Author: Li Yuanyuan

The micro electric vehicle market is booming, with competition intensifying.

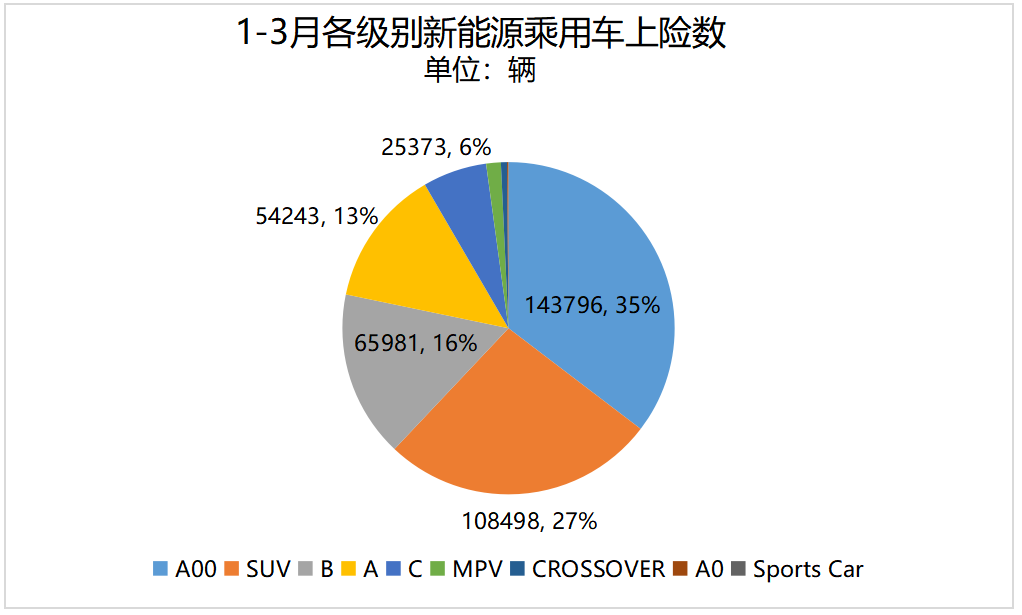

35% is the latest market share of A00 electric vehicles.

According to insurance data, from January to March 2021, a total of 407,000 new energy passenger cars were insured in China, nearly tripled compared to the same period last year. Among them, 144,000 A00-level models were insured, accounting for 35% of the total, while this proportion was only 15% in the same period last year, and the A00 market share in 2020 was only 26%.

The momentum of A00 electric vehicles is reflected not only in the fact that this level of models is highly favored in the private electric vehicle market, but also in the fact that many major new energy passenger car companies are currently focusing their sales growth products on the A00 electric vehicle sector, such as Wuling, Great Wall, Chery, and Leapmotor.

While the market is improving, the competition for A00 electric vehicles is also intensifying.

On the one hand, with the advantage of its Hongguang MINI EV, Wuling’s dominance in the micro electric vehicle market is still difficult to shake. On the other hand, the sales of Great Wall’s Euler brand A00 pure electric vehicles are growing rapidly, with strong potential. The recently launched Changan Benben E-Star National Version, Lingbao COCO and others have also set their sights on this level of market.

In the initial stage of subsidy reduction for new energy vehicles, micro pure electric vehicles, which suffered severely from sales decline, have shown unlimited vitality once again.

