Introduction

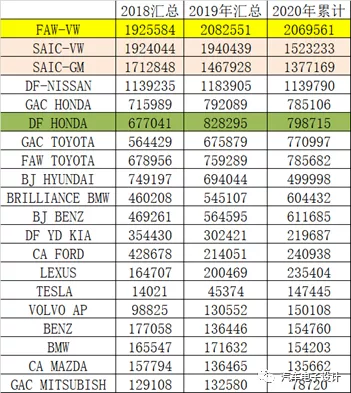

Recently, there has been media coverage that FAW-Volkswagen will purchase carbon emission credits from Tesla at a price of 3000 yuan per new energy vehicle credit. Interestingly, due to high fuel consumption requirements in 2020 and a low base, the handling of negative fuel credits has become an important issue for the year.

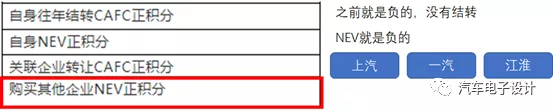

Previously, the Ministry of Industry and Information Technology released a notice related to the management of the average fuel consumption and new energy vehicle credits for passenger car companies in 2020. In fact, this gave automobile companies a certain amount of leeway, especially since negative new energy vehicle credits can be offset by positive credits in 2021. Therefore, it is mainly due to FAW-Volkswagen’s negative fuel credits that need to be handled this year. From the surface, there were negative credits in 2019, and after affiliated enterprises provide limited positive fuel credits, the only way to handle this is by purchasing new positive energy credits.

Note: In 2019, the industry had 4.57 million negative fuel consumption credits, and it is estimated that with the increase in average fuel consumption of domestic passenger cars in 2020, the industry will generate more than 10 million negative fuel consumption credits, triple the amount of positive credits. In addition to the increase in positive new energy vehicle credits, negative new energy vehicle credits will also increase significantly, making the overall game process need to be started as soon as possible.

Part 1: Volkswagen’s Credits Situation

First of all, let’s evaluate Volkswagen’s situation. FAW-Volkswagen was the only domestic automaker with a production capacity exceeding 2 million last year, while SAIC-Volkswagen produced nearly 1.5 million, totaling 3.5 million. It is estimated that fuel credit pressure will double and will likely decrease to -1 million. According to the requirement of 12% for new energy vehicles, FAW-Volkswagen and SAIC-Volkswagen need 179,400 and 248,400 new energy vehicle credits, respectively.

Based on actual sales figures in 2020 (which may be slightly lower without a qualification certificate), SAIC-Volkswagen has almost 50,000 credits, with a gap of 130,000 credits; FAW-Volkswagen has 60,000 credits, with a gap of 190,000 credits.

Note: Based on the calculation of 3000 yuan per credit, this is equivalent to 390 million and 570 million yuan respectively. Can you understand why Volkswagen must sell MEB well this year? In the long run, the new energy vehicle credits will not be available without it, let alone handling fuel consumption credits.

Therefore, for the general public, especially First Automotive Works Volkswagen, the options are to buy this year or rely on a large number of sales of NEV credits in 2021. However, according to the 14% carryover, the pace for this year is still 2 million, which already requires 280,000 new energy credits to offset. Assuming MEB’s new mileage setting is 5 points, it requires a scale of 56,000 units. For Volkswagen, selling an additional 1.6 PHEV credits this year doesn’t help much with new energy credits. The large-scale promotion of MEB is an inevitable choice.

Therefore, for the general public, especially First Automotive Works Volkswagen, the options are to buy this year or rely on a large number of sales of NEV credits in 2021. However, according to the 14% carryover, the pace for this year is still 2 million, which already requires 280,000 new energy credits to offset. Assuming MEB’s new mileage setting is 5 points, it requires a scale of 56,000 units. For Volkswagen, selling an additional 1.6 PHEV credits this year doesn’t help much with new energy credits. The large-scale promotion of MEB is an inevitable choice.

Part Two: Sellers of New Energy Credits

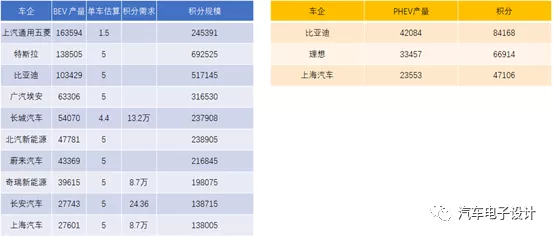

Looking at the sales volume in 2020 (production is always higher than sales), we can see that PHEV credits are relatively scarce, and joint ventures are using them themselves. Only three companies – BYD, Ideal, and SAIC – have a surplus with a scale of several thousand points.

For BEV, Wuling’s strategy mainly centers around fuel consumption credits. New energy credits are only one point per 120 km, which satisfies basic requirements. The main players with sufficient BEV credits are Tesla, BYD, GAC, NIO, and BAIC. Tesla has the largest scale with nearly 700,000 credits, corresponding to a scale of 2.1 billion.

Personally, I believe that new energy credits in 2020 are worth much more than originally estimated. The demand has been raised due to First Automotive Works Volkswagen’s appeal for them. Of course, this is also the result of batch selling. Although new energy credits are useful, they are the playthings of big buyers. In 2020, there were several sellers due to the generous credit amount. However, as the ratio gradually increases, the number of sellers who can provide positive credits on this market will be limited.

Conclusion2021年开始,能够看得出来日系和大众也是要逐步去卖新能源汽车的,这里是有新能源积分的冲动。当然规模在一定的限制范围内(50万的规模为门槛,算一算50万燃油车对应7万积分,也就是1万多台BEV的需求)。

Translated English Markdown:

Starting in 2021, it can be seen that both Japanese and Volkswagen’s intention to gradually sell new energy vehicles, driven by the New Energy Vehicle Credit System. Of course, the scale is limited within a certain range (with a threshold of 500,000, equivalent to 70,000 credits for 500,000 conventional vehicles, or a demand for more than 10,000 BEVs).

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.