the world, still does not have outstanding representatives. Europe does not have Musk or Li Bin, and the most famous electric car person is Diess, the highest-ranking Volkswagen employee.

This also reflects that the global technology and economic center of gravity is shifting towards the Asia-Pacific region, led by China. The old-school hegemon, the United States, will not relent on this point, and the result of the two powers’ struggle may be that Europe will be relatively backward.

But if we must find a successful new electric car brand from “Slow Europe”, the relatively closer answer is Polestar. A few days ago, this low-key Nordic new brand suddenly announced a financing of USD 550 million, including local government capital in Chongqing and Shandong and South Korean SK, all of whom are long-term investors, according to the official news release.

Why did Polestar suddenly get so much money? Especially given its average sales in China. This requires us to look at the global electric vehicle industry.

Looking at the sales list of electric vehicles in Europe in 2020, the Polestar 2 just entered the Top 20.

However, it should be noted that this car only started delivery at the end of July and was only sold for 5 months. Moreover, its positioning is in the high-end brand, and its direct combat object in Europe is the Tesla Model 3. Despite the disadvantage of just forming the brand and incomplete channel coverage, Polestar 2’s performance has surprised not only BBA but also Volvo.

But Polestar has not yet opened up the situation in China. Since the launch of the delivery in the second half of 2020, Polestar has been selling the “first edition” with high configurations, with a price as high as CNY 418,000. The single-motor version that users expect is finally on the market before the Shanghai Auto Show, with a starting price of CNY 252,800 after subsidies, the battery has been upgraded to 78 kWh, and the cruising range has increased to 565 km. It can be said that Polestar has launched a second onslaught against Tesla.

In another important electric vehicle market, North America, Polestar started slightly slower and only entered this year, and it is still unclear about the ultimate direction. The US market is not as fiercely competitive as in China, and there are many participants.With its unique brand image, design genes, and strong control, Polestar should be able to attract a group of “right-wing users among the left-wing” in the market. This is evident in the recent performance of Ford’s Mach-E electric car in the United States- EV users won’t settle just for Tesla, as people’s values and tastes will undoubtedly be diverse.

Overall, Polestar has already proven itself in the European market, but its prospects in China and the United States remain uncertain. The Nordic-style electric revolution still needs to work hard.

From an absolute perspective, this is not yet an ideal answer sheet, but from a relative perspective, this is already the new electric brand leader in Europe. Scarce targets always have some investment value.

Volkswagen’s ID sub-brand has stronger cost control capabilities and market coverage, and it has been the best-selling electric car in Europe for several months. Its plans in China and the United States are also moving steadily forward, but Volkswagen Group currently has no plans to spin it off, so investment is not possible.

Strategically, Polestar represents Volvo’s radical reform for the future. It is too difficult for a large-scale automaker to completely reform itself, so a faster way is to split off and cultivate a smaller and more flexible new organization. European automakers are generally conservative in strategy, and currently, Volkswagen and Polestar seem to be the vanguard of European automotive reform, but their methods are different.

This $550 million financing for Polestar, combined with a recent rumor, makes it even more interesting. It is said that Geely is pushing Polestar to go public on the US stock market through SPAC. This method is a new trend in the US capital market. In the past year, we have seen too many new electric car brands using or planning to use this method to enter the secondary market.

If the rumor about SPAC is true, then is the $550 million financing actually a Pre-IPO? I think it is possible. Before FF operated SPAC in the United States, it also received a fresh round of funding from primary market investors, with participation from the Zhuhai local government-supported fund and Geely.

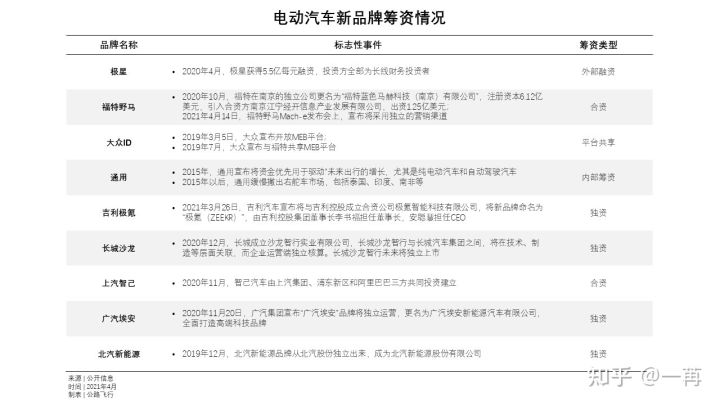

The capital market is not only for new forces, but also for old forces

Traditional automakers usually stay away from the primary market. They have long completed their IPO, and if they need money, they can obtain it in the secondary market. More importantly, these companies often have stable profitability and adequate cash flow, and therefore have low external fundraising needs.Over the past decade, figures such as Musk, Li Bin and He XPeng have been active in the capital market, conjuring up new electric car brands from scratch, winning the favour of investors.

