Investment Insights on Autonomous Driving

By Feng Xiangcheng

With the overall shift of primary market investment stages and the differentiation of secondary market sectors, autonomous driving has become an unstoppable strategic trend as a hot topic. As one of the few focus points at the angel round and related sectors in the secondary market, today I will talk about some investment insights in this field.

When it comes to investment essence, the first thing to recognize should be the market roles, the depth of these roles, growth logic and ceiling. Let’s discuss briefly:

Market Roles

Market roles are an important factor that directly affects the development ceiling and also affects the boundary conditions between market objects and market capacity. Autonomous driving companies include many segmented fields, mainly focusing on:

-

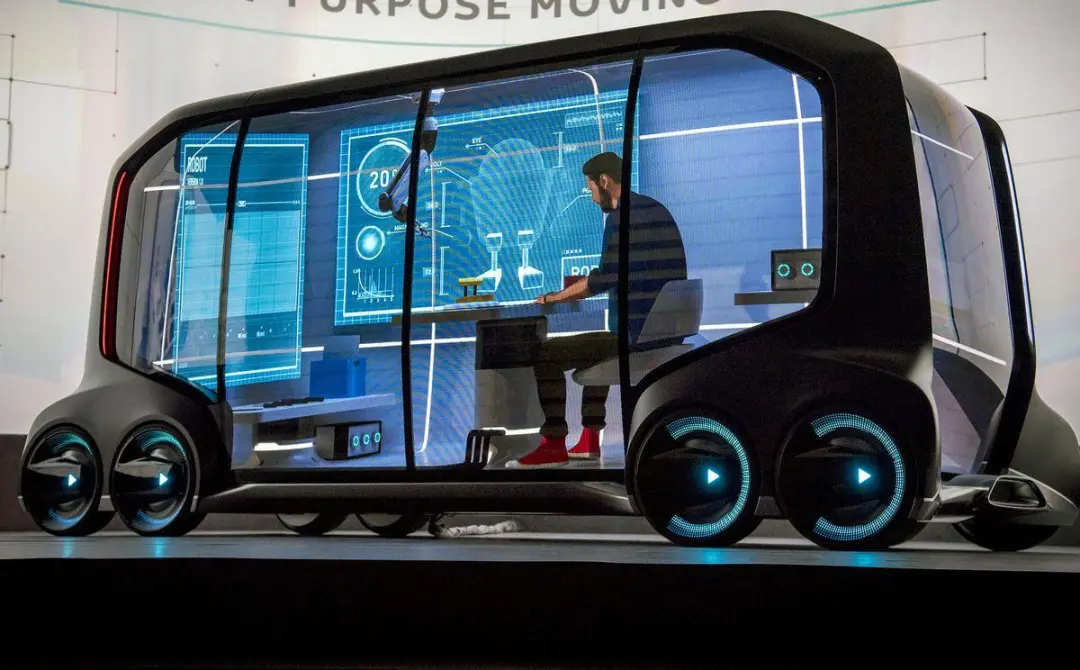

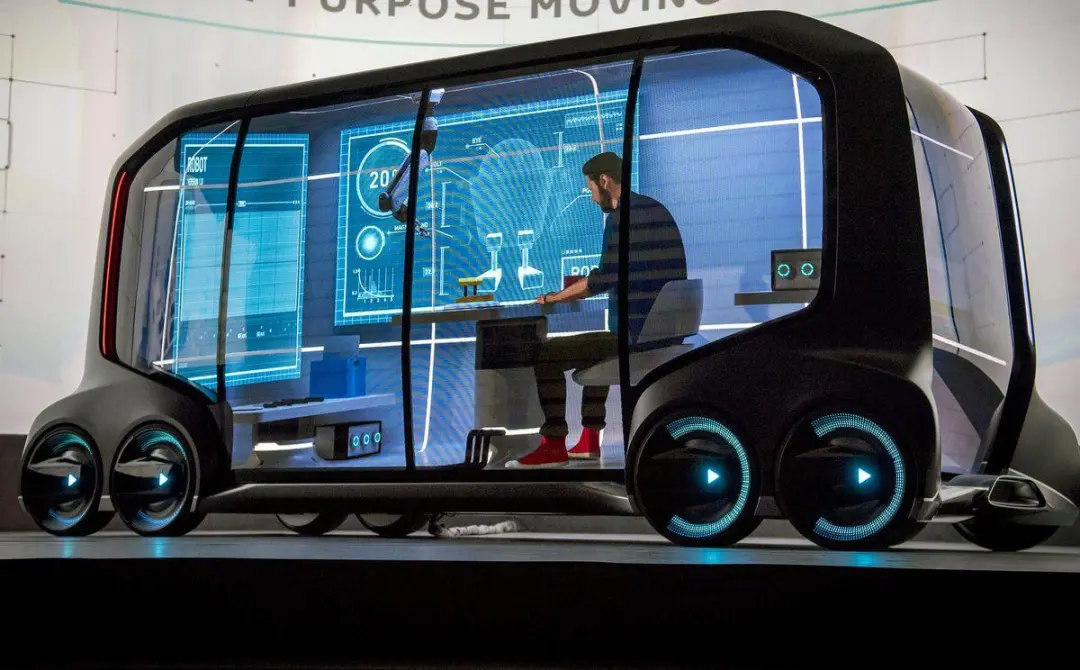

Autonomous driving whole-vehicle products

-

Autonomous driving systems and component products

-

Autonomous driving R&D tool chain products and technical services

-

Autonomous driving ecological fields based on specific solutions

-

Areas that promote industry development

The first three are relatively easy to understand:

