On March 3, XPeng officially released the P7 with the NCM lithium Iron Phosphate battery from CATL, with a battery capacity of 60.2 kWh and a NEDC range of 480 km. The starting price after subsidies is 229,900 yuan.

In terms of price, the standard range rear-wheel drive P7 is on par with the long-range rear-wheel drive P7, but the standard range model comes standard with XPILOT 2.5 driver assistance, and the price after upgrading to XPILOT 3.0 is only 239,900 yuan.

According to the data previously disclosed by XPeng in its financial report, up to 98% of users who purchase P7 models also order XPILOT 2.5 and 3.0 driver assistance features.

Therefore, for many friends who value XPeng’s autonomous driving capabilities, the threshold for owning XPILOT 2.5 or 3.0 has been greatly reduced, undoubtedly further boosting P7’s overall sales.

And the hero behind this success is the lithium iron phosphate battery.

The Return of Lithium Iron Phosphate Batteries

2020 is undoubtedly the “year” of lithium iron phosphate batteries.

Looking back at the development history of China’s new energy vehicles, it can be found that as early as 2015, most electric vehicles on the market were powered by lithium iron phosphate batteries, with a small number using ternary lithium.

However, the threshold for energy density continued to rise in the government’s new energy vehicle subsidy policy. Limited by their electrochemical properties, the energy density of lithium iron phosphate batteries is only about 120 Wh/kg, and the battery capacity is 33.3% lower than that of high-nickel ternary lithium batteries of the same weight.

Subsidy policies and users’ demand for energy density and range are still high, causing ternary lithium batteries to gradually become a more mainstream choice.

Of course, thanks to policy support, ternary lithium batteries have also seen rapid development in recent years.

Before 2020, the market share of lithium iron phosphate batteries had continuously declined from 68.6% in 2015 to 32.0% in 2019, while the market share of ternary lithium batteries increased from 28.4% to 61.7%.

But this trend reversed in 2020.

