On the evening of March 30, 2021, the GOVI team may have some regrets for choosing this day to hold their product launch. It’s not their fault though, as Xiaomi actually held their own product launch on the 29th – little did they know that Lei Jun had decided to hold two consecutive days of product launches. The next day, after the stock market closed, Xiaomi announced their electric car project, causing a stir in various circles. From the tech circle, to the home appliance circle, to the automotive circle, everyone was talking about Xiaomi.

The discussions of the general public pushed Xiaomi’s electric car project to the top of the Zhihu Hot List.

It has been a long time since the team at Garage 42 has seen such a frenzy of people joining a new brand’s user group. After responding to too many requests to manually add people to the group, founder Da Ji reluctantly announced that everyone should refer to the guidance of the intelligent assistant and apply to join on their own. I quickly joined a group and witnessed a lively argument among friends who had different opinions on Xiaomi’s electric cars. I don’t care what they were arguing about, as the argument itself is an indication of something. How many brands are worthy of getting people riled up these days?

In the PM Club, a group of nearly 300 professionals in the electric car industry, hosted on “Highway Flight”, had their most exciting night ever in 2021. While chatting in the group, I also hosted a Tencent Meeting for the first time and started a Clubhouse-style conversation with 40 students, who chatted for a full 80 minutes before I forcibly stopped them.

Obviously, tonight belongs to Xiaomi’s electric cars.

It has become the most eye-catching player in the second wave of new car-making forces. You can confidently remove the words “one of” from that statement; even your competitors wouldn’t dare sue you for false advertising.

Why is it so highly anticipated even though they’re not experts?

At midnight, I received a call from a senior colleague, and we only talked about one topic – why was Xiaomi able to generate such a large amount of attention and anticipation, despite having only held a single product launch with no concept cars, and hardly any pictures of cars in their presentation slides (except for an ordinary-looking RV that runs on gasoline)?

To answer this, I need to start with when Lei Jun founded Xiaomi 11 years ago…

Skipping over half an hour of lengthy conversation, we narrowed it down to 5 core viewpoints:

Product Category Attributes

Xiaomi has created a smart consumer electronics brand with international and particularly, Chinese influence. In simple terms, its core lies in the brand’s smart phones. The important point to note here is the product category attributes of smart phones.The phone is indeed small, and the car is indeed large. But smartphones and cars do have certain similarities, both being consumer goods produced by the manufacturing industry. This lays the foundation for positive associations between the two categories and brand value transfer.

Can you imagine buying an electric car from a food delivery company that enters the market three years later? Can you imagine buying an electric car from a car rental company that enters the market three years later? Can you imagine buying an electric car from a company that specializes in entertainment news videos or information searches three years later? To put it more bluntly, Coca-Cola and Durex are both famous, but would you really pay for a car with their logo on it?

It is possible, but the greater the difference between the categories, the more difficult it is to transfer brand value.

Recently, my team and I visited dozens of electric car users from different brands and price ranges, to some extent verifying the previous judgment.

We posed a hypothetical question, “If Apple, Huawei, Xiaomi, DJI, Baidu, Didi, and Evergrande all entered the car-making industry and launched their electric cars together in three years, which one would you prefer to buy or which one do you have more confidence in?” We hope to indirectly see what kind of attitude users have towards future electric car brands, whether they prefer classic mainstream or innovative changes.

The results were quite interesting. The protagonist of this article, Xiaomi, was not the first, but belongs to Huawei, and it is obviously ahead. Xiaomi and Apple are ranked second, each with their own fans. Evergrande was at the bottom of the list, with no one liking it, and even some people questioning whether its inclusion was a typo.

Often, when promoting a brand new brand in an all-category release, its disadvantages are quite obvious. Because you lack accumulation, users lack trust. But in this once-in-a-century great change in the automotive industry, the situation is different.

