Introduction

I recently read a material entitled “Electric Vehicles Statistics in the Netherlands” and was interested in the fluctuations in penetration rate in the Netherlands.

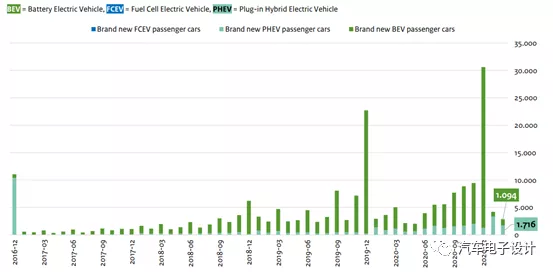

In December 2020, 31,000 new electric vehicles were registered in the Netherlands, with a year-on-year growth of 34.1% and a month-on-month growth of 291.4%, setting a new monthly high and achieving a monthly penetration rate of 71.9%.

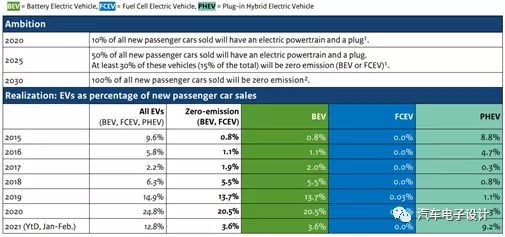

In this market, there were 358,000 vehicles sold in the entire year, with a year-on-year decrease of 20.6%. Among them, there were 89,000 new energy vehicles registered, with a year-on-year growth of 34.1% (EV sales were 73,000, accounting for 20.5%, and PHEV sales were 16,000, with a year-on-year growth of 214.7%, accounting for 4.3%).

Increase of Electric Vehicle Penetration Rate in the Netherlands

In 2018, the penetration rate of new energy vehicles in the Netherlands was only 5.5%, and it quickly rose to 13.7% in 2019. In 2020, the Dutch government proposed a new subsidy plan. The cabinet of the Netherlands approved the new 2020-2025 electric vehicle subsidy policy (the total annual budget needs to be reviewed).

In 2020, a total of 17.2 million euros were provided for subsidies, of which 10 million euros were used for subsidizing new electric cars, and 7.2 million euros were used for subsidizing second-hand electric cars. It is specified that a subsidy of 4,000 euros will be provided for purchasing or renting new electric cars (with a range of ≥120 kilometers and a price of 12,000-45,000 euros), and a subsidy of 2,000 euros will be provided for second-hand electric cars.

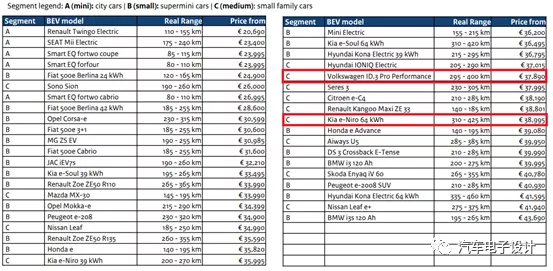

Note: The main Chinese vehicle models sold in the Dutch market include the MG ZS EV, the JAC iEV75, and the Aiways U5.

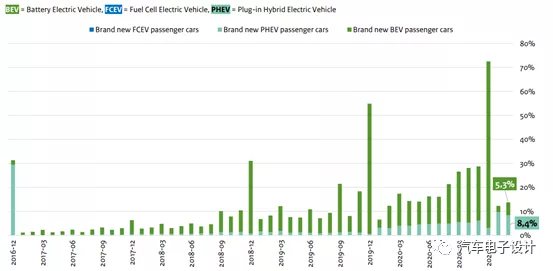

This rapid increase of new energy vehicles occurred after June 2020. Historically, we can see that the Dutch market objectively experiences severe pulse purchases on a monthly basis.

We can see from the figure below that there are three pulse peaks in December 2016, December 2019 (when the old new energy subsidy policy expired), and December 2020. In fact, there was a small pulse in December 2018.

This is mainly due to the increase in Dutch corporate vehicle tax since 2021, which has resulted in a year-end EV registration trend. The Netherlands has the following tax policies:

1) Acquisition tax: EVs are exempt from tax, and PHEVs pay less based on their emissions level.

2) Ownership tax: Before 2024, EVs are exempt from ownership tax, and PHEVs receive a 50% reduction. From 2024 to 2025, EVs receive a 75% reduction in tax, and PHEVs receive a 25% reduction.

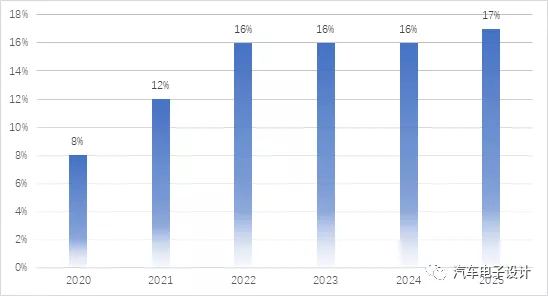

3) Corporate vehicle tax: The tax rates for 2020-2025 are 8%, 12%, 16%, 16%, 16%, and 17%, respectively. The upcoming increase in corporate vehicle tax is the main factor driving the rapid growth in sales at the end of the month in the Netherlands.

