Author: Li Yuanyuan, Dian Guan

In addition to making money by selling cars, electric vehicles will bring another considerable income to Tesla.

On April 9th, the Ministry of Industry and Information Technology announced the average fuel consumption and new energy vehicle scores for passenger car companies in 2020. In 2020, with a score of 860,000, Tesla became the champion of new energy vehicles’ positive score, followed closely by BYD with 750,000, and third place being SAIC-GM-Wuling with 440,000.

According to a Reuters report, FAW-Volkswagen has purchased new energy vehicle positive scores from Tesla China, with a price of about 3,000 yuan per point. Although this news has not been confirmed by the two companies, “Electric Vehicle Observer” has learned that since the end of last year, the market average price of positive scores has reached 2,000-3,000 yuan per point, and this year’s price will only be higher.

Therefore, if Tesla sells all of its new energy vehicle positive scores in 2020, it can earn at least 2.5 billion yuan. The era of making money by selling scores has arrived.

【Follow “Electric Vehicle Observer” public account and reply “double credit” in the public account dialog box to receive the 2020 average fuel consumption and new energy vehicle score situation of passenger car companies collected by “Electric Vehicle Observer”】

The soaring price of scores, Tesla may become the biggest winner

2020 was a critical year for the soaring price of new energy vehicle positive scores.

Before 2018, the automakers did not require new energy vehicle scores, and fuel consumption positive scores greatly exceeded fuel consumption negative scores, so new energy vehicle scores were basic without being taken into account in balancing carbon emissions. Therefore, in the new energy vehicle score trading platform, the transaction price was extremely low.

According to data obtained by “Electric Vehicle Observer”, in 2017, the average price of transaction on the official platform of the Ministry of Industry and Information Technology was around 1700 yuan, but outside the official platform, some scores traded for only 100-200 yuan.

This situation has changed significantly in 2020.

Several new energy vehicle companies have told “Electric Vehicle Observer” that since the second half of 2020, the price of new energy vehicle positive scores has started to rise significantly and deals with prices of 3,000 yuan per point are not uncommon.

Recently, Reuters quoted people familiar with the matter as saying that FAW-Volkswagen has purchased new energy vehicle positive scores from Tesla China with a price of about 3,000 yuan per point.

According to the annual fuel consumption and new energy vehicle scores for passenger car companies in 2020, Tesla produced a total of 860,000 new energy vehicle positive scores. If all of these scores are sold, Tesla may earn at least 2.5 billion yuan from this transaction.

In 2020, the new energy vehicle enterprises that ranked second in positive score after Tesla were mostly those with high sales of new energy vehicles that year, including BYD, SAIC-GM-Wuling, GAC Motor, JAC Motors, and Great Wall Motors in order.

However, not all automakers can monetize their new energy positive scores. For example, Great Wall Motors, as a major player in fuel vehicles, has a large number of average fuel consumption negative scores that need to be offset.

According to the Electric Vehicle Observer, one automaker that leads in new energy positive scores has sufficient funds and is not eager to sell the scores it has already obtained, possibly waiting for the right time to do so.

On the other hand, other electric vehicle companies with relatively limited new energy positive scores and tight capital chains, especially independent ones, are actively contacting potential buyers and hoping to sell their new energy positive scores at a good price as soon as possible.

Oversupply of new energy positive scores continues

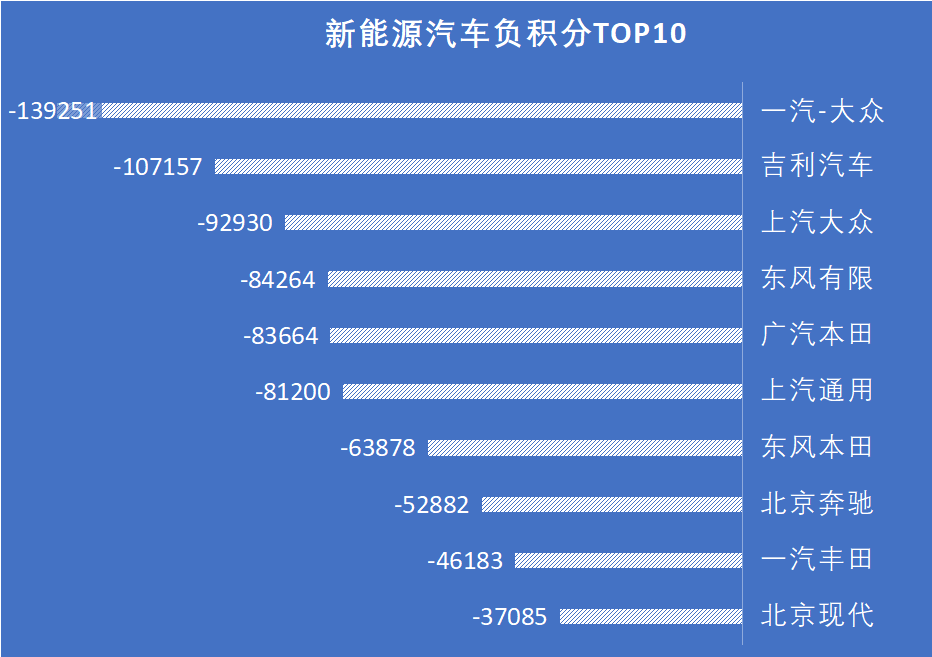

In 2020, the passenger vehicle industry in China generated 4.2 million new energy positive scores and 920,000 new energy negative scores. China’s new energy passenger vehicle market maintained a rare positive growth, and the positive growth of new energy vehicle positive scores was also expected.