Recently, I watched an episode of “Car Talks” on DCD, a professional program produced by DCD. I invited McKINSEY’s global director and China automotive partner, Guan Mingyu, to share his opinions. Guan mentioned a phenomenon: China’s high-end electric car market, defined as the market with an above 200,000 RMB price tag, is almost entirely controlled by new electric car companies. McKINSEY’s research shows that in the pure electric car audience in China, the percentage of “because the brand I am interested in only offers electric cars, so I purchased this electric car brand” rose from 10% in 2019 to 15% in 2020, an increase of up to 50%.

When I saw this research result from McKINSEY, I can empathize because my own research has seen the same trend. I believe that when users face a completely innovative new category (electric cars and gasoline-powered cars in the eyes of engineers may require rigorous treatment as the same type of car, but in the eyes of users, they are already two different categories), their inner desire is for a completely innovative brand. Subconsciously, many users don’t want to see another logo that smells like gasoline. I still remember what my little nephew said to me when he bought a new phone in 2012. Of course, I questioned why he didn’t buy Nokia or Motorola and instead went for a brand called Xiaomi and a model called Xiaomi 2, which sounded quite strange. He said, “Uncle, you just don’t get it! Xiaomi is a smart phone specially designed for us young people. Nokia only makes traditional functional phones (for you old folks).”

Brand Reputation

Speaking of brand recognition, many big business brands are well-known such as Evergrande, Wanda, Lenovo, Mengniu, and Gree. However, how many of them have high levels of intense love? It is a key watershed for measuring a consumer brand’s excellence to outstanding in the era of mobile internet.

Apple, Nike, Harley-Davidson, Costco, Tesla, NIO, Iverson (yes, that bad boy from the NBA), Luo Yonghao, and Xiao Zhan, the common characteristics of these new and old cases are: no matter how much people dislike these brands, there must be a group of people who love them. Such brands often have stronger user stickiness and unique competitive advantages.

Xiaomi is obviously among them. This entrepreneurial company can make smartphones with a global top three sales scale, not relying on Apple’s unparalleled ecosystem and software capabilities, Huawei’s massive resource investment in solid self-research capabilities, or Samsung’s in-depth grasp of the upstream and downstream industrial chains. They rely on their ability to capture user needs and communicate with users, thereby shaping a great soulful consumer brand and winning the love of many “Mi-fans”.

Poor brand decision makers always like to come up with a new story to please themselves and fool the world. The excellent brand decision makers are always uncreative like a repeater copying themselves. Xiaomi is 11 years old now. In today’s press conference, Lei Jun kept repeating the story he has been telling since the first year: Xiaomi’s seriousness towards users and their love for Xiaomi.

As for the car manufacturing business, Lei Jun did not say that it was his own decision. He said that Xiaomi conducted a survey on car manufacturing and 92% of users said they would buy Xiaomi’s electric cars. Whoever wins people’s hearts will win the world. Although the technology in the automotive industry is complex, it is after all a consumer product industry. In terms of capturing user needs and creating brand charm, Xiaomi has a great advantage.# English Markdown Text

Not only Xiaomi users love Xiaomi, but the whole society actually has a wide recognition. Sun Shaojun, a well-known automotive retail expert on Zhihu with ten years of experience in automotive channel retail, shared a very fresh first-hand information.

Recently, Volkswagen ID4 series was launched, and it was looking for commercial district sites in various places. Volkswagen went to negotiate with a high-quality commercial district it was interested in opening a store in, but was refused. The reason for the refusal might make automotive industry professionals somewhat speechless: the other party thinks that the Volkswagen brand is too traditional and has weak passenger flow attraction; they prefer to introduce new leading forces or brands like Huawei and Xiaomi. Sun Shaojun said that this is not an isolated case; he himself has heard of two similar incidents.

User Scale

There is no need to say much here. Just share some figures.

Since the launch of Xiaomi 1, Xiaomi has been in operation for ten consecutive years.

