Overview of Insurance for New Energy Vehicles

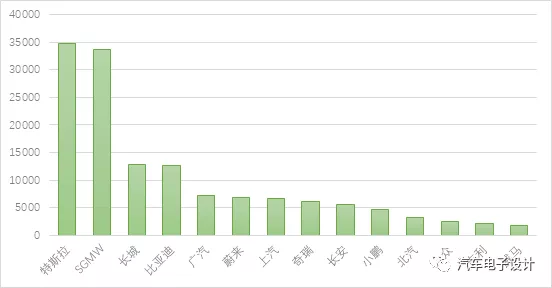

1) Manufacturer Ranking

First let’s take a look at the ranking of electric vehicles by manufacturers. This is interesting because we can focus on the overall situation of pure electric vehicles, after excluding plug-in hybrid vehicles. Tesla and Wuling have pushed the price of their BEVs to more than 30,000 in their respective fields. Changan and BYD follow closely with a pure electric scale of around 10,000 units. The major manufacturers with over 5,000 units include GAC, NIO, SAIC, Chery, and Changan.

Here is a list of over 2000 car models, we can see the current accumulation of car models.

-

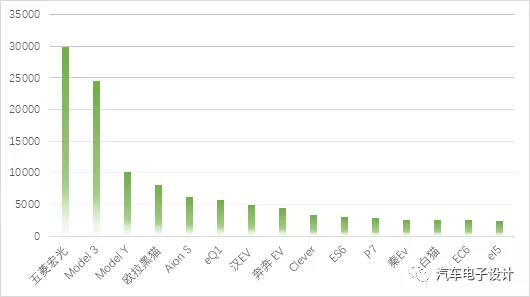

Wuling Hongguang Mini, with its phenomenal penetration, has really pushed the model to a high level. In fact, we can consider subsequent models such as the Chery eQ1, Clever, Black Cat, and White Cat as a single category of models. They all compete in the range of under 50,000 for cost-effectiveness.

-

Model 3 and Model Y: This pair of star models pushed Tesla to a very high level in March. Compared to other luxury brands, Tesla’s position in BEV is quite advantageous.

-

Aion S: This is also a phenomenal product that can maintain a quantity of about 6,000 per month in the B-end.

-

Han EV: As mentioned earlier, the volume of Han EV per vehicle has begun to decline, and I estimate that maintaining a scale of 4,000 to 5,000 units in the future is reasonable.

-

ES6, EC6, and P7 from new car companies: BEV products from new forces are completely comparable to Tesla. Following Tesla’s continued squeezing tactics,

2) Overview of Insurance for New Energy Vehicles

The insurance data is out today, after receiving the data, some basic analysis has been done. As previously mentioned, there is a high level of differentiation between A00 grade and B+ new energy vehicles with high insurance data. However, there is no significant differentiation in A0-A grades, except for a few models.

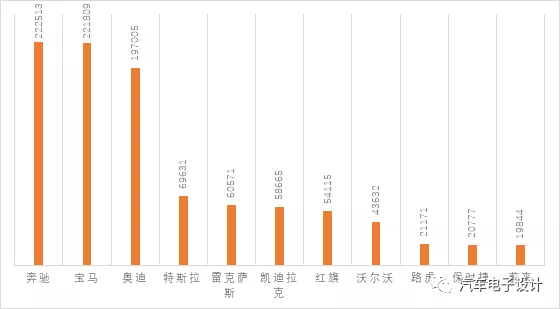

So a strange phenomenon occurred, where Tesla ranked fourth behind BBA in the luxury car segment, while NIO closely followed Range Rover and Porsche, ranking 11th.If we follow the previous data, Tesla is currently developing its market in the first-tier, new first-tier, and second-tier cities when it comes to location distribution of insurance for automobiles, with only 1611 cars in cities below the third-tier; NIO’s strategy is similar, mainly expanding its orders in the first-tier and new first-tier cities. As for the A00 level cars, which are led by Wuling, Great Wall Motors, Chery, and Changan, they are targeting cities below the second-tier. Note: we will analyze the permeation of Great Wall Motors and Wuling in the new first-tier cities separately later.

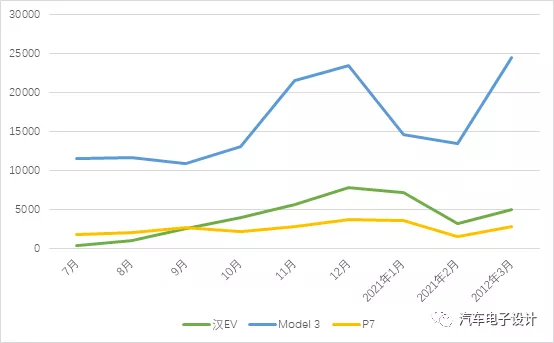

The charts below show that Han EV and P7, which are direct competitors of Model 3, still faced great pressure (price overlap and some differences in product performance). There is still significant difficulty for P7 and Han EV to return to the status they had in December last year.

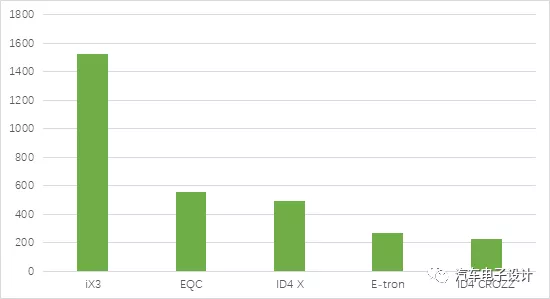

The data for several Chinese and foreign joint venture BEV companies is also interesting this month. iX3 reached about 1500 vehicles, EQC and ID4.X reached 500 vehicles, E-tron and ID4 Crozz reached 200+. The series of models based on the MEB platform may need until May or June to show significant improvement in their insurance data.

Conclusion

This mainly compares BEV models, and from the actual insurance data of cars, we can see the increasingly clear trend of market differentiation and concentration. The strategies of traditional automakers are not particularly effective in the current situation, mainly because the growth direction of the market is not entirely what we defined, as demand comes from the transition from fuel cars, and the conversion driven by the ultimate cost-effectiveness of A00-level cars. In the next article, we will conduct a systematic analysis of BYD’s car models, which may lead to further understanding.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.