Analysis of BYD’s First Quarter Sales

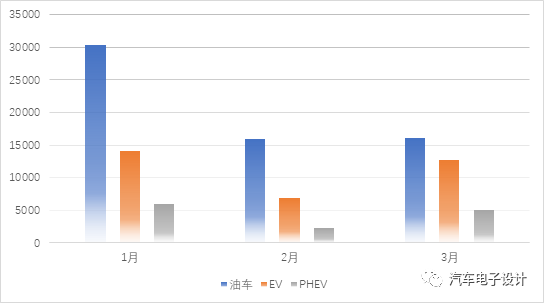

BYD has insured 109,000 vehicles in the first quarter, consisting of 62,396 fuel vehicles, 33,700 electric vehicles, and 13,347 plug-in hybrid vehicles. This report will focus on BYD’s first quarter sales analysis.

BYD Electric Vehicle Analysis

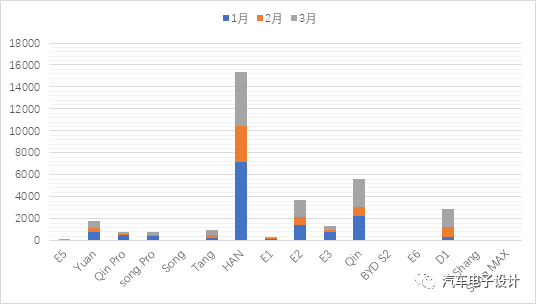

In the first quarter, the top three electric vehicle models are the Han (15,300 units), Qin (5,642 units), and E2 (3,730 units). The data for the D1 model has shown rapid growth. Currently, the sales of Han EV are in a bottleneck and require further upgrading and adjustment. The expansion of the blade battery to four models: Qin, Yuan, Song and Tang, which previously had low sales, may also bring about some positive changes.

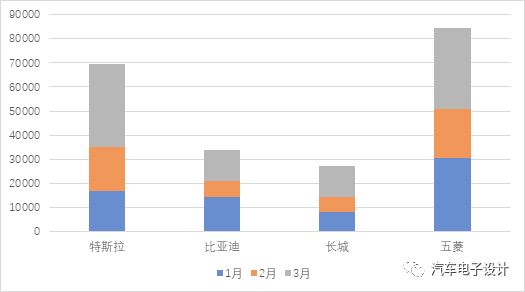

Breaking down BYD’s BEV volume, BYD Insured 33,698 units in Q1. The Han series targets individual consumers, while the D1 and Qin series target 2B clients. Due to the absence of A00 level, the pure electric growth rate of BYD still faces major bottlenecks. Comparison between EV companies shows that Tesla, Wuling, BYD and GWM all have different increase ratios in BEV sales.

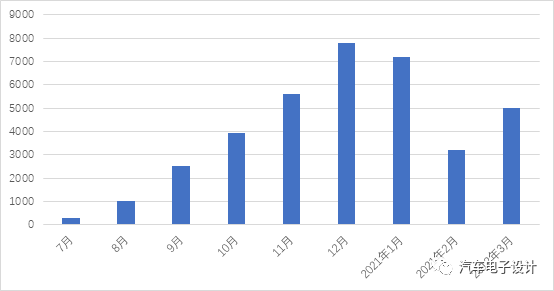

Last month, when focusing on the Han EV online data, the data declined. This month, with 4,980 insured units, there shouldn’t be any battery production bottlenecks (after all, it has expanded to the full range), which puts Han EV sales in direct competition with Model 3, but also implies that there is still a ceiling for Han EV sales.

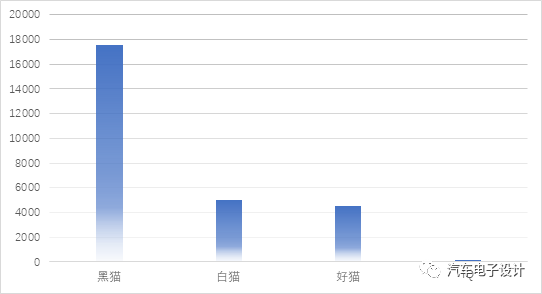

I see it this way, with the opening of the A00 market, the actual ranking of electric vehicles will be affected by the data. A large proportion of A00 models permeate in the second and third-tier cities, which creates a low-price differentiation competition against traditional A and A0 levels of original car manufacturers, and directly limits the individual consumption of existing models such as BYD Yuan, Song, and Qin. Here we focus on comparing BYD and Great Wall Motors. Great Wall Motors is not only developing its own battery production capacity, but also achieving great results after Eulai’s independent operation, as shown in the figure below. The Black Cat of A00 levels laid the foundation, and Good Cat gradually became a product with a very fast market share in sub-segments. The role of vehicle positioning is very obvious.