A00 becomes the sales champion, Wuling, Great Wall, SAIC, and others benefit

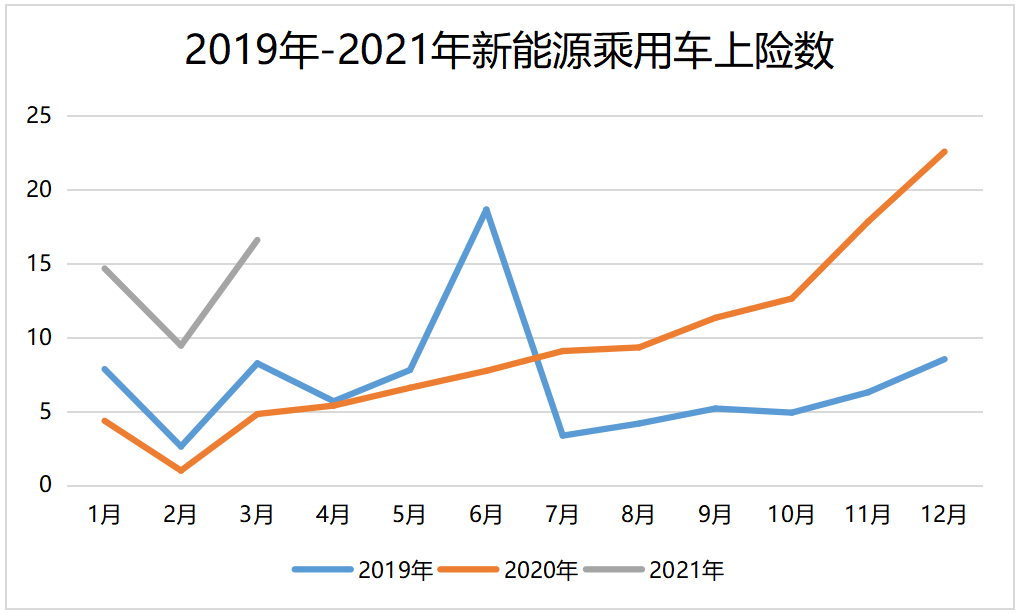

In March 2021, a total of 165,700 new energy passenger cars were insured in China, nearly 2.4 times the same period last year. From January to March, the cumulative number of new energy passenger cars insured was 407,000, an increase of nearly 3 times, and the sales market continues to improve.

Compared with the overall new energy passenger car market, the private pure electric vehicle market is more prosperous.

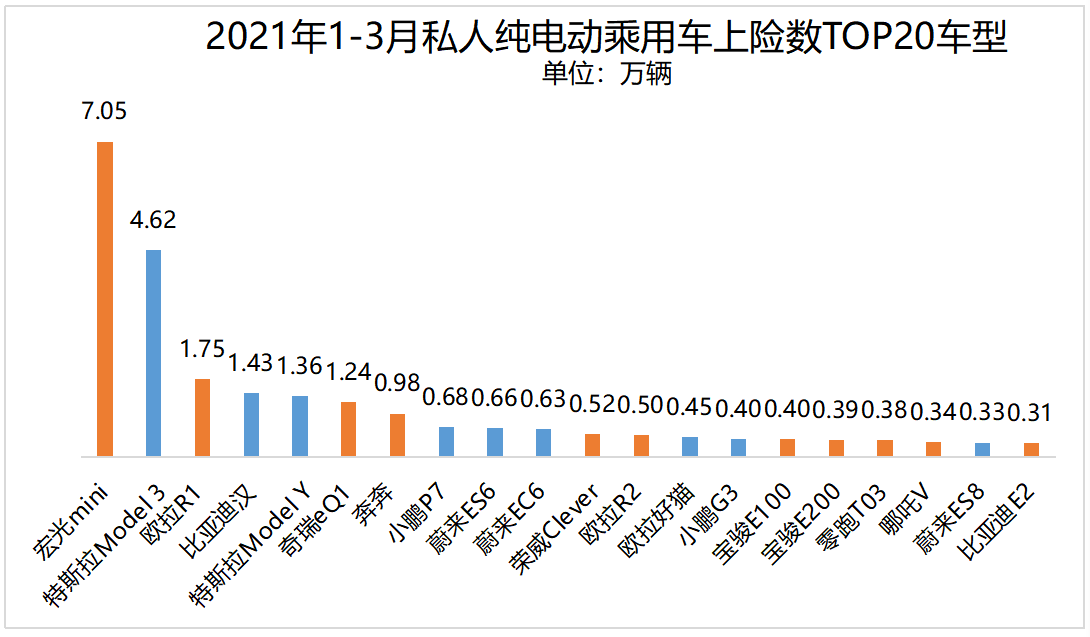

In March, 124,000 private pure electric passenger cars were insured in China, nearly tripled compared to the same period last year. Micro pure electric vehicles are still the main factor driving the growth of the private market. Among the TOP20 private pure electric passenger car models insured from January to March, 11 were micro pure electric vehicles and the best-selling one is still the Wuling Hongguang MINI EV.

In addition to Wuling, the prosperity of micro pure electric vehicle market also benefits many mainstream new energy passenger car companies.

Among the top 10 automakers with the highest insurance registration numbers from January to March, Wuling Motors, Great Wall Motors, SAIC Motor, Chery Automobile, and Changan Automobile all had micro pure electric vehicle models as their sales champions.

