*Author: Wang Lingfang

After entering 2021, power battery companies have frequently issued price adjustment letters.

Since January, Far East Battery, Zhongneng, Eve Energy, Penghui, Hengdian Dongci, and Delong Energy and other companies have successively issued price adjustment letters, hoping to raise battery prices.

“This is a very rare situation. You have to know that unless you have to, generally companies are unwilling to raise prices.” A relevant person in charge of a battery company revealed the reason, “If we can avoid raising prices, we will try our best.”

“The automakers are still trying to push down prices.” Another sales director of a battery company told Electric Vehicle Observer, “If battery materials continue to rise, the best result we can strive for may be not lowering the price.”

Squeezed by rising and falling prices, battery companies are struggling.

Battery Materials Surge

The price increase trend began in the second half of last year, to be precise, in November.

Price Rise of Battery Raw Materials

The market manager of a positive electrode material company said to Electric Vehicle Observer that the most obvious increases are in positive electrode materials and electrolytes, mainly including lithium carbonate, precursor, and lithium hexafluorophosphate. Negative electrode materials are relatively stable.

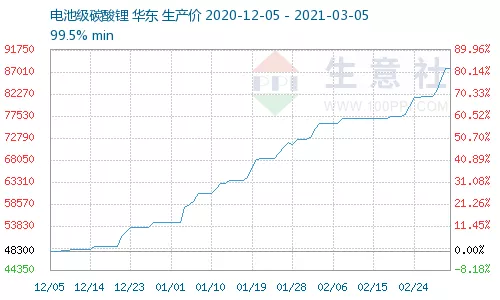

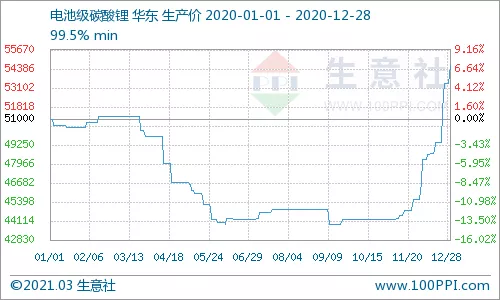

(1) Lithium carbonate prices have increased by more than 80%.

Lithium carbonate is an indispensable raw material for lithium battery positive electrode materials and electrolytes. The increase in the price of lithium carbonate will directly increase the cost of positive electrode materials and electrolytes.

From the price curve chart of Shengyin Business Information Co. Ltd., we can see that from May to November last year was the low valley period of lithium carbonate prices: at that time, affected by the epidemic, the terminal demand was relatively weak, and the overall market was sluggish.

With the control of the domestic epidemic in the second half of the year, there were obvious signs of market recovery. As the weather turned colder in winter, the production of lithium mines such as salt lakes decreased, the reduction of lithium carbonate inventory, and the growth of demand in the electric vehicle market have driven the continuous rise in the price of lithium carbonate.According to the data from SCI, as of March 5th, the price of lithium carbonate has surged to RMB 87,000, an increase of 80% compared to the price of RMB 48,000 at the end of last year.

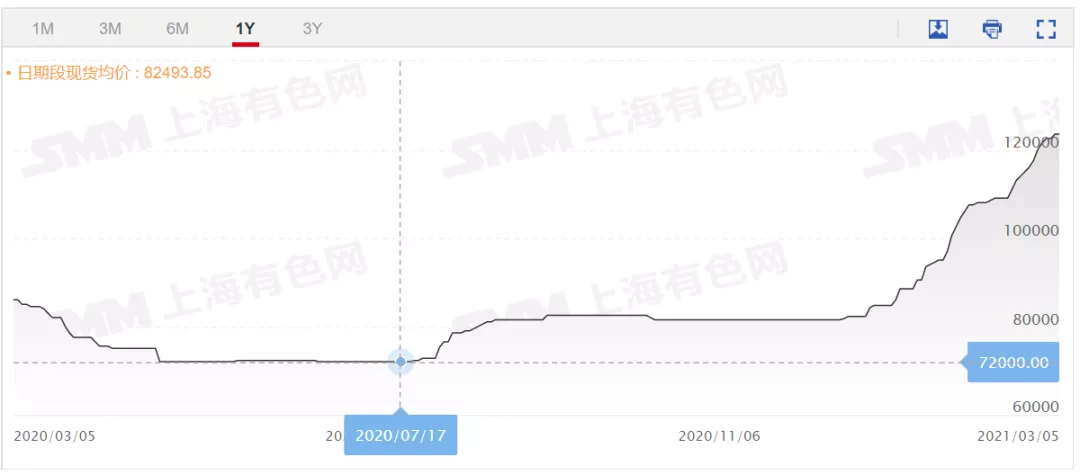

(2) The price of ternary precursor has risen by 67% since the end of last year.

