Author: Li Yuanyuan, DianGuang

FF’s Grand Plan for Becoming Debt-Free

FF, the company that aims to free itself from financial burden, has just announced its latest ambitious project.

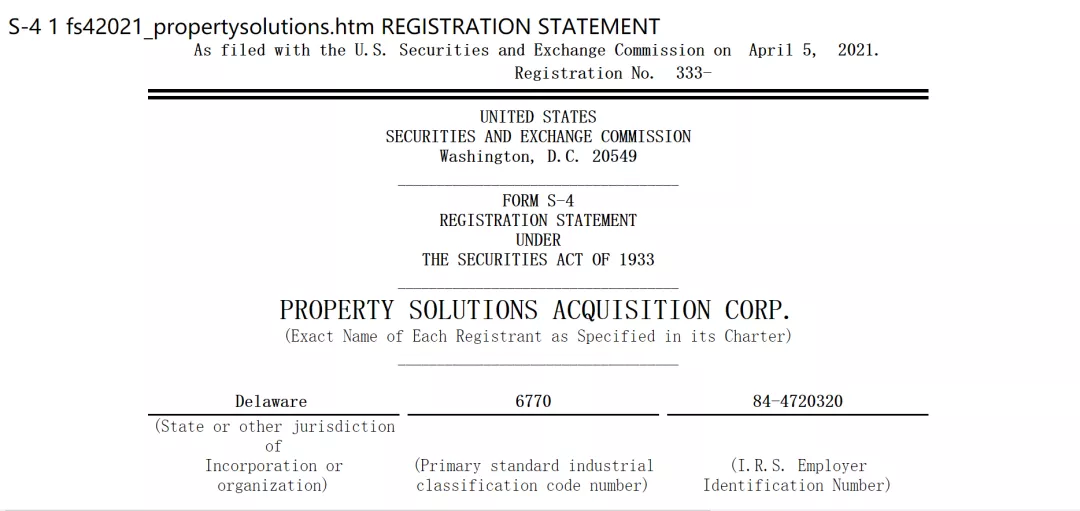

On April 5th, Faraday Future (FF) submitted its S4 document to the US Securities and Exchange Commission, marking the completion of its merger with Property Solutions Acquisition Corp. (PSAC) and the expected listing in the US market in May. The countdown to FF’s US stock market listing has begun.

According to the S4 document, FF has finally cleared all its previous debts and has obtained financial audit approval for 2020. After the merger, FF’s original shareholders and creditors will hold 66% of the company’s equity through debt-to-equity conversion. Getting rid of its debt burden means that FF founder Jia Yueting’s dream of making cars is one step closer to reality.

However, it is still uncertain whether FF will eventually succeed. At least in China, FF’s planned production with Geely and a joint venture in a certain first-tier city is still undecided. Nevertheless, these uncertainties do not affect FF’s grand vision.

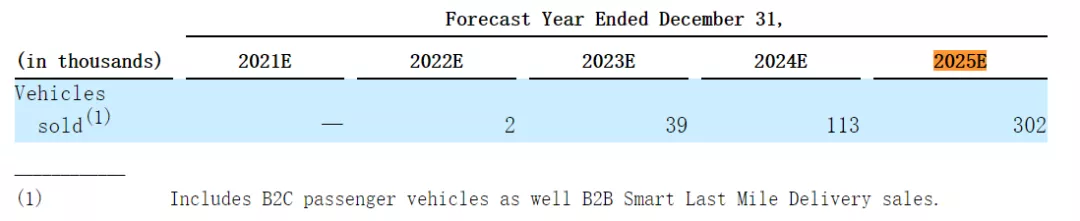

According to the S4 document, FF expects a revenue of USD 504 million in 2022, and it will rise to USD 21.445 billion by 2025. As for sales expectations, FF plans to deliver the first batch of FF91 in 2022, with an estimated sales volume of 2,400 units. By 2024, the sales volume of three models is expected to reach 113,000 units, while the annual sales volume of four models is expected to reach 302,000 units by 2025.

3 Years, 4 Models, and 456,000 Units

FF’s recent ambitious goal is to sell 456,000 units in the next few years.