In 2020, Xiaomi Group achieved 146 million shipments of intelligent phones, a year-on-year increase of 17.5%, and the average selling price of intelligent phones increased by 6.1% year-on-year to 1,039.8 yuan per unit. The number of Xiaomi IoT connected devices reached 325 million, a year-on-year increase of 38.0%. The number of users with five or more devices connected to the IoT platform reached 6.2 million, a year-on-year increase of 52.9%.

Many people are worried that Xiaomi users have limited purchasing power. But in fact, this will not be a problem because once the scale is large, there will always be a part of relatively high-budget users. Xiaomi’s users are constantly growing. Young people who spent one or two thousand yuan to buy Xiaomi mobile phones seven or eight years ago may have achieved success in their careers today, and their consumption vision has also improved. Their life stages are changing, and their consumption power will be upgraded.

In 2020, Xiaomi sold 10 million units of high-end smartphones priced over 3,000 yuan in mainland China or over 300 euros in overseas markets. Although the proportion is not high relative to the global shipment volume of 146 million units, the absolute number is already quite objective. The users behind these 10 million high-end phones were the most accurate seed customers for Xiaomi’s early electric vehicle business.

Ecological Synergy

When launching any strategy, you will always ask yourself a question: where are you stronger than your peers? The core of any press conference is to answer this question clearly.

Because Lei Jun openly admitted at the press conference that the formal research on electric vehicle business was not launched until January 15, 2021, obviously nothing can be released at the moment. I believe that this will also be the focus of external criticism of Xiaomi’s electric vehicle release: there is more feeling than substance.

But I think Lei Jun actually hinted at the killer of Xiaomi’s electric car to the outside world: one is the brand and users discussed above, and the other is the ecological advantage in terms of products.

