*Author: Michelin

The smart car field, a hotly contested race, has never lacked passionate pursuers. While major Internet companies have successively announced their intention to “build cars” recently, a hardcore player who has been quietly lurking for many years, DJI, has finally announced its own brand, “DJI Automobile”, which provides automatic driving solutions for automobile enterprises and has officially entered the field of automatic driving.

According to insiders at DJI, its related automotive business has been developed for five years. And Livox, a subsidiary of DJI, which specializes in laser radar products, will also appear on the upcoming XPeng P5.

Compared with the recent “futures-style” announcements in the automotive industry, DJI’s action, which took five years to prepare, stands out as a relatively low-key and pragmatic approach. What’s even more surprising is that this drone giant, DJI, which has been dominating the unmanned aerial vehicle market for years, has actually already crossed over into the automotive industry!

DJI’s Long-term Planning from UAV to Automatic Driving

When it comes to DJI, people think of it as a unicorn company in the UAV field that is occupying 80% of the consumer drone market globally. In fact, if DJI’s past ten years of vigorous growth are seen as the blue ocean of UAVs, today, DJI has already touched the ceiling in the consumer-level drone field due to limited functions. DJI users are still mostly niche players, and the already small user base must also face the successive implementation of flight restrictions in various regions.

Therefore, in the past few years, DJI began to enter industrial scenarios, such as various agricultural crop protection drones, while also seeking a way out of the field of unmanned aerial vehicles.

As early as 2016, Wang Tao himself stated in an interview: “The UAV market is about to saturate; DJI’s revenue will only reach 20 billion yuan (approximately $3.1 billion) at best.” DJI’s last financing occurred in 2019, with a valuation of as high as 24 billion U.S. dollars. With such a high valuation, DJI obviously needs to find a larger market to support its growth.

Therefore, in 2016, when Wang Tao predicted that the UAV market was about to saturate, DJI turned its attention to autonomous driving, which is regarded as the “crown jewel” in the field of artificial intelligence. DJI’s subsidiary, Livox, and “DJI Automobile,” responsible for autonomous driving business, were established in 2016.

Why Does DJI Do Autonomous Driving? DJI’s Patents Speak

Drones and autonomous driving, one flies in the sky, and the other runs on the ground, it seems that they have little to do with each other. But when you think about it carefully, you will find that the two are closely related. After all, whether it is an airplane or a car, to achieve unmanned driving, it is necessary to do well in technical aspects such as environmental perception, data processing, path decision-making, and planning. Although the two face different environments, the underlying logic requirements are similar.

DJI’s success in the field of drones has already demonstrated its strength in perception, algorithms, and obstacle avoidance. I brought out my killer skill of “We looked at 20,000 patents and tried to piece together what Xiaomi’s car looks like” to look at DJI’s 5-year preparations for car-based closed-door cultivation. Through the patent, we found that DJI first magnified its advantages in drones in autonomous driving.

Over 50% of DJI’s patents related to autonomous driving are related to its accumulated sensor hardware and visual recognition algorithms.

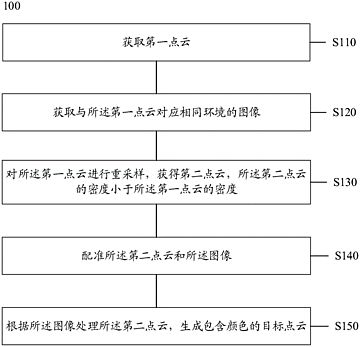

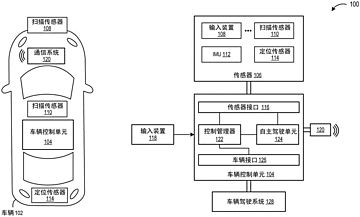

For example, “sensing components for autonomous driving” provides multiple LiDAR units to perceive the outside conditions of the car; “a vehicle and a side rearview mirror for installation on a vehicle” installs LiDAR and visual sensors on the side mirrors to increase the integration degree of the whole vehicle sensors; “method and assisted driving device of image stereo matching” and “data processing method, apparatus, device and mobile platform” respectively use multi-camera and multi-sensor fusion such as multiple sensors to construct two-dimensional views into three-dimensional views, improving the accuracy of image stereo matching and noise resistance; “method and device for processing point clouds” uses point cloud stacking multiple times to make the images taken by the camera more intuitive and visualized, facilitating fine operations when reversing and changing lanes.