The price of ternary precursor has increased from about RMB 72,000 in July 2020 to around RMB 120,000 in March 2021, an increase of 67%, which is relatively small compared to other materials. Ternary precursor can be understood as a semi-finished product of ternary cathode materials.

Meidu Haichuang is a research and development manufacturer of ternary cathode materials and ternary precursor. Liang Lingchuan, the procurement manager, told “Electric Vehicle Observer” that the rise in the price of cathode materials is entirely due to a shortage of raw materials. “The supply of cobalt sulfate and nickel sulfate in the market is tight, and even with production capacity, there is no raw material supply.”

Ternary precursor 523 price trend

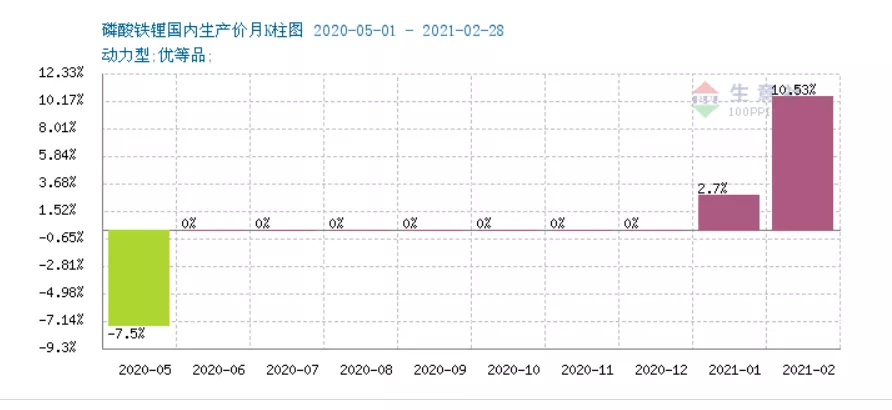

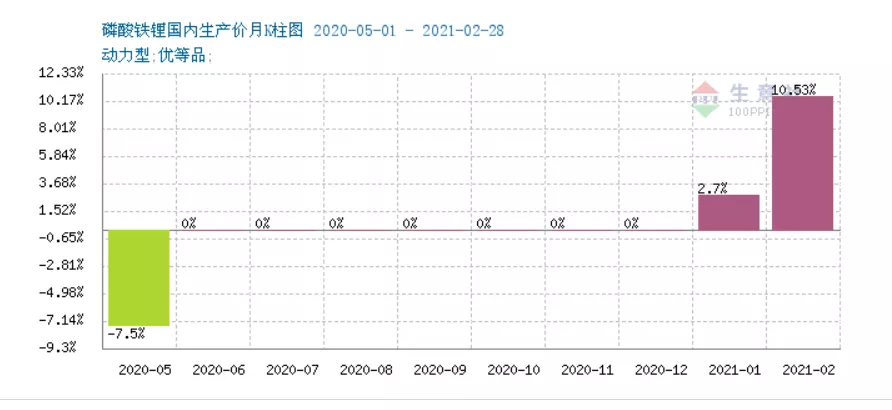

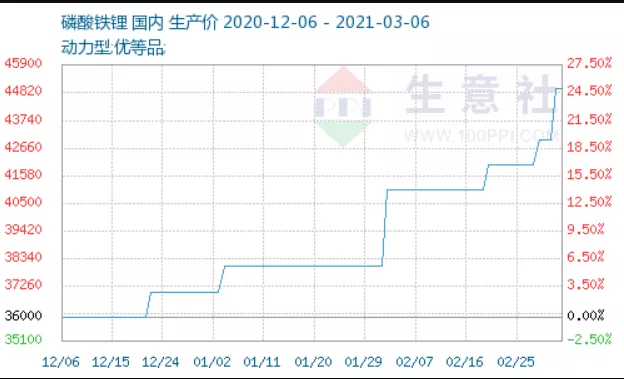

(3) Lithium iron phosphate fluctuates upward by 24%.