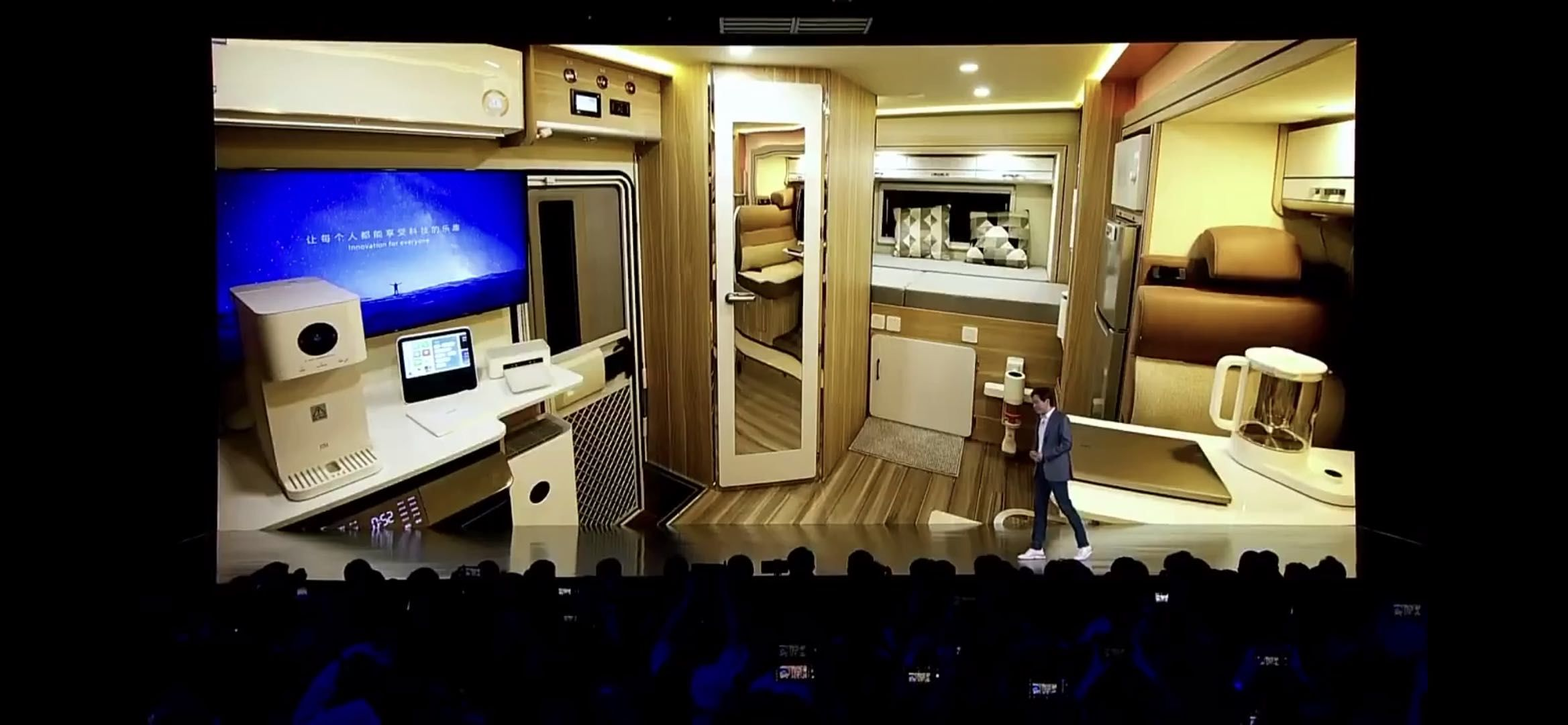

Lei Jun’s original words on stage were “high-quality intelligent electric cars for users to enjoy ubiquitous intelligent life worldwide.”

We have seen the synergy between Apple’s phones, earphones, laptops, tablets, cloud, music, movies, and maps, which brought about a seamless user experience and stickiness. Now imagine this synergy extended to cars, what would happen?

Users always love simple, consistent, and extremely low learning cost experiences. No one wants to sit in a car and say “hello BMW” to activate the ABC function, “hello zebra” for DEF, and “hello Tmall” for XYZ.

This is forcing users to figure out the complex Tier 1 industrial layout of a car. It would be a tragic experience, but it is happening in this new era of “cars + the Internet.”

Among the potential players in the electric vehicle industry, there are only three globally recognized companies that have the potential to leverage this ecological synergy: Xiaomi, Huawei, and Apple. They all have massive scale intelligent hardware across different categories, top-notch software development capabilities, and influential consumer brands. Xiaomi is the first to make a move.

Lei Jun’s Role

In this second round of new car making, there are state-owned enterprises and private businesses, some are making cars, some are offering travel services or doing autonomous driving. However, among the public players, there is not a big boss who personally rolled up his sleeves and got involved.

A few days ago, my friend asked me about Xiaomi’s car-making plan, and I said it depends on whether Lei Jun is personally involved. An entrepreneur who has repeatedly proven himself could make a huge difference in this game. Li Bin, He XPeng, and Li Xiang topped the leaderboard in the first round of new car making, and it was not by accident.

Cars are inherently different from other products. Many decisions involving billions of dollars of costs and years of verification cycles make the creative space for managers limited. It’s hard to understand for people not in this industry.

Some former colleagues from NIO found that they had become very slow after switching to a new company, even though they used to work efficiently. Upon analysis, it turned out that they had to make frequent reports before taking any action. The report alone wasn’t enough. They had to make a PPT then report again. Even if the report was accepted, it may not be useful, as the leader might reject it or ask them to further investigate.

Who wants to be like Carlos Ghosn, who heroically saved the then-bankrupt Nissan, but in the end, became a sacrifice in the struggle between Renault and Nissan? Ghosn had a salary of millions of euros, but he was still a manager.# Xiaomi’s Dilemma with its New Venture to Build Cars

Choosing to venture into the car industry is a bold move for Xiaomi’s CEO Lei Jun, as it presents both a great opportunity and a potential threat to Xiaomi’s core business. Managing a large and diverse company like Xiaomi, and competing with strong rivals like Huawei and OV, is already a challenge, so the decision to enter a new industry is not an easy one.

