*Author: Winslow

Today’s content is a bit “hard”, but it’s worth reading. I believe that you will gain something after reading it patiently 😊.

After deducting carbon emission trading points, Tesla’s vehicle gross profit margin is about 21%, BMW’s vehicle gross profit margin is 19%, and Toyota’s is 18%. This gross profit margin level represents the profitability of Tesla, BMW and Toyota in vehicle sales.

Looking at the data, it seems that Tesla has a “slight advantage” in cost control over BMW and Toyota. Let’s take a closer look at what the difference represents and whether there is any information that can be explored.

First of all, Tesla is an electric vehicle, while BMW and Toyota are fuel vehicles. The cost structures of these two are completely different.

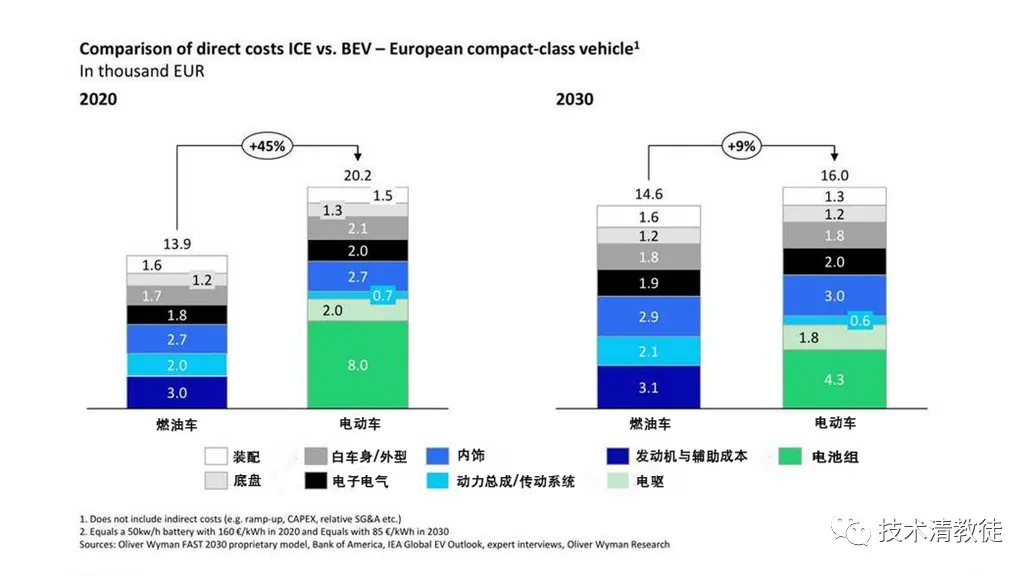

The cost composition of electric vehicles mainly includes body, interior, electric control, battery, and assembly costs. The cost composition of traditional fuel vehicles mainly includes body, interior, powertrain, and assembly costs.

The biggest difference between the two is the electric control and battery of electric vehicles and the powertrain of fuel vehicles. The cost of the entire set of electric control is roughly equivalent to the cost of the powertrain, which means that electric vehicles have an additional cost for the entire battery compared with fuel vehicles.

So looking back, Tesla’s gross profit margin of 21% compared to BMW’s 19% and Toyota’s 18% is not the concept of “slightly superior” in cost control.

The correct expression should be: After adding the cost of the battery, Tesla still achieved a higher gross profit margin than BMW and Toyota. How can we quantify this sentence and compare the cost levels of several companies?

Generally speaking, the battery that electric vehicles have more than fuel vehicles will increase the vehicle cost by about 30%. That is to say, if the battery is removed, Tesla’s gross profit margin for fuel vehicles can reach 50% +.

Of course, this kind of comparison is meaningless, but understanding it the other way around may be more practical. If BMW and Toyota want to make electric vehicles, their gross profit margin will be minus ten percent (-10%). That is to say, the existing cost level cannot support BMW and Toyota to invest heavily in making electric vehicles.

With this conclusion, let’s take a look at why Tesla can be so awesome and why there is such a big difference between leading companies in the automotive industry?

(1) Differences in assembly production efficiency: Tesla advocates integration and automation, defines factory design based on production efficiency, strives to unify models, and emphasizes universality. In contrast, other automakers such as BMW and Toyota are proficient in automation, but they are struggling with integration due to the large number of models, because the advantages of integration can only be fully reflected on the basis of centralized product design and large-scale production.(2) Different design: Tesla optimizes electronic, domain controller and central processing unit design towards electronic and independently develops core components, making the wiring harness more streamlined and saving electrical costs; meanwhile, the interior design is very minimalistic, saving interior cost, whereas BMW and Toyota still use gasoline car platforms to make electric cars, unable to optimize the platform towards electronic aspects and relying on Tier One, unable to streamline wiring harnesses to save costs, and the interior design still follows a luxurious sense, meaning it cannot save costs.

(3) Different sales model: Tesla adopts a direct sales model, with the factory price being the selling price to consumers; BMW and Toyota use a dealership model, with the factory price being the selling price to dealers, who then add a layer of profit to sell to consumers. Therefore, Tesla does not need to share profits with dealers, whereas BMW and Toyota need to share profits with their dealers.

Gross margin is the factory price minus material cost divided by the factory price. Tesla “reduces” material costs by increasing assembly production efficiency and optimizing streamlined designs, and “increases” factory prices through direct marketing. After these efforts to digest battery costs, Tesla achieves a higher gross margin than BMW and Toyota.

Thus, Tesla’s cost barrier is very high, and by continuously lowering prices, traditional companies like BMW and Toyota feel that the threshold for entry into the electric car industry is getting higher. Following their current organizational mechanisms to achieve the same “low price” and provide “equal quality” products means negative margins. Alternatively, they must completely reform their organizations from the above three aspects, and begin following in the footsteps of Tesla.

Tesla is not sitting idly by, however, optimizing batteries is one of the core components for reducing vehicle material costs and increasing gross margins.

Tesla has long been working on optimizing battery costs from both “improving batteries upstream” and “reducing battery capacity on products” perspectives. On one hand, Tesla lays out the upstream industry chain for batteries by buying nickel and lithium mines and researching new technology and new processes whilst developing 2170 and 4680 battery structures.

On the other hand, Tesla is expanding the Supercharger network; as the range requirement and Supercharger network density are inversely proportional, a dense Supercharger network means there will be a foundation for designing short-range electric vehicle products in the future.

If what Tesla said on Battery Day can be achieved, battery costs in the next five years can be reduced to 56% of the current cost, equivalent to Tesla’s electric car gross margin increasing to 34%.

Assuming that advances in battery technology can be a shared outcome for the entire automotive industry, the Supercharger network will become Tesla’s trump card to block BMW and Toyota since short-range electric vehicle products can only be launched in conjunction with a comprehensive and dense Supercharger network.

Therefore, based on the Supercharger network, Tesla can introduce “low-priced and super affordable” short-range electric vehicle products. At present, BMW and Toyota’s charging network layout can be said to be “zero”, making it impossible to launch similar products.It seems that BMW and Toyota have little chance to catch up, from this perspective. Unless from this very moment, BMW and Toyota make a determined transformation to fully embrace electric vehicles. But even so, it will take at least three years to see results, won’t it?

On this track, Tesla is like a diligent bunny, while BMW and Toyota are like lazy turtles.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.