“This is an old question.” Huawei’s rotating vice president, Xu Zhijun, responded somewhat helplessly when asked by the media whether Huawei’s strategy of not making cars would remain unchanged. It seems like the whole world doesn’t believe that Huawei won’t make cars, despite repeatedly announcing that they won’t and their increasingly close collaboration with the automotive industry. During the 18th Huawei Global Analyst Conference, Huawei even invited automotive media for the first time. The 60-minute keynote speech, which revealed Huawei’s strategic direction to the outside world, spent 25 minutes on intelligent cars.

Huawei’s rotating chairman, Xu Zhijun, also shared at the conference that the vehicle BU is currently the most complete business unit within the Huawei system other than the Consumer BG, covering everything from planning and R&D to sales and delivery. Even in 2020, which was affected by both sanctions and the pandemic, Huawei’s investment in intelligent car technology still reached USD 1 billion.

So does Huawei really intend to stay firm on not making cars? In fact, for companies like Huawei with software as their core R&D capability, choosing not to make cars may be even more difficult than choosing to make them. Not making cars means having an absolute leading position in technology, having sufficient bargaining power in the design and procurement of core components, ensuring a certain market share and sufficient hardware sales profits, and being able to build an ecosystem without actually participating in manufacturing and assembly.

In other words, producing cars may be a safer option. As one’s own client, even if no one in the world chooses their solution, at least they can hold on to themselves. Being able to promote high-profit, highly efficient, and low-substitutable businesses such as software technology, operating systems, and content ecology obviously suits the organization’s interests better than engaging in traditional manufacturing.

Therefore, not producing cars shows Huawei’s confidence in its autonomous driving and intelligent connected vehicle capabilities, which it considers to be the core of the automotive industry’s transformation.

Huawei believes that autonomous driving is the core of the transformation of the automotive industry, so developing a self-developed full-stack of autonomous driving software and hardware is also the focus of Huawei’s efforts in the automotive field. With its accumulated technological expertise in the ICT industry, Huawei has already developed full-stack R&D capabilities in areas such as sensors, perception algorithms, computing platforms, autonomous driving operating systems, and intelligent vehicle control operating systems. At a global analyst conference, Xu Zhijun also stated that “Huawei’s autonomous driving solution can achieve 1000 kilometers without intervention in Shanghai’s urban area, which is much stronger than Tesla.”

How extensive is Huawei’s layout? Let’s take a closer look.