Yesterday’s Xiaomi launch event had three segments. The first was from 7:30 pm to 9:00 pm, featuring the launch of new products such as smartphones, air purifiers, and laptops. Lei Jun, who was feeling unwell and had a lot on his plate, may not have been in top form, and some of the product presentations were done by other members of the team.

From 9:00 pm to 9:15 pm, there was a transition period which included Lei Jun’s personal motivational speech on his three major life turning points, titled “Transformation”. During this segment, Lei Jun gradually got into his best state, and his cold virus got suspended temporarily due to the inspiring moment. He also relied less on the teleprompter, although it would be helpful if they use a remote-controlled one next time.

The final segment, from 9:15 pm to 9:40 pm, was the climax of the event, where Lei Jun announced Xiaomi’s new venture to build cars. Lei Jun’s passionate and confident words brought back memories of the ambitious entrepreneur he was a decade ago when he started Xiaomi. He said he is ready to take on the biggest challenge of his life, and put everything on the line, including his reputation and hard-earned wealth. Lei Jun’s picture in running gear repeatedly appeared in the presentation, conveying his determination and entrepreneurial spirit for Xiaomi’s new challenge in the automotive industry.

Despite this impressive event, Xiaomi will face three major challenges in its new venture:

- Finding resources, including both human capital and supply chain resources

In just six years from the end of 2014 to early 2021, China has seen the emergence of a number of new, innovative and aggressive car makers and their supply chains. While there is also a dark side to this, involving fraud and corruption, the rise of new car makers and the reabsorption of industry talent has posed a significant challenge to foreign car makers and local incumbents.

(Note: The original Chinese text included emojis and timestamps, which have been omitted in this English version since they lose their meaning or don’t translate well in the target language.)Starting from 2020, the second wave of new car forces has been continuously mustering. Regardless of how loud the hills are or how rich the fathers are, CEOs, HRs, and headhunters know best that it is difficult to find truly knowledgeable and experienced talents in both cars and entrepreneurship. This is because the talent market is a zero-sum game in the short term, and the head players like Tesla, NIO, Xpeng, and Ideals have already absorbed a large number of talents. It is unlikely that the market will produce a large number of talents out of thin air to fill the gaps.

The fact repeatedly proves that if you do not have a profound understanding of cars, you will have to pay tuition fees. In the 0 to 1 phase, job skills and methodologies are obviously less important than essential knowledge of the industry, products, and markets. Soviet representatives and Wang Ming, Borbet who knew the classic theories and methodologies of the revolution, if they did not understand the nature of Chinese workers, peasants, and the Chinese revolution, they could not command the Red Army of Workers and Peasants well.

Supply chain is also the same, as high-quality resources are scarce. Just like the project director of Yi Ke Na in the PM Club group of highway flying, Pan Changxing shared: “Excellent supply chain has serious capacity shortages since the second half of last year, and receives 2-3 customer inspections or inquiries every week on average. In order to control business risks, several meetings are usually required to mutually understand, evaluate the OEM’s financial strength, potential cooperation value and other factors, and then decide whether to cooperate.” They believe that in the current development situation of the automotive industry, not only do OEMs choose suppliers, but quality suppliers also carefully choose OEMs. Current new car-making companies themselves do not have strong systemic capabilities. Only by competing for talents and resources in the battle can they succeed. Zhu Kai, the founder of Geranlu Automotive Consulting Company, added: “As the shopping district stores become the choice for automotive brands to contact users, some electric car brands will take the initiative to sign cooperation agreements with the shopping district. This will make it more difficult for latecomers to find good offline channels.”

The more the moment of diversity and competition, the easier it is for resources to quickly concentrate on the head players, because everyone is playing their cards on the table. This is an experience that can be seen from history.