According to FF’s S4 document, FF plans to sell 2,000 units, 39,000 units, 113,000 units, and 302,000 units of vehicles in 2022, 2023, 2024, and 2025 respectively, accumulating 456,000 units sold in the first three years.

Source: FF S4 documentThe sales in 2022 will only be the FF91, which is also FF’s first mass-produced car. On August 29, 2018, Jia Yueting, the former global CEO of FF, announced that the first pre-production car of FF91 was officially rolled off the production line, and it was planned to be mass-produced and delivered in the Hanford factory in the United States by the end of 2018.

However, after experiencing the turmoil of Evergrande disputes, Jia Yueting’s resignation as CEO, etc., the car has been unable to be listed as scheduled. According to the FF S4 plan, the first batch of FF91 will be delivered starting in 2022.

Starting from 2023, in addition to the FF91, which is positioned as a luxury performance electric vehicle, the FF81, which is positioned as a high-end vehicle, and the electric logistics vehicle (FF called Last-Mile Delivery Vehicles, LMDV) for the B-end market will also start to be sold.

In 2025, including the FF71, which is positioned in the mass market, the four models of FF will be mass-produced, and FF plans to sell 266,800 units of FF71, FF81, and FF91, and 35,000 units of LMDV that year.

With high sales goals come high earnings expectations.

FF expects its revenue to reach USD 504 million in 2022, USD 4.038 billion in 2023 and USD 10.555 billion in 2024. By 2025, its annual revenue can reach USD 21.445 billion.

It is worth mentioning that FF expects to achieve positive EBITDA (earnings before interest, taxes, depreciation, and amortization) in 2024, reaching USD 914 million, and achieve EBITDA of USD 2.312 billion in 2025.

Money, people, cars, and plants are all in place. Prior to the listing on the US stock market, FF has prepared for the realization of its grand vision.Regarding funding, on March 26th, FF announced that it had raised nearly $100 million in debt financing, led by Ares and participated by existing lenders such as Birch Lake.

The next day, FF’s Chief Product and User Ecology Officer, Jia Yueting, announced on Weibo that FF had obtained another $100 million loan before going public. This new financing will help FF advance the preparations for the Hanford factory and the delivery of FF91, and accelerate the landing of FF’s Chinese business.