The growth of lithium iron phosphate cathode materials began in January this year, especially in February it rose sharply.

According to the data from SCI, as of March 5th, the mainstream quotation of power-type lithium iron phosphate was between RMB 43,000 and RMB 48,000 per ton, and the price is still on an upward trend.

Since January, lithium iron phosphate cathode materials have fluctuated upward by more than 24%, with unclear future growth prospects.

(4) Insufficient supply of lithium hexafluorophosphate and additives.

Another raw material with a significant increase in price is lithium hexafluorophosphate, which is an important component of electrolyte.

Due to tight supply, the price of lithium hexafluorophosphate has doubled from its lowest point of RMB 64,000/ton in 2020 to RMB 115,000/ton in January 2021. As of now, the price of lithium hexafluorophosphate has reached around RMB 200,000/ton.

Guo Yingjun, Chairman of Xianghe Kunlun Chemical Products Co., Ltd., a comprehensive supplier of electrolytes, has a deep understanding of the shortage of raw materials causing supply shortages.Guo Yingjun told “Electric Vehicle Observer” that the additive Vinylene Carbonate (VC) is even more important than lithium hexafluorophosphate. “VC is an important additive in the electrolyte, which helps the formation of SEI film and prevents further reduction and decomposition of the electrolyte at the negative electrode surface.”

The tight supply of these raw materials has made them very cautious in receiving customers and increasing production, for fear of serious consequences of supply shortages for customers.

(5) Copper foils, cobalt, etc. are all rising sharply.

On March 3, market data showed that the average price of 6 μm copper foil and 8 μm copper foil rose to 117,000 yuan/ton and 103,000 yuan/ton, respectively, up 18% and 24% from the early January prices of 99,000 yuan/ton and 83,000 yuan/ton.

Deng Yongkang, chief analyst of power equipment and new energy at Anxin Securities, believes that from the supply and demand pattern of copper foil, especially the high-quality capacity of 6μ and below, copper foil (processing fees) still has a demand for price increases.

The price of cobalt has also risen significantly year-on-year, from over 260,000 yuan at the end of December to 400,000 yuan in March, with a slight downward trend at present.

As we can see, battery raw materials are experiencing a general price increase.

However, Li Jigang, general manager of the positive electrode material company Tianjin Scoland Technology Co., Ltd., believes that the price increase of battery raw materials is already relatively restrained.

He reported a set of numbers to “Electric Vehicle Observer”: “As of the end of February, 1,4-Butanediol has risen by 200% year-on-year, n-Butanol has risen by 180%, sulfur has risen by 153%. Lithium carbonate has only risen by 70%, which is already one of the lowest-rising products.”

In Deng Yongkang’s view, this relatively low growth is mainly due to the limited endurance of the battery industry. “Positive electrode materials can’t be sold at a high price, and battery companies can’t bear it.”

Li Jigang and Deng Yongkang share similar views. Li Jigang believes that battery costs will increase by about 20%. “Material companies will bear as much as they can, and will only pass on to downstream if they can’t.”

From what “Electric Vehicle Observer” understands, most automakers have not yet received requests for price hikes, and battery companies are also rarely in a situation where they ask automakers for price hikes.

Reasons for growth:

Demand last year and inflation expectations this year

Why did prices suddenly rise?After communicating with raw material suppliers and relevant experts, “EV Observer” believes that the current increase in raw material prices is mainly due to four factors: rising demand, short-term supply-demand imbalance, insufficient production capacity, and inflation expectations.