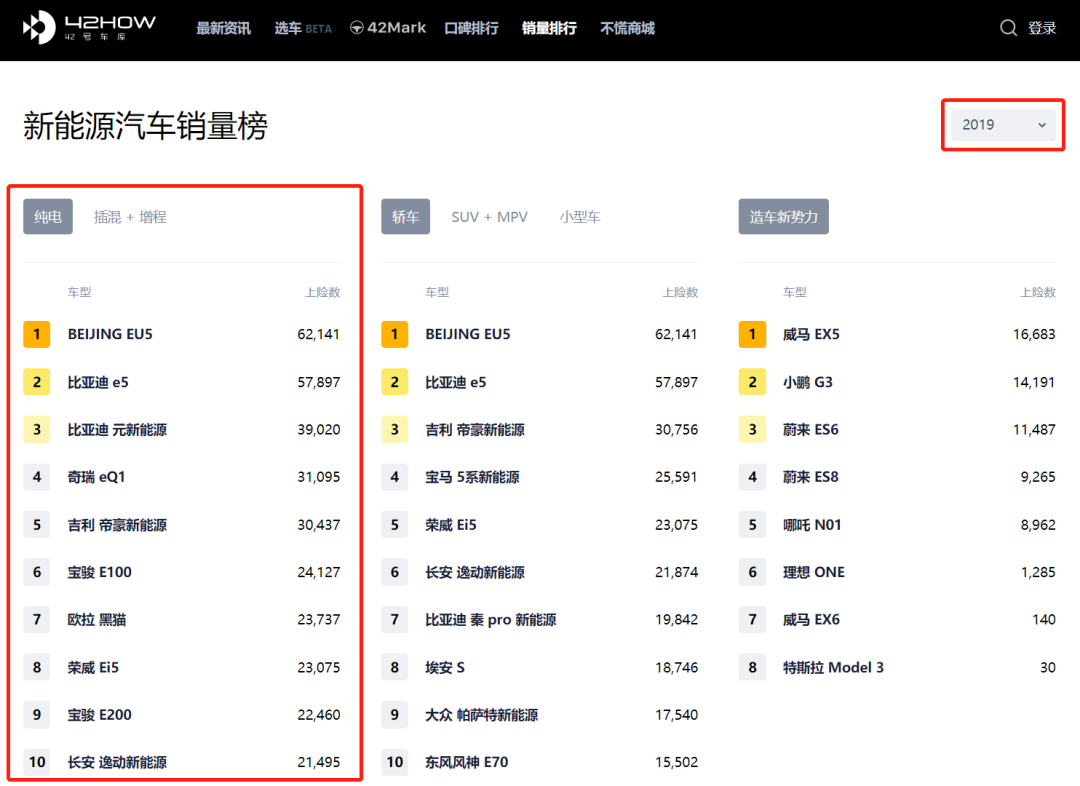

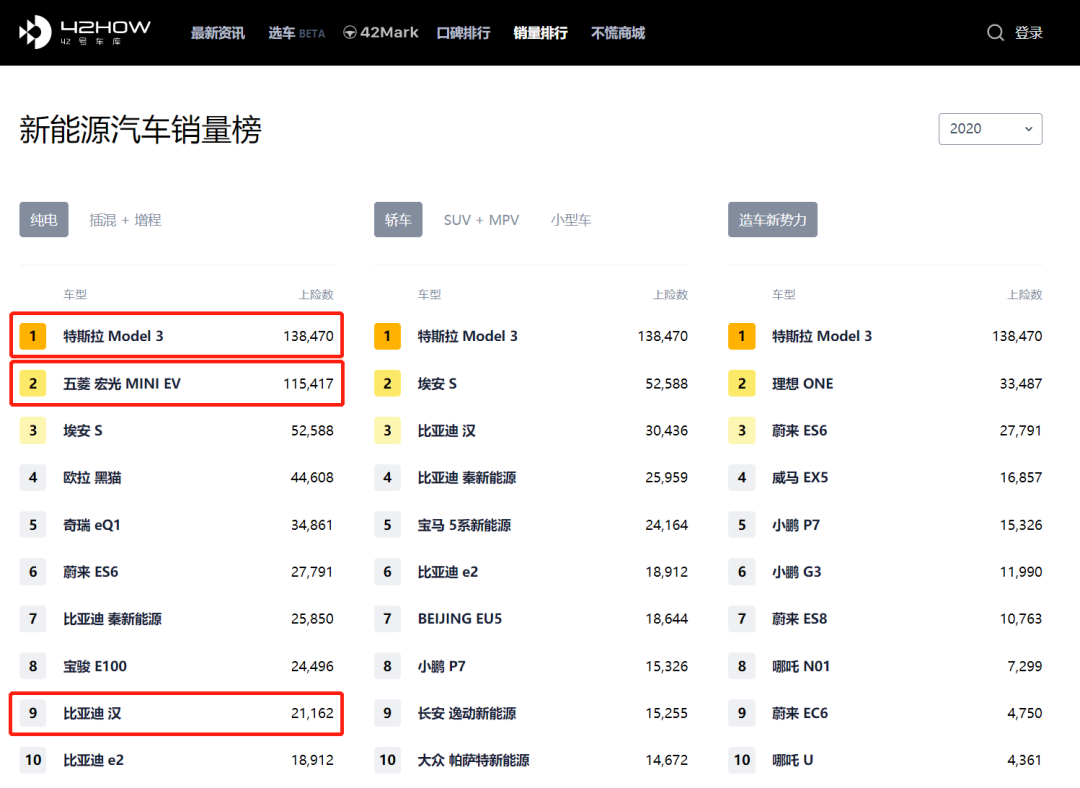

According to the ranking of insurance coverage on the 42HOW website, in the top 10 best-selling domestic pure electric vehicles in 2019, all models used ternary lithium batteries.

However, among the top 10 best-selling models in 2020, three models have versions that use lithium iron phosphate batteries.

According to the data of the Ministry of Industry and Information Technology, there are a total of 115 models in the first batch of promotional models in 2021, of which 85 models are equipped with lithium iron phosphate batteries, accounting for 73.9%.

Obviously, lithium iron phosphate batteries have become one of the two technical routes parallel to ternary lithium.

After careful study, this can be mainly attributed to two factors: the improvement of lithium iron phosphate battery technology and its absolute price advantage.

Solving the Hard Problems of Lithium Iron Phosphate Batteries

The development of ternary lithium batteries slowed down in 2020, while lithium iron phosphate batteries made rapid progress.

Low energy density and poor low-temperature performance have always been the drawbacks of lithium iron phosphate batteries. The electrochemical characteristics are difficult to change, but they can be overcome with auxiliary technology.

At the end of 2019, CATL officially released the CTP (Cell To Pack) technology. Simply put, this technology changes the layout structure inside the battery pack, eliminates the module, and directly arranges the battery cells into a pack.

