As a former partner of Volkswagen JAC and a company that once captured a large number of orders from the then LiDAR leader Velodyne, which directly led to its withdrawal from the Chinese market, Hesai Technology has recently been exposed to the news of terminating its IPO on China’s Science and Technology Innovation Board, which is lamentable. On January 7th this year, Hesai Technology’s application for listing on the Sci-Tech Innovation Board was just accepted and its valuation reached 10 billion RMB, making it a shining star. As the leading enterprise of domestic LiDAR, Hesai Technology’s listing was expected to become the first domestic “LiDAR First Stock.”

Before Hesai’s application for listing, two foreign LiDAR companies, Luminar and Aeva, had successfully gone public through special purpose acquisition companies (SPACs) in the North American market, becoming the new nobility in the global autonomous driving field. In theory, with many major automakers worldwide considering autonomous driving as their primary breakthrough direction, with the exception of Tesla, almost all automaker’s autonomous driving technology roadmap includes LiDAR. Facing such a huge market, Hesai Technology’s prospects should have been very promising, so why did it fall at the last moment before going public?

The primary reason for terminating the IPO of Hesai was its own worrisome financial performance. From 2017 to the first three quarters of 2020, Hesai Technology’s revenue was CNY19.474 million, CNY133 million, CNY348 million, and CNY253 million, respectively. Correspondingly, its net profits were -CNY24.2723 million, CNY16.1123 million, -CNY149.7335 million, and -CNY93.7975 million, with a cumulative loss of CNY268 million. A company with such problems should not go public, which is irresponsible to domestic investors. Although the threshold for listing on the Sci-Tech Innovation Board is lower than that for listing on the main board, many companies going public with problems on the board have caused high attention from regulators due to the rapid expansion of the board. Besides Hesai Technology, many companies that have withdrawn from listing on the Sci-Tech Innovation Board have taken a step back after knowing their own limitations.In addition, Hesai Technology also has a significant concern. It previously got involved in a patent dispute with Velodyne. Although both parties eventually chose to settle, the cost was that Hesai Technology paid as much as 160 million yuan in patent licensing fees to Velodyne in 2019, and the situation of paying patent licensing fees will continue until 2022. Although the US court has not made a final ruling on whether Hesai Technology is suspected of infringing Velodyne’s patents, the fact that Hesai Technology is willing to pay for the settlement fee has already explained everything.

Hesai Technology is repeating Velodyne’s embarrassment

At the end of 2019, Velodyne announced its withdrawal from China, and the main reason was that its product cost remained high, making it difficult to become a standard for mass-produced autonomous driving vehicles of automakers. This was also the biggest reason for Tesla to abandon LiDAR. Compared with Velodyne, Hesai Technology has similar technical indicators, but it has a significant price advantage. Therefore, it is not surprising that Hesai Technology squeezed Velodyne out of the Chinese market.

Nowadays, solid-state LiDAR companies, including Luminar, are repeating this scene. Taking Luminar as an example, seven of the top ten global automakers have chosen its products, with a contract value of up to 1.5 billion US dollars. In China, SAIC, NIO, and other companies regard Luminar’s products as the standard for the next generation of autonomous driving technology solutions. On the other hand, Hesai Technology’s multi-line mechanical rotating LiDAR has little technical advantage compared to solid-state LiDAR, but it has much higher costs. More importantly, its performance reliability is relatively low, making it difficult to meet the vehicle-level standards, so it can only be used on test vehicles. According to the official statement of Hesai Technology, more than 50% of the 65 companies that have been granted open-road autonomous driving test licenses by the California DMV are Hesai Technology’s customers. However, the market capacity of this market is too small compared to that of mass-produced cars.

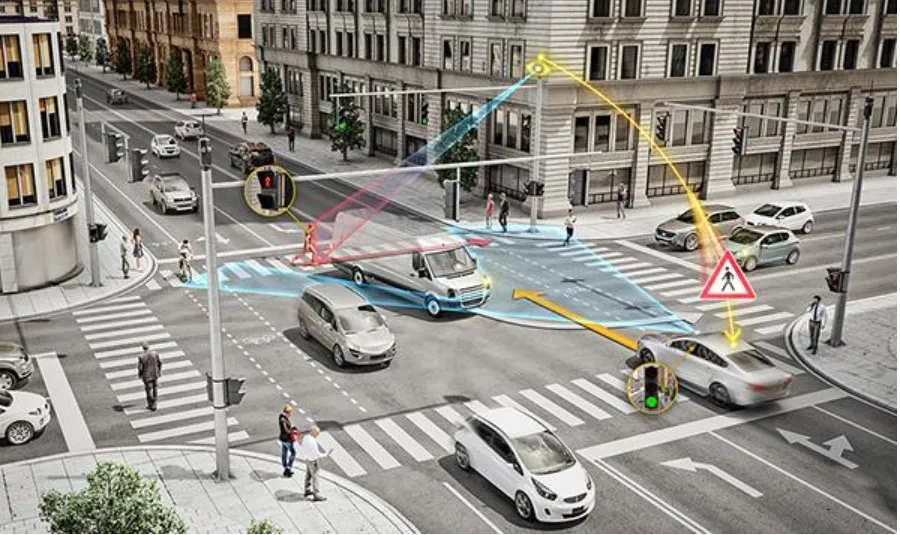

Who is the biggest enemy of LiDAR?Actually, for lidar products, the biggest competition does not come from technical or cost challenges, but from autonomous driving solutions like Tesla’s, which completely abandon lidar. As we all know, due to cost considerations, Tesla’s autonomous driving technology has long excluded lidar, not only mechanical lidar like Velodyne but also solid-state lidar like Luminar. By developing autonomous driving-specific chips with stronger cognitive power, combining massive actual road scene data and machine learning, high-level autonomous driving systems can escape dependence on lidar. In addition, with V2X technology being considered in more and more smart city construction, the demand for sensors in bicycles will continue to decrease, and it is questionable whether lidar will still be needed by then.

For Hesai, not going public is a loss for the company itself, but for Chinese stock investors, it may not be a bad thing. Most Chinese stock investors do not have a very deep understanding of lidar products, and cannot understand the difference between mechanical rotating lidar and solid-state lidar, nor do they know what the two technology routes mean. Now that Hesai has terminated its IPO, it can minimize potential losses for stock investors in the future and maintain the reputation and credibility of the STAR Market.

Looking at the entire intelligent connected vehicle industry, Hesai’s case has strong reference significance. For products such as lidar, because there are multiple technology routes, a slight misstep in the selection or even lagging behind the market pace can lead to complete failure. This is the biggest charm of lidar, or even the entire autonomous driving and intelligent connected vehicles, and why they can focus global capital and attract many well-known technology giants to join in. However, one thing that can be certain among so much uncertainty is that any development of lidar or other core components related to intelligent connected vehicles must revolve around mass production.

Finally

Auto companies are not universities. They value performance and focus more on efficiency. Hesai’s situation should serve as a warning for many high-tech companies in the fields of car networking, new energy, and autonomous driving. In the current situation where chip shortages have caused many automakers to stop production, we should call on many companies that are currently actively involved in chip design and manufacturing to remember the lidar, which was a hot topic a few years ago, to avoid repeating Hesai’s story in the next three to four years.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.