The 19th Shanghai International Automobile Industry Exhibition as Scheduled

The 19th Shanghai International Automobile Industry Exhibition is here as scheduled, and this year’s exhibition appears to be busier than ever before. With the pandemic under control in China, both domestic and international car companies are fully committed to presenting the most talked-about products in Shanghai, at the end of spring. While new forces have completely taken on the “new car release” banner, traditional fuel car companies seem somewhat “discolored.”

Amidst this “prosperous” atmosphere, the LI (ZERO RUN) Technology booth at Hall 4.1 appears somewhat “low-key,” which is different from other showy exhibitors.

“Product Improvement Plan”

This year at the booth, LI has updated its T03 model, which is responsible for sales, and also showcased the performance version of the C11 model.

T03

As the sales representative, the T03 has added two new exterior colors, “Desert Sand” and “Coral Orange,” and also appeared with the LI T03 x Teddy Bear Collection Limited Edition. In terms of interior design, there are now multiple optional materials and colors, which obviously takes into account the aesthetic needs of potential female customers. The power of the OBC has been upgraded to 6.6 kW; in response to user demand, a tailgate opening button has been added, as well as standard one-touch up/down for all four car doors.

C11 Performance Edition

LI also showcased the performance version of the C11 model. As a four-wheel-drive model, the front and rear axles each carry a self-developed Panghu electric drive, with a total power of 400 kW and peak torque of 720 N·m. The acceleration within 100 kilometers is less than 4.8 seconds.

Now let’s take a look back at the 28 sensors used by C11:

-

10 camera radar

-

5 millimeter-wave radar

-

12 ultrasonic radar

-

1 facial recognition camera

C11 also uses self-developed Lingxian 01 chips, with 4.2 Tops computing power, using 28nm process technology, power consumption of 4W, and adopting “Iron Core C860” from Alibaba’s PTH Technology Corporation as the core processor.

## Zero Run C11 OTS Car Leverages 8.4 Tops Computing Power

## Zero Run C11 OTS Car Leverages 8.4 Tops Computing Power

Zero Run C11 is equipped with two processors, providing a total of 8.4 Tops computing power. Compared to Nvidia’s Orin (254 Tops), there is a gap, but compared to commonly used Mobileye EyeQ4 (2.5 Tops) and Horizon Journey 2 (4 Tops), it still has an advantage. Moreover, as it is self-developed, Zero Run can further optimize its performance in memory bandwidth, video data flow, and other areas.

The luxury version (CNY 159,800) and the premium version (CNY 179,800) of Zero Run C11 will be delivered in the fourth quarter of this year. They will be equipped with all functions of Leap Pilot 2.0 and later achieve version 3.0 functions through OTA updates.

Users Are Always God

On April 19, Zero Run unveiled a new brand strategy, LIMES (Leap Intelligent Movement Eco-Society), which is centered around the user and consists of three parts, cloud, core, and edge.

“Cloud” refers to the travel big data cloud platform and car networking services designed to customize exclusive services for users. “Core” includes Leap Pilot’s self-driving technology, Leap AI’s self-developed chips, and Leap Power’s power system. “Edge” refers to intelligent cars, Zero Run App, offline stores, and charging piles that users can access.

I am particularly interested in community operations, and I can tell from the upgrade of various pain points regarding T03 that Zero Run listens to user concerns. Community operations can be seen as a good investment for Zero Run, as its cost and effect are better than big-budget marketing initiatives with no immediate effects.

In my opinion, Zero Run could learn from Xiaomi’s community building approach, which allows users to be more involved in product development and recommend the product to others, leading to a good market presence. Furthermore, it would help users to have a higher level of tolerance for the product, making it easier for the company and the users to grow together.

InterviewAfter the press conference, I had a chance to interview Zhu Jiangming (founder/chairman/CEO of Leapmotor), Cao Li (vice president of Leapmotor in charge of vehicle development), and Zhou Ying (general manager of Leapmotor Marketing Department). Below are some of the key points:

About R&D team

Leapmotor currently has three R&D departments, responsible for the entire vehicle engineering, electronic product line (lights, ADAS, controllers, car machines), and powertrain respectively.