The benefit of this modual-free structure is that the volume utilization rate of the battery pack increases by 15-20%, the energy density increases by 10-15%, the number of parts decreases by 40%, and the production efficiency increases by 50%.

As a result, the energy density of the lithium iron phosphate battery system can exceed 160 Wh/kg, successfully getting access to subsidy policy. This is an important prerequisite. If the iron phosphate battery cannot meet the requirements of the subsidy policy, it cannot achieve the goal of reducing costs, and it is better to continue using ternary lithium batteries.

Another company also using similar technology is BYD, which has been working hard in the field of lithium iron phosphate batteries. In early 2020, BYD officially released the blade battery which, in principle, is very similar to CATL’s CTP technology. The blade battery employs the way of removing the battery module in limited space of the battery pack to increase the amount of batteries and improve the overall energy density of the pack.

However, the blade battery pack based on lithium iron phosphate batteries used in BYD Han has an energy density of only 140 Wh/kg, which is not as dazzling as the 160 Wh/kg of the CTP pack based on lithium iron phosphate batteries from CATL.

In terms of application scenarios, under the same weight, CTP technology can have a larger battery and stronger endurance.

Regarding the low-temperature performance, which is another major pain point of lithium iron phosphate batteries, CATL also released the cell self-heating technology in 2019. By using BMS control algorithm and the entire vehicle powertrain architecture, the battery cells can be charged and discharged quickly in a short period of time, allowing the cells to heat internally and achieve the self-heating effect of the battery cells.Under experimental test conditions, the heating rate can reach 2 ℃/min, and the temperature difference of the battery core does not exceed 4 ℃ throughout the heating process.

In addition to the improvement of the battery itself, the improvement of infrastructure is also an important driver of lithium iron phosphate batteries.

According to data released by the China Electric Vehicle Charging Infrastructure Promotion Alliance, as of the end of December 2020, the number of charging piles in the country has reached 1.681 million, of which 807,000 are public charging piles, with a year-on-year growth of 56.4%; private charging piles are 874,000, with a year-on-year growth of 24.3%.

With the increasingly convenient charging environment, users’ sensitivity to endurance has gradually decreased, which is also an important opportunity for the emergence of lithium iron phosphate batteries.

The core reason why battery manufacturers and car companies actively use lithium iron phosphate batteries is the cheap price advantage, which solves the “shortcomings” of lithium iron phosphate batteries!

Absolute price advantage

Tesla was the first automaker to adopt lithium iron phosphate batteries.

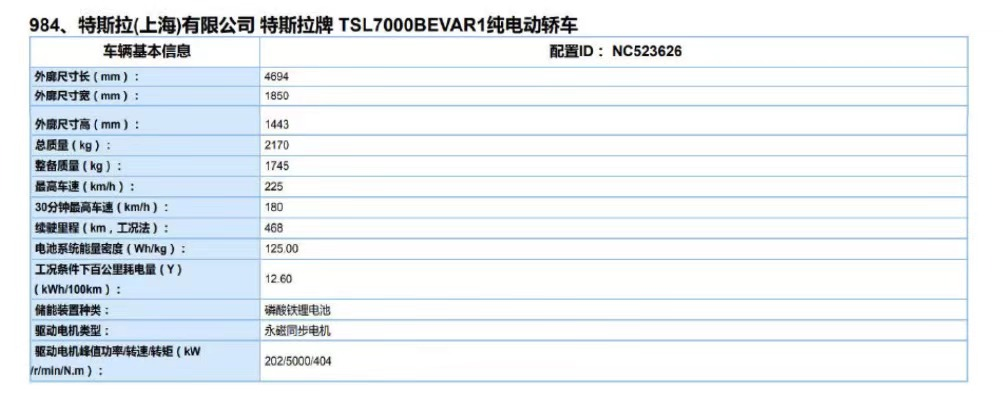

In October 2020, Tesla officially launched the NEDC with extended range, using CATL lithium iron phosphate battery versions of the Model 3; the standard range was increased from 445 km to 468 km, but the selling price was reduced from 271,500 yuan to 249,900 yuan, further lowering the threshold for buying a car.

This is Tesla’s second choice of local Chinese suppliers and the first time to use battery types other than ternary lithium.

