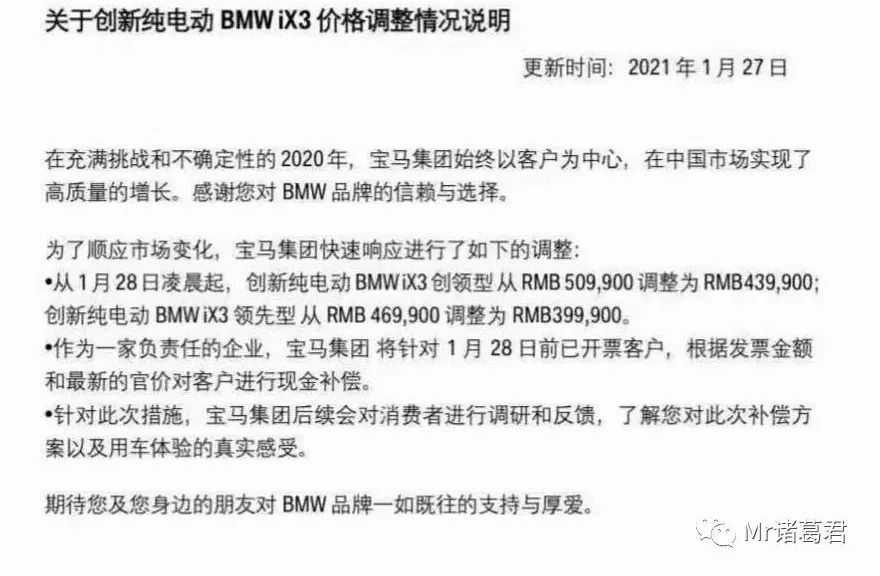

Overview: On January 27th, BMW China announced an official price cut of 70,000 yuan for the iX3 electric SUV that was launched at the Guangzhou Auto Show in November last year. In addition, cash subsidies will be given to old customers who previously bought at higher prices.

iX3 Product Information: Single motor 210 kW, 400 N·m, rear-wheel drive.

74 kWh ternary lithium battery, NEDC range up to 500 km.

0-100 km/h acceleration in 6.8 seconds, maximum speed of 180 km/h.

After the 70,000 yuan price cut, the new price is 399,900 yuan.

Reasons: In January, Tesla announced the price of the domestic Model Y, which ranged from 339,000 yuan to 369,000 yuan, with a reduction of 150,000 yuan from the previous import version priced at 588,000 yuan. As a result, the orders were so popular that the current delivery time has been postponed to May.

Model Y product information: Performance domestic version, dual motor, 339 kW, 663 N·m, front and rear motor all-wheel drive, 77 kWh ternary lithium battery, WLTP range of 480 km

0-100 km/h acceleration in 3.7 seconds, maximum speed of 241 km/h.

Price: CNY 3,699,000

Market situation:

-

The NIO ES6, which is affected by the Model Y, has proposed promotional policies such as “Zero Rate” + limited free battery swap. Although the official statement is that NIO will not lower the price, it can be seen that policies relating to interest rate and service are necessary measures to enhance product competitiveness without reducing prices. If the ES6/EC6 orders continue to rise and customers remain stable, NIO does not need to offer policies.

-

The Mercedes-Benz EQC currently has a transaction price approaching CNY 400,000. Although the official MSRP has not been shaken, the low transaction price has not boosted sales, which stood at 400+ units in December.

-

The Audi e-tron, which was launched the earliest and had large-scale discounts, still has sluggish sales.iX3 Analysis Forecast:

-

The BMW iX3 was just launched and sold over 800 units in December, but was clearly not a hot seller. iX3 is a good choice for customers who choose luxury brand electric SUVs, but neither iX3, EQC, nor e-tron can meet customers’ higher expectations for intelligent electric vehicles and new technological brands. iX3 can probably beat EQC and e-tron, but it cannot directly compete with Model Y.

-

Similar to EQC, maintaining the same price and giving discounts on policies, or adjusting the price in a timely manner to attract attention and boost sales. BMW China chose the latter, obviously seeing the lessons from Mercedes-Benz and Audi.

-

Although the price reduction of iX3 is significant and it is now priced similarly to X3, it is unlikely that it can shake the market and compete with Model Y.

-

I admire BMW China’s quick decision-making and efforts, but the product itself can only maintain a less unattractive position. It is only a temporary solution and may not even withstand the attacks of the next wave of Model Y and other new products in the second half of 2021.