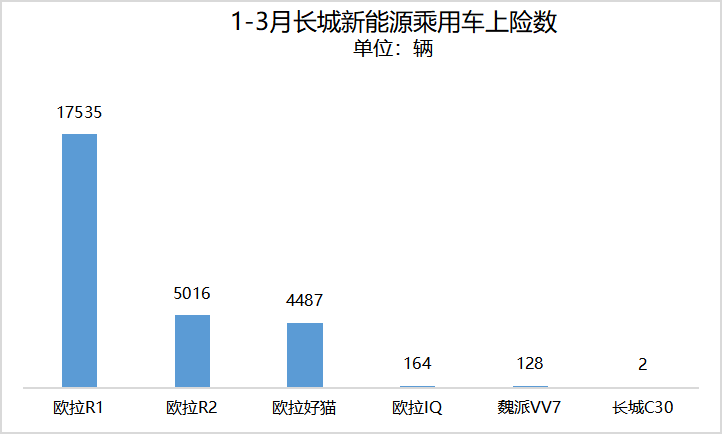

Taking Great Wall Motors as an example, from January to March, its new energy passenger vehicles accumulated more than 27,000 insurance registrations. Among them, the A00-level ORA R1 (Black Cat) and R2 (White Cat) had 18,000 and 5,000 insurance registrations respectively, accounting for 83% of Great Wall’s total insurance registrations.

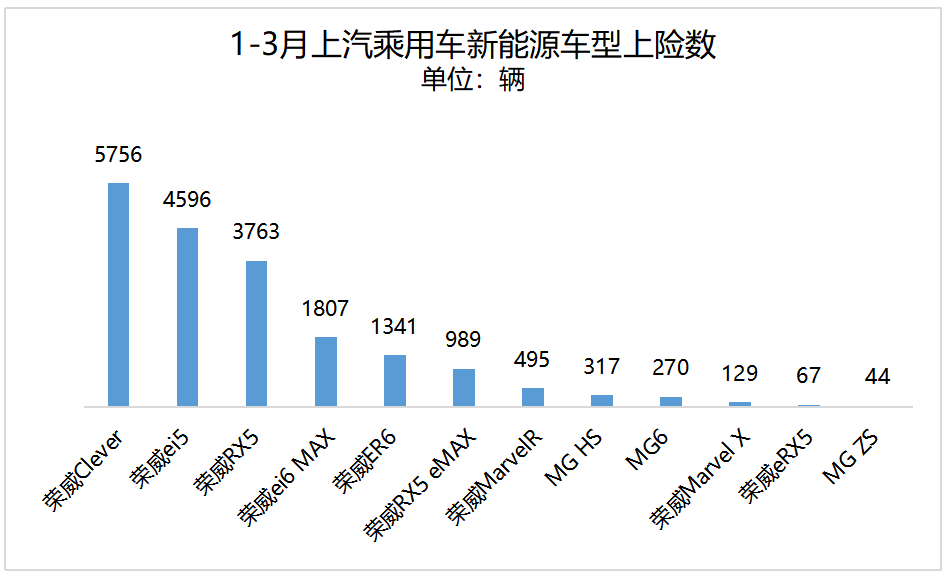

Another company, SAIC Motor, launched its first micro pure electric vehicle, the Roewe Clever, last year, which has been doing well ever since. From January to March this year, the Clever had a total of 5,756 insurance registrations, surpassing SAIC’s traditional mainstay model, the Roewe Ei5, becoming SAIC’s best-selling model. In 2021, the Clever is still one of SAIC’s key models.

Lower-priced micro cars appear in the market, benchmarking Hongguang MINI EV

Micro pure electric vehicles, particularly the hot-selling Hongguang MINI EV, have attracted more automakers to join this market competition.

Before the New Year’s Day of 2021, Changan Benben E-Star National Edition was launched for pre-sale, with a range of over 300 kilometers, and a limited price of only RMB 29,800, aiming directly at the low-end price of the Hongguang MINI EV.

From January to March this year, Changan Benben electric vehicles had more than 10,000 insurance registrations, accounting for 84% of Changan’s total sales of new energy passenger vehicles during the same period.

There are even more latecomers with lower prices.

On April 12th, Lingbao Automobile launched two micro pure electric models, among which the Lingbao COCO was priced at RMB 26,800 and RMB 31,800 respectively, directly refreshing the lowest price of RMB 28,800 for the Hongguang MINI EV. It is worth paying attention to whether this new car can have outstanding performance in the fiercely competitive micro pure electric vehicle market.

Currently, many automakers are considering producing mini electric cars that compete with Wuling and Ora brands – unsubsidized models with reduced range and price. According to the “Electric Vehicle Observer,” not only Changan and Lingbao, but also many other automakers are preparing to launch pure electric mobility vehicles priced below ¥40,000.

The battle of A00 electric cars has just begun.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.