On January 7th, the title of the world’s richest person changed hands.

Elon Musk, CEO of Tesla, became the world’s wealthiest person with a net worth of $185 billion, roughly 1.2 trillion RMB, which CNBC called “the fastest ranking billionaire in history.” The company that launched Musk to the top of the billionaire rankings, with rocket-like speed, Tesla, also exploded in the Chinese automobile industry a week ago.

On the first day of 2021, Tesla announced the price of the domestically-produced Model Y: 339,900 yuan, compared to the originally-priced long-range version at 484,800 yuan, a direct reduction of 148,100 yuan. After the price was announced, people’s speculation about Tesla changed from “will the price drop” to “when will it drop again” and “how much further can the price drop?” Is Tesla’s frequent price reduction just to “cut leeks”?

According to Guosen Securities research, the production cost of the domestically produced Model Y is 237,930 yuan, corresponding to a selling price of 339,900 yuan, with a gross profit margin of up to 30%. Although gross profit margin does not represent the final net profit, Tesla’s direct sales model and personnel costs are much lower than those of traditional car companies, leaving Tesla with a lot of room to lower costs.

How does Tesla manage to keep their costs so low?

First, minimalistic design reduces costs from the source. At the beginning of its debut, Tesla was referred to as the “Apple of the car industry” by many, and one of the reasons for this is that they both have minimalist design. Unlike traditional car designs, Tesla relies more on subtraction in its design, such as eliminating physical buttons and gauges, and replacing them with a large screen; eliminating complex interior design and using simple interactions to meet functional needs… From the interior to the body, this simple design creates a sense of technology and, at the same time, minimizes the cost of production.

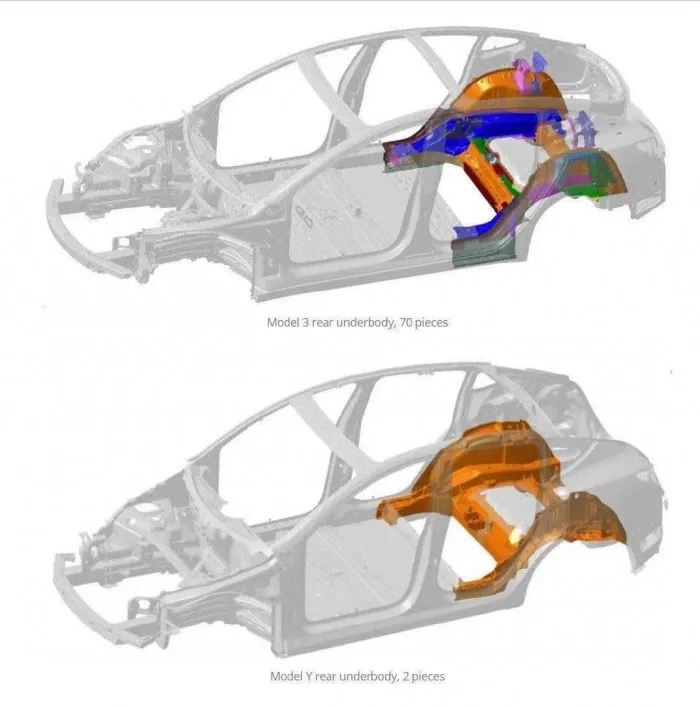

Second, high automation saves production costs. A year ago, Musk’s comments about “when we have a large casting machine, the body will reduce from 70 parts to one part” ignited speculation about Tesla’s casting integrated bodywork. Indeed, the recently released comparison chart of the Model Y’s bodywork confirmed everyone’s speculation.

Compared to the Model 3, the Model Y’s body is reduced from 70 parts to 2 parts. Similar simplified structures in the manufacturing of the entire vehicle are not uncommon.As an essential component connecting various parts of a car, the internal wiring harness can be several kilometers long in conventional gasoline-powered vehicles. Tesla has integrated the wiring harness into subcomponents with controllers, reducing the length of the wiring harness from 3 km in the Model S to 100 m in the Model Y. This modular design not only reduces material costs but also saves labor and facilitates assembly on the production line.

Although the initial research and development of these designs and the construction of the production line require significant investment, with the increase in productivity and improvement of production efficiency, the cost per vehicle has decreased.

Thirdly, with the massive increase in production capacity, the cost per vehicle is spread out. According to Tesla’s data, the production capacity reached 509,737 vehicles in 2020, and it delivered 499,550 vehicles per year, which is largely credited to the contribution of the Shanghai Super Factory. The operation of the Shanghai factory has improved Tesla’s production capacity and directly reduced production costs. It is reported that the production cost for the Model 3 line in the Shanghai factory is nearly 65% lower than that in the US factory on a per unit basis. Moreover, the increase in production capacity has brought more benefits.

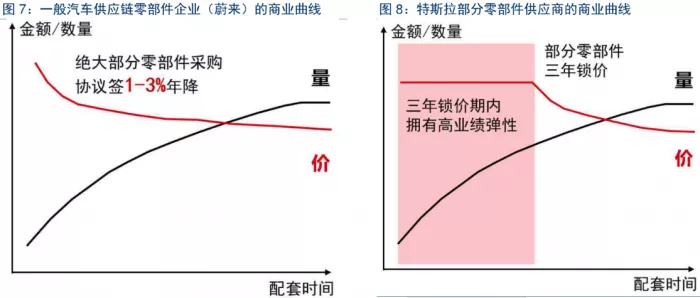

In the early days, due to the small scale of production and the requirement for breakthrough electric vehicle performance, Tesla used a three-year locked-in pricing strategy when choosing suppliers, resulting in higher premiums for early-stage components compared with the traditional brand annual price reduction strategy. Now, with the increase in production capacity and the expiration of the three-year locked-in pricing period, the procurement cost of components has been significantly reduced.