I see it this way, with the opening of the A00 market, the actual ranking of electric vehicles will be affected by the data. A large proportion of A00 models permeate in the second and third-tier cities, which creates a low-price differentiation competition against traditional A and A0 levels of original car manufacturers, and directly limits the individual consumption of existing models such as BYD Yuan, Song, and Qin. Here we focus on comparing BYD and Great Wall Motors. Great Wall Motors is not only developing its own battery production capacity, but also achieving great results after Eulai’s independent operation, as shown in the figure below. The Black Cat of A00 levels laid the foundation, and Good Cat gradually became a product with a very fast market share in sub-segments. The role of vehicle positioning is very obvious.

According to insurance data, a total of 407,000 new energy passenger vehicles were insured from January to March 2021 in China, nearly three times more than the same period last year. Among them, A00 models were insured with 144,000 units, accounting for 35% of the total. Looking at the quantity, the market growth of A00 models is with extremely high cost-effectiveness, and there is no obvious ceiling.

Conventional and PHEV Vehicles

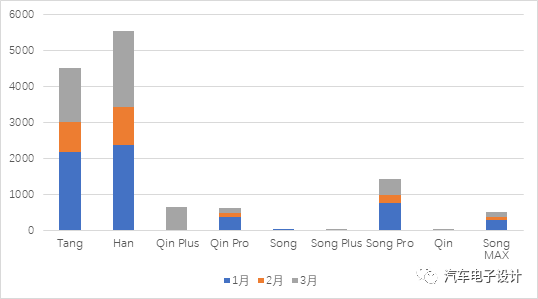

Among the PHEV models, a total of 13,300 vehicles were insured in the first quarter, of which 5,539 were Han DM and 4,525 were Tang DM, accounting for the vast majority. Due to early promotion of DMI, Qin and Song series had only 1,500 units in Q1.

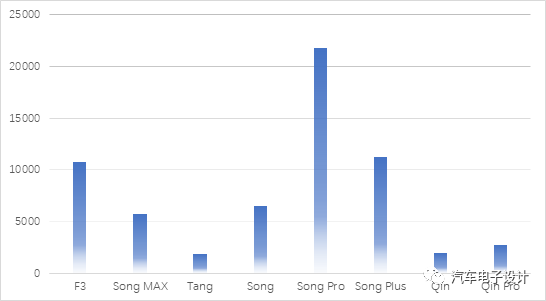

Currently, BYD sold 62,390 conventional vehicles in the first quarter, mainly from the Song series (Song, Song Pro, Song Plus, and Song Max), totaling 45,000 units. The remaining F3 and Qin series sold less than 10,000 and 5,000 units respectively. We can fully understand that with the investment in DMI and the new powertrain system, the demand for models not only differentiates the quantity of original PHEV, but also completely changes the demand from conventional vehicles. Therefore, in the short term, potential orders for DMI’s PHEV series are triggered by the high cost-effectiveness of relative conventional cars and the existing license plates in restricted areas, which has caused tremendous attention. As a new energy vehicle, it also shoulders the task of adding differentiation to the BYD’s existing 4S store network in the increasingly competitive conventional vehicle market.

Conclusion:

In my opinion, if new energy vehicles cannot get out of the path of homogenization, they are more likely to become typical examples of internal competition on the original track. Simply put, if they cannot expand the differentiation of product power and occupy the bargaining power of the supply chain by rapidly increasing quantity. It is easy to see more and more products in the subdivision market and fall into group competition. Currently, most products are playing the smart card, which may indeed be more eye-catching than the characteristics that everyone has, such as endurance and power.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.