Firstly, the demand for new energy vehicles, electric bicycles, electronic products, and other items has increased. According to CPCA statistics, in 2020, production and sales of new energy vehicles reached 1.366 million and 1.367 million units respectively, an increase of 7.5% and 10.9% YoY, respectively, hitting a historic high. According to the data released by the Ministry of Industry and Information Technology, the output of China’s electric bicycle enterprises above designated size reached 29.66 million units in 2020, a YoY increase of 29.7%. China Motorcycle Industry Association data shows that in 2020, electric motorcycle sales totaled 2.2954 million units, a YoY increase of 20.91%. In addition, the rapid growth of smart devices, 3C products, and other items has also driven the demand for batteries.

Secondly, the off-season was not weak, and short-term supply-demand mismatch led to the price surge. Whether it is due to insufficient production capacity or raw material supply, this is caused by a mismatch in the supply-demand relationship. Normally, affected by the Spring Festival holiday, automobile production and sales belong to the relative offseason in the first quarter. But this year is entirely different. As early as January, CATL announced that it would continue to work overtime during the Spring Festival holiday, with frontline employees able to receive a monthly salary of 13,100 yuan. In January, Penghui Energy stated on its interactive platform that the company’s power batteries were continuously being shipped, and the production line was fully operational, with the sales of power batteries continuing to increase. All the power batteries produced and sold at present are LFP batteries. During the Spring Festival, China National Grid’s bases in Hefei, Lujiang, Tangshan, Qingdao, and Nanjing were all working overtime to produce. At the same time, the suspension of production in winter in salt lakes, the financial crisis of Tianqi Lithium, and the entry of Altura Mining, one of Australia’s five largest lithium mines, into bankruptcy management, have led to a short-term supply shortage of lithium carbonate. When battery head enterprises work overtime to produce, they will stock up on large amounts of raw materials. The short-term supply-demand mismatch in the market is evident. It can be said that since November 2020, the price of lithium carbonate has been skyrocketing. The problem of lithium carbonate’s supply at the supply end was gradually eased as the weather became warmer and the salt lake resumed production.

Thirdly, the insufficient production capacity resulted in a shortage of important raw materials for electrolytes, such as lithium hexafluorophosphate and additives VC (ethylene carbonate).

#### Translation:

#### Translation:

Due to the inventory clearance of lithium hexafluorophosphate in the early stage and a long period of investment construction with high environmental barriers, the surplus of the market capacity is not high, and the construction cycle of new capacity is generally around 1.5-2 years. These factors combined make lithium hexafluorophosphate still in tight supply in the short term.

The supply of VC is similar. When talking about the shortage of supply, Guo Yingjun believes that the shortage of additives is mainly due to insufficient production capacity. “The production process of additives is dangerous and complex, and the project approval is difficult. In addition, the equipment requirements are relatively high, so it is difficult to build production capacity. Therefore, the available market capacity is not much.”

Guo Yingjun stated that VC is an important additive (2%-4% of quality percentage) in the electrolyte of lithium iron phosphate batteries and its usage significantly exceeds that of the electrolyte of ternary lithium batteries (thousandths of quality percentage).

When the proportion of lithium iron phosphate batteries is small, this situation is not obvious. However, the rapid rebound of lithium iron phosphate batteries this year has intensified the shortage of VC.

Guo Yingjun believes that the problem of tight supply of raw materials for electrolytes may continue throughout the year.

Fourth, inflation expectations push up commodity prices

Liang Lingchuan, Li Jigang, and Deng Yongkang all believe that the current growth is closely related to inflation expectations.

Liang Lingchuan analyzed that the soaring price of raw materials is caused by two factors.

On the one hand, the accelerated clearance of raw material inventories since the second half of last year due to the unexpected recovery of the new energy automobile industry has made the three major primary raw materials for lithium batteries, nickel, cobalt, and lithium, in short supply and unable to resume supply in a short time.

On the other hand, the global epidemic situation has not been effectively stabilized, resulting in continued imbalance between supply and demand. With the global monetary liquidity remaining loose under the influence of the epidemic, the US dollar index has been declining, while global commodities and metals are all priced in US dollars. This has led to strong inflation expectations on the asset side, and therefore, the prices of commodity assets have skyrocketed along with the decline of the US dollar.

“In this case, all links including production enterprises and trading companies essentially join together to store goods passively, which contributes to a further shortage of raw materials in the market, thus pushing up the soaring prices of raw materials,” said Liang Lingchuan.