From the gradually increasing sales and the Model 3 produced at the Shanghai Super Factory exported to Europe and Japan, we can see that Tesla has fully recognized the lithium iron phosphate battery from China and wants to rely on the price advantage of lithium iron phosphate batteries to slaughter more overseas markets.

Zeng Yuqun also stated in an interview with the media: “We do not rule out the possibility of supplying to the Berlin Tesla factory.”

According to BNEF’s battery report released in December 2020, the cost of the battery pack in 2020 was about 137 US dollars/kWh, a decrease of 13% compared to 2019. The price of the battery cell is 102 US dollars/kWh.

BNEF predicts that by 2021, the cost of lithium iron phosphate batteries will drop to a minimum of 80 US dollars/kWh, and it is expected to drop to 50 US dollars/kWh by 2023.

From the currently sold car models, the launch of the XPeng P7 lithium iron phosphate battery version has reduced the ownership cost of XPILOT by 20,000 yuan. In the low-end car model, the Wuling Hongguang MINIEV uses lithium iron phosphate batteries, so the selling price can be lowered to around 30,000 yuan.The rise of lithium iron phosphate (LFP) batteries has significantly reduced the overall bill of materials (BOM) for electric cars, making them more affordable for consumers who want to try electric cars. Correspondingly, the shipment of LFP batteries has surged.

In 2020, the installed capacity of ternary lithium batteries was 38.9 GWh, a decrease of 4.1% year-on-year, while the installed capacity of LFP batteries was 24.4 GWh, an increase of 20.6% year-on-year. Ningde Times, BYD and Guoxuan High-tech were the top three companies by installed capacity of LFP batteries in 2020. Among them, Ningde Times had a market share of 58.9%, a total installed capacity of 13,680.12 MWh, and a year-on-year increase of 21.21%. In contrast, BYD had a market share of 17.38% last year, an installed capacity of 4,036.3 MWh, and a year-on-year increase of 45.21%.

Market diversification is needed. Although the previous text talked about the outstanding advantages of LFP, and it can be seen from the shipment volume that LFP batteries are rising, this is not a signal of the decline of ternary lithium batteries. With the gradual introduction of policies, the new energy vehicle industry is gradually returning to a market-oriented era.

It can be found that the Tesla Model 3 standard range upgrade version, XPeng P7 standard range version, and Wuling Hongguang MINIEV, all of which use LFP batteries, have several common features: they have low requirements for cruising range, and extremely high requirements for BOM cost. As consumers’ acceptance of electric cars continues to increase, LFP batteries can indeed allow more people to buy pure electric cars at lower prices. However, the lower energy density and weaker low-temperature charging and discharging performance are the weak electrical scenarios that LFP batteries cannot avoid.

On November 2, 2020, the General Office of the State Council issued the “Development Plan for the New Energy Vehicle Industry (2021-2035),” which stated that by 2025, the proportion of new energy vehicle sales in China will reach about 25%, corresponding to a sales volume of 8 million vehicles. In 2020, China’s sales of new energy vehicles were 1.366 million units, an increase of 7.5% and 10.9% year-on-year, respectively, and the production and sales volume reached a historical record high.

This means that in the next four years, the sales of new energy vehicles will increase 5.8 times. In order to sell so many new energy vehicles, it is necessary to ensure that they can cover more people’s usage scenarios. LFP batteries have replaced ternary lithium batteries for some price-sensitive users with lower prices, but ternary lithium batteries are still the optimal choice for users sensitive to cruising range.2019 saw CATL leading the industry with their 811 ternary lithium battery, enabling a range of up to 600-700 km for many vehicle models. In addition, CATL launched the 523 module-encased battery, which achieved an energy density of 180 Wh/kg using safer 523 cells with higher module efficiency.

The increase in energy density of ternary lithium batteries has made electric vehicles more acceptable to consumers, exemplified by NIO’s successful development in recent years. In 2018, the ES8 model equipped with a 70 kWh CATL battery had a range of only 355 km. However, the adoption of the higher energy density 811 cells increased this to 423 km in 2019, and further optimization in 2020 brought it up to 500 km.

There is no absolute superiority of either lithium iron phosphate or ternary lithium batteries in this diverse market. In a similar way to the era of traditional combustion engines, cars sold to the Middle East require larger cooling systems, while those sold in the Far East require larger PTC heating components.

Batteries also require the utmost value release. Looking back, CATL is the biggest winner in this era with the largest shipment of both lithium iron phosphate and ternary lithium batteries in China.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.