Introduction

The rapid growth of new energy vehicle sales in Europe in 2020 has objectively made European automakers transform quickly. On the other hand, it is similar to the problem in China.

Regarding the issue of the subsidy policy’s continuous cycle, a few days ago, the British government updated its subsidy policy, reducing the amount of subsidies for new energy vehicles from £3000 to £2500 and lowering the price limit from £50,000 to £35,000. This means that existing BEV models such as the Model 3 have lost their subsidy eligibility.

Note: China’s defined subsidy limit of 300,000 RMB is also similar. Germany may continue to provide direct money for some time in Europe, while other governments will have an exit mechanism, relying on taxation and zero-emission areas to drive transformation.

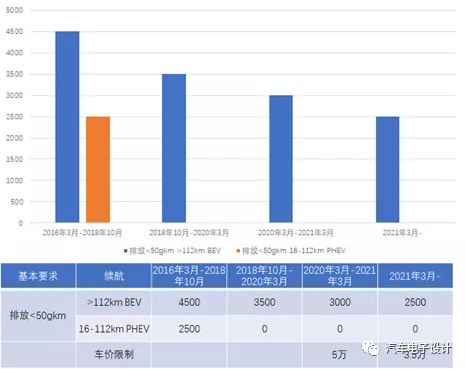

Analysis of the UK’s new energy vehicle subsidy policy

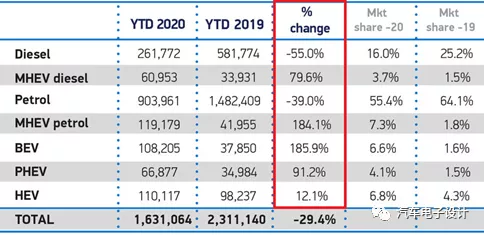

In 2020, the UK’s car sales were 1.63 million units, a year-on-year decrease of 29.4%, the lowest level since 1992. However, sales of new energy vehicles have increased significantly, accounting for over 10% of UK sales. In 2020, a total of 175,000 new energy vehicles were sold, including 108,000 BEVs and 66,800 PHEVs.

On the government website, there is a list of plug-in car-van grants, as shown below. Currently, compliant models below £35,000 tend to be small cars, including the ID3, but the price of the ID4 is £37,800, which is excluded. The KONA 64 kwh and the Model 3 are also excluded.

Note: Regarding subsidies, there is also a lot of controversy overseas. A previous report questioned the effectiveness of the British government’s new energy vehicle subsidies. This time, the British government’s reason is that since 2019, the number of pure electric vehicles on the market that cost less than £35,000 has increased by nearly 50%. This threshold increase and the amount reduction can still resist 100% growth, as the previously planned funding pool is limited.

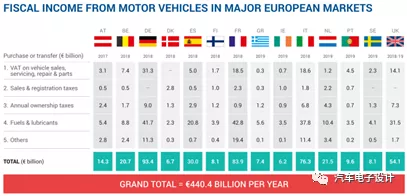

Actually, this can also be understood that the major EU countries receive a lot of money from the automotive industry every year, and the strategy of shifting to zero emissions is also based on this revenue transfer.

Currently, Germany, France, and the UK have the highest revenue. If the penetration rate of BEVs rises rapidly to a certain extent, they will have fewer available cards to play.

Note: The major source is still fuel tax, which has been accumulated over time.

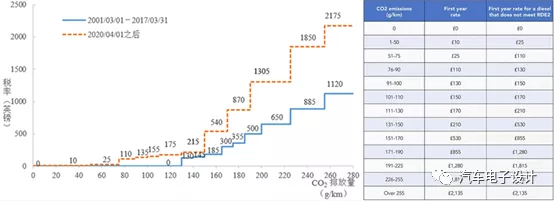

Of course, the British government’s game plan is more long-term from a tax perspective. The difference between purchase tax and retention tax starting from April 2020, as shown in the figure below, further exempts zero-carbon emitting vehicles from car tax, including initial registration tax and standard retention tax.

From what I understand, in addition to the previous MG BEV beginning sales in the United Kingdom, some domestic brands in China will also begin entering the European market through the sale of whole vehicles.

The European market grew too quickly last year, to the point where everyone felt that this part was a steep increase. However, we should also objectively recognize that the main few large markets, Germany, France, the United Kingdom, and Italy, all have positions, and the country has a certain scale of the automotive industry. The high subsidies for new energy vehicles are essentially the governments of these countries’ incentive to stimulate their own national automotive industry’s transformation worries.

Not only policies, but whether core batteries and key components will be limited in the name of Localization in the future is inevitable to some extent.

Note: The two main benefits the government receives from the automotive industry are driving employment and tax revenue, if traditional internal combustion engines are replaced in the short term, a large number of job losses (of course, some form of retirement) and reduced tax revenue may cause relatively serious problems, and this type of stimulus is periodical.

Conclusion

Looking at the situation in China, from dependence on subsidies to everyone starting to abandon them and think of various solutions, every step of growth in new energy vehicles requires phased support, and every rapid growth is easily accompanied by the phased withdrawal of supporting policies. Nevertheless, each time the product strength grows, it also gradually makes new energy vehicles a mainstream choice, which is the historical development process that presents a complete spiral trajectory.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.