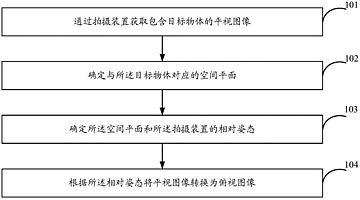

In response to the “lane” as a “new target” that has not been involved in the field of drones before, DJI uses patents such as “method for extracting road structure information, unmanned aerial vehicle and automatic driving system”, “method for maintaining lane map, electronic equipment and storage medium”, “image processing method, equipment and computer readable storage medium” to update data such as lane lines and lane environment in real-time, determine lane grouping information, and road surface conditions, while generating an overhead lane map to provide accurate guidance for intelligent driving.

In addition to patents related to sensors and algorithms, DJI also has a large number of patents related to driving mode switching, such as “technology for switching between manual control and autonomous control on a movable object”, “vehicle control system and vehicle”, “control system for autonomous driving vehicles and autonomous driving vehicles”, “method, device and autonomous driving vehicle for alarm control of autonomous driving vehicles”, etc. DJI has set rules for switching between human and autonomous driving and warning conditions for different situations, which is equivalent to setting a protective switch for autonomous driving.

These patents also tell us that from the beginning, DJI has aimed at L3 and above autonomous driving, which requires frequent switching of driving modes. This is consistent with DJI’s innovative and challenging style.

When writing this, I was thinking, is it easier to apply the perception and control technology of drones in a three-dimensional state in the air to ground vehicles in two dimensions, which is a “dimensional reduction attack”? In fact, it is just the opposite. Although ground vehicles have less longitudinal control, the environment they face is much more complex than drones, otherwise countless companies would not fail in autonomous driving projects.

For safety, we can accept drones “crashing” in extreme environments, but we will never allow cars to frequently lose control. The requirement for the consistency and stability of the product itself is up to the million level. At the same time, the flying environment of drones is much simpler, encountering only a few birds that do not follow rules in the sky, while autonomous driving vehicles have to face complex obstacles on the ground, changing road conditions, and vehicles and pedestrians that do not follow rules that can appear at any time, all of which require higher intelligence of the vehicle.

For path planning, drones only need to set the starting point and the end point, and the precision of the intermediate path planning is not high, nor does it affect the flight effect. The precision of intelligent car path planning has reached centimeter-level precision, and with the improvement of autonomous driving level, the precision may need to be even more accurate.

All of these add challenges for DJI to enter the autonomous driving field. Perhaps DJI chose to come to everyone’s attention only after five years of establishing its car business unit, just step by step breaking these challenges.

DJI vs Huawei?When it comes to DJI, people easily associate it with another representative of China’s new generation of technology companies, Huawei. Both occupy a leading position in their respective fields, adopt high investment in R&D, and attach importance to independent innovation. If the two were still “beautiful alone” before, the appearance of DJI’s car made them meet face to face in the hot track of intelligent automobiles. The two even chose somewhat similar paths: DJI focuses on the R&D, production, and sales of the core intelligent driving system components, while Huawei claims that “Huawei does not make cars, but helps cars make good cars”. Both sides target the intelligent automobile era and the incremental market Tier 1.

At present, Huawei has a larger volume and a wider range of coverage in the automotive industry, not limited to autonomous driving, but almost covering all parts of the entire vehicle. Meanwhile, DJI is currently only targeting automatic driving hardware and software. As for whether DJI will cut into a larger automobile market through autonomous driving, time will give us the answer.

Although the field of intelligent automobiles has become quite crowded, autonomous driving is a cake that requires technology companies like DJI to enter in order to make it bigger and bigger. The reputation and technological barriers of the products created by DJI in the UAV field, as well as its attractiveness to talent, are undoubtedly their boost into the field of autonomous driving. The ambition of DJI to enter the automobile industry will depend on how far they want to go in this race.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.