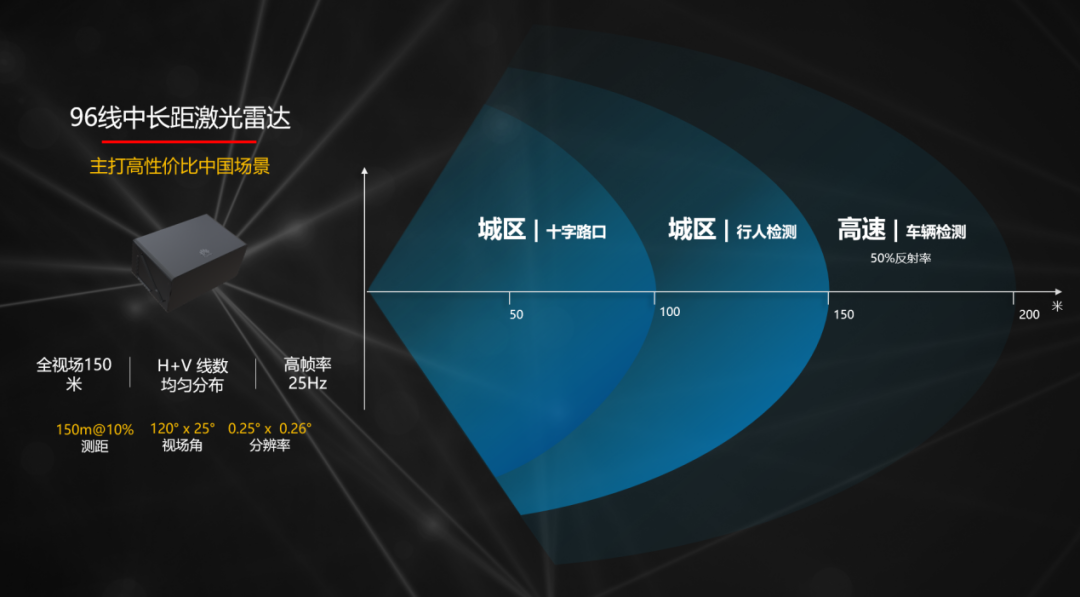

In the field of sensors, in December of last year, Huawei released a self-developed 96-line “semi-solid-state laser radar with micro-rotating mirror”, which can detect up to 150 meters with 10% reflectance, with a horizontal field of view of 120°. By equipping three of these laser radars, a 360° depth information environment perception can be achieved, providing powerful perception capabilities for intelligent driving. The first model to carry Huawei’s “HI” logo, the Alpha S of HiPhi, is equipped with three Huawei laser radars, enabling automated driving on complex urban roads.

The biggest obstacle to the mass production of LiDAR is its cost. Huawei’s self-developed 96-line LiDAR currently costs around $500 and is planned to gradually reduce to around $200 in the future. Leading the way in mass production and gradually lowering the price is a big contribution Huawei has made to promoting autonomous driving.

In addition to LiDAR, Huawei’s sensor product line also includes millimeter-wave radar and cameras. The more significant one is that on the eve of the Shanghai Auto Show this year, Huawei will hold a brand night, where a 4D millimeter-wave radar will be launched, completing the last piece of the puzzle for Huawei’s autonomous driving sensor mass production.

In the field of computing, Huawei also has a comprehensive product line of cloud computing and edge computing. Huawei has launched “Huawei Octopus” in the field of autonomous driving cloud computing, which can achieve automatic driving data sorting, automatic labeling, model training, and provide cloud-based virtual simulation testing. Autonomous driving model training is extremely expensive and time-consuming. With mature cloud computing technology, it can save both time and money.The same as in edge computing, autonomous driving demands extremely high computation power from vehicles. As Xu Zhijun shared at a conference, intelligent vehicles must achieve autonomous driving independently, without relying on network devices at the roadside, because operators cannot guarantee 100% network connectivity in any area. In order to enable intelligent vehicles to achieve autonomous driving, Huawei also released the heterogeneous computing platforms MDC210 and MDC610 last year, based on Huawei’s self-developed CPU and AI processors. The former has a computing power of 48 TOPS, and the latter has a computing power of 160 TOPS, which can support the current computing power needs of intelligent vehicles. In order to achieve higher levels of autonomous driving, Huawei will also release more powerful computing platforms of MDC this year.

Huawei also has a complete set of domain controllers and self-developed EE architecture for controlling execution, as well as an intelligent vehicle control operating system designed for intelligent vehicles. In summary, Huawei has indeed mastered the full-stack software and hardware capabilities of sensing, decision-making, and execution in autonomous driving.

Currently, Huawei’s complete autonomous driving solution has landed through the Alpha S HI version of the FOXCONN vehicle, which is expected to be mass-produced and delivered in the third quarter of this year, with the “HI” logo of Huawei on the tail. In addition to FOXCONN, Huawei will also cooperate with Changan and GAC in a similar manner. “As an ICT industry enterprise, Huawei hopes to choose some friends in the automotive industry for deep cooperation, support vehicle manufacturers to create their sub-brands in the way of Huawei inside, and bring different experiences to consumers. But we will select our partners and not have too many cooperations,” as the statement from the boss suggests.

Through this statement, we can see that Huawei is very confident in the prospects of its own autonomous driving solution, and even started a “Huawei’s strict selection with limited supply” marketing play.