The first is the complete product of autonomous driving cars;

The second is the key systems and components that make up autonomous driving cars, such as lidar, millimeter wave radar, cameras, autonomous driving computing platform, algorithm software, and line controlling chassis for autonomous driving;

The third is the product and service providers for autonomous driving R&D testing including autonomous driving algorithm verification and testing, autonomous driving simulation and testing, autonomous driving human-machine interaction, among others. There are many sub-directions in it, and businesses dedicated to automatic driving scene library and sensor simulation. This area is quite complex and is strongly related to solution design, which we will discuss further later.

The fourth is the autonomous driving ecological fields based on specific solutions. For example, we know that the autonomous driving solutions in Europe and America are mainly single-bike intelligence-based solutions, while the one that is currently popular in China is the collaborative car-road solutions. Car-road collaboration means that autonomous driving solutions are not only limited to the car body itself, but it will extend to road facilities and other supporting systems, such as roadside units (RSUs/RCUs) for communication between cars and roads, and communication methods (5G base stations), etc. The car is only a relatively important part of it, the most critical main body, and it must have a decoupled operating mechanism.

The fifth is the area that promotes industry development. The establishment of a new product and new ecological model is inevitably related to the emergence of institutions such as access, rights and responsibilities, and the management of pre- and post-markets. To explain this further, the insurance industry will be an important guarantee for L3 and above autonomous driving vehicles on the road. Insurance is almost the only solution to avoid risks or legalize risks under immature, unstable technology, and uncertain risks.

Roles’ DepthInvestors all understand one thing, which is the capability of how far a company can go. In my personal opinion, it depends on the following factors:

-

The importance of the enterprise’s core technology in autonomous driving products or their development.

-

Ownership of the core technology. This is crucial because the core technology of many domestic companies is under agency relationships.

-

The ability to iterate technology, which is in turn essential for survival, to adapt and upgrade existing core technology.

-

Industry recognition of the technology, which is more meaningful for short-term investments. Industry recognition means the ability to keep up with the trend of development. Of course, disruptive technologies and new trends are not ruled out, which also need to be evaluated for disruptive capabilities.

-

The coupling of technology with products, the degree to which technology can be deeply integrated into products, or whether it is just a concept that has not yet been combined.

-

The risk of technology stage effects, whether the technology is in a development stage where it can be replaced or is itself transitional technology.

-

The difference between product profits and the cost of iteratively investing in products, as well as the trend of this difference.

-

The composition and expansion ability of the team’s core technical personnel.

Growth Logic

Growth logic is of great research value for investment in the technology field. Although many do not grow or decline according to the growth logic of traditional industries, one decisive factor is that they will develop along with the overall development of the industry. This means that it is essential to judge the overall industry and the technology solutions supporting the industry, but there will also be differences in the following areas based on the different follow-up methods or stages of products and company businesses:

-

For companies of the type of autonomous driving whole vehicles and their components (systems, components), their explosive power and tension depend entirely on the maturity, development trends, and policies and regulations of the overall industry. For example, the sales volume of L3+ whole vehicle system products (high-precision maps, lidars) rigidly depends on the quantity of L3+ whole vehicle products.

-

For technical solution and R&D service providers, there will be great tension from the initial stage of industry development to the maturity stage. The growth logic of this area mainly depends on the degree of compatibility between their own technology and product development trends. On the one hand, it depends on the demand for the product itself, and on the other hand, it requires active guidance for new method schemes. From an investment perspective, it is more about betting on an industry or solution’s competitiveness.

-

One thing to note is that there are some differences between the development of the autonomous driving automobile industry and the new energy automobile industry. The first difference is that the technological stages at the beginning of autonomous driving and new energy vehicles are completely different. New energy vehicles have more mature technological solutions that date back to more than a century ago, even before gasoline-powered vehicles. On the other hand, autonomous driving is a technology that began almost from scratch, with far less accumulated experience and maturity, and the level of general applicability is far from enough, basically being deepened through iterative functional upgrades.

Ceiling

This is a very difficult problem to define, but one thing is certain: the overall depth of industry development depends on the maturity of technology, which is manifested in the following aspects:

-

The functionality meets the expected design and the cost is in line with the quantified positioning;

-

The function can be realized with stable and safe operation, achieving a reasonable traffic safety accident rate;

-

There are mature risk avoidance mechanisms, as well as handling strategies and mechanisms for dangerous working conditions;

-

Mature road policies and insurance mechanisms, clear and reasonable division of rights and responsibilities (L3 certification is particularly challenging);

-

Perfect after-sales and service system;

-

Scientific product testing access and road assessment mechanisms.

The above are the difficulties and considerations for how far we can go. Of course, there are many other factors that we won’t discuss one by one, so let’s stop here.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.