With the ammunition provided by the capital, these entrepreneurs dared to revolutionize the industry’s longstanding problems, to endure periodic losses, and to recruit outstanding talents, breaking through the traditional salary ceiling and attracting many cross-domain talents, which is one of the important reasons why these companies look so different from traditional automakers.

However, traditional car companies were slow to react to this trend. Many initially believed that the financial and scale sustainability of the success of Tesla and Nio was questionable and therefore not worth considering. While investment in areas such as large-scale battery swapping, expensive downtown direct sales stores and hiring high-paid software engineers to fully automate products and services, objectively contribute to customer experience, they also negatively affect the financial balance sheets of the car companies.

However, investors and individual traders alike who believe that intelligent electric cars are the major trend and that technology will inevitably disrupt the industry, have helped Musk and Li Bin to alleviate much of the pressure. They wave large amounts of money to tell entrepreneurs that it is okay to lose money, because they, the investors, are here -in other words, as long as innovations in products and patterns can be achieved and a strong brand can be established in the new race, time will be on their side.

The global pandemic has created unprecedented consensus in the capital market. In early 2020, with the exception of Tesla, start-up electric car companies were still considering layoffs and budget cuts, but by mid-year, the situation had changed. Despite few significant improvements in sales for many brands, ample liquidity and collective enthusiasm for the digital new economy have led to soaring valuations and sufficient ammunition for start-up electric car companies.

Increasingly, traditional car companies have come to realize that capital, as an external force, should not be the exclusive patent of new car builders. If others can create a visionary PPT, raise a flag that ignites passion, and gather a group of elite talents from 0 to 1, why can’t traditional car companies? If grain and food do not enter their own pockets, they will enter the pockets of competitors. They can also transfer some of their unique advantages from large enterprises, such as supply-chain, manufacturing systems, and government relations.

Thomas, the CEO of Polestar, even criticized the overheated electric car capital market at the Shanghai Auto Show. Some start-up companies have not even produced a single automobile but are valued at tens of billions of dollars (in fact, one particularly exaggerated start-up electric car company had a valuation of $100 billion without producing a single car).He believes that the wave of electric vehicles is a key action of human society to respond to climate change, but if there are more speculators than practitioners, it will ultimately harm the interests of the entire society. This attitude is actually the advantage of traditional automakers facing the capital market, essentially a message to the outside world – we have a more solid supply chain and more reliable continuity, choose us.

If we pay attention, we will find that this ideological shift is unanimous. Domestic car companies such as Geely, Great Wall, SAIC, and international giants such as Ford and General Motors have all become more active in learning from start-ups and embracing the capital market.

A Born European Leftist becomes a Rightist in China

Like Volvo, Polestar was born in Gothenburg, Sweden.

It inherited the name Polestar with a certain history, creating an independent electric car brand Polestar, and was led by Thomas, a former Audi and Volvo chief designer, as CEO. He made great achievements during his time at Volvo, creating the very successful design language of the Volvo Thor’s Hammer. Thomas shaped a completely different new minimalist aesthetic for Polestar from Audi and Volvo, pursuing the unity of simplicity, restraint, and art.

Sensitive people to design will quickly notice that the taste of this brand is quite unique.

In Polestar’s regular product line, only cold-toned body colors are provided (except for the limited edition Polestar 1 gold).

When other designers are making logos on the body of the car bigger and using metal to reflect texture and light to reflect technology, Polestar chooses to keep the logo in a small size and paint it with the color of the car, “hidden” in the whole car in a low-key way.

There is a glowing Polestar logo light on the ceiling of Polestar’s car, which, like other interior lights, uses the aesthetic of “half-covering the pipa”, just like the reserved and implicit culture of the Orient. People who don’t understand it will certainly not notice it, while those who do will naturally smile.

In the Polestar Space retail store, it also follows the minimalist, restrained, and artistic design style of the brand. Going to the Shanghai Auto Show, four LED lights and a large screen support the entire booth, which is definitely the most minimalist design among all the booths at the Shanghai Auto Show.

Even in the Polestar global factory in Chengdu, this huge industrial building itself is also regarded as a work of architectural art. From the design consistency of a brand, Thomas has done a complete job, not only on the vehicles themselves.It is extremely unusual for a designer to serve as CEO in the automotive industry, a position typically held by executives with backgrounds in engineering management, manufacturing management or finance. With the CEO as its backer, the first brand gene of Polestar is a pioneering, minimalist and low-key design aesthetics.