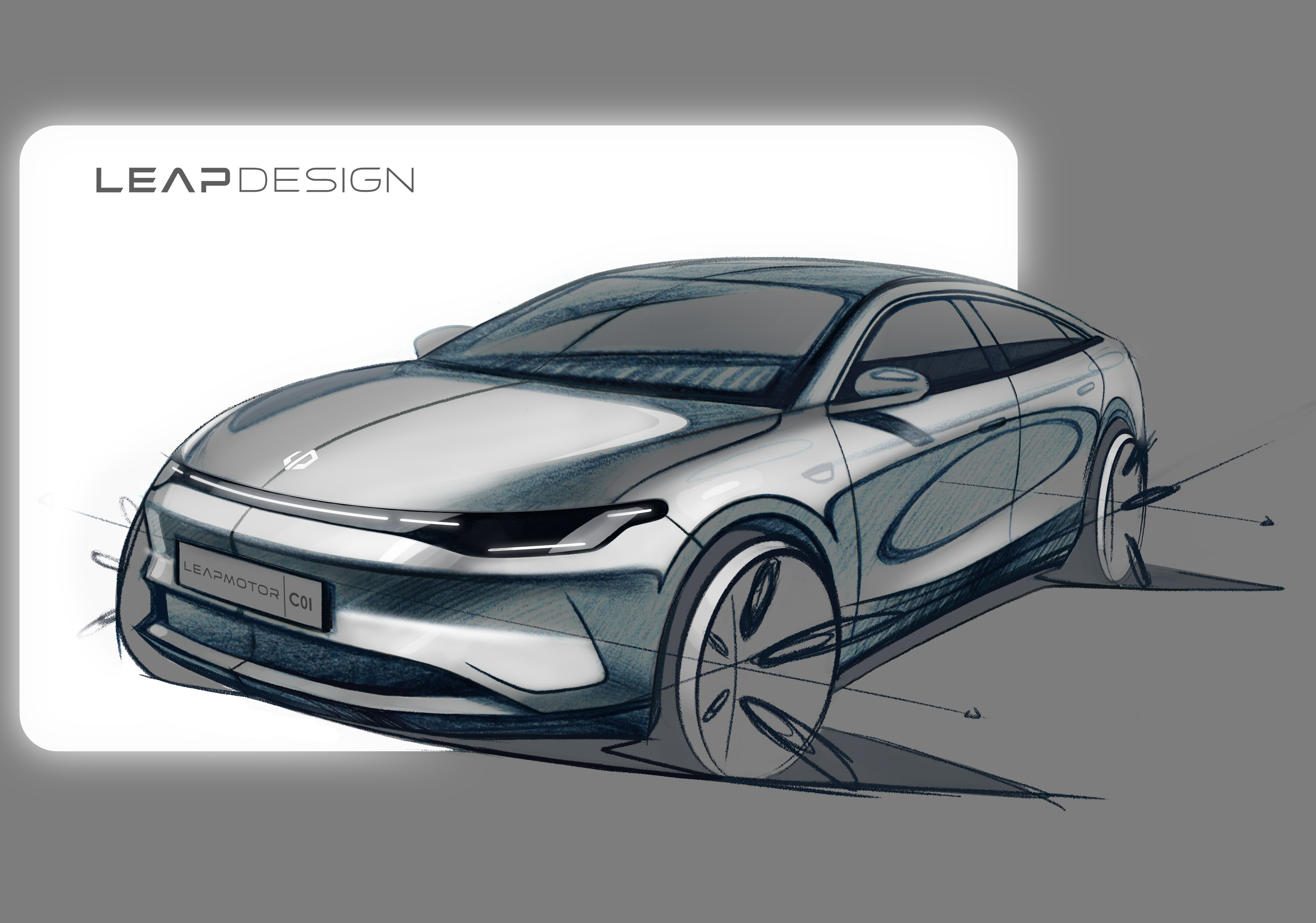

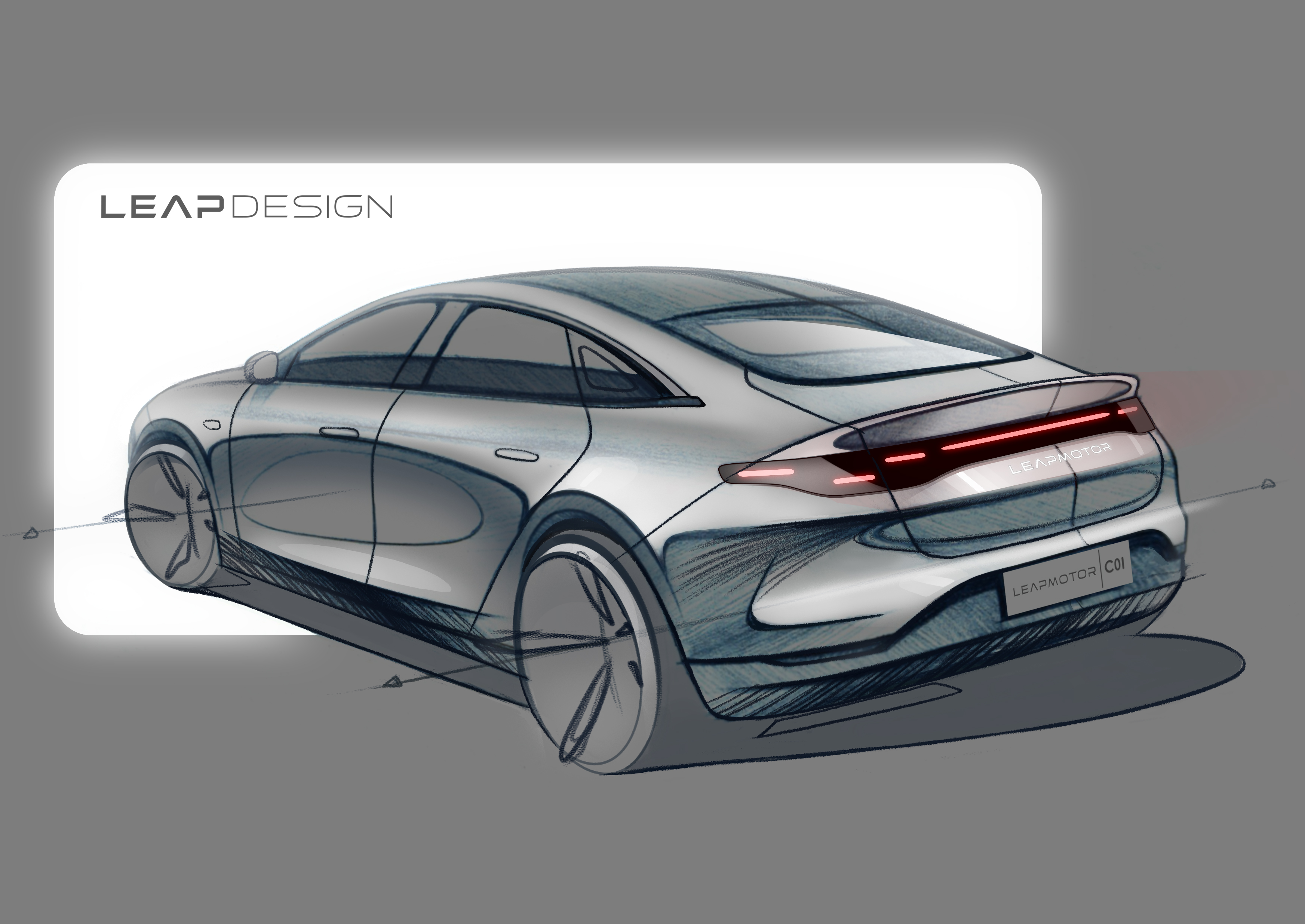

About C01

Zhu: C01 is expected to be launched in August or September 2022. It uses the same C platform as C11, with a length of about 5.06 meters and is positioned at the B+ to C level. C11 and C01 aim to compete with BBA (Mercedes-Benz, BMW and Audi), with the main selling price still at around 150,000-200,000 RMB. Leapmotor does not want to make unrealistic luxury cars, and the product concept is still based on “practicality”.