Connecting seamlessly with HarmonyOS for intelligent experience

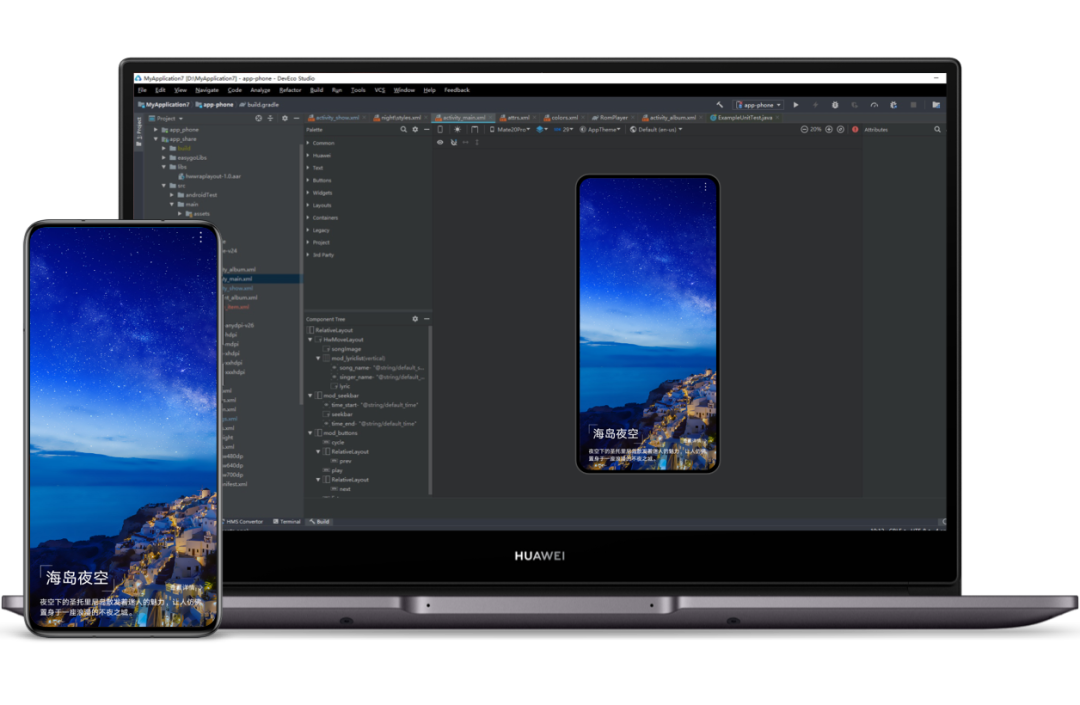

If the deployment of HarmonyOS is extensive enough, Huawei indeed has no need to build cars on their own, just as Google can define the software and hardware development throughout the entire Android ecosystem even if they do not build smartphones themselves.At present, HarmonyOS has been applied to post-installed smart screens, smart wearables, and the Alpha S HI version of the HarmonyOS vehicle system in cooperation with ARCFOXxing (aka HEYHI). More importantly, Huawei will soon launch HarmonyOS for smartphones. Xu Zhijun revealed at an analysts’ conference that there are currently 20 hardware vendors and 280 app vendors participating in the construction of the HarmonyOS ecosystem, and it is expected that by 2021, over 40 mainstream brands and one hundred million devices will become carriers of the HarmonyOS experience.

In Huawei’s ecological landscape, there is also the Huawei Mobile Services (HMS), which includes a convenient development platform for developers and account and application services for consumers. At present, Huawei has connected phones, PCs, tablets, and Huawei Cloud through the Huawei account system, allowing consumers to experience seamless services across different devices. As the next intelligent terminal, the automobile will also join the HMS ecological landscape with the help of HarmonyOS.

This not only means that Huawei’s massive ecosystem can be quickly ported to the car scene, but also that consumers can experience seamless intelligent services in the car, with the help of a unified account system to achieve linkage between all smart devices and cloud. For example, the car can read heart rate information from Huawei’s smartwatch to better understand the needs of the passengers in the car.

By connecting a series of intelligent terminals, such as smartphones, automobiles, smart wearables, PCs, etc., with HarmonyOS, and connecting the scene-end, road-end V2X information, and Huawei Cloud information through 5G, even if you don’t build a car, you can still construct an ecological closed loop. Of course, all of this depends on the powerful capabilities of HarmonyOS.

If Huawei is just a smart hardware manufacturer, it has to make cars, otherwise it will miss the ticket to the era of ubiquitous interconnectivity. However, if Huawei is regarded as a definer of a smart ecosystem, then it is not necessary to manufacture cars.

Therefore, don’t expect Huawei to make cars, if it is strong enough, it is not necessary to make cars. As Xu Zhijun envisaged, Huawei can help automakers transform their cars, and earn RMB 10,000 for every car. If the future domestic annual sales of cars reach 30 million units, then Huawei’s annual profit will be CNY 300 billion, which is almost equivalent to the revenue of Huawei’s operation business.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.