If the first two attempts of Polestar 1 and Polestar 2 still have some traces of Volvo, the subsequent release of the Polestar Precept concept car shows the brand’s independent evolution direction for the future.

Another brand gene inherited from Polestar in the past is the sports gene. Due to Chinese people’s strong stereotyped impression of Nordic cars being environmentally friendly, safe and simple, Polestar 2, although equipped with yellow safety belts, yellow calipers, manually adjustable 22-level Öhlins high-performance shock absorbers, and a very tough sports chassis, still only a few people can feel the car’s sincerity in pursuit of sports performance.

The third brand gene is sustainability (environmental protection). The Nordic region has always led the social atmosphere in environmental protection, and it is not difficult to understand Polestar’s emphasis on this field. As an electric car brand, Polestar not only pays attention to the carbon emission reduction brought by pure electric drive, but also makes many efforts in interior materials, factory manufacturing and other aspects.

For example, the Weave Tech seat fabric used in Polestar 2 gives people a very “vegan” feeling. This new material, similar to diving suit material, is dust-proof and waterproof, and can be wiped clean with a cloth even if coffee is spilled.

Most importantly, through the use of new materials such as Weave Tech, Polestar clearly expresses the pioneering concept that “leather is not luxury, and chrome plating is not design”. This concept will make users who share the values of environmental protection and sustainability feel a sense of identity.

Of course, to convey this brand value in China is like telling Sichuan people that not eating spicy food and reducing salt intake is healthier – it is definitely correct, but people may not be willing to listen. Evangelism takes time, and comrades still need to work hard.

BBA is the leading brand in the European high-end car market. In the absence of any brand launching a pure electric car in Europe, Volvo, which is not very large in scale, took the lead by hatching an independent pure electric brand. In the European market pattern, Polestar can be said to be a “left-wing” avant-garde brand that leads the industry trend. Therefore, some people commented that they are Europe’s NIO.

This left-wing play, combined with brand genes that conform to European market preferences (design, handling, environmental protection), has also welcomed Europeans who have left-leaning values to vote with their feet. The fact that all Polestar global products are manufactured at the Chengdu Polestar factory and exported to Europe and the United States has not posed any challenges to Polestar’s development in Europe.

However, it is very interesting that after the Polestar brand landed in the Chinese market last year, it found it difficult to be recognized as a left-wing avant-garde.因为在用户心中,欧洲的左和中国的左,定义有所区别。在欧洲,汽车行业的左,主要是指电动。而在中国,眼下汽车行业的左,更多是看智能。单单完成电动化革命,是无法在中国被视为左派电动车品牌的,比如威马、欧拉和几何,中国用户们认为这些品牌都挺传统的。

你要在车顶上插两个犄角、浑身上下二三十个传感器、每两个周推一个 OTA 更新,这才叫中国市场的左派。中国市场四家正宗的左派先锋是特斯拉、蔚来、理想和小鹏。这些品牌背后都站着个性鲜明的创始人,坚定下注智能电动车赛道,大把向车内塞入各种传感器、芯片和自家程序员编写的程序,迫切希望把车变成会直立行走的电脑。你说你运动操控了得、工业设计先锋、材质选择考究,这在中国车市,其实会被视为在维护行业里的经典价值观,这是典型的右派。

显然,来到了万里之外的中国,极星先生也需要重新调整适应一下不同的气候和人文环境。在这里,它没法继续当一个彻底的左派,但基因也绝对和一个典型的右派保守大厂不同。我更愿意把在中国发展的极星为右派偏左。

它需要结合这个市场的实际情况,发挥自己的独特优势。极星传承了沃尔沃的一些核心价值观,比如安全、环保和健康,这些是右派会看中的。

另一方面,它的极致简约设计、强劲性能和对环保的忠诚,又让它有左派的基因。极星需要在中国「左右逢源」,让左派的用户觉得他身上有品牌底蕴和可靠性,让右派的用户觉得自己看起来有些桀骜不驯、特立独行。美国政治有个词叫摇摆州,极星需要拿下的或许就是这些摇摆人。

我是一名天秤座。做决定经常有一些犹豫,喜欢两边都要。我喜欢 iPhone 的智能创新,但我也不想放弃诺基亚的靠谱。这让我当年成为了 Lumia 800 的第一批用户。

最近我入手了一台极星 2,顶配挂满所有装备,包括那条骚气的金色安全带。我希望这个品牌,能走出自己独特的路。它不会成为下一个特斯拉或者沃尔沃,但希望它会是另一个 Marc Jacobs、Alexander Wang 或者电气化时代的 Alfa Romeo。

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.