This article is translated from the official account of Autocarweekly

Author: Luoji

Seeing the pricing of the Ford Mustang Mach-E, the first thing that came to mind was: Tesla is going to lower the price again.

In the United States, Mach-E was released as early as 2019, and subsequently the media’s car reviews compared it to its closest competitor in terms of pricing and level – the Tesla Model Y. In the domestic market, the domestically-produced Mach-E starting at RMB 265,000 seems to be targeting Tesla’s entry-level sedan Model 3.

Since Tesla’s electric cars began to threaten traditional fuel vehicle manufacturers in the mainstream market, a very hot profession has emerged in the auto industry – the Tesla Killer. Those who have gained this title include Jaguar, Porsche, BBA, Volkswagen, Volvo’s Polestar, and even domestic automakers NIO, XPeng, and BYD.

However, after so many years, under the siege of the various killers, Tesla has become even stronger, expanding from the US market to Europe, and sweeping across China. Those car companies known as “killers” have either become “friends” growing together with Tesla or merely a background accessory.

With this background, since the release of Mustang Mach-E in 2019, I haven’t really paid attention to it. Even the basic information such as its range, speed, and price in the US, I am too lazy to investigate. Can Ford accomplish the task that many luxury brands cannot?

But when I saw the price of Mach-E, I immediately realized that I was wrong. In disbelief, I confirmed it twice, reviewed the performance, range, and configuration of each version, and a hard-core killer that had aimed its gun directly at Tesla suddenly appeared.

In addition to pricing strategy, Ford’s sales strategy for Mach-E also caught many people by surprise. Ford has directly abandoned the sales channels that are currently available in various markets across the country for this model and instead uses a direct sales model to develop a brand new exclusive electric vehicle sales network, just like many new automakers. In the first half of this year, the first batch of experience stores aimed at 20 core cities in China will be positioned .

As for the charging network, Ford has clearly stated that it is working closely with State Grid Corporation of China, and through an app, it can access more than 300,000 charging piles in over 340 cities with over 160,000 fast charging piles.

What surprised me even more was that Ford, as one of the representatives of traditional fuel manufacturers, put its own logo alongside NIO’s logo at the press conference, and the two carmakers have reached a cooperation. NIO’s national fast charging network will also be opened to Ford’s Mach-E.

Obviously, as the “Tesla killer” that poses the greatest threat so far, Ford doesn’t plan to fight alone.

The highlights of Mach-E are not just the price

In a sense, it is not difficult to lower the price of a product by lowering the material grade and reducing the functional configuration, which can always lower costs and prices.

However, the Mach-E has a standard configuration of functional features that can already be considered entry-level top-of-the-line.

In terms of safety, knee airbags, lane keeping, active braking, adaptive cruise control, and other features have been realized, which is level 2 of autonomous driving and is standard.

Comfort and convenience features such as panoramic sunroofs, electric tailgates, heated seats, connected cars, and automatic air conditioning are also standard throughout the lineup.

This is the sincerity that Mach-E demonstrates in terms of its configuration. As long as the product can impress and the price is acceptable, there is basically nothing to worry about with this car. The next question is, what will Mach-E use to attract consumers or, in other words, what is its advantage over Tesla’s two models?

There’s no need to say much about the exterior design. Aesthetics is subjective, and it’s hard to say which is better without talking about it in-depth. However, it should be acknowledged that the Mach-E is indeed more like a sports car, and its presence and momentum are absolutely not inferior to the Model Y, with a more obvious sloping back.

However, it should be noted that the sloping back of the Mach-E is not really sloping, but it achieves the visual effect of a sloping back by the clever combination of lines and colors. In fact, the roof and rear lines are still relatively flat, so you don’t have to worry too much about the headroom in the rear seats if you care about this aspect.

One of the main reasons why Tesla attracts consumers is because of its various innovative small designs in the body and interior, such as the pop-up hidden door handles, which have influenced a series of later electric vehicle models.In this regard, the Mach-E is even more radical by completely eliminating the door handles and replacing them with door opening buttons for both the front and rear doors. This enhances the minimalist and streamlined feel on the side and is more impressive than the current hidden door handles.

The overall layout inside the car seems somewhat ordinary with a vertical large screen combined with a full LCD instrument panel, minimizing unnecessary physical buttons and featuring a minimalist center console, which is currently a very popular style. However, upon closer inspection, there are still some interesting elements worth exploring.

For example, below the center console screen, there is a prominent physical knob. Upon seeing it, one would first think that this is an embedded knob inside the screen and that the screen has been hollowed out behind it. However, the knob is actually “stuck” to the screen in some specific way, preserving the integrity of the screen, and the rotating function is not triggered mechanically, but with the use of materials at the back of the knob that simulate finger actions.