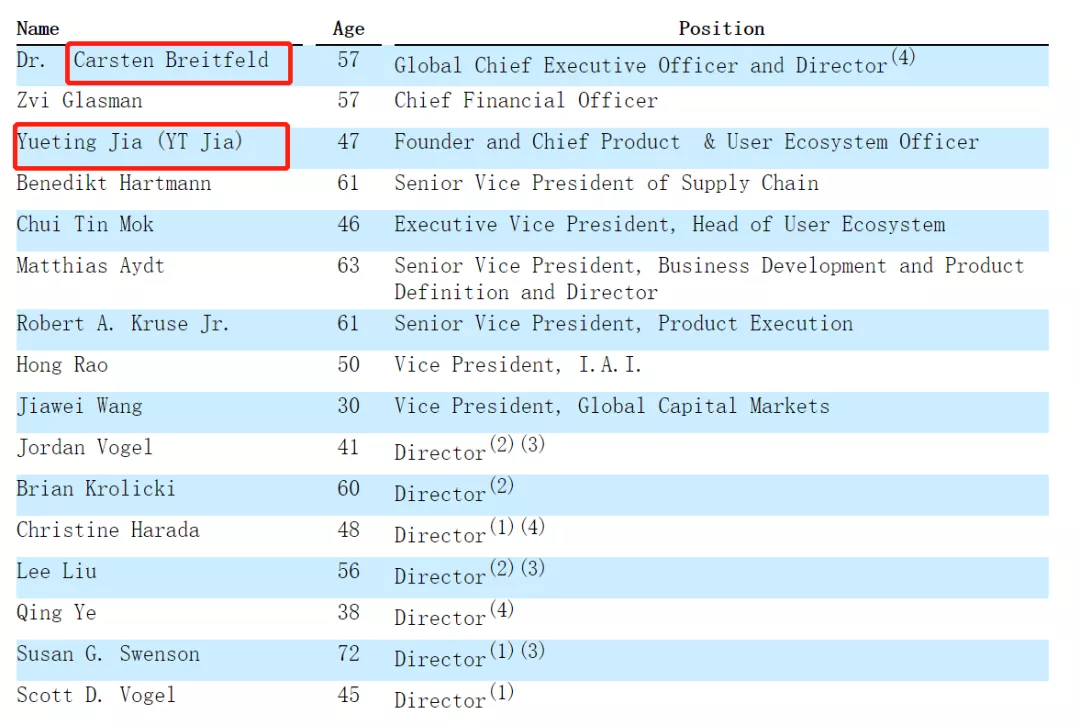

In terms of personnel, on March 31st, FF announced that it would appoint 9 new board members after completing its merger with PSAC. Of the latest 16 FF board members, they include Bi Fukang (first row in the picture below) who jumped from Byton, and FF founder Jia Yueting (third row in the picture below).

Source: FF S4 document

FF’s other management and technical teams also include core members from companies such as Motorola, Maserati, Tesla, BMW, General Motors, Karma Automotive, and Mercedes-Benz, as well as some core members from LeEco Auto.

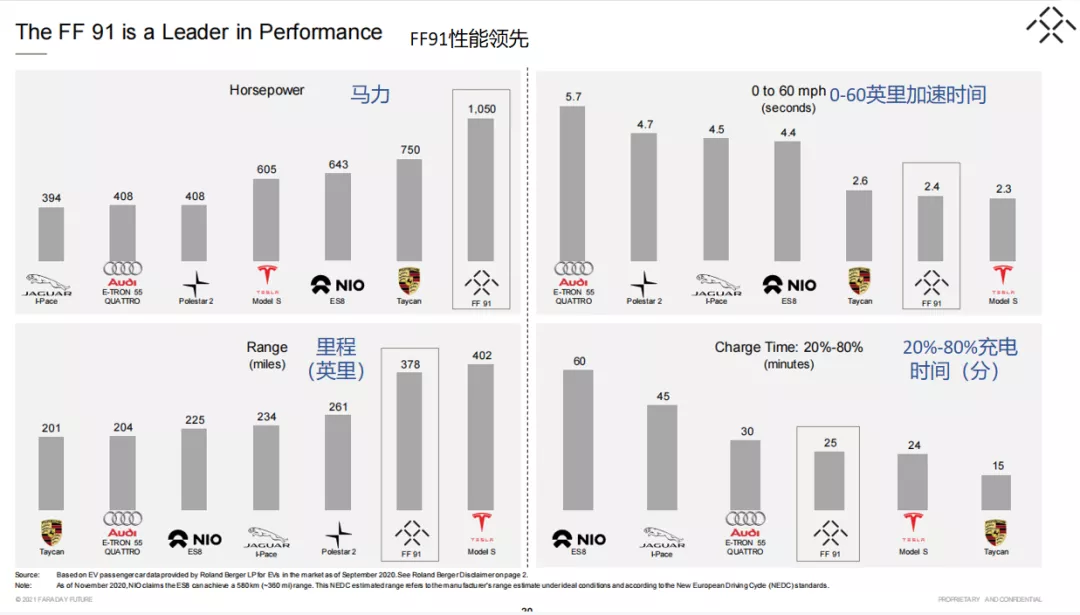

Regarding models, FF’s three passenger vehicle models cover both the Volkswagen market at around $45,000 and the luxury car market at around $180,000, benchmarking representative electric vehicle models such as Tesla’s Model 3, Model Y, Model S, NIO’s ES8, Porsche’s Taycan, and so on.

