According to Reuters, Ma Yilong has been sued by a shareholder, accusing him of violating the settlement agreement reached with the Securities and Exchange Commission (SEC) in 2018 on using Twitter.

On Thursday evening, the Delaware Chancery Court released a complaint. The unstable tweets of Musk on Twitter and the Tesla board’s failure to ensure that he complied with the settlement agreement with SEC resulted in billions of dollars in losses for shareholders. Ma Yilong and the Tesla board are both defendants.

Ma Yilong has always liked to stir up trouble on Twitter, although many people believe that this is also part of his charm. In August 2018, Ma Yilong tweeted that there was “funding” to take Tesla private. In fact, Ma Yilong did not have enough funds to complete the privatization.

Later, Ma Yilong and Tesla each paid a civil fine of USD 20 million and agreed to review some of Ma Yilong’s upcoming tweets in advance.

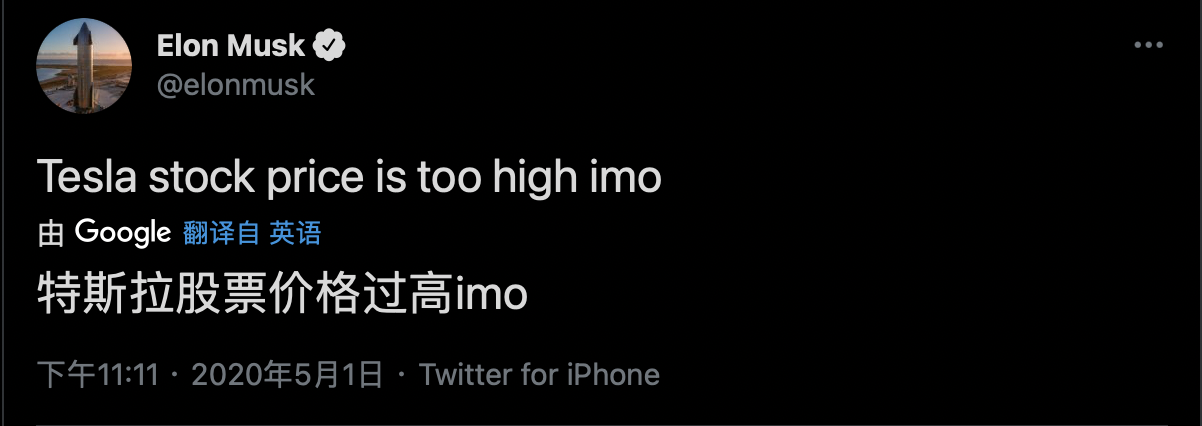

But on May 1st last year, Ma Yilong tweeted again, claiming that Tesla’s valuation was “too high”, causing Tesla’s market value to evaporate by $13 billion in an instant, and many Tesla investors were lamenting. Plaintiff Chase Gharrity stated that Musk’s behavior and the inaction of the Tesla board caused them “huge economic losses” and sought economic compensation. During this time, the SEC did not publicly criticize Ma Yilong.

Although neither the official Tesla nor Tesla’s lawyers have made any response, the anger of many investors seems to have been ignited.🔗Source of information: Reuters, Twitter Elon Musk, QUARTZ

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.