- Upgrade the brand to reshape a car-class brand

For so many years, I have not forgotten a line in an old movie. A foreign actor, with vivid expressions, expressed his contempt for Chinese manufacturing. The copy goes something like this: “I love Chinese manufacturing! The lighters I buy are made in China. The ties I wear are made in China. The suits I wear are made in China. But when I buy a car, I definitely won’t choose one made in China!”

We can apply this routine to many future Xiaomi electric vehicle critics. They will say, “I love Xiaomi! My mobile phone was made by Xiaomi. My TV at home was made by Xiaomi. My router, laptop, socket, charging treasure, air purifier, water purifier, air conditioner, toothbrush, and sweeping robot, are all made by Xiaomi! I love Xiaomi so much! But if you ask me whether I will buy a Xiaomi electric car, then I will definitely not choose Xiaomi.”# One is that there is a certain boundary when brands cross categories, and there is a hierarchy between different categories. The strong areas of cars and Xiaomi brands are really two different things. Another reason is that in its past history, Xiaomi has not been known for its workmanship, reliability, and longevity.

In the PM Club, the classmate Huajiao spoke directly: “Users of fast-moving consumer goods do not have high requirements for reliability and longevity, nor are they willing to pay a high price. They don’t use them for very long and can just throw them away. But users see cars as assets for their families. That’s two different things. Xiaomi’s quality control in the fast-moving consumer goods field is also shaky.”

As a long-time Xiaomi user myself, my feeling about Xiaomi is that it always produces products with 8 points of performance at a 6-point price, but it’s not high performance nor high quality. In fact, the failure rate may be higher than that of traditional big brands in the same category.

How Xiaomi responds to these simple user concerns and how it creates true car-grade quality and quality as a company without car manufacturing experience will be a big challenge for Xiaomi to upgrade itself to a car-grade brand.

- Unprecedentedly Strong Opponent

Let’s take a look at the strongest opponents Xiaomi has encountered in its history.

When its mobile phone business went from 0 to 1, there were many competitors. New challengers included Apple, and traditional old powerhouses such as Nokia, Motorola, HTC, and Lenovo. This battle was extremely difficult. Xiaomi started from scratch without people, supply chain and money. There were multiple opponents with diverse strengths.

In the end, Xiaomi made a brilliant breakthrough and was once the best-selling smartphone brand in China! The battles that followed seemed not so difficult. When it entered the smart TV market, its biggest challenger was the radical LeTV, followed by traditional TV manufacturers like Hisense and TCL. After LeTV’s financing chain broke, Xiaomi TV did not encounter any major challenges. When entering the laptop computer market, Xiaomi was faced with a group of mainstream old factories, and it appeared very unique. Although it may not take a large market share, it is not difficult to stand out with its characteristics. Even just doing a good job in industrial design and giving users a Macbook-like feeling can win a segmented market.

Air purifiers, smart speakers, power banks and other products usually start with a leading pace, and then rely on their strong advantages, brand empowerment and self-operated channel capabilities to achieve success in each segmented market. But cars are completely different. This time, the opponents Xiaomi faces are probably even stronger than 11 years ago. In terms of traditional large automakers, there are Volkswagen, Toyota, BMW and Mercedes-Benz on the outside, and BYD, Geely and Great Wall on the inside. Among the new challengers, there are Tesla and XPeng Motors. The challengers Xiaomi faced back then, such as Apple, Nokia, and Lenovo, can now all be matched, and the scale has been several times larger.Xiaomi is a young company with founder genes, internet software capabilities, and an understanding of local users. It relied on these differentiation advantages to break through and overtake mainstream giants and international behemoths. Today, the likes of Wei Xiaoli possess these traits, and these companies have cash reserves of hundreds of billions of RMB in their accounts, which are expected to double after their listing on the Hong Kong stock exchange later this year.

In addition, the founders of BYD, Great Wall, and Geely are all still young and energetic, with more momentum than Lenovo had in its early days. As for Tesla, this company shares some similarities with Apple, but its pursuit of low prices is unlike Apple and more like Xiaomi.

