This article is reproduced from the autocarweekly WeChat public account.

Author: Li Zhi from Tiexi District

The second model in the ID series has been released, and China is the first stop for the ID.6 series (hereinafter referred to as ID.6).

If this car proves anything, it is that although the automotive industry is undergoing changes, China is still the largest market. In the field of fuel vehicles, China is the core market for luxury, ultra-luxury, sports car, and supercar brands, and in the field of EVs, the Chinese market is also the most open.

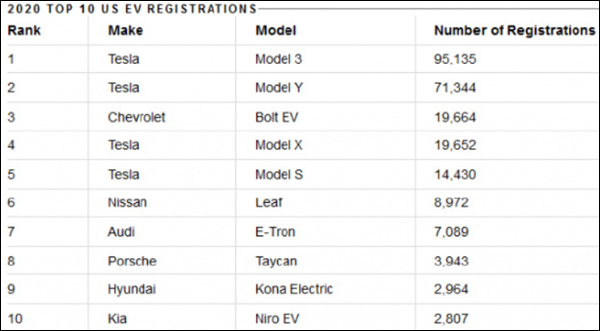

Looking at the 2020 sales rankings for new energy vehicles in the three major market regions of Europe, the United States, and China:

The new energy market in Europe maintains the characteristics of fuel vehicles: small cars are the mainstay, and larger cars are not easy to sell. Basic American cars are not popular, and only Tesla is a new brand.

The US market is the same: the price acceptance is relatively high, and the sales of Porsche Taycan and Audi e-tron are not particularly impressive, but still acceptable; European cars below the BBA level have no chance; only Tesla is a new brand, but it completely dominates the market.

The Chinese market is the most unique: high price acceptance and high brand acceptance. Even domestic new brands priced at three to four hundred thousand yuan can make it onto the list.

Looking at it this way, the fact that the Volkswagen ID.6 first arrived in China is simply a normal development. In the field of the automotive industry in Europe and the United States, it is a state of no one looking at each other. Especially in the European automobile market, the exclusiveness is quite serious, and even the relatively better-performing Japanese and Korean car companies can only scrape by, and cannot obtain substantial market shares.

For ID.6, the reality it faces is that Europe does not welcome large cars, and as for the United States, it is Volkswagen’s long-term Waterloo, even though EVs are a good opportunity to turn the situation around, there are still too many painful lessons.

So, let’s come to China. China is the most welcoming market for Volkswagen, even more so than Europe.

I don’t know if it’s because it was designed for the Chinese market, but the ID.6 doesn’t feel like an ID at all, and is more like Volkswagen’s fuel vehicles. Let’s take a look at the three models of Volkswagen ID that have been launched so far, in chronological order: ID.3, ID.4, and ID.6:

I don’t know if anyone else feels the same as I do, but the front of the ID.3 is the simplest, most distinctive, and most EV-like; the ID.4 is okay, except that the light strip of the closed grille has become wider, but it doesn’t affect the EV look; when it comes to the ID.6, it looks like a fossil fuel car, with a still closed grille, but the light strip has become two and it is very wide, like a real air intake grille. The lower air intake also occupies a larger proportion, and the more you look at it, the more it feels like a fossil fuel car.

There are two ways to interpret this phenomenon:

Firstly, the ID.6 is not like the ID and ID.CROZZ concept cars of the ID.3 and ID.4 series respectively. It is purely a platform derivative product, so the design is not as radical as it was at the beginning of the ID project, and the design experience of fossil fuel cars has been played out.

Secondly, the ID.6 is entering a higher-priced market, and the higher the price, the stronger the user’s brand awareness. The fossil fuel design may be an effective competitive advantage for the brand symbol presented by the ID.6, which is likely to face competition from Ideal ONE and NIO ES8.

In any case, it can be confirmed that the strategic significance of the ID.6 and the ID.4 are different. The latter is oriented towards the future and aims to maintain Volkswagen’s leading position in the future. As for the former, while it is oriented towards the future, there may be some consideration of cost balance due to its larger size and higher price, whether it is to increase profits or reduce losses during the transition.

With the arrival of the ID.6, it also officially marks the beginning of a new competitive situation in the EV market:

Traditional giant EV and new carmaker EV

Since April, the automotive industry has been constantly hit by heavyweight news, new brands, new cars, and new technologies emerging in an endless stream. Considering that the Shanghai Auto Show may be the only international auto show this year, coupled with the fact that CES was held online earlier, almost all car manufacturers have brought their most heavyweight topics to this month.

Among the overwhelming automotive news, the two most representative and highly talked-about products (excluding the ID.6) are the Ford Mach-E and the XPeng P5.The former is a typical example of traditional giant EVs. We can see the immense expectations for this model from the media, especially from traditional automotive media, who even greeted this car with a carnival-like attitude. Its features are also very obvious, with a competitive price, driving experience, especially driving pleasure, unanimously recognized by Chinese and foreign media as the huge advantage of Mach-E.

The latter is a typical example of new EVs. Media reports focus on two points: one is to enter the 150,000-level market and compete with traditional gasoline-powered cars (However, XPeng G3 has already entered the 150,000 market and competed with joint venture compact SUVs); more importantly, it is the ability to pass through traffic lights with Lidar and NGP.

ID.6 is obviously a member of traditional giant EVs, and its product advantages focus on seating space, DCC dynamic electromagnetic suspension, matrix intelligent headlights, light language system, breathing-type ultra-high-strength battery pack, no dead-angle battery armor, and vehicle safety design.

Without exception, these are the product advantages inherited from traditional gasoline cars. One of the few exceptions is the IQ. Drive smart driving-assistance system.

From the R&D team, design team, production process to market promotion, every employee of traditional giants has developed a common way of thinking after decades or even hundreds of years of accumulated mature experience. If the Model Y is handed over to Volkswagen’s marketing department for promotion, Volkswagen will also rack their brains to design various phrases such as “XX-style design,” “XX-level active safety.”

Similarly, if ID.6 is handed over to Tesla, the focus of experience store staff will be on acceleration performance, assisted driving, and so on. Even though it has been established for a short time, new car companies already have their own value system.

With the rollout of Volkswagen’s MEB platform, the launch of the ID.6, and the strategic launch of EVs such as the Ford Mach-E, the real duel between traditional giants and new EVs has begun.

ID.6’s competitive pressure is less than that of the ID.4, which directly competes with the Model Y. Considering the size and the fact that the Model Y is bound to reduce prices sooner or later, the more direct competitor of the former may be LI One and NIO ES8.

ID.6 is likely to be a low-profile product. As for the ID.4 series of compact SUVs, the entry-level price is only 30-40,000 yuan more expensive than the same-level gasoline-powered cars such as the Tiguan and T-Cross. In comparison, as a mid-to-large-sized SUV, the entry-level price of ID.6 will probably be about 50,000 yuan more expensive than the same-level Touareg (starting at 299,900 yuan). It is more expensive than Li One but not ES8. When Volkswagen competes with local brands, it turns out to be the one with the price advantage. Can you believe it?# Translation

Perhaps Volkswagen will have a feeling of finding back their youthful vigor. They finally have a chance to prove themselves: we are not idle heirs living off the ancestral glory, it’s our turn to convert gas-powered cars to EV.

Not every traditional car company is excited about this though.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.