-

If we analyze the pricing of the X3 gasoline model at 400,000 yuan, the single vehicle cost is around 200,000 yuan, and the retail price is 360,000 yuan / 90% off, with a brand profit of 100,000 yuan per vehicle. Replacing the powertrain with electric power is estimated to increase the cost by about 100,000 yuan, causing the single vehicle profit of iX3 to decrease to 100,000 yuan. In theory, iX3 is expected to have a price reduction/promotion space of around 50,000 yuan, but if it can bear losses from a score-based strategy or political needs, then the price of iX3 can still continue to decrease.“`markdown

BMW’s Electric Car Strategy

- Background: BMW’s electric car strategy began with the i3 and i8 exploring various routes such as pure electric, hybrid, and plug-in hybrids, and was put on the market early on. However, they did not receive sales recognition and, under pressure from shareholders/performance, BMW management put aside the radical development of electric vehicles and continued to invest in the development of mature vehicle models such as the X7 and 2 series that could clearly bring profits and sales growth. But when the market trend shifted to Tesla, BMW shareholders and management were suddenly shocked and had already lost their advantage.

-

Personnel: What’s more, the team members of BMW’s electric car team kept leaving during the early stage of product development. The former senior executives of Byton were from the i8 team, NIO’s stylists, and even some members of new forces in China came from BMW’s new energy team.

“`* Petrol to Electric Conversion: The sales price of the petrol vehicle X3 is quite stable and it has the second largest market share in the market, without being affected by iX3 at all. On the contrary, after the conversion from petrol to electric, why can’t iX3 keep its price stable? Are customers comparing iX3 to X3 or to ModelY and other electric cars? For already failed Jaguar I-pace and other luxury electric cars based on petrol cars, they need to see clearly and quickly enter the market at a low price, don’t be afraid of affecting petrol cars, and worry about affecting petrol cars, which may be defeated along with electric cars.

-

Premium: In the era of petrol engines, BMW’s M-power was proud of its power combined with the best-tuned ZF8AT gearbox, but this is obsolete in the electric car era.

* Pure electric platform: In 2020, BMW management stated that they would not develop a pure electric platform. On the one hand, the current architecture can meet the needs of gasoline + hybrid + electric cars, and on the other hand, the benefits of developing a pure electric platform without obvious sales support are worrying. However, by the end of the year, they changed this decision and needed to develop a pure electric platform before 2025. The mental journey must have gone through Tesla’s massive development in the Chinese and American markets for a year, and BMW found that products developed not based on pure electric platforms cannot compete with rapidly developing pure electric platform competitors in the market. Oil-to-electric products can only respond to low-end entry-level demand among mainstream brands.

* Pure electric platform: In 2020, BMW management stated that they would not develop a pure electric platform. On the one hand, the current architecture can meet the needs of gasoline + hybrid + electric cars, and on the other hand, the benefits of developing a pure electric platform without obvious sales support are worrying. However, by the end of the year, they changed this decision and needed to develop a pure electric platform before 2025. The mental journey must have gone through Tesla’s massive development in the Chinese and American markets for a year, and BMW found that products developed not based on pure electric platforms cannot compete with rapidly developing pure electric platform competitors in the market. Oil-to-electric products can only respond to low-end entry-level demand among mainstream brands. -

Competition: The iX3 still has huge disadvantages compared to NIO’s ES6, an existing Chinese internet brand, at the same price point, such as size, acceleration, range, autonomous driving, battery swapping, intelligent network connection, OTA, let alone NIO’s unique user operation and service advantages.

-

Strategic swings: Is BMW making iX3 or series of electric cars to develop new markets, comply with double credits/environmental balance, or both?

-

Price reduction impact: Lowering prices in an area where one is not good at does not affect the brand, because BMW only brings gasoline-car awareness to the electric car industry, but not the familiarity and reputation of gasoline cars. What core technology does BMW have in the electric car industry, and what benefits can it bring to customers? Unfortunately, not yet.

-

Customer psychology: In fact, customers do not care what platform you say you are on, but care about the experience value given by the platform. The problem is precisely the core disadvantages brought by the oil-to-electric platform, which are high weight, low range, and insufficient intelligentization and difference in appearance. It is necessary to repeatedly educate customers that mid-to-high-end electric cars must be based on a pure electric platform.“`

-

Price Strategy: The traditional pricing strategy is ineffective, first loosen up the development cost, then set the total project revenue and profit target, and finally set the sales volume/unit price/unit profit. However, when the unit price and competitiveness cannot be achieved in the market, the sales will collapse, so-called unit profit/marginal contribution/single vehicle profit rate cannot be achieved, and the investment of the entire project cannot be completed. It also causes huge losses to the brand. Pricing success depends on occupying a 3-6 month time window, successful ramp-up, rapid product iteration, and then meeting the further cost-reduction opportunities of the supply chain, that is the key to win step by step.

“`* Consequences of Mistakes: In the pricing strategy, customers are attracted to the store through official prices, and dealers provide discounts to complete the transaction. However, now that the product’s listing price is announced, customers are not excited at all and have no interest in discussing it in the store, let alone using dealer discounts. If the correct price is not set at the time of listing (which can only be guaranteed for a period of time), there is no opportunity to improve the mistake, and one misstep leads to another.

- Painful Lesson: For ordinary or emerging brands, the position of luxury/high-end/premium is not achieved overnight, nor is it achieved through high prices. The time window may only be 6-18 months, with 1-2 product opportunities. Once lost, it may never come back.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.