In other words, the operation of this knob is still based on “touch,” but the object being touched is the knob.

The creation of this function actually has a small backstory. It is said that Ford solicited feedback from customers and many expressed the desire for a physical knob on the center console. Therefore, Ford engineers found a way to implement this suggestion. This alone shows that Ford is more willing to listen to consumer feedback than Tesla.

In addition, the Mach-E comes equipped with the new SYNC+ 2.0 smart connected system, which integrates native capabilities such as Baidu data, cloud, maps, voice, and payment, tailored specifically for Chinese consumers. Beyond being more feature-rich, the voice interaction also supports natural dialogue, something other brands lack including Tesla.

In terms of intelligent driving, the Mach-E has L2+ level autonomous driving ability. Its hardware system includes 6 cameras (4 360° surround-view cameras) and 17 radars (12 ultrasonic and 5 millimeter-wave radars). With a new generation of Co-Pilot360 smart driving assistance upgrade package, Mach-E can achieve a range of functions such as BlueCruise active driving assistance, side distance warning system, FAPA one-click parking assistance system, and a 360° panoramic visual system, etc.

From a technological perspective, it has functions that match other smart brands such as Tesla, NIO, and XPeng, but Ford has not heavily promoted these functions not because of their inadequacy, but rather that these functions rely on basic infrastructure such as vehicle networks and high-precision maps. Over-promoting autonomous driving could mislead the market while these fundamental systems are still under development.

However, there is no need to rush. Mach-E also has a huge potential for over-the-air (FOTA) upgrades. As the infrastructure gradually improves, it will be possible to upgrade with features like automatic lane change assistance, automatic lane deviation collision avoidance assistance, and intelligent cornering speed adjustment.

Compared to Tesla, perhaps Mach-E is not as aggressive, but in terms of technological level, Ford is still standing at the same height as Tesla.

What does Mach-E’s pricing mean?

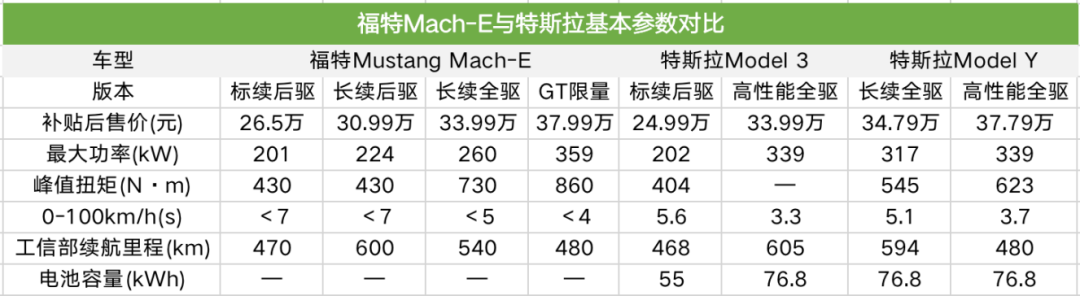

With a starting price of 265,000-379,900 yuan, Ford did not announce an official guide price, but directly gave the price after subsidies for the entry-level model. Looking at this pricing alone, Mach-E’s starting price is only 15,100 yuan higher than Tesla Model 3, while compared to its true rival Model Y, it is 82,900 yuan lower. This price comparison is based on the fact that Model Y has not yet released a single motor version, even if it does in the future, its price advantage over Mach-E will not be much.

As for the price ceiling, Mach-E’s highest version, GT First Edition, is currently priced at 379,900 yuan, slightly higher than the high-performance all-wheel-drive version of Model Y by 2,000 yuan.

This pricing is very subtle and interesting. Ford didn’t beat around the bush, it went straight for its killer move, making it clear that it wants to hunt down Tesla. Whether it’s the entry-level price or the top-end price, it’s slightly cheaper than Tesla, as if it’s saying, “I’m hunting you down, but I’m still nobler than you.”

In terms of size, Mach-E is a fully-fledged medium SUV and is a direct competitor to Tesla Model Y. Considering the natural premium of SUVs, this also means that it should be one level higher than Tesla Model 3, but its entry-level price is almost on par with Model 3.

The interesting thing is that the standard rear-wheel-drive version of the Mach-E, with a basic range of the Ministry of Industry and Information Technology, is basically equivalent to the entry-level Model 3, but the power parameters of the Mach-E are slightly higher. However, after all, it is a heavier and larger SUV, and the official 0-100 km/h acceleration score is less than 7 seconds, slightly behind the Model 3.

The interesting thing is that the standard rear-wheel-drive version of the Mach-E, with a basic range of the Ministry of Industry and Information Technology, is basically equivalent to the entry-level Model 3, but the power parameters of the Mach-E are slightly higher. However, after all, it is a heavier and larger SUV, and the official 0-100 km/h acceleration score is less than 7 seconds, slightly behind the Model 3.