If the research starts on January 15th and was officially announced yesterday, Xiaomi will also recruit a team and establish a supply chain. Even with a 996 work schedule, the new car may not be delivered to customers until 2024.

By that day, assuming nothing unexpected happens, NIO’s annual sales are expected to exceed 200,000 units, similar in scale to Lexus in China today, but with a higher average price than that of Tesla. XPeng is expected to sell 300,000 units annually, becoming the young people’s first high-performance, cost-effective electric vehicle. XPeng’s NGP is expected to have already iterated to version 5.0, and laser radar may already be standard.

On that day, will users choose a brand new Xiaomi or a well-known and mature technology brand like XPeng?

How will Xiaomi achieve its differentiation positioning and break through in the face of the siege of electric car giants at the summit of enlightenment?

In the “Auto Talk” mentioned earlier, McKinsey also revealed another research result. In 2020, there were 40 vehicle brands with sales of more than 1,000 units in the United States, 39 in Germany, 26 in Japan, and a whopping 101 in China. China has the richest automobile brand supply in the world for users to choose from.

But! Faced with many choices, Chinese users are becoming increasingly focused. The initial list of brands before 2019 had 2.7 brands, which has now become 1.9 brands in 2020. This means that when users actually buy cars, they are only choosing between two brands. 60% of users end up buying one of the two or so initial brands they thought of in their minds.Don’t be fooled by the automotive enthusiasts on CarDiy and the automotive boards on Zhihu: they know all the major car brands like the back of their hand, and they are up to date on all of the latest developments. However, the typical average user will not consciously absorb automotive knowledge. Just like me, as an average consumer of digital products, I never pay attention to the latest notebook and smartphone releases. I just blindly update Apple products and, at most, take a glance at Huawei and Xiaomi.

When an average user suddenly decides to buy a car, they will instinctively think of a limited number of brands, and then they will deliberately learn about those brands and selectively listen to others’ opinions and advice. In short, if you praise the brand they are thinking of buying, they will probably think you are making a lot of sense. If you criticize the brand they want to buy, they will think you really don’t know much about cars and consult someone else. If a brand cannot enter the average user’s subconscious mind on a regular basis, it is basically out of the game.

With Lei Jun entering the car-making industry, this is the most interesting time for the industry. Apple has long since entered the field, but has not made an official announcement. Xiaomi has just decided to enter the field and immediately made an official announcement. From the perspective of the maturity of the industry chain, it is highly likely that the entrepreneurial pioneers will be the first to enter, followed by Apple, and then Xiaomi will quickly follow, and the industry will enter its peak.

Xiaomi’s attitude towards making cars internally is very clear. They have estimated all the difficulties mentioned above and others.

Lei Jun was obviously nervous yesterday! Otherwise, the script of his speech at the press conference would not have been so grand. One moment he said it was his last major entrepreneurial venture, the next moment he said that he was betting his life’s savings and reputation, and then he said “we have money.”

If Xiaomi had only entered a wireless earphone category, would Lei Jun still need to speak like this?

We all have experiences in life where we speak the most grandiosely. Usually during confession, proposal, election, financing, and recruitment moments. Because at these moments, you don’t have complete confidence in yourself, and the other person may not follow you. Therefore, you need to step out of your usual self, say the strongest words, blow the biggest trumpet, play the most genuine role, and create the grandest scene!

Only those who have walked through the dark of the night need to light a lamp, and those who need to scream with courage are those who may not win the fight.

But for Xiaomi, this is a good thing.

Going back to fight a battle that you are sure to win will not go down in history.

Finally, I would like to wish Lei Jun and Xiaomi all the best. Lei Jun is my most admired Chinese entrepreneur, just like Li Bin. Xiaomi is the consumer brand that I have loved for many years.

I hope that these two figures and this brand can overcome all known and unknown difficulties and ultimately succeed!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.