Li Jigang also stated that this price increase is closely related to excessive currency issuance.

Deng Yongkang also believes that the current market price trend has deviated from the supply-demand relationship and is the result of a push-up by inflation expectations.

As for the duration of this upward trend, Deng Yongkang finds it difficult to predict. He believes that major raw materials largely depend on the trend of oil prices, and “if the price of crude oil continues to rise, the upstream raw material prices of power batteries may also maintain a high level.”

Response Strategies:

Trading methods, industry chain layout, and technological innovation

In response to the price hike, material and battery companies will not only passively accept it, but also try to hedge some risks, mainly in the form of short-term and long-term plans.

Of course, different companies have different choices.

(1) Short-term plan: futures, back-to-back orders, and industry chain layout# Material Manufacturers Use Long-term Solutions to Reduce Rare Metals Usage and Develop New Batteries

Material manufacturers lock in raw material prices by purchasing some futures. However, there are relatively few financial talents in material enterprises who can engage in futures trading. Therefore, only a few enterprises can do it.

Some companies also avoid risks by signing back-to-back orders with customers. The main idea is to purchase raw materials while obtaining customer orders. This action is equivalent to obtaining customer loans while releasing loans to suppliers, thus fully avoiding fluctuations in raw material prices. However, due to the procurement cycle, it is difficult to achieve.

Another solution is to lay out the industrial chain and work closely with upstream material vendors to achieve self-sufficiency for raw materials, such as Ningde Times, BYD, and Guoxuan High-Tech.

According to industry insiders, stronger battery companies also use metal price linkage to reduce costs. Upstream material companies can only earn some processing fees.

Of course, for most batteries, feasible ways to reduce the impact of rising raw material prices are to optimize production management, improve technology, and increase product qualification rates.

Long-term Solutions: Reduce the Use of Precious Metals and Develop New Batteries

After multiple rounds of ups and downs in raw material prices, battery companies have realized the importance of breaking free from rare metal control. Concepts such as cobalt-free batteries and precious metal-free batteries have been valued by companies.

In May 2020, SVOLT Energy Technology Co., Ltd. launched two cobalt-free batteries, becoming the world’s first battery manufacturer to successfully develop a cobalt-free battery.

Ningde Times’ ambitions are even greater. They not only plan to achieve cobalt-free batteries but also nickel-free batteries.

In August 2020, at the China Auto Forum, Meng Xiangfeng, assistant to the chairman of Ningde Times, publicly proposed the concept of “rare metal-free batteries”. Meng Xiangfeng stated that Ningde Times is laying out a strategy for “rare metal-free batteries.” He said, “This kind of battery is not only cobalt-free, but also the nickel elements can be replaced, which will increase the vehicle’s endurance and significantly reduce the overall cost.”

In addition to nickel and cobalt, lithium can also be replaced, such as sodium-ion batteries.

Sodium has an advantage in that the sodium element’s content on Earth is thousands of times higher than that of lithium.

Academician Chen Liquan of the Chinese Academy of Engineering mentioned the advantages of sodium-ion batteries at a forum.

Chen Liquan believes that the most outstanding advantage of sodium-ion batteries compared with lithium-ion batteries, as batteries, is their low cost, which is a very core advantage for industrialization. “In the market, the price of lithium carbonate, the lithium raw material, is tens of thousands of yuan per ton; while the price of sodium chloride, the sodium raw material, is only a few thousand yuan per ton.”

Sodium-ion batteries do not contain cobalt, lithium, and copper, and the batteries have higher safety and better thermal stability, which is a safe, sustainable, and cost-effective high-performance technology.

“Compared with lithium iron phosphate batteries (the cheapest lithium-ion battery), the material cost per watt-hour for sodium-ion batteries is 2.6 cents, while that for lithium iron phosphate batteries is 3.4 cents.” Chen Liquan said.“`markdown

However, industry experts believe that the performance of sodium-ion batteries is still about 20 years behind that of lithium batteries. Therefore, the road ahead is still long for sodium-ion batteries to be practically applied.

As for the price increase of power batteries, the sales director of a power battery company mentioned that “as long as the leading enterprises do not raise prices, it is difficult for other companies to follow suit.”

“`

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.