Introduction

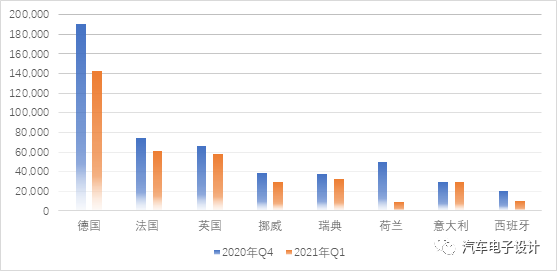

The data for the first quarter of new energy vehicles in the main European countries has come out. The total registered new energy vehicles in these countries (Germany, France, UK, Norway, Sweden, Netherlands, Italy, and Spain) is 373,800. Based on the calculation of these major countries accounting for 85%, the new energy vehicle registrations in Europe for the first quarter was 440,000, slightly less than China. According to the data from the Ministry of Public Security, China had 466,000 in the first quarter (which is estimated to include all types of vehicles, not just passenger cars), and it is expected that both China and Europe will exceed 2 million this year.

US Traffic Data

Monthly Data Comparison

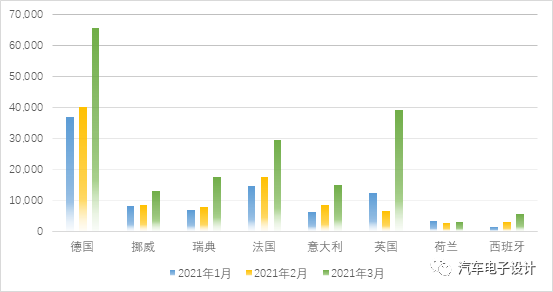

March was the end of the first quarter. From the perspective of new energy vehicles, the sales volume of new energy vehicles in Germany, Norway, Sweden, France, Italy, UK, and Spain were 65,681, 12,997, 17,500, 29,455, 15,000, 39,333, and 3,000, 5578 respectively. Compared to the previous month, all of these sales had a significant increase in March.

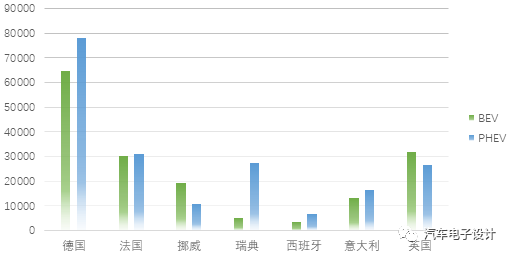

BEV and PHEV Comparison

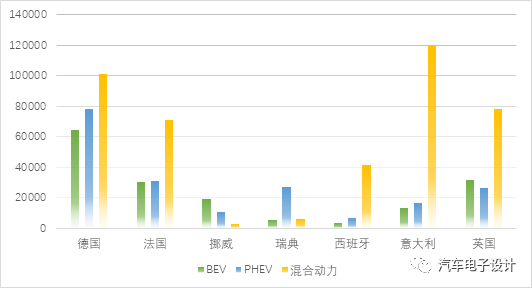

In the first quarter of these countries, the sales volume of BEVs was 168,000, and PHEVs was 197,000 (the ratio of PHEVs to BEVs in Sweden is really weird). The most obvious feature in Q1 was the recovery of PHEVs in France, UK, and Italy, which overall had a much better volume than before.

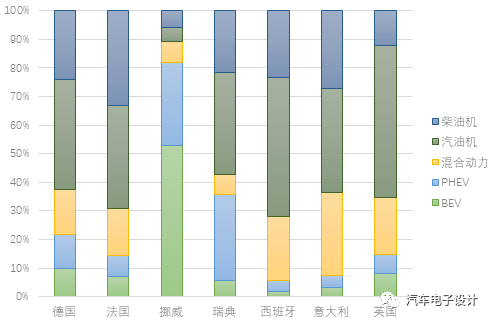

Quarterly Overall Penetration RateWe won’t go into detail about individual cases such as Norway and Sweden (where PHEV+BEV is directly implemented for relatively small scale situations). However, looking at the first quarter of the major European car markets, the penetration rate of hybrids has increased significantly. Especially in Italy, Spain, and the UK, the penetration rate of hybrids has rapidly increased to over 20%.

Hybrid Data

In the first quarter, hybrid sales in major countries amounted to 420,000, and it is estimated that the number of hybrid vehicles in Europe in the first quarter of 2021 was 520,000, a rapidly increasing figure. Like new energy vehicles, hybrid sales are primarily concentrated in five countries: Germany, Italy, France, Spain, and the UK. In the future, we can compare the differences between Toyota’s presence in Eastern and Western Europe to observe the actual distribution.

Comparison with China’s Data

Recently, the Ministry of Public Security released data on the registration of new energy vehicles in the first quarter, which amounted to 466,000, with a total of 5.51 million in existence. I compared this data with the 4.92 million reported at the end of December last year and found some confusion. The difference between the Q1 figure of 466,000 and the total number of cars of 5.51 million is 590,000.

However, based on this data, we can still see that the preference for new energy vehicles is changing rapidly in the entire automotive market after the experience of the epidemic. We can confirm that the global increase in new energy vehicles may exceed 5 million per year this year.

Conclusion:

Tracking monthly and quarterly data in Europe is still very interesting. The overall situation shows that several major countries in Europe are making every effort to promote new energy vehicles, and these efforts are reflected in the rising sales figures of new energy vehicles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.