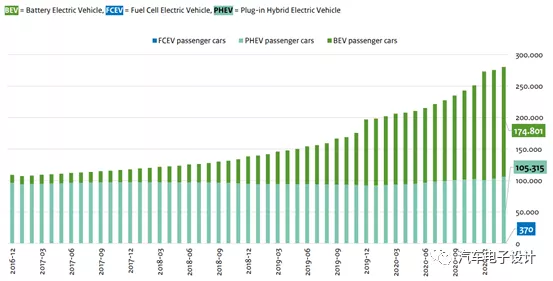

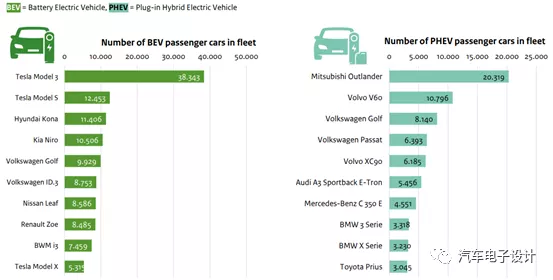

Of course, we can also take a look at the stock situation. The subsidy effect has kept the stock of PHEVs in the Netherlands stable at 105,000 units, while the stock of BEVs has risen to 174,800 units.

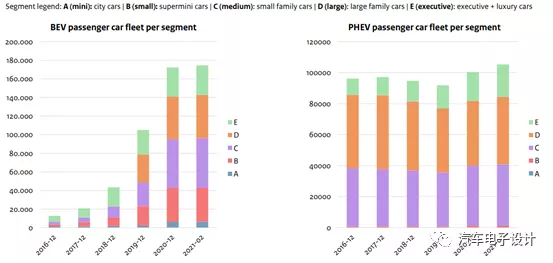

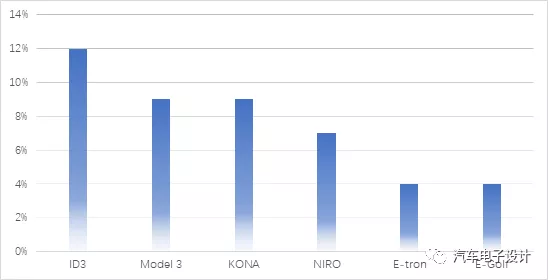

Due to the small market size, we can also see that the increase is mainly in two categories: home use cars (ID3 and Niro) and large cars (Model 3), which have greatly promoted the rapid growth of BEV.

Analysis of new energy vehicle models

In 2020, the three best-selling electric cars in the Dutch market were the Volkswagen ID.3 (10,954 units), Tesla Model 3 (8,374 units), and Hyundai Kona EV (7,761 units).The Volkswagen ID.3 has been delivered in the Netherlands since September, with sales of 6,083 units in December, accounting for 55.5% of the total sales for the year. Tesla’s export supply has been unstable, with sales of 3,938 units in December.

Note: There is a slight deviation between the registration and sales figures for the ID.3.

From the perspective of inventory, the accumulated inventory from 2019 and 2020 has made the Model 3 the largest BEV in quantity, followed by the Model S and KONA.

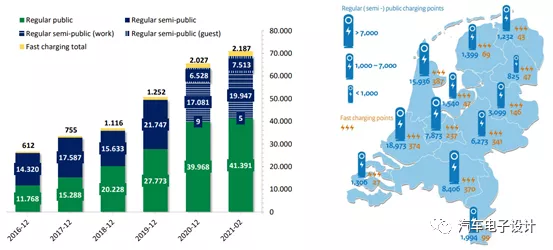

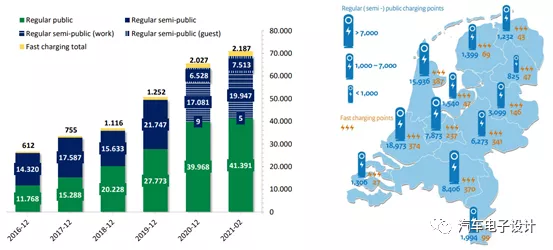

The main reason for the rapid development of electric vehicles in the Netherlands is the highest density of public charging networks in Europe, although there are currently only 2,187 fast charging stations, they support the entire highway network. The popularity of slow charging public networks is also sufficient for a region with a population of over 300,000, as there are still a considerable number of home charging facilities to support this.

Conclusion

The Dutch market is moving towards the Norwegian direction, which is an interesting development. I estimate that once the Dutch government completely phases out subsidies for internal combustion engines in 2025, the increase in new internal combustion engine vehicles will be minimal, and electric vehicles will be the main choice.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.