Source: FF Investor Presentation PPT

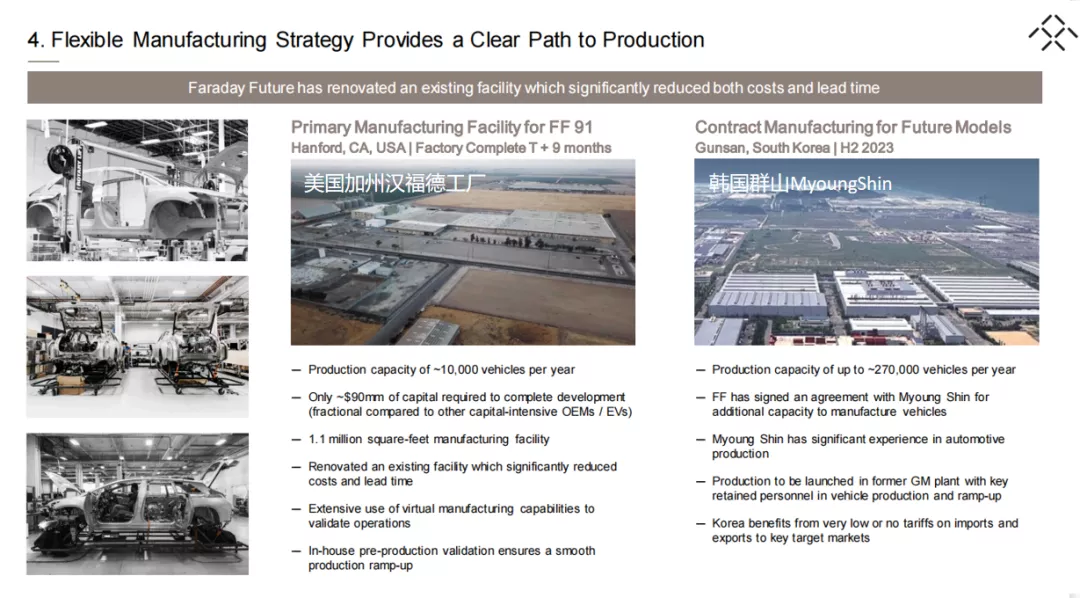

The production locations for several models have also been basically determined. The FF91 is expected to be produced within 12 months after the completion of the merger between FF and PSAC at the Hanford factory, which is leased by FF and covers an area of approximately 1.1 million square feet (about 1,022 acres). The annual production capacity of the factory is 10,000 vehicles, and approximately $90 million is required for the completion of the car’s development.

Source: FF Investor Presentation PPT

The rest of FF’s production capacity plan will be produced by Myoung Shin in Gunsan, Korea, with an annual capacity of 270,000 vehicles. Myoung Shin is a subsidiary of Korean automotive parts manufacturer MS Autotech, which signed a strategic cooperation agreement with BYTON in 2019 and announced its participation in BYTON’s Series C financing. After BYTON stopped production, the cooperation between the two sides also came to an end.

In addition, FF stated in the S4 document that it has signed a non-binding Memorandum of Understanding with Geely and a certain first-tier city in China. One of the cooperation contents is to establish a joint venture to support FF’s production in China. FF expects that starting from 2025, the annual production capacity of this factory will be 100,000-250,000 vehicles, and it will be increased by another 150,000 vehicles in 2026.

Source: FF Investor Presentation PPT

FF did not mention which “first-tier city” it refers to, but several media outlets quoted multiple sources as saying that FF’s domestic factory is located in Zhuhai, Guangdong Province. Geely is the main leader in the three-party cooperation, while FF and Zhuhai city have set up a gambling condition on FF’s localization progress and sales targets. If everything goes well, FF will start mass production in China in the second half of 2022.

Of course, “if” is still an “if”.

On the one hand, FF stated in the S4 document and the investor PPT that it had not reached a definitive agreement with Geely on the establishment of a joint venture, and “cannot guarantee the ultimate establishment of the company”. On the other hand, although Geely signed a framework cooperation agreement with FF, Li Shufu, the chairman of Geely Holding, specifically stated that Geely does not want to OEM for anyone, and it is Foxconn that wants to OEM for FF.

Currently, FF’s Chinese official website shows that the FF91 has started accepting reservations with a deposit of RMB 50,000. After opening the reservation page for the FF91 in the United States, the website will automatically redirect to the Chinese website. As a company that has delivered many promises but has failed to deliver, FF has become a frequent guest in the political and business circles. Can it really realize its ambitious vision this time?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.