We have seen the appearance of the C01 whole vehicle in the mobile phone of General Manager Zhu Jiangming in advance. The design is similar to the Mercedes-Benz EQS short front and rear fuselage design concept. We are very much looking forward to it.

Sales

Zhu: The target plan for 2021 is 60,000 units. The main product is still T03, because the delivery of C11 will be in September, and the predicted sales volume of C11 is around 10,000 units for the year.

In 2021, the sales volume of T03 is expected to reach 100,000 units, and Leapmotor is confident about its performance in the A00 market.

Core Competitiveness of C11

Zhu: The just-released W6 from WM Motor and P5 from Xpeng are both compact or A-class in terms of positioning. Leapmotor’s C11 and C01, on the other hand, are at the B to B+ level, and in terms of chassis, interior, and intelligent configuration, they are all of high-end cars quality, with a price of around 150,000-200,000 RMB, giving them a good cost-performance ratio.C11 will have a LiDAR version in the future, and the C platform has reserved interfaces for higher-level hardware needed in the future. However, it appears that it is better in terms of technology and practicality to focus on L2 and L3 for now, rather than being overly forward-looking.

Investment and plans of the software team, as well as OTA update frequency.

Zhu: Currently, LI’s released models all come with intelligent features, including the previously released T03 and S01, which already have intelligent configurations. The computing power platform is about 1-1.5 Tops, but due to computing power limitations, the degree of intelligence is not high. Starting with the use of the self-developed Lingxian 01 chip after C11, the computing power reaches around 4.2 Tops, and C11 uses two, showing a significant improvement in computing power compared to the previous generation of products.

Considering the sales price, positioning, and cost issues of LI, Lingxian 01 will be used in C11, C01, and C12. In 2023, they hope to release a model with a LiDAR version on the C+ platform to prepare for L4.

Currently, more sensors have been used in C11, such as 5 millimeter-wave radars, while T03 and S01 only have one. C11’s camera has 8.

In addition, due to LI’s late start, the experience of the autonomous driving function will gradually catch up in the later period. Starting in September, the standard L2 functions (LCC, ACC, LKA, AEB) will be updated, and attention will be paid to the details of the L2 usage experience. It is expected that C11 will have a high-speed navigation function similar to that of XPeng’s NGP. It is expected to be updated in March 2022, and the internal team has not yet reached a consensus on whether this function will be charged, and if so, how much.

About Financing

Zhu said there is a plan, but it is low-key. However, there will be good news soon. As for what it is, we will just have to wait and see.

About Marketing

Zhu gave us a rough understanding of the marketing team situation and related expenses of competitors. It is estimated that there is a plan to establish their own marketing team.

Others

-

T03 and C11 will both have overseas versions.

-

There is also a model named C12, which comes from the same platform as C11 and C01, but we have no other information.

Finally

LI relies on Dahua to make cars and has many advantages. First of all, in terms of core hardware, such as sensors and chips, LI has its own technology, and costs are controllable. In addition, Dahua, as the second-largest global security and monitoring industry player, has many similarities in business technology itself as well as algorithms for autonomous driving. Zhu Jiangming is also full of confidence in LI’s autonomous driving.

However, Zhū Jiāngmíng repeatedly emphasized that the precondition for OTA updates in autonomous driving is to ensure maturity and safety. The current models will have more features but without increasing the price after restyling. There will not even be any so-called “luxury cars” priced above 200,000. “Practical” is the tag that has deeply impressed me about Líng Pǎo.

However, Zhū Jiāngmíng repeatedly emphasized that the precondition for OTA updates in autonomous driving is to ensure maturity and safety. The current models will have more features but without increasing the price after restyling. There will not even be any so-called “luxury cars” priced above 200,000. “Practical” is the tag that has deeply impressed me about Líng Pǎo.

The incremental growth of the pure electric vehicle market is now entering a period of explosion, and Líng Pǎo has chosen the “practical and affordable” route, more similar to Xiaomi than to XPeng. However, there are still many uncertainties in the future. Even if the marketing efforts keep up, the process of OTA updates for autonomous driving is likely to become the biggest gap between Líng Pǎo and the leading new forces.

🔗Source: Interview with Líng Pǎo

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.