What’s interesting is that even after increasing more battery capacity, the long-range rear-wheel-drive version of the Mach-E still maintains its 0-100 km/h acceleration below 7 seconds. This shows that 7 seconds is a bottom line for the Mach-E, and even the slowest non-performance version cannot be higher than 7 seconds.

Do you think 7 seconds is too slow? Need four-wheel drive? The long-range all-wheel drive version of the Mach-E is priced at 339,900 yuan, which is equivalent to the high-performance all-wheel drive version of the Model 3 and slightly lower than the long-range all-wheel drive version of the Model Y by 8,000 yuan. Naturally, the performance of the Model 3 high-performance version is faster, but the Mach-E’s long-range all-wheel drive version also competes well with the corresponding version of the Model Y, with a 0 to 100 km/h acceleration of less than 5 seconds, which is slightly faster than the Model Y’s 5.1 seconds.

At this point, the comparison should be over. The versions above the two models are no longer the main models. In order to achieve more extreme performance, the range must be greatly reduced. Even for those who have plenty of money, they should know how to make rational choices.

In conclusion, Ford’s Mach-E pricing is a head-to-head confrontation with two Tesla models, fighting on two fronts and trying to challenge Tesla.

But when amateurs fight, they usually only harm themselves, and when gods fight, the destructive power often extends to civilians. What people are most worried about after seeing the Mach-E pricing is not necessarily just Tesla.

Is Mach-E only a threat to Tesla?

From a certain perspective, the current electric vehicle market is still in its early stages of development. Although various car companies are competing with each other, there is still a huge market to be developed, and all gasoline vehicle markets are good fields to be developed by electric vehicles.

However, in this state of near barrenness, there is still a prominent problem, that is, the rules and order have not yet taken shape, and how should car companies position themselves? How should a car model be priced? No one knows for sure.Two recently launched cars, the ID.4 CROZZ/ID.4 X, were considered a self-revolution by Volkswagen with their pricing range of 200,000-280,000 yuan and L2-level autonomous driving system, which was almost impossible in the fuel era.

Before the launch of Mach-E, ID.4 CROZZ/ID.4 X were indeed attractive with excellent comprehensive cost performance, even surpassing some domestic brands of electric SUVs. However, with the starting price of 265,000 yuan for Mach-E, the closest ID.4 CROZZ and it is the 23.99 million long-endurance PRO two-wheel-drive version, the price difference has now narrowed to 25,100 yuan.

In addition, both ID.4 CROZZ/ID.4 X are compact SUVs, only one level smaller than Mach-E, and Volkswagen’s true potential for competing directly with Mach-E lies with the upcoming ID.6 series that has not yet been launched. With the pricing of ID.4 CROZZ/ID.4 X now confirmed, even a slight increase in the price of ID.6 is likely to “overtake” Mach-E.

Although Volkswagen’s brand is still superior to Ford, Mach-E bears the Mustang logo, and considering its design and positioning as a performance sports car, the brand advantage should have been on par with Tesla and higher than Volkswagen.

Therefore, the pricing space left for the ID.6 series is now very limited.

In fact, on the day when Mach-E was launched, another significant adjustment was made to the pricing of Polestar 2.

The car was launched with a very high price of over 400,000 yuan, but after a period of poor market response, it was internally reduced to less than 340,000 yuan, but it still had little effect.

Yesterday, Polestar 2 added two single-motor two-wheel-drive versions. While maintaining the same driving range, the price dropped to 252,800 yuan, finally standing at the same height as its competitor, Model 3.

If we turn our attention to domestic brands, whether it is traditional brands like BYD, Geely, GAC, or new players like NIO, Xpeng, and LI, the brand’s high or low and premium have lost their clear boundaries and entered into fierce competition in the face of Tesla and Ford Mach-E.

Losing the advantage of price and cost-effectiveness may seem like bad news for Chinese car manufacturers at first glance, but looking at market sales, whether it’s ultra-low-priced commuting vehicles like the Wuling Hongguang MINI EV or mid-end family cars like the Aiways S, or high-end cars like BYD Han EV and NIO ES6—as separate segments, they all are at the forefront. In particular, foreign traditional brands, apart from Tesla, have not posed any real threat to Chinese brands of electric cars.

The emergence of the Ford Mustang Mach-E allows us to see the strength that foreign traditional giants can exhibit when facing serious threats. It is indeed a competitor that is worth paying close attention to, respecting, and even fearing. However, in the era of electrification, we have gradually rid ourselves of the burden of brand underestimation by foreign automakers. Both in terms of core technology and overall product strength, we have confidence and ability to compete with them on an equal footing.

The era of exploration and development is far from over. With hard work, we all have a bright future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.