Fourthly, localizing components helps to control costs. The local production of the Shanghai factory has not only reduced tariffs and transportation costs but also contributed to the cost reduction by localizing components. For example, the joint effort with CATL on the battery pack of the Model 3 reduced the material cost from over 150,000 yuan to less than 140,000 yuan. It is expected that the Shanghai factory’s production cost for the Model 3 will have a further 6% reduction after full localization. With the Model Y sharing about 75% of components with the Model 3, the cost reduction brought by localizing components can be easily imagined.

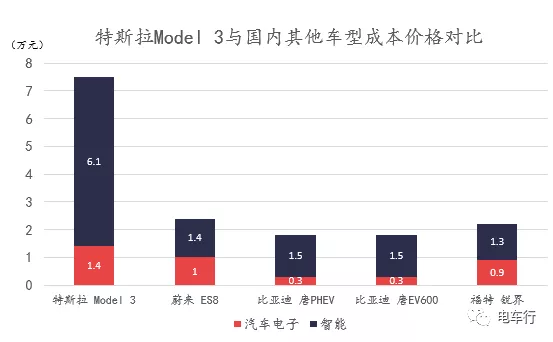

Fifthly, changes in the business model have lowered the threshold for purchasing a vehicle. With the increase in the level of intelligence, the cost structure of cars is also changing. Currently, electronic products account for 35% of the BOM in EVs, including 12% of powertrain electronic products. Some predict that by 2030, electronic products and software will account for 50% of the BOM cost of cars, with software alone accounting for 30%.

Compared with other vehicle models, Tesla’s intelligent functions account for a high proportion of the total cost.

How to lower the price while increasing the cost of intelligence?

Unlike the traditional business model of selling vehicle hardware for gasoline-powered cars, Tesla has transformed the business model of electric vehicles into a combination of hardware and software services through embedded hardware. For example, users can spend RMB 339,900 to buy a Model Y and additional RMB 64,000 to experience Autopilot’s functions. After purchasing a Tesla, users can also pay for OTA upgrades to remotely increase the acceleration from 4.6 seconds to 4.1 seconds per 100 kilometers. This “software-driven hardware, co-defining products” model not only reduces hardware iteration and update costs but also shortens the waiting period for users to experience new technologies, and lowers the entry barrier for buying a car. Whether to pay for new features is up to individual car owners.

Tesla’s positioning becomes clearer

In 2012, when the first Model S appeared, it left consumers with the impression of a luxurious car brand, at least in terms of price. However, Tesla’s positioning was not the same. As Elon Musk said when the Model Y was launched, it was a compact SUV that “everyone can afford.” In a recent interview, he also talked about Tesla’s sales in ten years, saying, “There are about 2 billion cars and trucks running in the world, and that number is still growing. We believe that we want to replace 1% of the global fleet every year. To make real progress, we must break the decimal point. So Tesla needs to sell about 20 million cars per year.” Tesla’s goal is not to be a niche high-tech, high-end brand but rather to create a national car brand like Ford did with the Model T and Volkswagen with the Beetle.

When Tesla announced plans to open up its superchargers to other companies and license Autopilot and batteries, we found that the price cuts for the Model Y and Model 3 weren’t about grabbing a share of the electric car market but about creating a bigger pie, the one that’s still held by gasoline-powered cars. With this brand positioning, it seems reasonable for Tesla to continuously lower its prices.

Under the pressure of price cuts, what will other brands do?With the launch of the Model Y, Tesla’s SUV model has entered the 300,000+ price range. Currently, both emerging new energy vehicle automakers such as NIO ES6 (358,000), EC6 (368,000), and Li Auto ONE (328,000), and traditional internal combustion engine vehicles such as BMW X3 (389,800), Mercedes-Benz GLC (397,800), and Audi Q5 (387,800) have a strong new competitor in the domestic market due to the introduction of the Model Y. Will they follow Tesla’s frequent price adjustments and engage in a price war, or stick to their pricing strategies?

Accelerating the Trend of Electric Vehicle Price Reductions

Although several electric vehicle brands have not yet made any adjustments to their pricing, we can see the long-term trend of decreasing electric vehicle costs from Tesla’s cost reductions. As the electric vehicle market expands and brand production capacity increases, and with the continuously matured supply chain and production lines, material and production costs will gradually decrease. Additionally, the significant R&D investments made in the early stages of these brands will be alleviated by increases in production volume. In the traditional industrial history of internal combustion engines, this trend of product price decreases with industrial technological maturity might take more than a decade or even several decades to appear, while Tesla’s series of actions has undoubtedly accelerated changes in the electric vehicle market. In the future, electric vehicle brands’ exploration of cost reduction will not stop.

Brand Differentiation: Sticking to Strategies Amid Changes

In the second half of 2020, domestic electric vehicle sales continued to rise. With the expansion of the electric vehicle market, besides price and range, consumers are increasingly evaluating electric vehicles from multiple angles, such as the experience of the vehicle infotainment system, cabin comfort, and brand services, just like they would when purchasing internal combustion engine vehicles. Just as Tesla positions itself as the electric national car, and NIO as the “BBA” of their own, establishing differentiation and clear brand positioning is the key to adapting to changes in future fierce market competition.

Conclusion

Every time Tesla reduces prices, “shearing leeks” becomes a hot topic of discussion. Looking back at the century-long industrial history of internal combustion engines, cost reductions, customer diversification, and brand positioning differentiation are all inevitable developments as technology advances and the market expands. In this youthful electric vehicle market, with Tesla’s stirring, it is accelerating to experience what it should undergo. Just like Musk’s response to becoming the world’s richest man, “alright, back to work.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.