Introduction

Today I want to raise some questions, which are also the problems that many traditional car companies encountered in the field of new energy vehicles in 2020, similar to Geely’s innovative launches of new energy vehicle brands, especially under the homogenized platform, launching the brand new pure electric vehicle brand “Geometry”, firstly, whether it can separate from other brands; Secondly, can establishing a new company and operating independently promote the development of electric vehicles to a higher level?

Note: In the short term, there is no car company that does not pursue high-end brands and simultaneously strive to operate electric vehicles separately. Can this strategy work?

New Energy Vehicle Situation of Geely

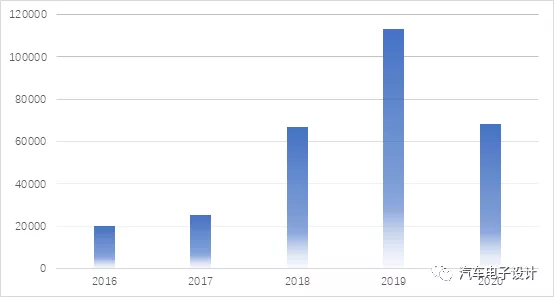

Geely actually started developing new energy vehicles very early, especially around BEV. In 2016, with its first pure electric sedan, Emgrand EV (which began to use CATL battery, making Geely the top-tier car company to use CATL batteries), Geely completed sales of 17,200 units, accounting for 2.24% of the total sales. Based on the same tactics, in 2017, sales of new energy vehicles increased by 47.06% with 25,300 units sold (Emgrand EV sold 23,300 units that year).

In 2018, Geely sold 67,100 new energy vehicles, a year-over-year increase of 165.45%, accounting for an increase in the total sales rate to 4.47% (Emgrand EV sold 31,400 units, a year-over-year increase of 34.74%, contributing 47% of new energy vehicle sales), and Geely began to experiment with a P2.5 PHEV plan, including the very popular Borui GE PHEV.

In 2019, Geely reached a high point in new energy, basically introducing multiple new energy and electrified models. With sales of 113,100 units over the year, it increased by 68.58%, accounting for 8.3% of total sales. During this period, Geely began to focus on the private market, but it was centered around PHEV models, with models released including the Jiaji PHEV, Borui GE PHEV, and Xingyue PHEV; hybrid models accounted for 53% of new energy vehicle sales.

In terms of pure electric, there were basically no significant changes in the product. The Emgrand EV was aimed at the B-side market, while the Emgrand GSe was aimed at the private market, selling 29,400 and 10,800, respectively, and contributing 26% and 9.6% of new energy vehicle sales. During this period, Geely began to promote the Geometry brand. The all-electric sedan Geometry A sold 12,700 units throughout the year, contributing 11% to new energy vehicle sales.Note: In recent years, there has been almost no change in Geely’s Geometry series on BEVs. Starting from 2017, the main modifications around the platform have all been shifted to PHEVs.

By 2020, Geely’s new energy vehicle sales were not particularly good, with a total sales volume of 68,142. Among the BEVs, Geometry A sold 6,196 units, and Geometry C sold 4,185 units. Actually, in 2021, the sales of the Geometry series are also unsatisfactory. The collision data of Geometry in January was more than 800, and in February, it was 368.

The overall sales of Polestar, which Volvo came to do, are not very ideal either, with only 365 vehicles insured in 2020. Then, they came up with a Maple Leaf brand, which is a try for battery swapping. From the overall operation point of view, Geely tends to keep trying, but the investment in each segment is not enough.

Note: Polestar’s sales in Europe are still good, and the overall trend is upwards.

How many brands can the vast architecture support?

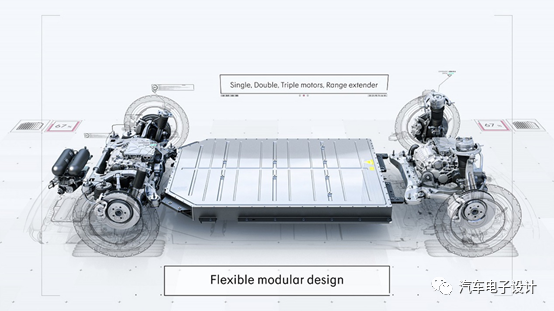

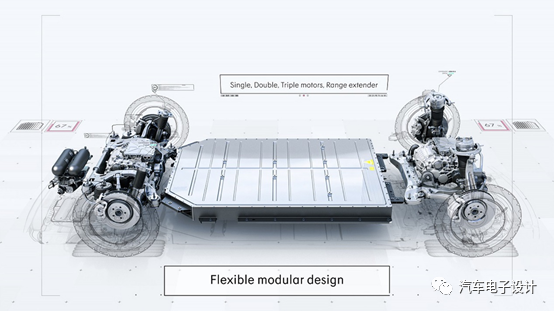

What Geely currently has on hand is the SEA architecture shown before. This architecture has three electric parts. From the overall perspective, this is very similar to MEB, and it is also an architecture designed around the rear-drive system.

From an overall perspective, the SEA architecture achieves full coverage from A-class cars to E-class cars, with wheelbases ranging from 1800-3300mm. Correspondingly, the battery length is also divided into several sizes to match this wheelbase span.

The initial layout of this battery system should be based on the 590 module. The promotion was very aggressive, including 200,000 km non-attenuation and 2 million km long life, which still explains the highest goal of the architecture so far.

This means that in the future, Geely will not only use this extendable architecture for the Ji Ke brand, but also for Volvo, Polestar, Lynk & Co., and possibly Geometry and Emgrand sections.The challenge here is to cover a price range of 120,000 to 400,000 yuan with different configurations of interior and exterior designs, coupled with different EE systems. Why would consumers pay a premium for a single architecture with similar powertrain characteristics?

The real challenge lies in these artificial brand divisions. Consumers cannot see the differences in vehicle characteristics placed under different brands.

Conclusion

My question is whether Volkswagen can differentiate across multiple brands with a single architecture. There is currently no answer to this question in China, and Geely’s attempt to replicate such an operation may not be successful.

In the past, the promotion of the PHEV platform did not produce good results in practice. Placing PHEVs and traditional cars together for sale did not generate good sales. Simply launching a bunch of electric cars may also disappoint consumers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.