However, the situation is very severe from the perspective of fuel consumption score.

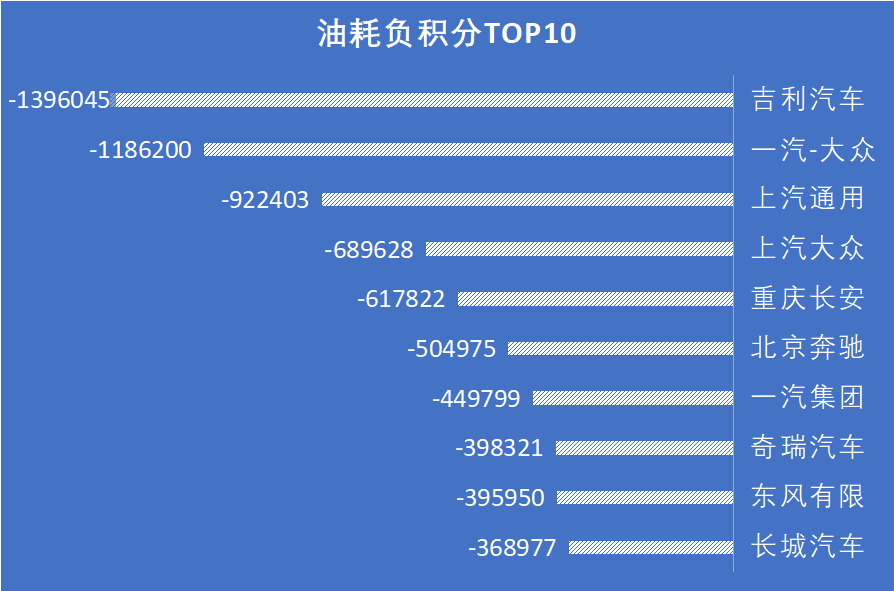

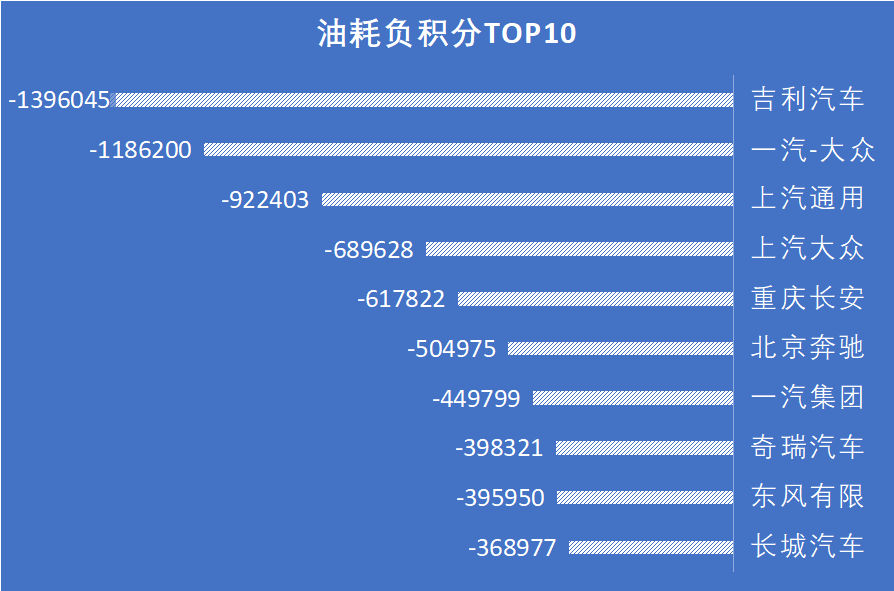

In 2020, the passenger vehicle industry in China generated 10.57 million fuel consumption negative scores and 3.91 million fuel consumption positive scores, and fuel consumption negative scores are much greater than positive scores. The automakers with the most fuel consumption negative scores are still joint venture enterprises such as Volkswagen, GM, and Mitsubishi, as well as traditional independent brands such as FAW and Geely.

Li Jinyong, Executive President of the China Automobile Dealers Association and President of the New Energy Vehicle Committee, analyzed that due to the increasing difficulty in obtaining scores and the rise of fuel consumption negative scores, the oversupply of new energy positive scores will continue in 2021.He expects that the points in the first half of 2021 will continue to rise and may reach 5000 yuan/point. After 2021, the price of new energy positive points is expected to rise to 6000-10000 yuan/point.

With the sales volume of the ID. series unknown, Volkswagen had no choice but to pay its competitors for points. It is certain that beyond Volkswagen, more high-consumption car manufacturers have reached out to new energy vehicle production companies to meet their own point needs.

On June 22, the Ministry of Industry and Information Technology announced the decision to revise the Measures for the Parallel Administration of the Average Fuel Consumption of Passenger Cars and New Energy Vehicle Points, clarifying the policy objectives for the double points system, one of which is to maintain a supply slightly greater than demand in the positive and negative point market from 2021 to 2023, and for the point price to objectively reflect the market value.

It seems that the goals of the regulatory authorities have been initially achieved.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.